Property Law Documents

Property Taxes

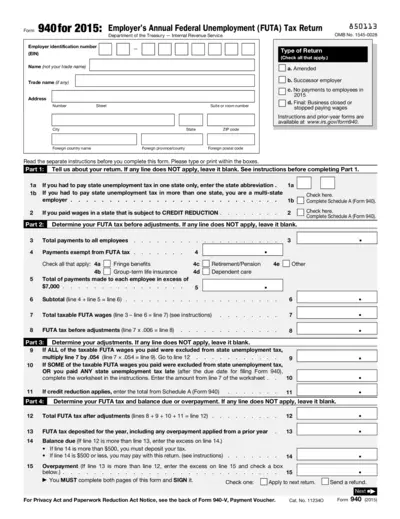

Employer's Annual Federal Unemployment (FUTA) Tax Return 2015

Form 940 for 2015 is used by employers to report their annual Federal Unemployment (FUTA) tax. It includes details about payments to employees, taxable FUTA wages, and adjustments. Employers must file this form with the IRS.

Property Taxes

The Pastor & His Income Tax for 2023

This file provides tax guidance and preparation services for pastors and their churches. It contains important information about federal and state income tax, clergy tax seminars, and deadlines for submission. The purpose is to help conservative evangelical Christians manage their finances in accordance with their faith.

Property Taxes

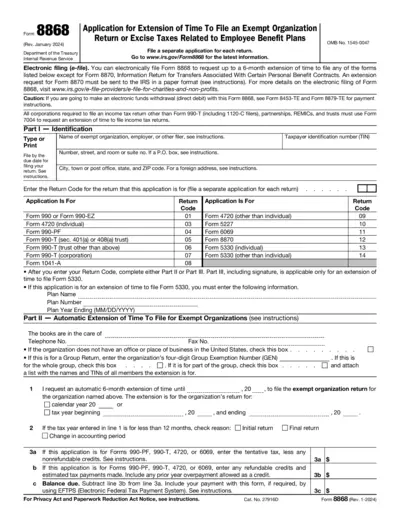

Application for Extension to File Exempt Organization Return

This application allows exempt organizations to request a 6-month extension to file their returns. Specific forms for different kinds of exempt organizations are addressed. Detailed instructions and the e-filing process are included.

Property Taxes

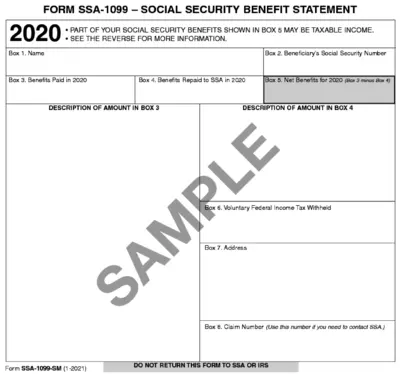

Form SSA-1099 - Social Security Benefit Statement 2020

The Form SSA-1099 is a document sent by the Social Security Administration. It details the total benefits paid and any amounts repaid in 2020. Use this form for tax reporting purposes.

Property Taxes

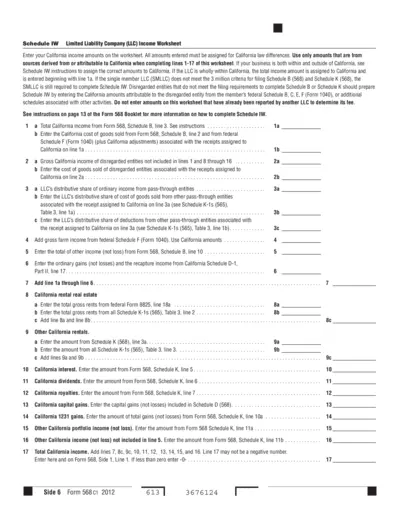

Schedule IW LLC Income Worksheet

This file provides the Schedule IW form for Limited Liability Company (LLC) Income Worksheet. It details how to enter California income amounts and contains instructions for proper completion. If your business operates within and outside of California, ensure to follow the instructions to assign the correct amounts.

Real Estate

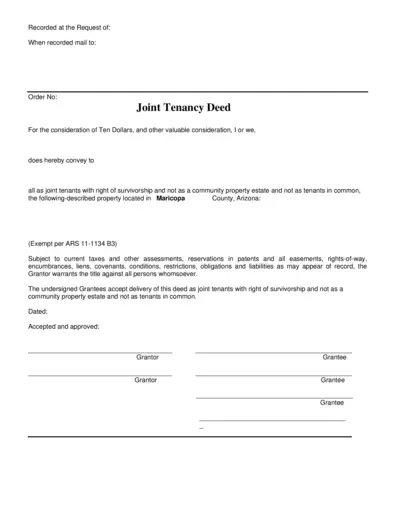

Joint Tenancy Deed for Property in Maricopa County

This Joint Tenancy Deed file is used for transferring property ownership with the right of survivorship in Maricopa County, Arizona. It outlines terms, conditions, and parties involved. The form needs signatures and notarization.

Property Taxes

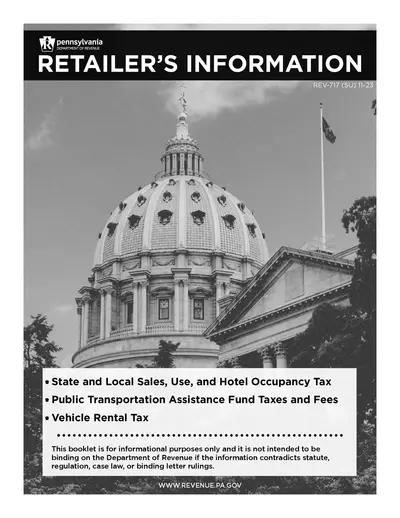

PA Department of Revenue - Retailer's Information

This file provides detailed information for retailers, including state and local sales, use, and hotel occupancy tax guidelines. It also covers specific tax rates, exemptions, and filing procedures. This booklet is designed for informational purposes and offers a comprehensive guide for tax compliance.

Property Taxes

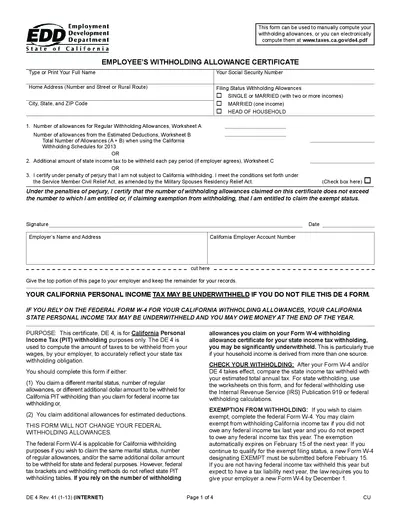

California Employee's Withholding Allowance Certificate

The California DE 4 form is used to determine the amount of state income tax to be withheld from an employee's wages. This form helps employees compute their withholding allowances for California Personal Income Tax. It also provides the option to claim exemptions from withholding.

Property Taxes

Uniform Sales & Use Tax Resale Certificate - Multijurisdiction

This file is a Uniform Sales & Use Tax Resale Certificate for multiple jurisdictions, detailing which states accept it as a resale/exemption certificate. It includes instructions on how to properly complete and use the certificate. Additionally, it provides information on state-specific requirements and regulations.

Real Estate

WR ZipForm FAQ - Wisconsin REALTORS Association

This file contains FAQs and instructions related to the use of ZipForms by Wisconsin REALTORS Association members. It provides details on downloading, renewing, and troubleshooting ZipForms. It also includes contact information for further assistance.

Property Taxes

Illinois Department of Revenue 2023 IL-1040-X Instructions

The 2023 Illinois Form IL-1040-X Instructions provide guidance for amending individual income tax returns. This document explains when and how to file amended returns. It includes details on the necessary attachments and timing considerations.

Property Taxes

Form W-8BEN-E Instructions for Beneficial Owners

This document provides detailed instructions for entities on how to complete Form W-8BEN-E to certify their status for U.S. tax withholding and reporting.