Property Law Documents

Property Taxes

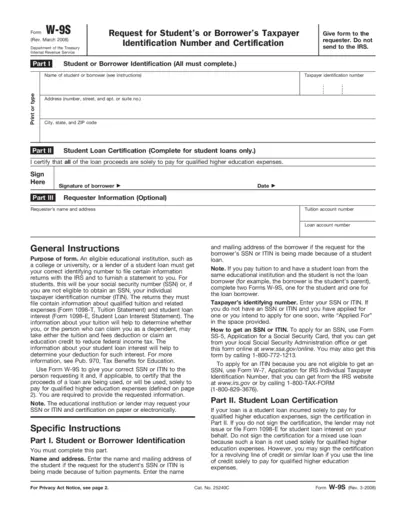

Form W-9S - Request for Student's or Borrower's Taxpayer ID

Form W-9S requests the taxpayer identification number and certification from students or borrowers. It is used by educational institutions or lenders to report tuition payments and student loan interest to the IRS. The form ensures compliance with federal tax rules and regulations.

Real Estate

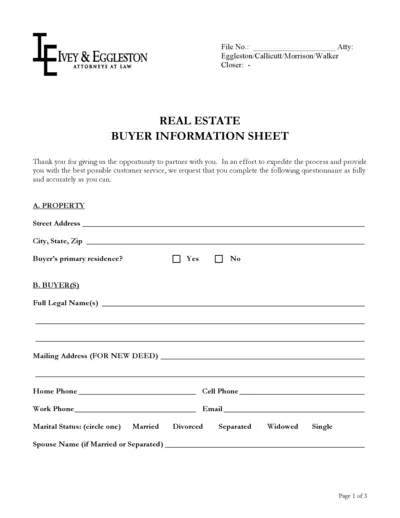

Real Estate Buyer Information Sheet by Ivey & Eggleston

This document is used by Ivey & Eggleston for collecting important buyer information in real estate transactions. It includes sections on property details, buyer details, buyer agent information, mortgage and insurance details, and closing information. Accurate completion of this form helps expedite the closing process.

Property Taxes

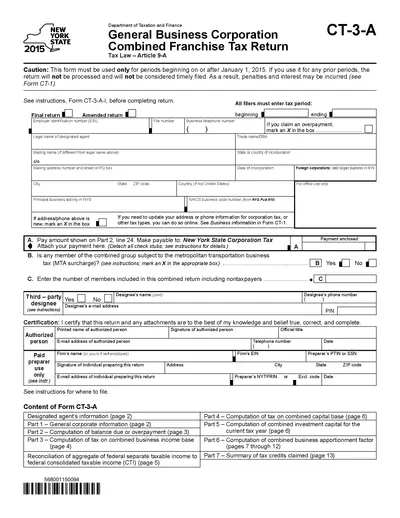

NY State General Business Corporation Tax Return 2015

This document is the New York State General Business Corporation Combined Franchise Tax Return for the year 2015. It includes detailed sections on corporate information, computation of taxes, and reconciliation of federal taxable income. Essential for businesses operating in NY State.

Property Taxes

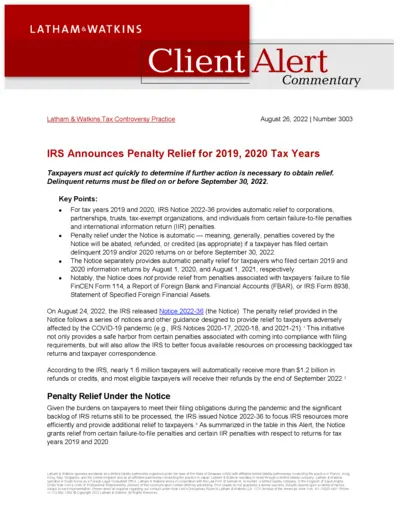

IRS Announces Penalty Relief for 2019, 2020 Tax Years

This file provides information on the IRS Notice 2022-36, which offers automatic penalty relief for certain tax years. It covers eligibility criteria, the automatic nature of the relief, and specific penalties addressed.

Property Taxes

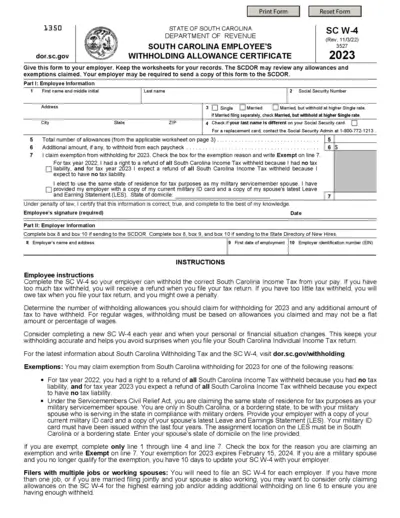

South Carolina Employee's Withholding Allowance Certificate SC W-4 (2023)

This document is the South Carolina Employee's Withholding Allowance Certificate, also known as SC W-4. It is used to determine the amount of South Carolina Income Tax to withhold from an employee's paycheck. Employees should complete this form with accurate information and provide it to their employers.

Zoning Regulations

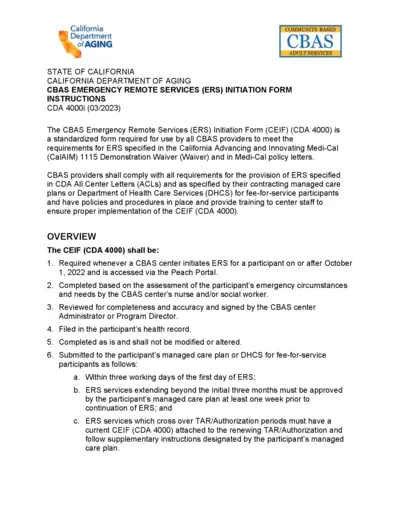

CBAS Emergency Remote Services (ERS) Initiation Form Instructions

This file contains instructions for completing the CBAS Emergency Remote Services (ERS) Initiation Form (CEIF) (CDA 4000). It is a standardized form required by all CBAS providers. This document outlines the requirements as specified by the California Advancing and Innovating Medi-Cal (CalAIM) and other relevant guidelines.

Property Taxes

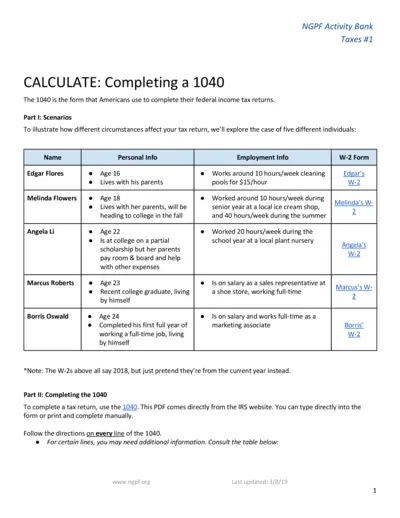

NGPF Activity Bank: Completing a 1040 Tax Form

This file provides detailed instructions for completing a 1040 tax form using various scenarios. It includes personal information, employment details, and step-by-step guidance. Additionally, it offers a section to audit a classmate's 1040 form.

Property Taxes

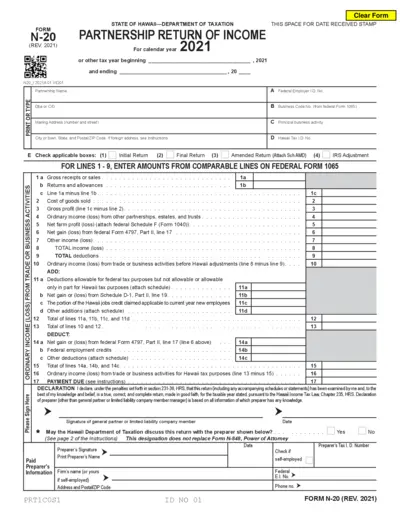

Hawaii Department of Taxation Partnership Return of Income 2021

This file is the Hawaii Department of Taxation Partnership Return of Income form for the year 2021. It includes sections for gross receipts, deductions, income adjustments, and partner distributions. The form must be completed and signed by the general partner or limited liability company member.

Property Taxes

Millions of Dollars in Erroneous Business Income Deductions

This report by the Treasury Inspector General for Tax Administration identifies issues with the verification of Qualified Business Income Deductions. It assesses IRS processes and provides recommendations for improvement. The report is crucial for understanding how tax laws impact taxpayers.

Property Taxes

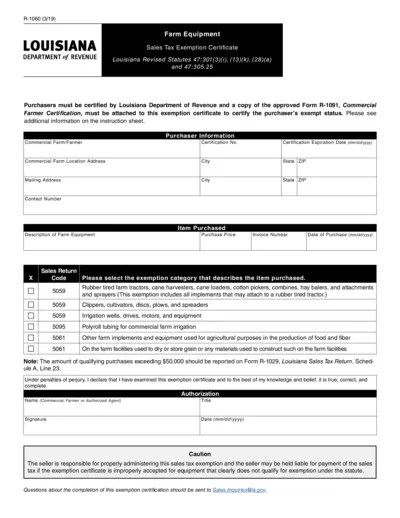

Louisiana Form R-1060: Farm Equipment Sales Tax Exemption Certificate

This document outlines the requirements for Louisiana farm equipment sales tax exemption. Commercial farmers must attach their certification. Learn about qualifying equipment and submission details.

Property Taxes

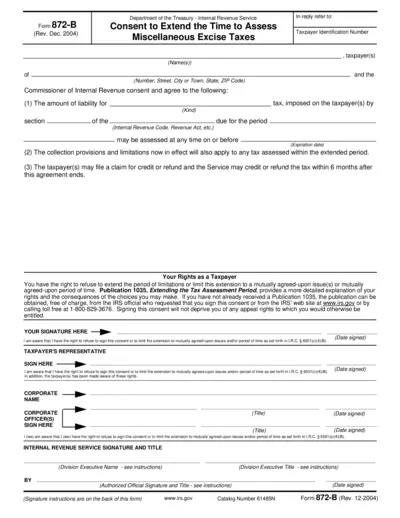

Form 872-B: Consent to Extend the Time to Assess Miscellaneous Excise Taxes

Form 872-B allows taxpayers to consent to extend the time for the IRS to assess miscellaneous excise taxes. It outlines the conditions and rights of the taxpayer in relation to the extension. Instructions and relevant contact information are also provided.

Real Estate

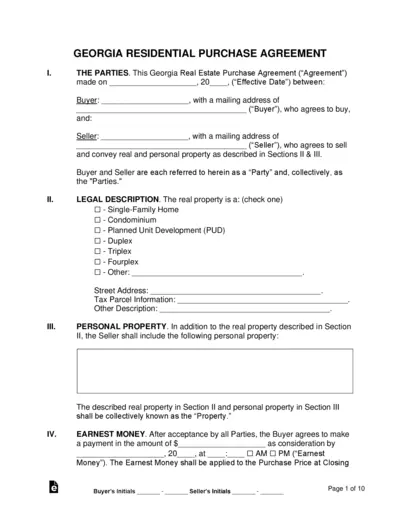

Georgia Residential Real Estate Purchase Agreement

This Georgia Residential Purchase Agreement outlines the terms and conditions for buying and selling real estate in Georgia. It includes essential details about the parties involved, legal description, and personal property included. Completing this form is crucial for a smooth real estate transaction.