Property Law Documents

Property Taxes

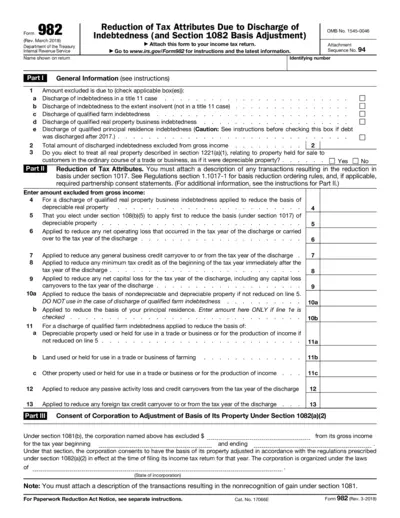

IRS Form 982 Reduction of Tax Attributes Due to Discharge

Form 982 is used to reduce tax attributes due to the discharge of indebtedness. Attach this form to your income tax return. Go to the IRS website for instructions and the latest information.

Property Taxes

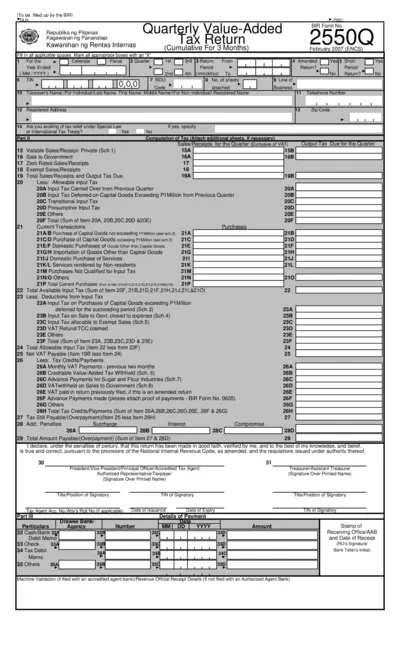

BIR Form No. 2550Q - Quarterly Value-Added Tax Return

This file is the BIR Form No. 2550Q, used for quarterly value-added tax returns. It is filled out by taxpayers to report and pay VAT. The form covers sales, purchases, input and output tax details, and more.

Property Taxes

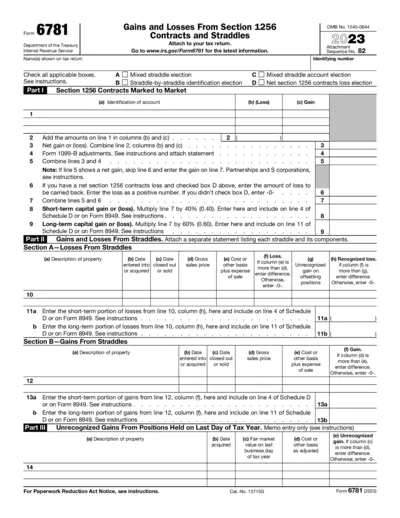

Gains and Losses From Section 1256 Contracts and Straddles

Form 6781 is used to report gains and losses on Section 1256 contracts and from straddle positions. This form helps taxpayers compute the proper amount of tax liability. Use this form to comply with the Internal Revenue Code for certain investment activities.

Property Taxes

Massachusetts Estimated Income Tax Payment Instructions

The purpose of this file is to guide taxpayers in Massachusetts on how to make estimated income tax payments. It includes information on who needs to make these payments, when they are due, and how to make them. The file also details the penalties for failing to make estimated tax payments on time.

Zoning Regulations

Final Rule 2021R-05F: Definition of Frame or Receiver

This file provides detailed information about the Final Rule 2021R-05F, defining the terms 'Frame' and 'Receiver' for firearms. It includes regulatory definitions and addresses technological advancements. Useful for individuals and organizations involved with firearms.

Real Estate

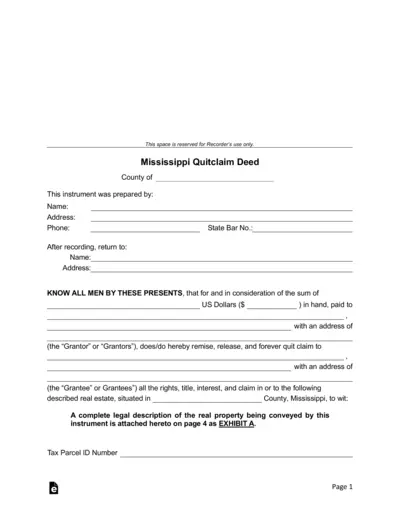

Mississippi Quitclaim Deed Form

The Mississippi Quitclaim Deed is a legal document used to transfer ownership of real estate. It requires the names and addresses of the grantor and grantee, along with the specific property details. This file includes notarization for authenticity.

Property Taxes

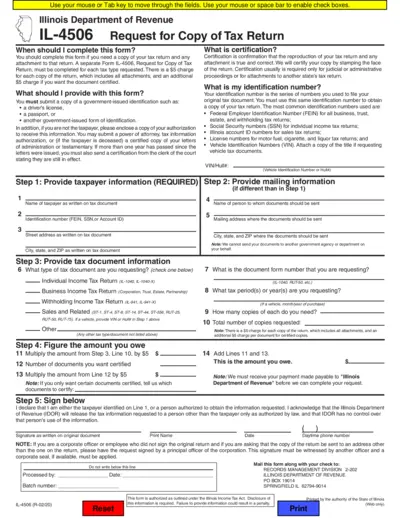

Illinois Tax Return Copy Request Form IL-4506

This form is used to request a copy of your Illinois tax return and any attachments. It includes a $5 fee per copy and an additional $5 for certification. Submit with government-issued ID and necessary authorizations.

Property Taxes

Form 2290 Filing Requirements for Heavy Highway Vehicles

This file provides information about filing Form 2290 for heavy highway vehicles. It includes instructions and requirements for registering vehicles within 60 days of purchase. Learn how to e-file, who needs this form, and important deadlines.

Property Taxes

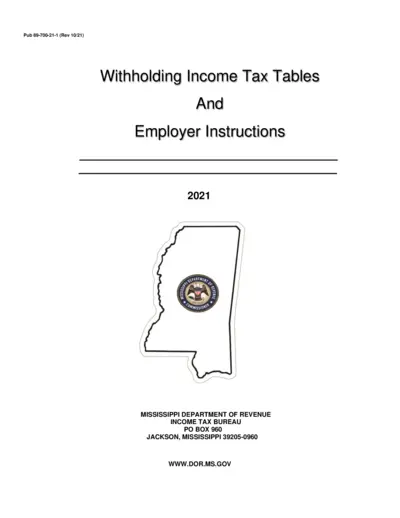

Mississippi Employer Withholding Tax Tables and Instructions 2021

This document provides the withholding income tax tables and instructions for employers in Mississippi for the year 2021. It includes information on filing requirements, exemptions, deductions, tax rates, and more. Employers must follow these guidelines to ensure compliance with Mississippi tax laws.

Property Taxes

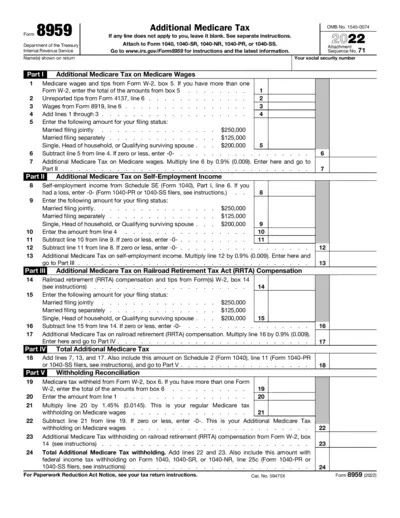

Form 8959 - Additional Medicare Tax Instructions 2022

Form 8959 is used to calculate and report the Additional Medicare Tax on Medicare wages, self-employment income, and railroad retirement compensation. This form is attached to your Form 1040, 1040-SR, 1040-NR, 1040-PR, or 1040-SS. Access the latest instructions and information on the IRS website.

Property Taxes

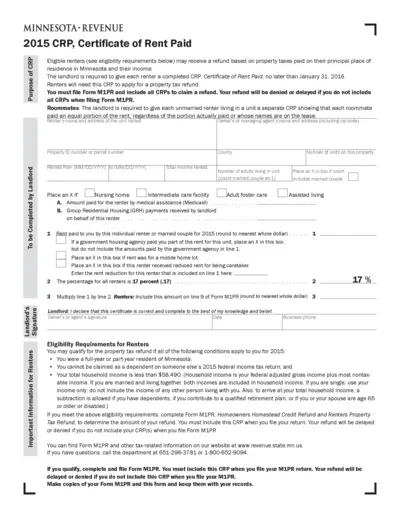

Minnesota 2015 Certificate of Rent Paid (CRP) Form

The Minnesota 2015 Certificate of Rent Paid (CRP) form is required for renters to apply for a property tax refund. The landlord must provide a completed CRP by January 31, 2016. Renters must file Form M1PR including all CRPs to claim their refund.

Property Taxes

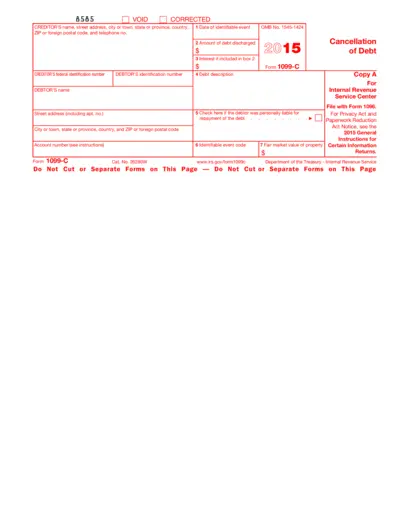

Form 1099-C: Cancellation of Debt Instructions

This file provides the instructions for filling out the IRS Form 1099-C. It covers the necessary details needed to report canceled debt. It includes fields, descriptions, and submission guidelines.