Property Law Documents

Property Taxes

Where to Get IRS Forms and Publications

This file provides detailed information on how to obtain IRS forms and publications for tax preparation. It includes various methods such as online, mail, and local IRS offices. Essential for individuals preparing taxes efficiently.

Real Estate

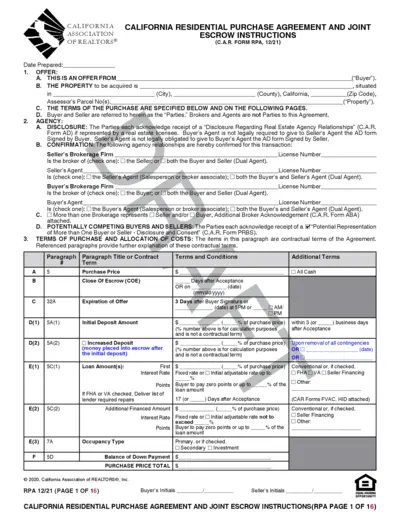

California Residential Purchase Agreement Instructions

This file contains the California Residential Purchase Agreement and Joint Escrow Instructions. It's a guide for both buyers and sellers in California real estate transactions. Clear terms and detailed instructions ensure smooth escrow processes.

Property Taxes

Instrucciones FTB 3519 SP Pago Extensión Individuals

This file contains essential instructions for individuals filing their taxes using the FTB 3519 SP form. It provides detailed guidelines sobre cómo realizar pagos electrónicos y el proceso de presentación de la declaración de impuestos. Follow these instructions to ensure compliance with California tax regulations.

Property Taxes

IRS e-Signature Requirements for Electronic Filing

This file outlines the IRS requirements for electronic signatures when filing tax returns electronically. It provides detailed instructions on how to generate e-signature PINs and the process involved. Essential for taxpayers seeking to comply with e-filing regulations.

Property Taxes

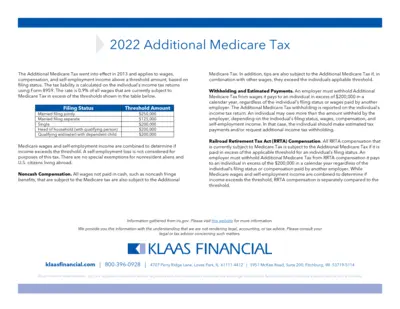

2022 Additional Medicare Tax Guidelines and Details

This file provides comprehensive information on the Additional Medicare Tax.

Property Taxes

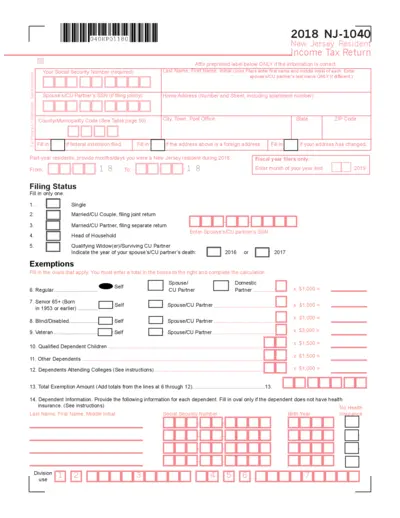

New Jersey 2018 Income Tax Return Form NJ-1040

This is the New Jersey 2018 Income Tax Return Form NJ-1040. It is required for New Jersey residents to file their state income tax. Ensure to provide accurate information to avoid any issues with your tax return.

Real Estate

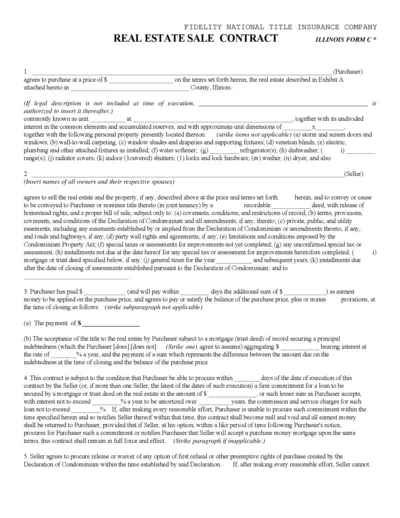

Fidelity National Title Insurance Real Estate Sale Contract

This file contains the Fidelity National Title Insurance Company's Real Estate Sale Contract for Illinois. It includes essential details regarding the purchase of real estate, terms of sale, and conditions applicable to the transaction. Suitable for buyers and sellers involved in real estate transactions in Illinois.

Property Taxes

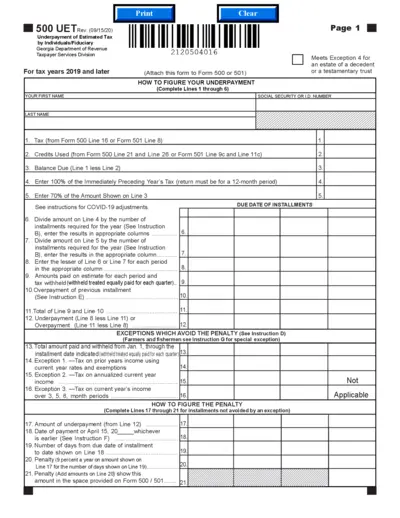

Georgia Underpayment of Estimated Tax Form

This file contains detailed instructions for individuals and fiduciaries on how to calculate underpayment of estimated tax in Georgia. It includes relevant exceptions to avoid penalties and filing procedures to ensure compliance. This form is essential for anyone who needs to assess their tax obligations for the year.

Zoning Regulations

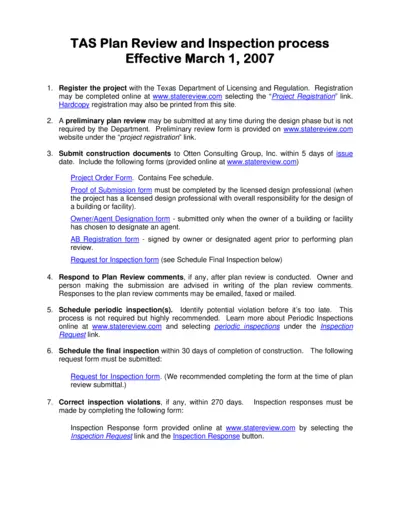

TAS Plan Review and Inspection Process Guide

This document outlines the TAS Plan Review and Inspection process. It provides essential steps, forms, and submission details necessary for compliance. Ideal for project owners and professionals involved in construction and design.

Property Taxes

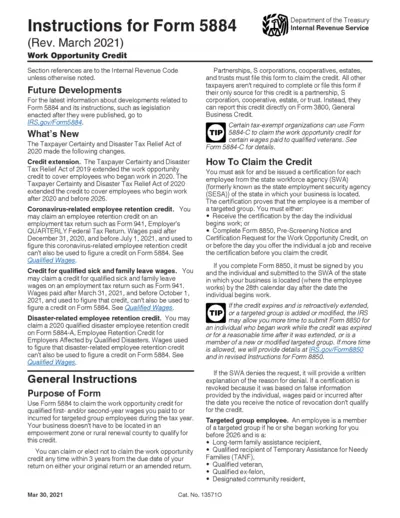

Instructions for Form 5884 Work Opportunity Credit

This document provides important instructions for Form 5884, which allows businesses to claim the Work Opportunity Credit. Understanding these instructions is essential for ensuring compliance with tax regulations and maximizing potential credits. Use this guide to navigate through the form, ensuring that all eligible wages and employees are accounted for.

Property Taxes

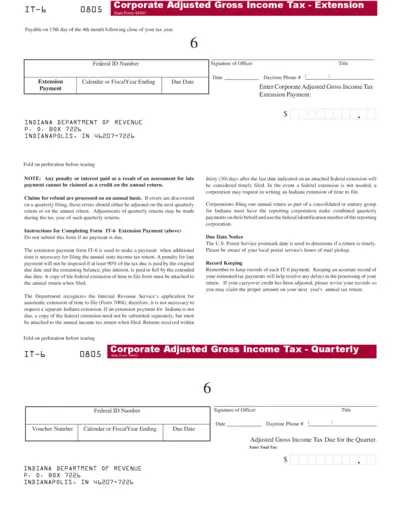

Indiana Corporate Adjusted Gross Income Tax Extension

This file is the Indiana Corporate Adjusted Gross Income Tax Extension form. It provides instructions for corporations that need to file for an extension. It includes payment details and the necessary steps for submission.

Property Taxes

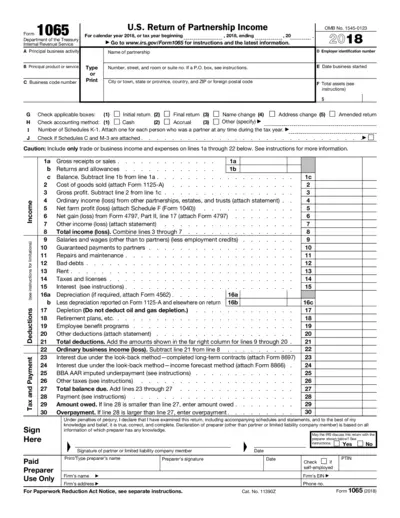

Form 1065 U.S. Return of Partnership Income 2018

Form 1065 is used by partnerships to report income, deductions, and other tax-related information. This form is essential for accurate tax filing for partnerships. It helps the IRS determine the taxable income of partnerships and their partners.