Property Law Documents

Property Taxes

IRS Revenue Procedure 2011-62 General Rules W-2 W-3

This document provides the general rules and specifications for preparing substitute Forms W-2 and W-3 as outlined by the IRS. It targets tax preparers and employers who need guidance on filing wage and tax statements. Proper adherence ensures compliance with IRS requirements.

Real Estate

Residential Lease Agreement Template Guidelines

This residential lease agreement document provides essential terms and conditions for renting a property. It outlines responsibilities for both landlords and tenants, including rent payment, security deposits, and utility management. Whether you're a first-time tenant or an experienced landlord, this document streamlines the rental process.

Property Taxes

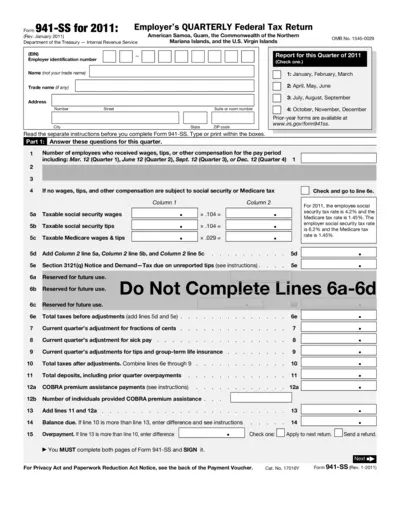

Employer's Quarterly Federal Tax Return (Form 941-SS)

Form 941-SS is essential for employers in territories like American Samoa, Guam, and the U.S. Virgin Islands to report taxes. Utilizing this form ensures compliance with federal tax obligations efficiently. Employers must follow specific guidelines to fill this out correctly for quarterly reporting.

Property Taxes

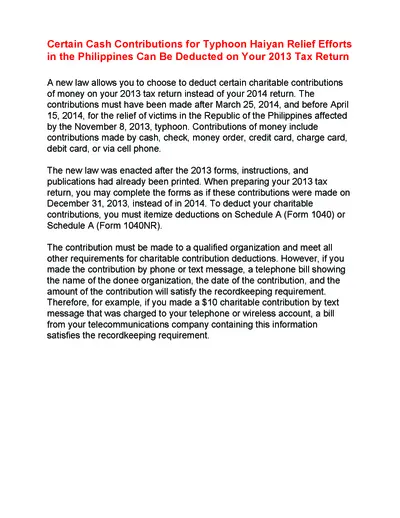

Tax Deductions for Typhoon Haiyan Relief Contributions

This file provides essential guidance for taxpayers on how to claim deductions for certain cash contributions made to relief efforts for Typhoon Haiyan in 2013. It explains the eligibility criteria, recordkeeping, and proper forms required. Understanding this file will help ensure compliance and maximize your tax benefits.

Property Taxes

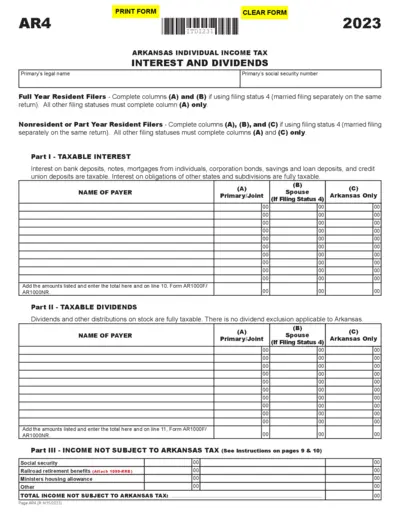

Arkansas Individual Income Tax Filing Instructions

This file provides essential details on how to file Arkansas individual income tax. It outlines the instructions for filling out interest and dividends disclosures. Use this form if you are a resident or a part-year resident of Arkansas.

Property Taxes

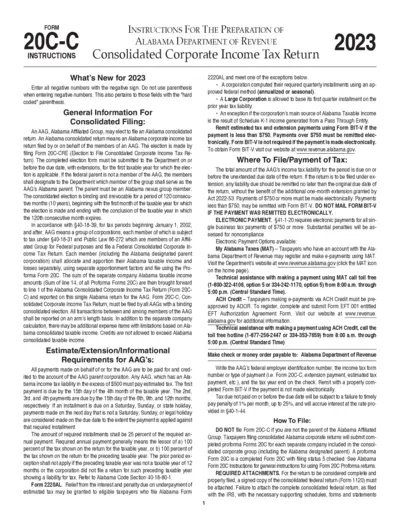

Alabama Corporate Income Tax Return Instructions

This document provides comprehensive instructions for filing the Alabama Consolidated Corporate Income Tax Return. It includes details on eligibility, filing requirements, and important deadlines. Businesses must understand these instructions to ensure compliance with Alabama tax laws.

Property Taxes

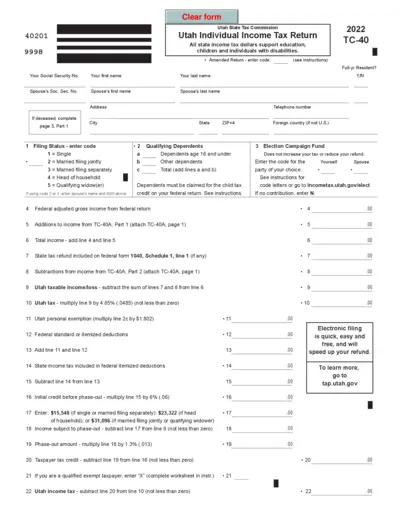

Utah Individual Income Tax Return 2022 Instructions

This file contains the instructions for filling out the Utah Individual Income Tax Return form for the year 2022. It provides essential details on completing the return accurately and efficiently. Whether you're a resident or non-resident, this guide offers the necessary steps to file your tax return correctly.

Property Taxes

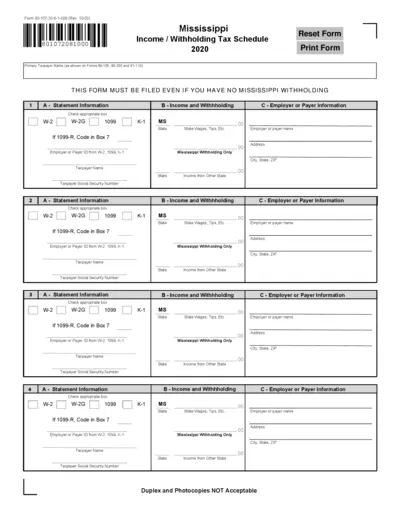

Mississippi Income Withholding Tax Schedule Form

This form is essential for individuals filing Mississippi income tax returns. It outlines the necessary information regarding income and withholding. Ensure all details are accurately filled to comply with state regulations.

Real Estate

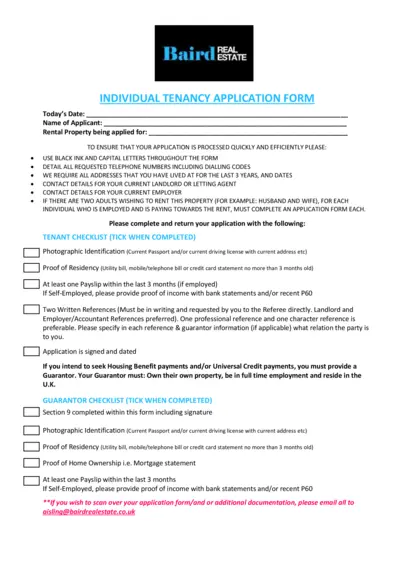

Individual Tenancy Application Form for Rental Property

This form is essential for individuals applying to rent a property. It provides necessary details and documentation to ensure a smooth application process. Fill it out accurately to avoid delays in your application.

Property Taxes

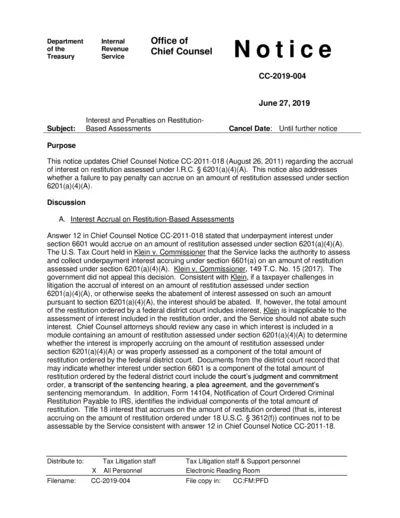

Interest and Penalties on Restitution-Based Assessments

This document provides important updates regarding interest and penalties associated with restitution-based assessments under IRS rules. It outlines the implications of recent court decisions and procedures for taxpayers. Essential for understanding IRS policies on restitution.

Real Estate

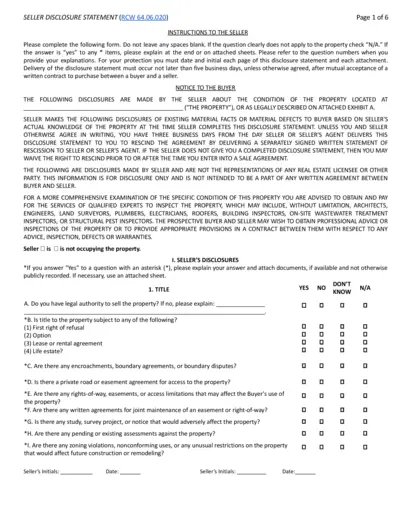

Seller Disclosure Statement Instructions and Guidelines

This file contains essential information and instructions for sellers regarding the Seller Disclosure Statement. It outlines the requirements and questions that pertain to property disclosures. Utilize this template to ensure compliance and transparency in property transactions.

Real Estate

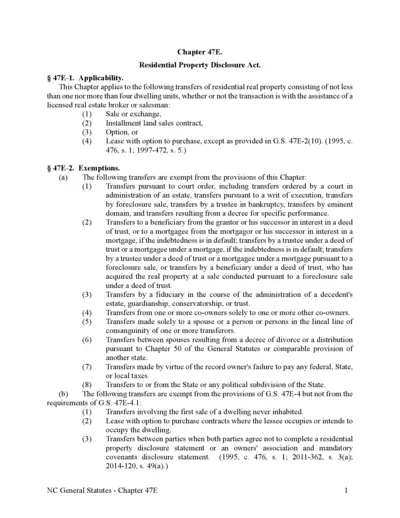

Residential Property Disclosure Act Guidelines

This file contains essential guidelines regarding the Residential Property Disclosure Act. It provides detailed instructions and definitions critical for residential property transactions in North Carolina. Users will find information on the applicability and exemptions under the Act.