Property Law Documents

Real Estate

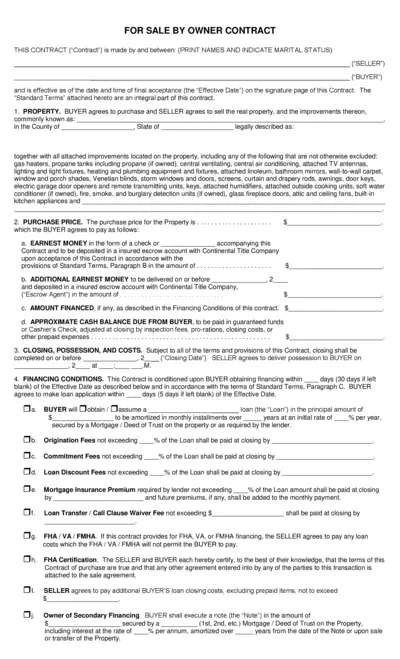

For Sale By Owner Residential Contract Template

This file contains a standard contract for a residential property sale between a seller and a buyer. It outlines the terms, conditions, and responsibilities associated with the transaction. Utilize this contract to ensure a smooth real estate transaction when buying or selling property.

Property Taxes

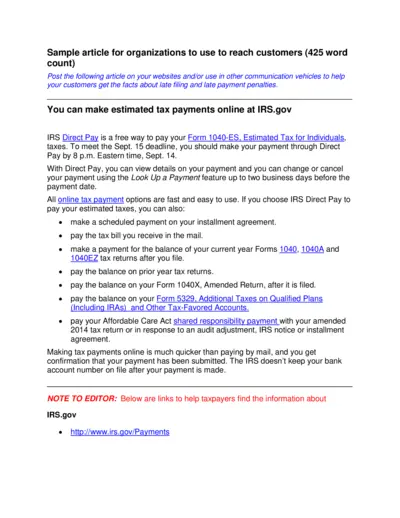

IRS Direct Pay Tax Payment Options for Individuals

This file provides essential information about using IRS Direct Pay for estimated tax payments. Learn how to make secure and easy tax payments online. Stay informed about deadlines and payment options to avoid penalties.

Real Estate

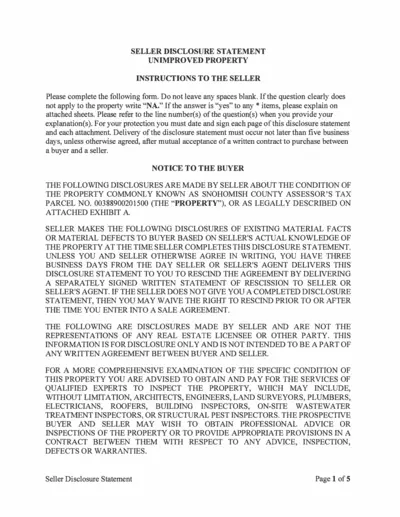

Seller Disclosure Statement for Unimproved Property

This file is a Seller Disclosure Statement specifically for unimproved properties. It includes important disclosures regarding the condition and status of the property. Buyers should carefully review this document to understand any existing issues or concerns.

Property Taxes

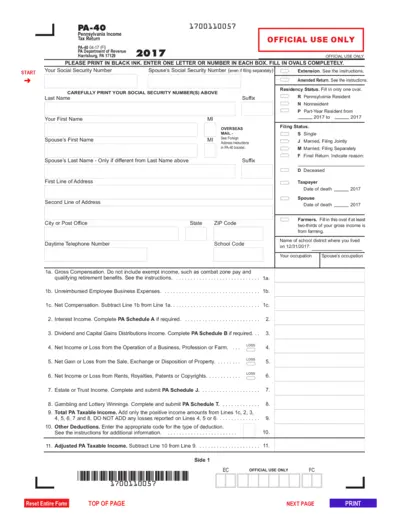

Pennsylvania Income Tax Return PA-40 for 2017

This Pennsylvania Income Tax Return PA-40 form is required for individuals filing their state taxes for the year 2017. The document includes instructions and fields that need to be completed accurately to ensure compliance with state tax laws. Users can edit and download the form using our tools for easy submission.

Property Taxes

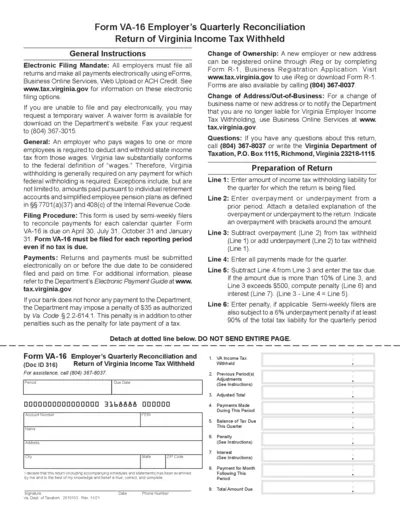

VA-16 Employer's Quarterly Reconciliation Form

The VA-16 form is used by employers for quarterly income tax reconciliation in Virginia. It details the income tax withheld and payments made during the quarter. Employers must file electronically to comply with Virginia law.

Property Taxes

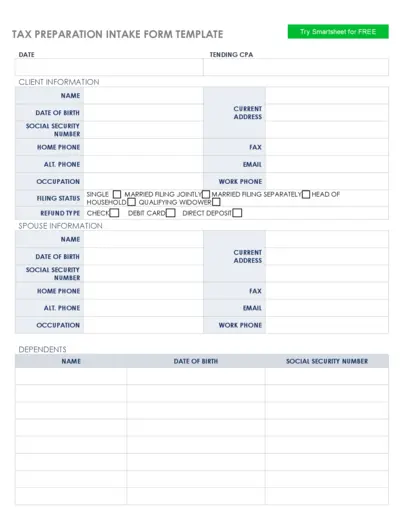

Tax Preparation Intake Form Template

The Tax Preparation Intake Form Template is essential for efficiently gathering client information and income details. This form streamlines the tax preparation process, ensuring all necessary data is collected. Ideal for both individuals and businesses seeking structured tax documentation.

Property Taxes

Sales and Use Tax Exemption for Purchases

This file provides a Sales and Use Tax Exemption Certificate under the Buy Connecticut Provision. It includes instructions for both purchasers and sellers to effectively complete and utilize the form. The document outlines the necessary details for exemptions related to tangible personal property purchases in Connecticut.

Property Taxes

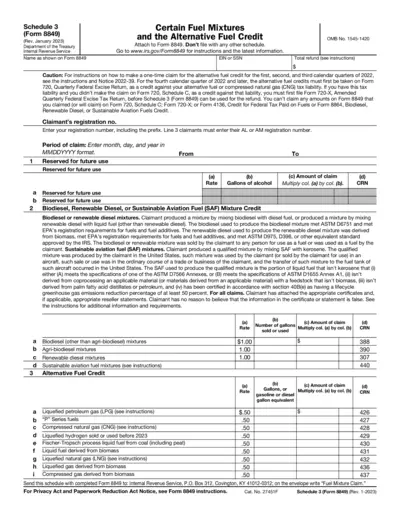

Schedule 3 Form 8849 Fuel Mixture Claim Instructions

This file provides detailed instructions and requirements for claiming alternative fuel credits using Schedule 3 (Form 8849). It is essential for anyone involved in the production or sales of specific fuel mixtures. Use this form to ensure you meet all necessary guidelines and claim your refunds correctly.

Property Taxes

Instructions for Hawaii Form N-848 Power of Attorney

Form N-848 allows individuals to grant authority to a representative for tax matters in Hawaii. This form is essential for taxpayers needing assistance with confidential tax information. Follow the guidelines carefully to ensure proper submission and representation.

Property Taxes

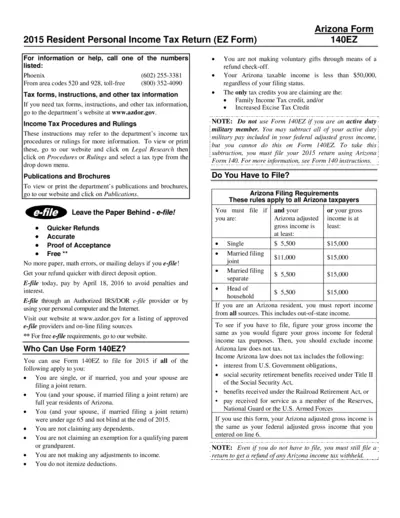

2015 Resident Personal Income Tax Return EZ Form

This document is essential for Arizona residents filing their 2015 income tax. It provides necessary instructions and details on eligibility. Utilize this form to ensure compliance with state tax regulations.

Property Taxes

California Franchise Tax Board Form 568 Instructions

This document provides comprehensive instructions for completing Form 568, the Limited Liability Company Return of Income in California. It includes vital reporting requirements, important deadlines, and guidance on how to navigate the form. Suitable for LLCs in California and their tax preparers.

Property Taxes

Instructions for Form IT-558 New York State Adjustments

This document provides essential instructions for completing Form IT-558, which is used by taxpayers in New York State to report adjustments due to decoupling from the Internal Revenue Code. It outlines the necessary requirements for partnerships, S corporations, and beneficiaries of estates or trusts. Understanding these instructions is crucial for proper tax filing compliance.