Property Law Documents

Property Taxes

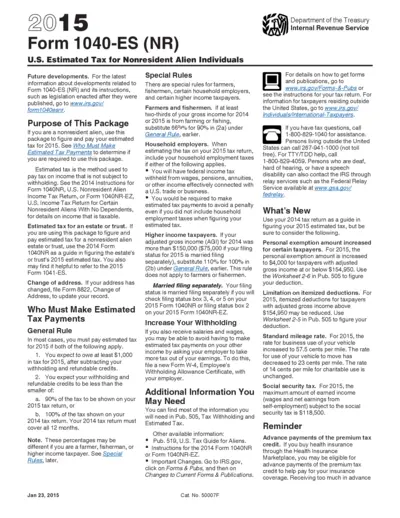

U.S. Estimated Tax Form 1040-ES for Nonresidents

Form 1040-ES (NR) helps nonresident aliens estimate and pay their 2015 tax. Ensure compliance with IRS regulations by using this guide. This document outlines essential information and instructions for taxpayers.

Real Estate

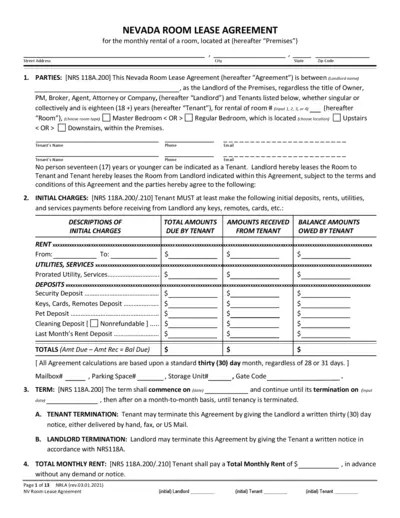

Nevada Room Lease Agreement for Rental of Room

This Nevada Room Lease Agreement outlines the terms and conditions for renting a room. It includes detailed information on initial charges, monthly rent, and tenant responsibilities. This document serves as a legal binding between the landlord and the tenant.

Real Estate

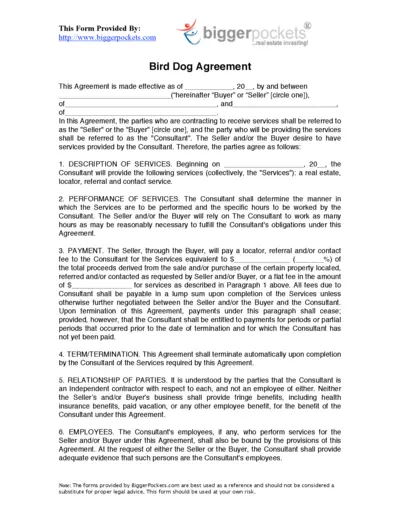

Bird Dog Agreement for Real Estate Consulting

This Bird Dog Agreement serves as a formal contract between a Buyer, Seller, and Consultant in real estate transactions. It outlines the roles of each party, services provided, and payment terms. Ideal for individuals looking to engage in real estate investing with proper documentation.

Property Taxes

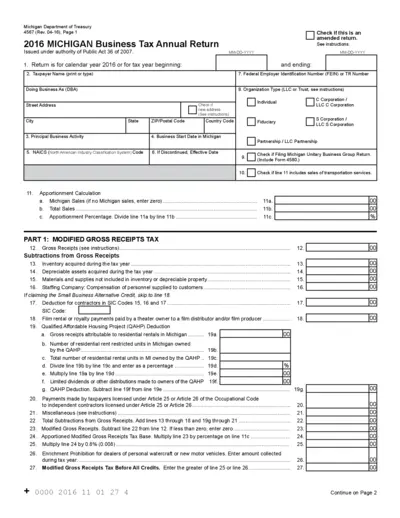

Michigan Business Tax Annual Return 2016

The Michigan Business Tax Annual Return form is essential for businesses to report their income and tax liabilities accurately. This form is required for compliance with Michigan tax laws and helps calculate the business tax due. Businesses should fill out this form to ensure they meet their tax obligations and avoid penalties.

Real Estate

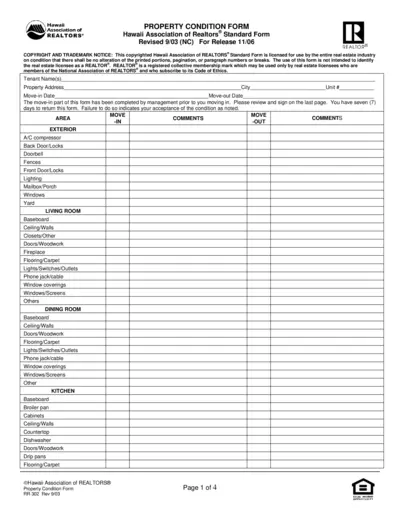

Hawaii Property Condition Form for REALTORS

The Hawaii Property Condition Form is essential for documenting the condition of rental properties. This form enables both landlords and tenants to have a clear understanding of the property’s state. Users can fill, edit, and sign this form easily through PrintFriendly.

Property Taxes

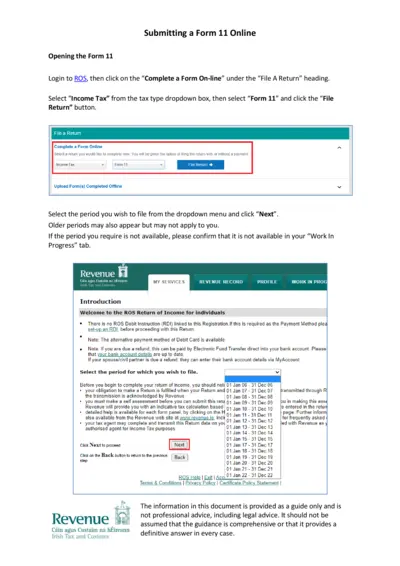

Form 11 Online Submission Guide for Income Tax

This document provides detailed instructions on how to submit Form 11 online. It includes guidance on filling out the form and important deadlines. Ideal for individuals filing income tax in Ireland.

Property Taxes

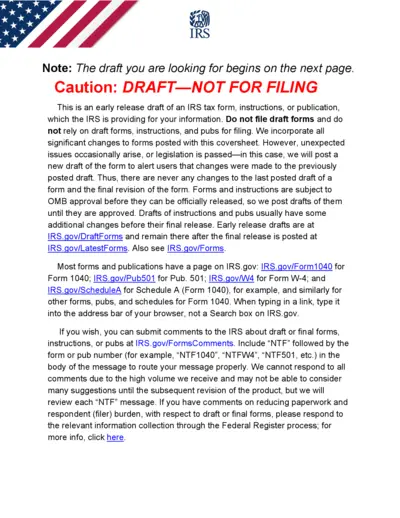

IRS Instructions for Form 1041 for Estates and Trusts

This document provides essential instructions for filing Form 1041, which is used for U.S. Income Tax Return for Estates and Trusts. It outlines the requirements, deadlines, and important filing information necessary for compliance with IRS regulations.

Property Taxes

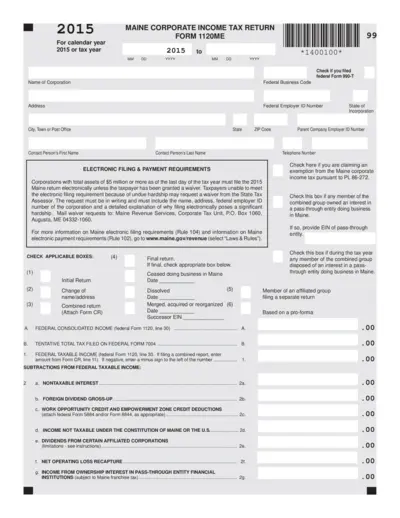

Maine Corporate Income Tax Return 2015 Form 1120ME

This document is the Maine Corporate Income Tax Return for the calendar year 2015. It provides important information and instructions for filing corporate taxes in Maine. Businesses must complete this form accurately to comply with state tax regulations.

Real Estate

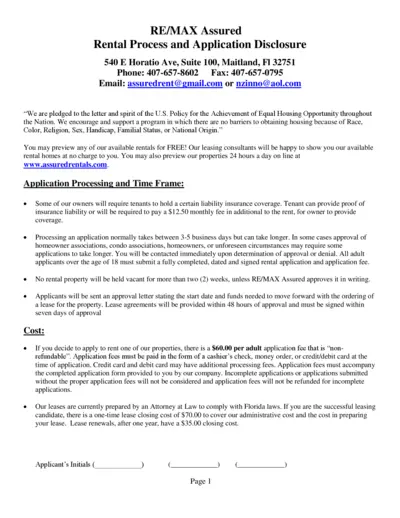

REMAX Assured Rental Process and Application Disclosure

This file outlines the rental process and application requirements for RE/MAX Assured. It provides essential guidelines for prospective tenants. Understanding this document is crucial for smooth approval and compliance.

Property Taxes

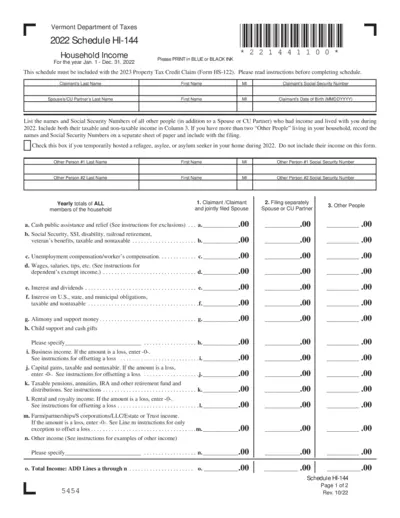

Vermont 2022 Schedule HI-144 Household Income Form

The Vermont Schedule HI-144 is essential for filing your household income for property tax credits. It captures all relevant income details for all household members. Ensure you follow the guidelines carefully to maximize your benefits.

Property Taxes

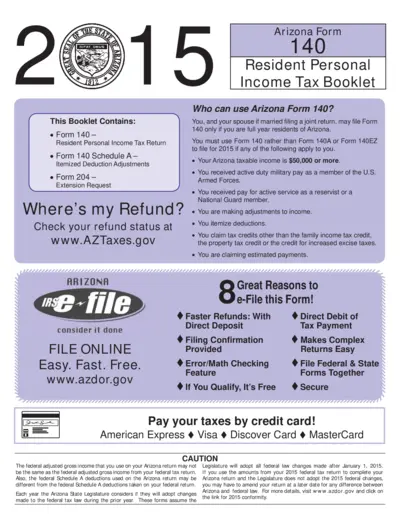

Arizona Form 140 Instructions and Information

This file contains important information and instructions for filling out Arizona Form 140. It covers eligibility, filing process, and updates for 2015 taxes. Ideal for Arizona residents seeking to file their income tax returns accurately.

Property Taxes

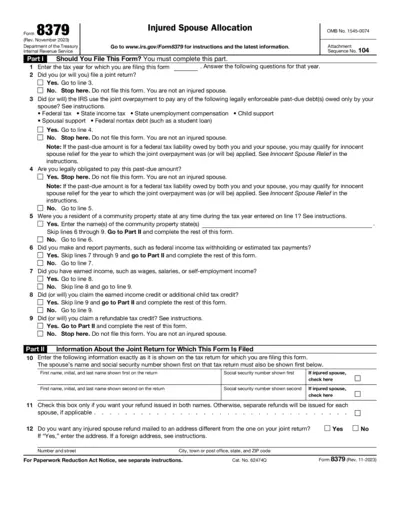

Injured Spouse Allocation Form 8379 Instructions

This document provides critical information regarding the Injured Spouse Allocation Form 8379. It helps individuals understand their eligibility and how to properly file this form to receive their refunds. Make sure to follow the instructions carefully to ensure accurate filing.