Property Law Documents

Property Taxes

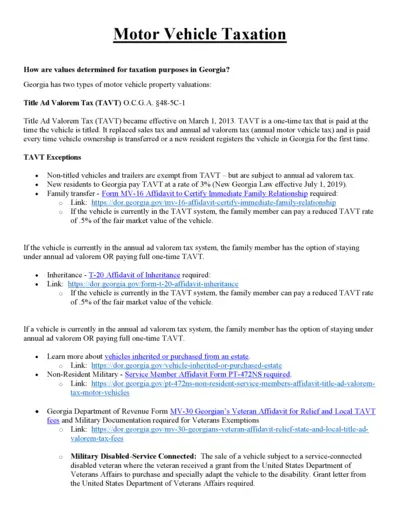

Motor Vehicle Taxation in Georgia - Overview and Instructions

This file provides detailed information on motor vehicle taxation in Georgia, including Title Ad Valorem Tax (TAVT) and annual ad valorem tax. It also outlines exemptions and instructions for filing. Ideal for vehicle owners and residents in Georgia.

Property Taxes

North Carolina Tax Forms and Instructions 2015

This document provides essential guidelines for filling out North Carolina tax forms, specifically the D-400, for individuals. It includes instructions for accurate submission without discrepancies. Ideal for taxpayers looking to complete their 2015 tax filings correctly.

Real Estate

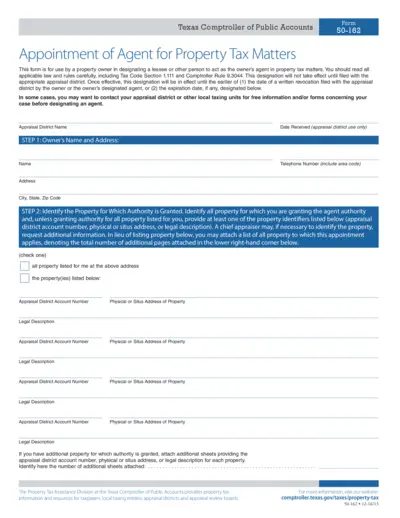

Appointment of Agent for Property Tax Matters

This form allows property owners to designate an agent for property tax matters. It provides clear instructions regarding property identification and agent authority. It's essential for ensuring proper representation in property tax issues.

Property Taxes

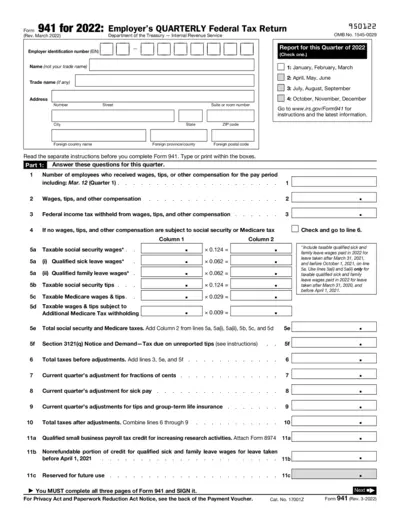

Employer's Quarterly Federal Tax Return Form 941

Form 941 is the Employer's Quarterly Federal Tax Return required by the IRS. This form allows employers to report income taxes, social security tax, and Medicare tax withheld from employee wages. Proper filing is essential for compliance with federal tax laws.

Property Taxes

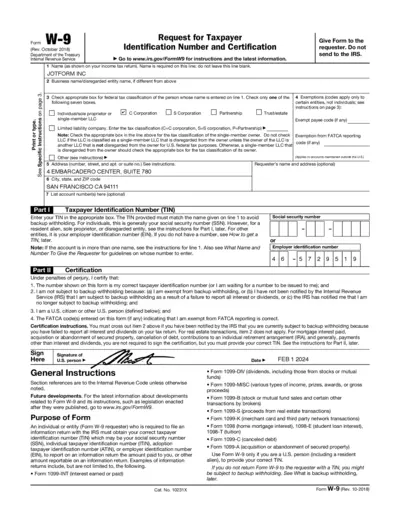

Request for Taxpayer Identification Number W-9

Form W-9 is essential for individuals and entities to provide taxpayer identification information. It ensures accurate reporting to the IRS for payments. Use this form to avoid backup withholding on your income.

Real Estate

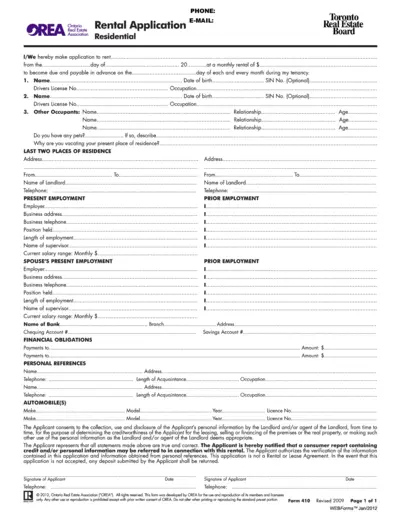

Residential Rental Application Form for Ontario

This Residential Rental Application is essential for tenants looking to rent a property in Ontario. It collects necessary personal and financial information to assess creditworthiness. Ensure to fill it out completely for a smooth application process.

Real Estate

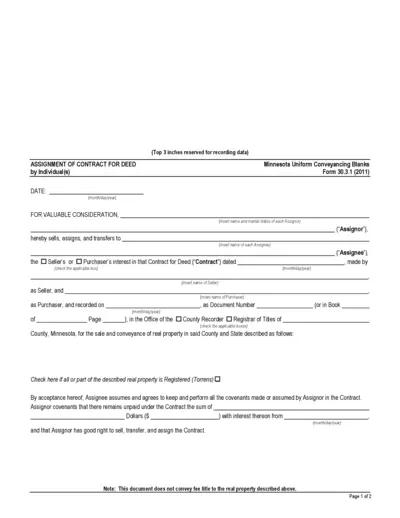

Assignment of Contract for Deed in Minnesota

This form is essential for individuals looking to assign their interest in a contract for deed in Minnesota. It provides necessary details and instructions to ensure proper completion. Ideal for both personal and business purposes regarding property transfers.

Real Estate

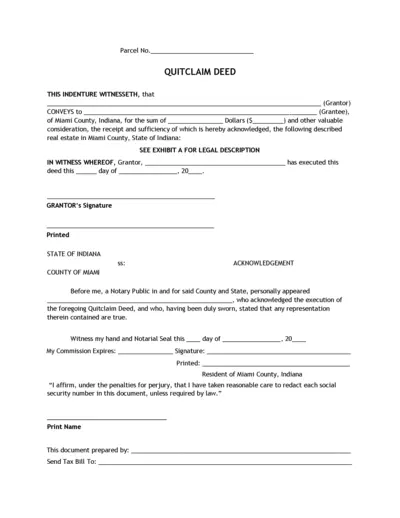

Quitclaim Deed for Real Estate in Indiana

This Quitclaim Deed is a legal document utilized for transferring property ownership. It includes essential information about the grantor and grantee, and details about the property involved. Ideal for those looking to execute property transfers in Miami County, Indiana.

Property Taxes

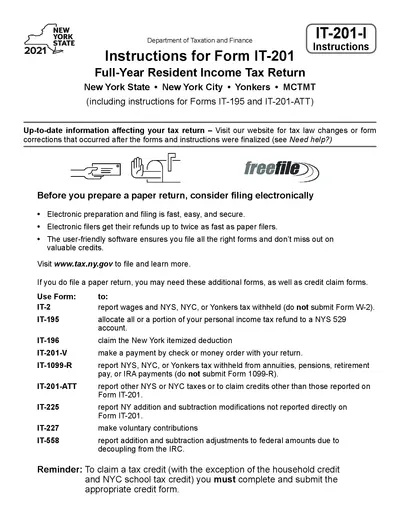

New York State IT-201 Instructions for 2021

This document provides detailed instructions for completing the New York State IT-201 Full-Year Resident Income Tax Return for 2021. It includes essential guidelines for filing taxes in New York State, New York City, and Yonkers, as well as important credit and payment information. Users will find valuable resources and links for e-filing and tax law updates.

Property Taxes

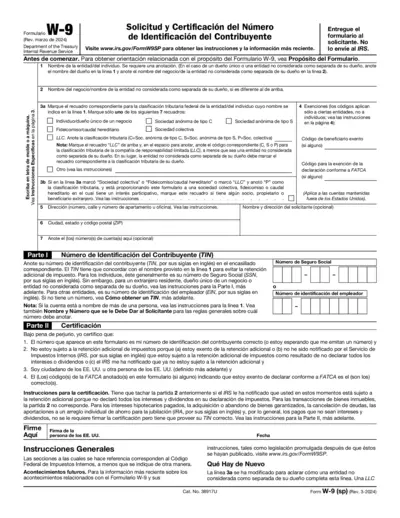

Form W-9 Instructions 2024 - IRS Tax Identification

This document provides detailed instructions for filling out Form W-9, which is essential for U.S. taxpayers. It explains how to correctly input taxpayer identification information. Understanding this form helps ensure compliance with IRS regulations.

Property Taxes

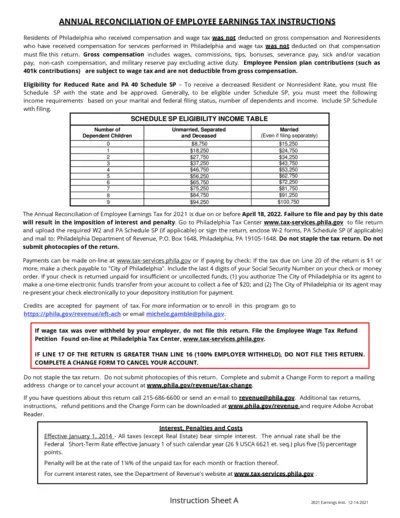

Annual Reconciliation Employee Earnings Tax Instructions

This file provides essential instructions for residents and non-residents of Philadelphia regarding the filing of the Annual Reconciliation of Employee Earnings Tax. It outlines eligibility criteria, submission guidelines, and important deadlines to ensure compliance with local tax regulations.

Tenant-Landlord

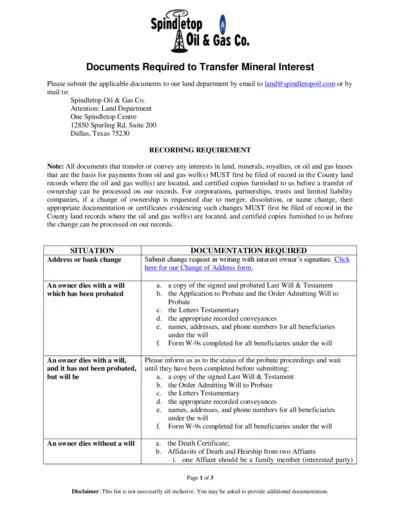

Transfer of Mineral Interest Documentation

This document outlines the requirements for transferring mineral interest ownership. It details necessary documentation and submission processes. Essential for both individuals and entities engaged in mineral interest transactions.