Property Law Documents

Property Taxes

Instructions for Schedule R Form 941 Rev March 2024

This file provides detailed instructions for completing Schedule R, Form 941, for the year 2024. It explains eligibility for filing, how to fill out various sections, and the purpose of Schedule R in context with the IRS. Users will find guidance on necessary information and requirements for aggregate Form 941 filers.

Property Taxes

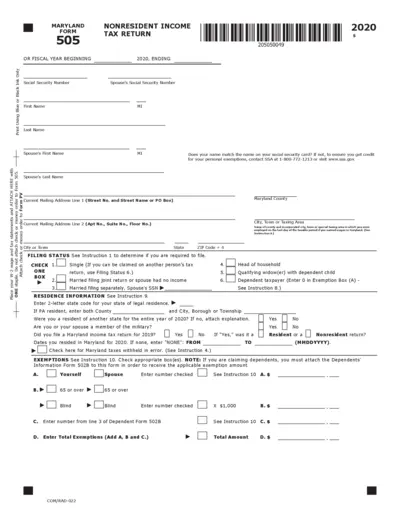

Maryland Nonresident Income Tax Return 2020

The Maryland Form 505 is designed for nonresidents to report their income tax for the year 2020. This form includes information about income, exemptions, and tax calculations. It is essential for nonresidents who earned income in Maryland to ensure accurate tax reporting.

Property Taxes

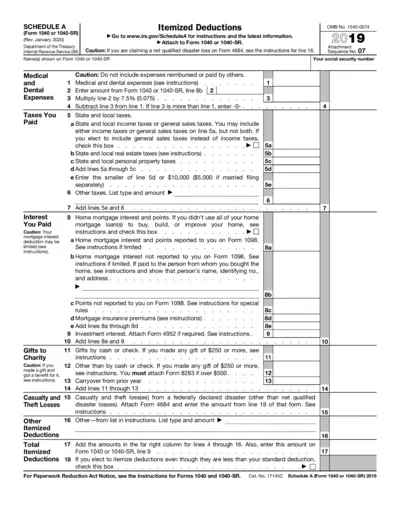

Schedule A Itemized Deductions IRS Form 1040

Schedule A is used to report itemized deductions for individual income tax returns. This form helps taxpayers claim deductions such as medical expenses, taxes paid, and mortgage interest. Accurate completion maximizes potential deductions and ensures compliance with tax regulations.

Real Estate

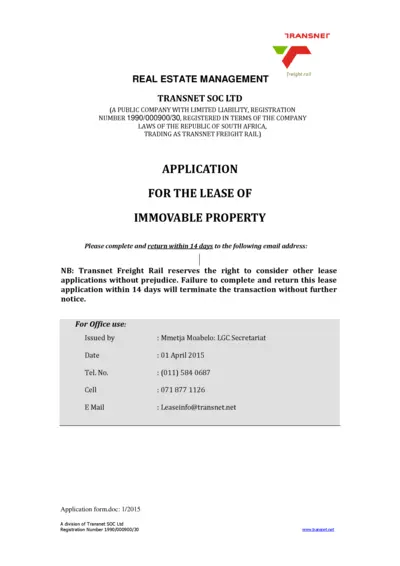

Transnet Lease Application for Real Estate

This file serves as the official lease application for Transnet Freight Rail's immovable properties. It contains important instructions and requirements for submitting a lease application. Ensure all sections are completed and supporting documents are included for a successful application.

Real Estate

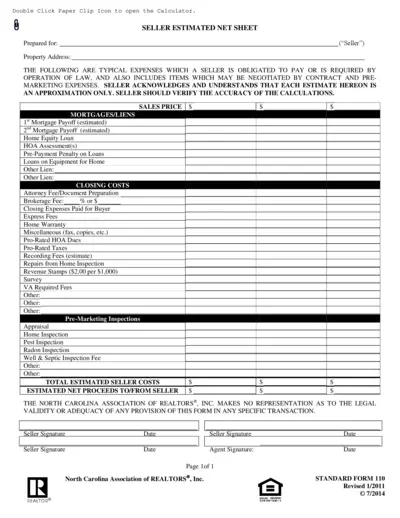

Seller Estimated Net Sheet Calculator

This Seller Estimated Net Sheet Calculator provides a detailed breakdown of the estimated costs sellers may incur during a real estate transaction. Users can easily input their mortgage payoffs, closing costs, and other expenses to calculate their net proceeds. It is essential for sellers to understand their financial obligations clearly before closing.

Property Taxes

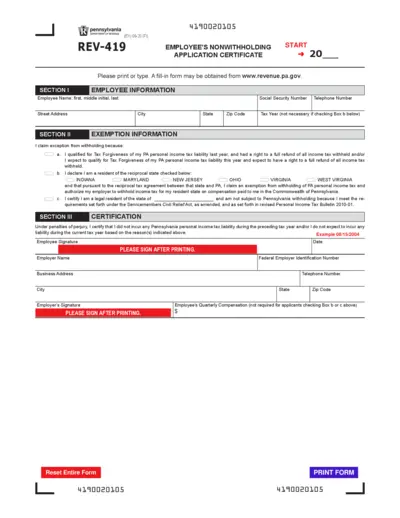

Employee's Nonwithholding Certificate Form REV-419

The REV-419 form allows employees to apply for nonwithholding of Pennsylvania personal income tax. This certificate is essential for individuals expecting no tax liability. Ensure accurate completion to facilitate proper tax management.

Property Taxes

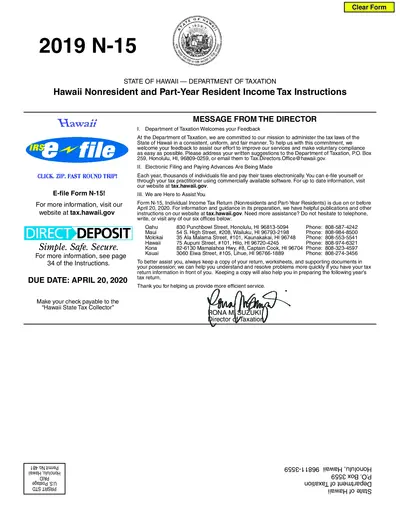

Hawaii Nonresident Part-Year Resident Tax Instructions

This file provides important instructions for filing the Hawaii Nonresident and Part-Year Resident Income Tax form. It includes details on due dates, filing methods, and contact information for assistance. It is essential for anyone needing to understand their tax obligations in Hawaii.

Tenant-Landlord

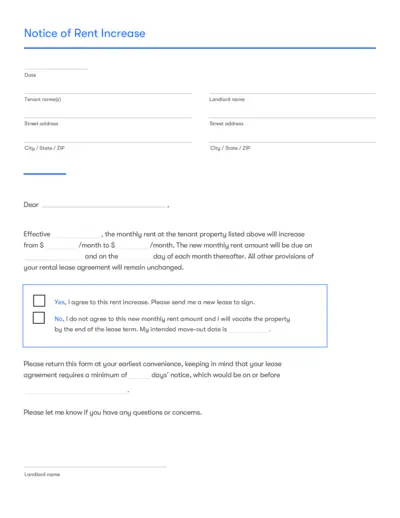

Notice of Rent Increase Notification Template

This document is a formal notice of rent increase for tenants. It includes essential details for both landlords and tenants. Use it to ensure compliance with rental agreement terms.

Property Taxes

Understanding Adjusted Gross Income for Tax Purposes

This file provides a comprehensive overview of the Adjusted Gross Income (AGI) as defined by tax law. It discusses its components, recent changes, and comparisons with other income measures. Ideal for taxpayers seeking clarity on AGI and its calculation.

Real Estate

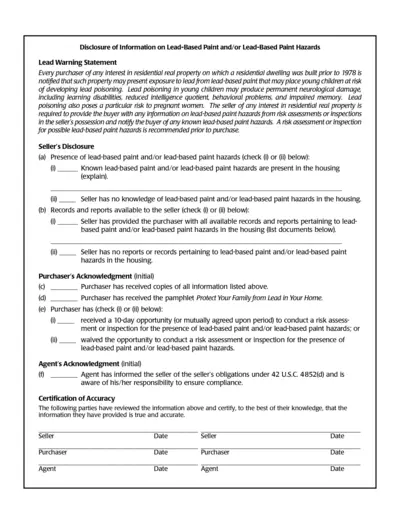

Lead-Based Paint Disclosure Form Guidelines

This form provides essential information regarding lead-based paint and potential hazards for properties built before 1978. It’s crucial for buyers to be aware of lead risks, especially for children and pregnant women. Sellers are required to disclose known hazards and provide relevant documentation.

Property Taxes

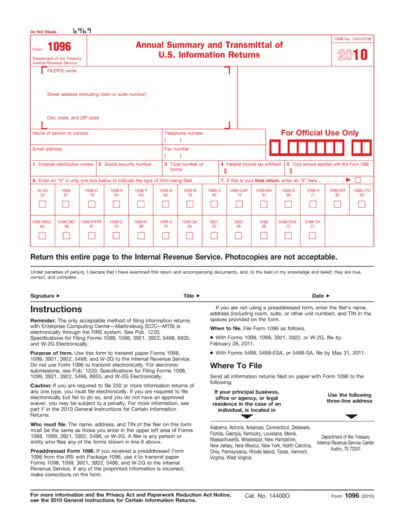

Form 1096 Annual Summary Transmittal U.S. Information Returns

Form 1096 is used to summarize and transmit information returns to the IRS. It must accompany Forms 1098, 1099, 3921, 3922, and 5498. Ensure accurate completion to avoid penalties.

Real Estate

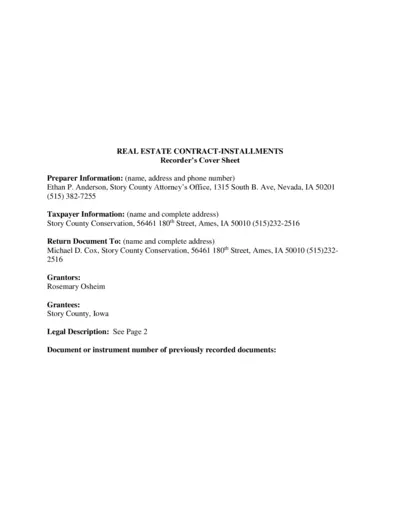

Real Estate Contract Installments for Buyers

This file outlines a real estate contract for installments between a seller and buyers. It details the payment terms, property description, and responsibilities of each party. Ideal for individuals and entities involved in property transactions.