Property Law Documents

Property Taxes

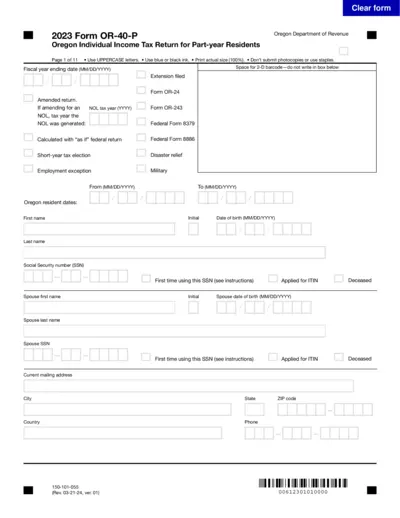

2023 Oregon Form OR-40-P Part-Year Tax Return

The 2023 Form OR-40-P is the Oregon Individual Income Tax Return for part-year residents. This form is essential for individuals who have moved in or out of Oregon during the tax year. Ensure accurate completion to avoid issues with the Oregon Department of Revenue.

Property Taxes

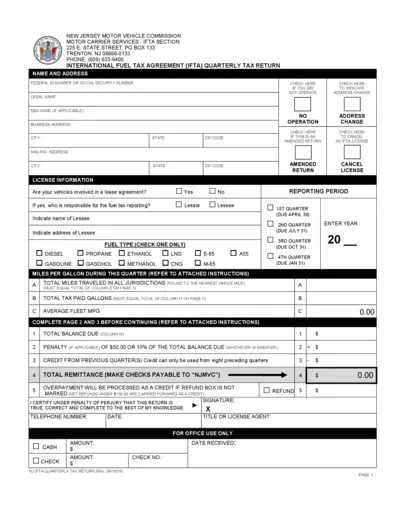

New Jersey IFTA Quarterly Tax Return Instructions

This document provides essential information and instructions for completing the New Jersey IFTA Quarterly Tax Return. It guides users through the necessary steps to ensure accurate submission. Understanding the requirements and sections helps in avoiding penalties and ensuring compliance.

Property Taxes

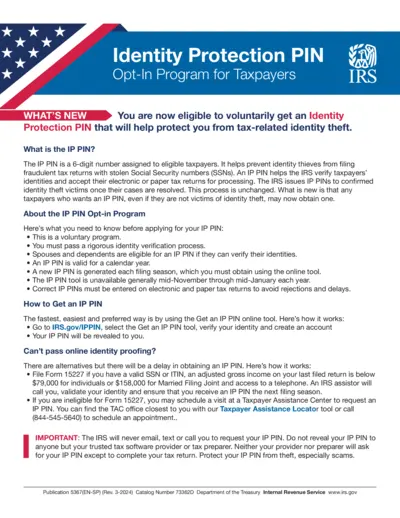

Identity Protection PIN Opt-In Program IRS Details

This file outlines the Identity Protection PIN (IP PIN) program by the IRS for taxpayers. It details eligibility, application processes, and security measures. The document is essential for individuals looking to safeguard themselves against tax-related identity theft.

Property Taxes

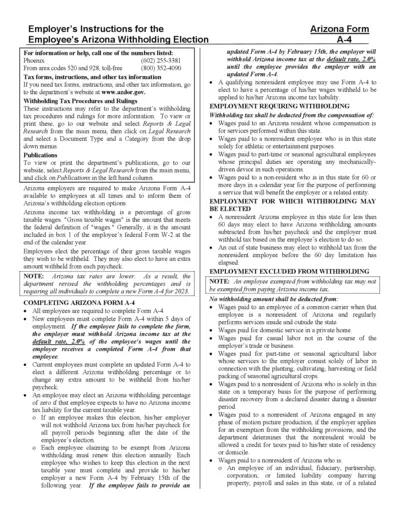

Employer's Instructions for Arizona Withholding Election

This document provides essential instructions for employees regarding Arizona's withholding tax election. It includes information on the procedure to complete Arizona Form A-4 and the tax withholding requirements. This guide is crucial for new and current employees to ensure proper tax withholding.

Property Taxes

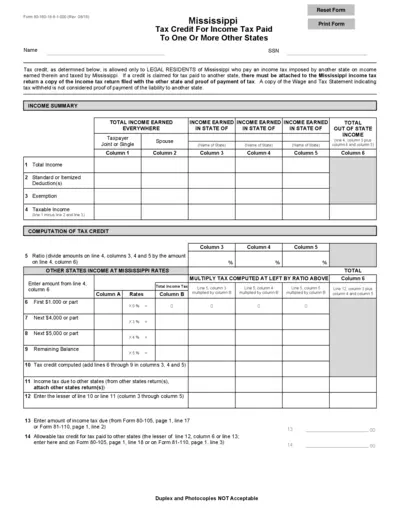

Mississippi Tax Credit for Income Tax Paid Form

This form allows Mississippi residents to claim a tax credit for income tax paid to other states. It is essential for those who earn income outside Mississippi and wish to offset their tax liability. Ensure to attach required documents for successful processing.

Zoning Regulations

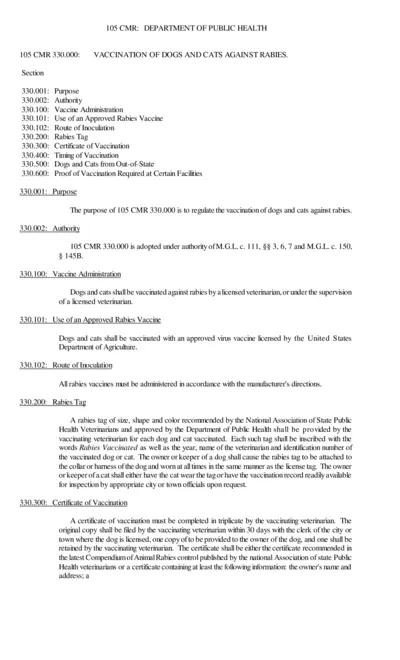

Vaccination of Dogs and Cats Against Rabies Regulations

This document outlines the regulations for vaccinating dogs and cats against rabies. It includes guidelines on vaccine administration, timing of vaccinations, and necessary documentation. Veterinary professionals and pet owners must adhere to these regulations to ensure public health and safety.

Property Taxes

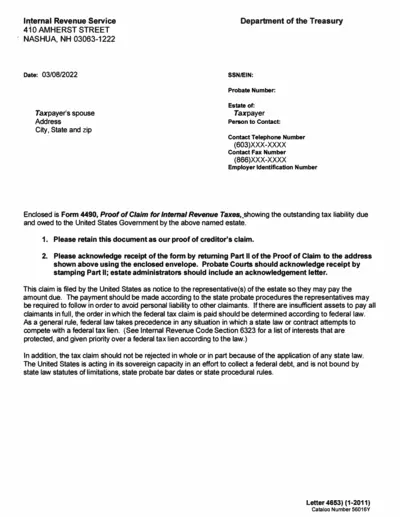

Proof of Claim for Internal Revenue Taxes Form 4490

This file contains the Proof of Claim for Internal Revenue Taxes, outlining tax liabilities due by an estate to the IRS. It includes detailed instructions for submission and important legal information regarding the filing. Ideal for those needing to address federal tax claims associated with an estate.

Property Taxes

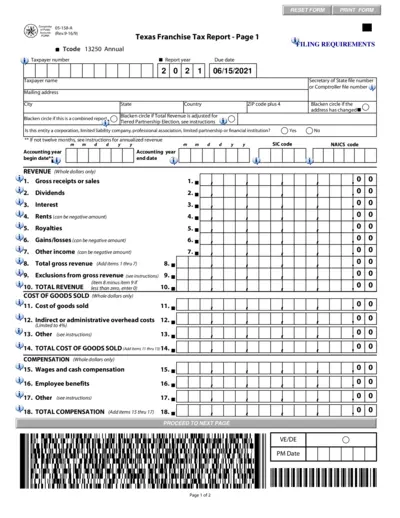

Texas Franchise Tax Report for 2021

The Texas Franchise Tax Report is essential for businesses reporting their tax obligations in Texas. This form requires detailed financial information to determine tax liability. Ensure accurate completion to avoid penalties.

Real Estate

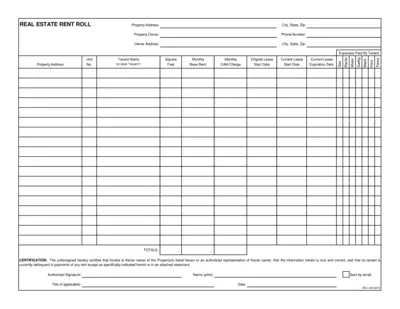

Real Estate Rent Roll Document Template

This file serves as a comprehensive real estate rent roll, detailing property and tenant information. It includes sections for expenses paid by tenants and certification of accuracy. Property owners and managers will find this document essential for maintaining accurate records.

Real Estate

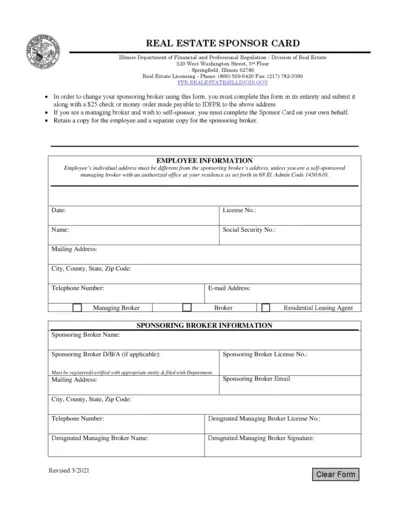

Illinois Real Estate Sponsor Card Submission

This document is the Illinois Real Estate Sponsor Card, necessary for changing your sponsoring broker. It provides mandatory fields to fill out for accurate processing. Use this form to ensure compliance with Illinois real estate regulations.

Real Estate

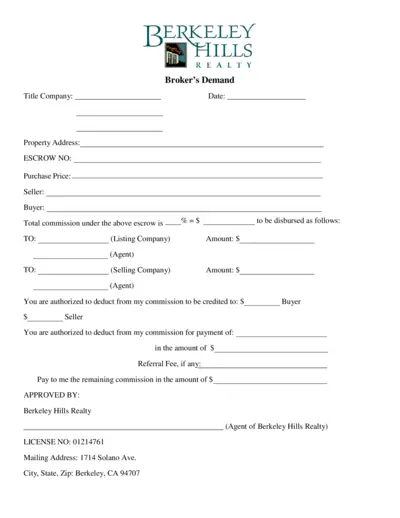

Escrow Commission Agreement for Property Sales

This file is an escrow commission agreement used in real estate transactions. It outlines the terms of commission disbursement between agents and the company involved. This document is essential for maintaining clear financial dealings during property sales.

Property Taxes

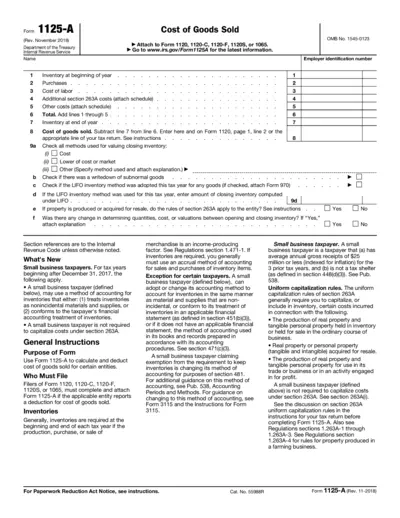

Form 1125-A Instructions for Cost of Goods Sold

Form 1125-A is used to calculate and report the cost of goods sold for various tax returns. This form is essential for businesses to accurately compute their taxable income. Make sure to follow the instructions carefully to ensure compliance with IRS regulations.