Property Law Documents

Real Estate

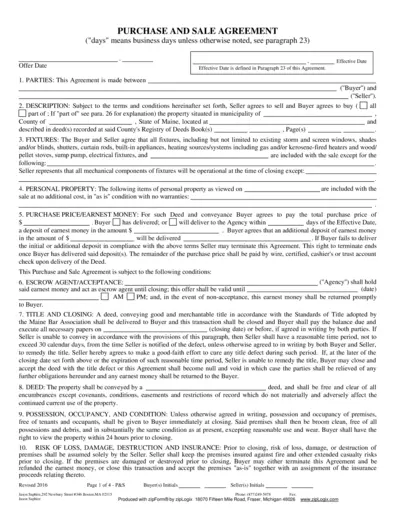

Purchase and Sale Agreement Template Maine

This Purchase and Sale Agreement template outlines the terms and conditions between a buyer and seller for a property transaction in Maine. It includes essential sections such as parties involved, purchase price, and conditions for sale. Users can utilize this file to ensure a clear and legally compliant agreement standard for real estate transactions.

Property Taxes

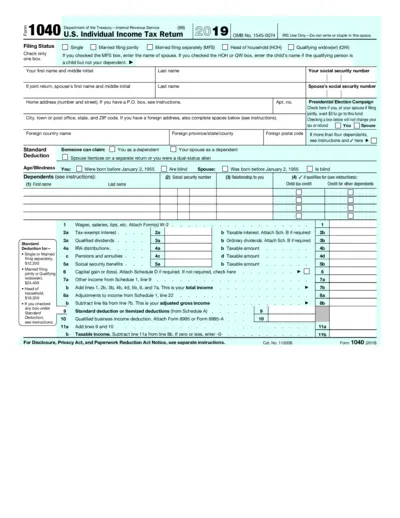

U.S. Individual Income Tax Return Form 1040 (2019)

The U.S. Individual Income Tax Return Form 1040 for 2019 is essential for individuals filing their annual income taxes. This IRS form requires personal information, income details, and deductions for accurate tax assessment. Use this guide to understand how to complete and submit the form effectively.

Real Estate

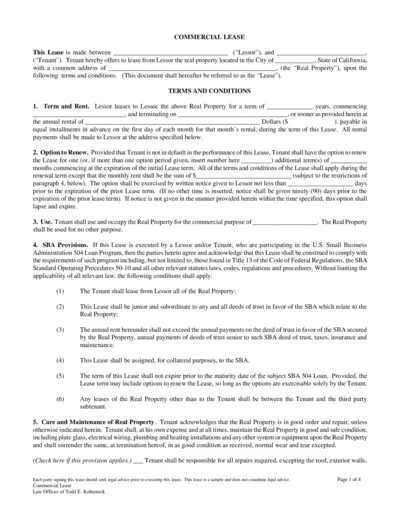

Commercial Lease Agreement in California

This Commercial Lease Agreement outlines the terms and conditions for leasing a property in California. It serves as an essential legal document for both lessors and tenants. Understanding its clauses helps ensure a smooth leasing experience.

Property Taxes

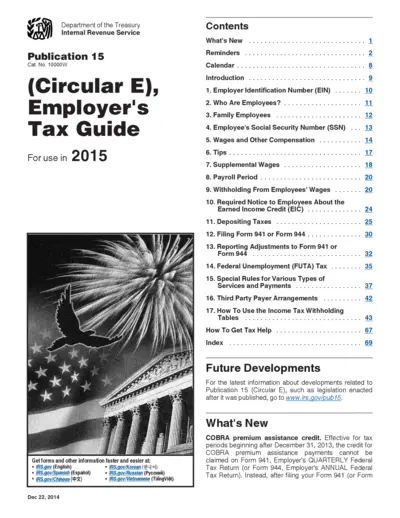

Employer Tax Guide 2015 | IRS Publication 15

The Employer's Tax Guide (Publication 15) provides important information for employers regarding tax responsibilities and requirements. This resource aids employers in understanding payroll tax calculations, withholding requirements, and tax forms they need to fill out. Essential for every employer managing taxes effectively and staying compliant with IRS regulations.

Property Taxes

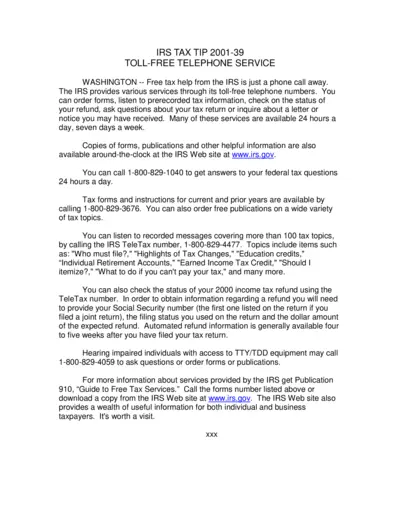

IRS Tax Tip 2001-39: Toll-Free Telephone Service

Discover how to access free tax help from the IRS via telephone. This resource explains the various services offered by the IRS to assist taxpayers. Learn about the specific numbers you can call for different inquiries and support.

Real Estate

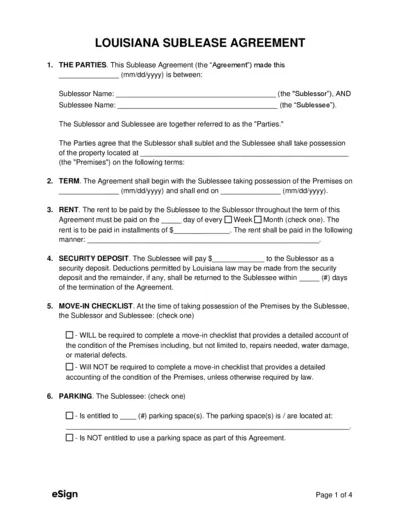

Louisiana Sublease Agreement Template Download

This Louisiana Sublease Agreement outlines essential terms and conditions for subleasing a property. It includes important sections like rent, security deposits, and utilities. Perfect for Sublessors and Sublessees looking to formalize their agreement.

Property Taxes

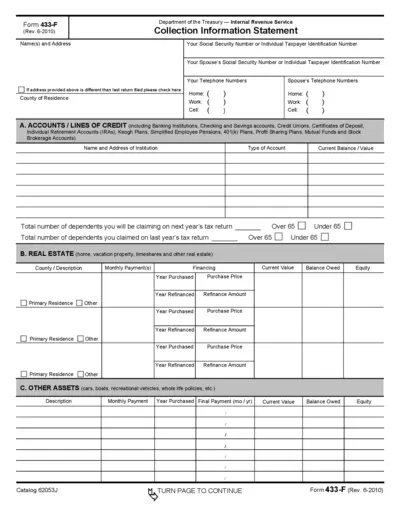

Form 433-F Collection Information Statement

Form 433-F is a crucial document for individuals seeking an installment agreement with the IRS. This form gathers financial information to assess payment capability. Complete the form accurately to facilitate your financial negotiations with the IRS.

Real Estate

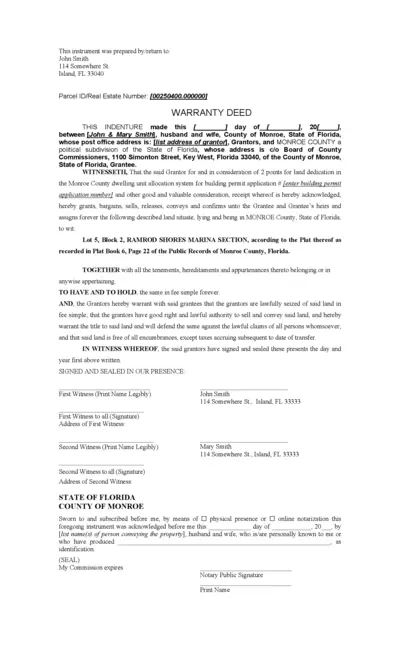

WARRANTY DEED FOR MONROE COUNTY FLORIDA PROPERTY

This warranty deed is a legal document recording the transfer of property ownership in Monroe County, Florida. It includes essential details such as grantor and grantee information, property description, and signatures. Ideal for those involved in real estate transactions in Florida.

Property Taxes

IRS Notification Requirements for Tax-Exempt Organizations

This document outlines the IRS notification requirements under Section 501(c)(4). It highlights key compliance issues and provides recommendations for organizations. Essential for understanding tax compliance obligations.

Property Taxes

Instructions for Filing Form 1040X Amended Tax Return

This document provides comprehensive instructions for completing Form 1040X, the Amended U.S. Individual Income Tax Return. It covers the purpose of the form, important dates, and additional requirements for various situations. Perfect for individuals looking to amend their tax returns efficiently.

Property Taxes

IRS Form 8829: Business Use of Your Home Instructions

This form provides instructions for calculating expenses related to the business use of your home. It is essential for self-employed individuals who want to deduct home office expenses. Complete this form alongside Schedule C (Form 1040) for accurate reporting.

Property Taxes

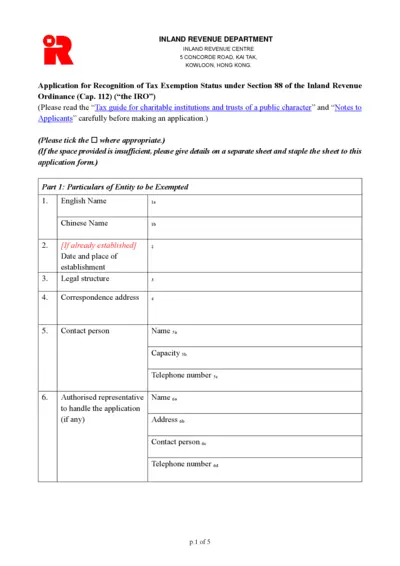

Application for Tax Exemption Status in Hong Kong

This file provides the application form for recognition of tax exemption status under Section 88 of the Inland Revenue Ordinance in Hong Kong. It is essential for charitable institutions and trusts of a public character seeking tax exemptions. Follow the instructions carefully to complete the application correctly.