Property Law Documents

Property Taxes

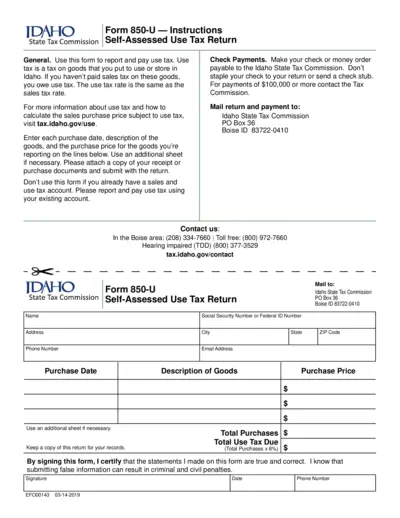

Idaho State Tax Commission Form 850-U Instructions

Form 850-U allows you to report and pay use tax in Idaho for goods that have not been taxed upon purchase. It provides clear instructions to ensure accurate reporting. Use this form to fulfill your tax obligations effortlessly.

Property Taxes

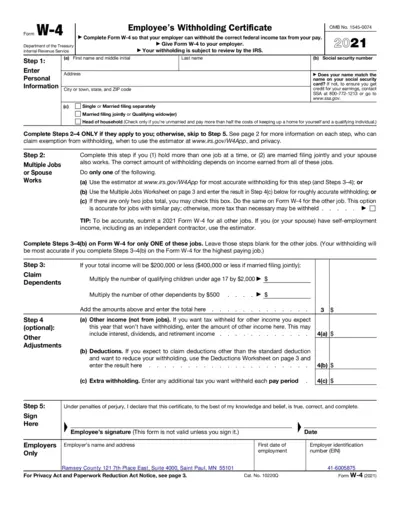

W-4 Employee's Withholding Certificate Form 2021

The W-4 form helps employees provide their withholding preferences to their employer for accurate federal income tax withdrawal. It is essential for adjusting your tax withholding based on personal circumstances. Completing this form correctly ensures you owe the right amount of tax or receive a refund when you file your return.

Property Taxes

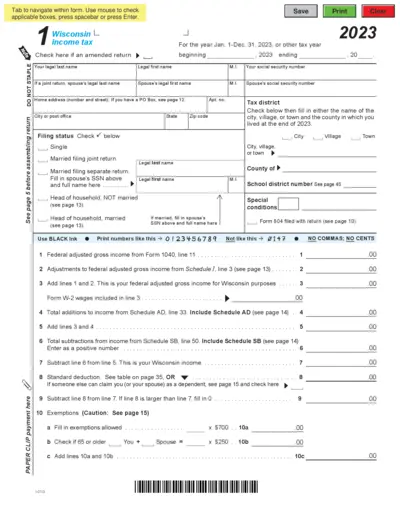

Wisconsin 2023 Income Tax Filing Form

This PDF file contains the necessary forms and instructions for filing Wisconsin income tax for the year 2023. It is essential for both residents and non-residents who earned income in Wisconsin. Ensure you fill it out accurately to avoid delays in processing.

Property Taxes

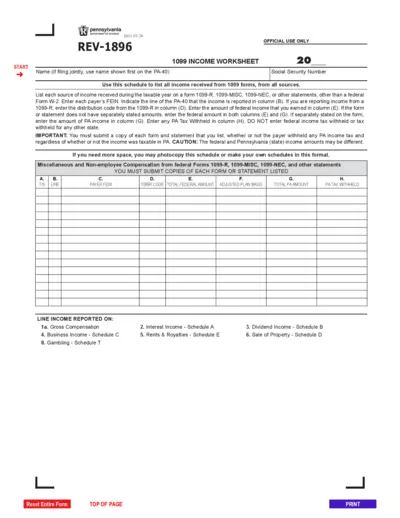

Pennsylvania 1099 Income Worksheet Instructions

The Pennsylvania 1099 Income Worksheet is essential for individuals reporting various income types. It helps ensure accurate income declaration from 1099 forms. This guide provides step-by-step instructions for completing and submitting the form correctly.

Property Taxes

Property Tax Exemption Application Instructions

This document provides crucial information on applying for a property tax exemption. It outlines eligibility, filing procedures, and requirements. Perfect for property owners seeking tax relief.

Property Taxes

Net Operating Losses (NOLs) for Tax Years 2015

This document provides guidelines on net operating losses (NOLs) applicable to individuals, estates, and trusts. It offers detailed instructions on how to figure, claim, and carry over NOLs for tax purposes. Essential for understanding your tax obligations and maximizing deductions.

Property Taxes

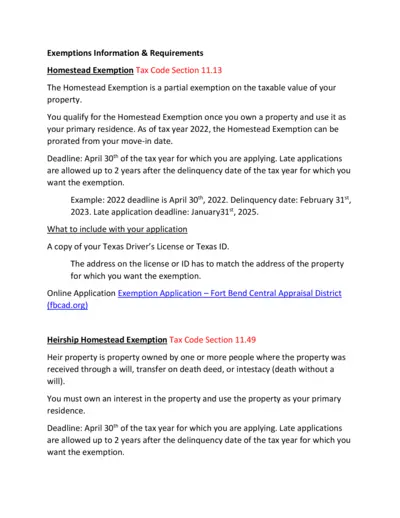

Homestead Exemption Application Instructions and Details

This file provides comprehensive information about the Homestead Exemption application process, including eligibility, required documents, and submission guidelines. It's essential for homeowners seeking tax reductions in Texas. The instructions also cover deadlines and late application procedures.

Real Estate

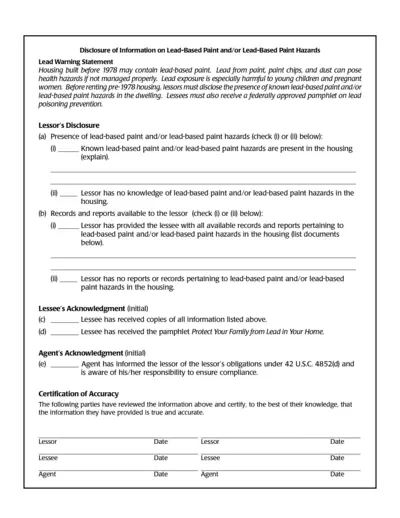

Lead-Based Paint Disclosure Form Instructions

This file contains essential information about lead-based paint hazards for housing built before 1978. It outlines the disclosure obligations of lessors and the acknowledgment requirements of lessees. This document is vital for ensuring safety and compliance with federal laws.

Property Taxes

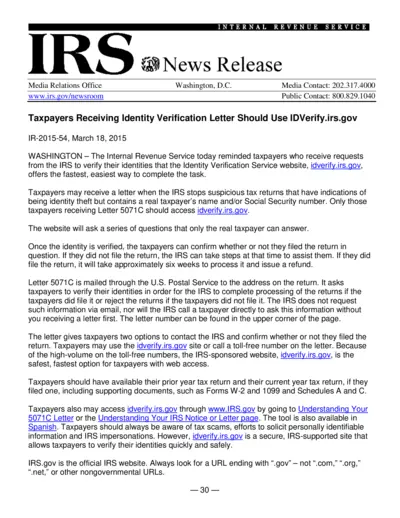

IRS Identity Verification Process Guidance

This file provides detailed instructions for taxpayers receiving an identity verification request from the IRS. It includes steps to verify your identity through the IRS website. Ensure you follow these guidelines carefully to protect your personal information.

Property Taxes

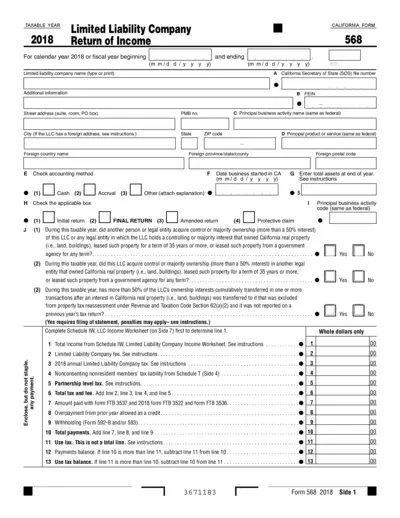

California LLC Tax Return Form 568 Instructions

The California Form 568 is the official return of income for Limited Liability Companies (LLCs). It provides essential information for tax filing for the taxable year 2018. The form includes details on income, assets, and tax liabilities.

Property Taxes

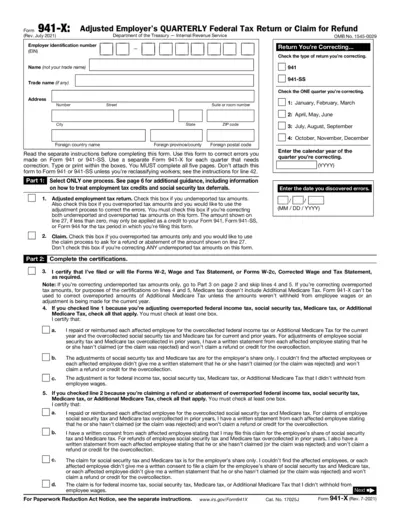

941-X Adjusted Employer's Quarterly Tax Return

Form 941-X is used to correct errors made on Form 941 or 941-SS. This form allows employers to adjust their reported tax amounts and claim refunds. Stay compliant with IRS regulations by accurately completing this form.

Property Taxes

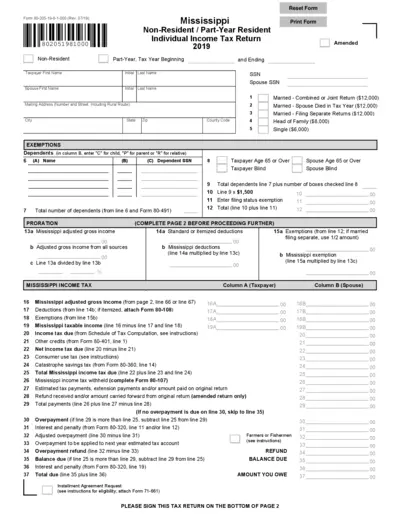

Mississippi Non-Resident Individual Income Tax Return

This file contains the form 80-205 for filing the Mississippi non-resident or part-year resident individual income tax return for 2019. It provides sections for reporting income, deductions, exemptions, and determining tax liabilities. Use this file to ensure compliance with state tax obligations.