Property Law Documents

Real Estate

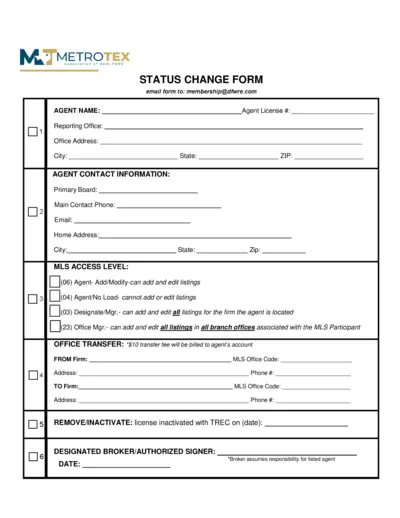

Metrotex Association Status Change Form Instructions

This status change form is essential for REALTORS needing to report agent information changes. It provides guidelines for agent transfers or license inactivation. Utilize this form to ensure compliance with MLS requirements.

Real Estate

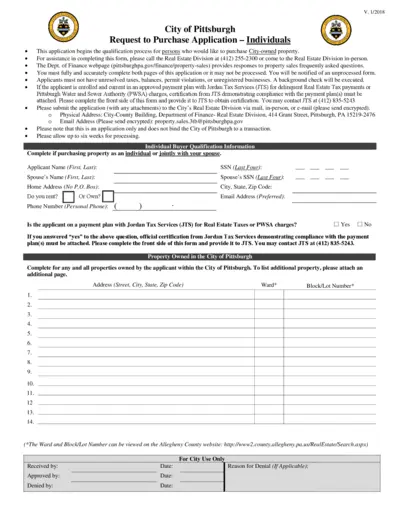

City of Pittsburgh Request to Purchase Application

This application is essential for individuals looking to purchase city-owned properties in Pittsburgh. It outlines the qualification process and necessary requirements for potential buyers. Applicants must ensure all information is accurate to facilitate smooth processing.

Property Taxes

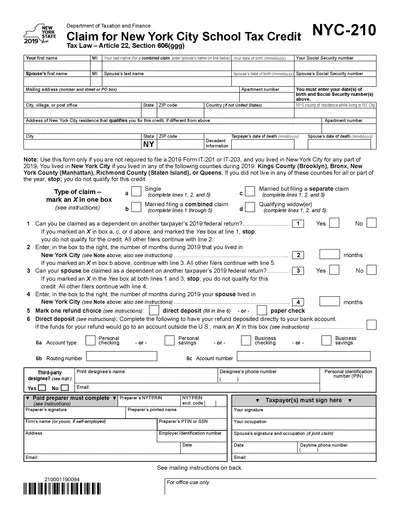

Claim for New York City School Tax Credit (2019)

This form is essential for residents of New York City who want to claim their School Tax Credit. It outlines the necessary information regarding eligibility and the submission process. Users can complete the form efficiently to ensure they receive their due credits.

Property Taxes

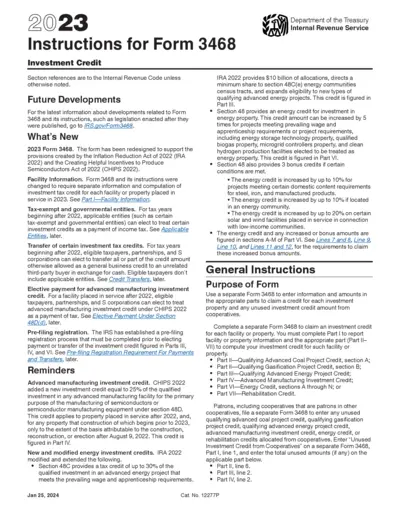

Instructions for Form 3468 Investment Credit

This document provides essential instructions and guidelines for taxpayers regarding Form 3468, which pertains to the Investment Credit. Users will find insights into eligibility, changes, and the claiming process for investment credits introduced by the Inflation Reduction Act and CHIPS Act. It's an invaluable resource for individuals and businesses looking to navigate the complexities of tax credits associated with investments.

Property Taxes

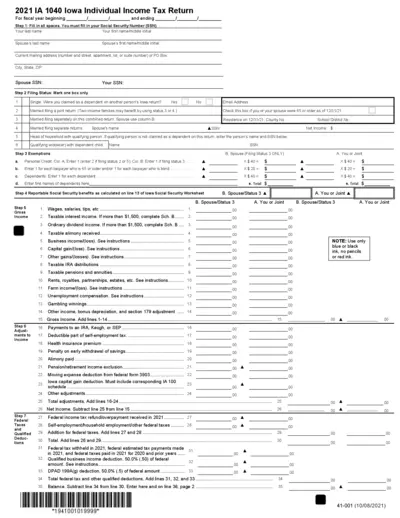

2021 Iowa Individual Income Tax Return Form IA 1040

The 2021 IA 1040 is the Iowa Individual Income Tax Return required for filing your state tax. This form is essential for residents of Iowa to report their income and calculate their tax liability. Follow the instructions to ensure accurate completion and submission.

Real Estate

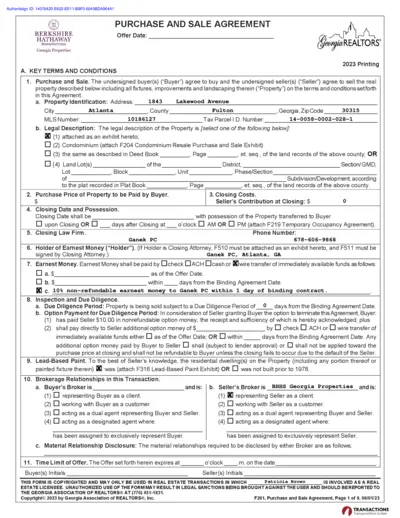

Georgia Purchase and Sale Agreement Document

This document outlines the purchase and sale agreement for real estate transactions in Georgia. It details key terms, conditions, and responsibilities for both buyers and sellers. Essential for anyone looking to engage in real estate transactions within the state.

Real Estate

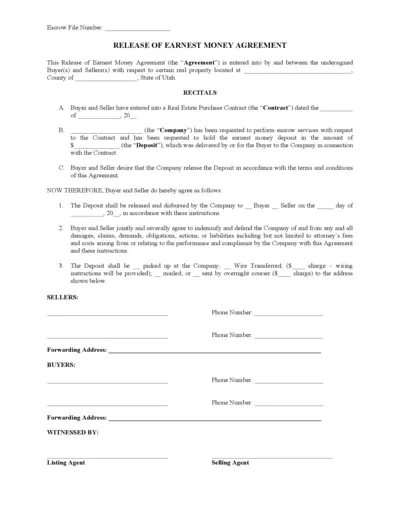

Release of Earnest Money Agreement in Utah

This file is a Release of Earnest Money Agreement intended for real estate transactions. It serves as a formal document for the release of deposits held in escrow. Buyers and sellers can use this agreement to ensure proper handling of earnest money.

Real Estate

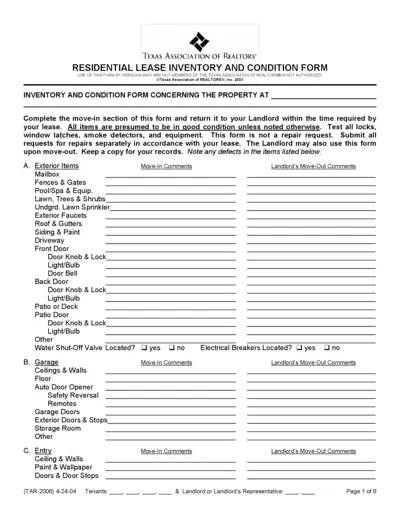

Texas Association of Realtors Residential Lease Form

This Residential Lease Inventory and Condition Form is essential for landlords and tenants in Texas. It helps document the condition of the property at move-in and move-out. Proper usage ensures smooth communication about repairs and maintenance.

Property Taxes

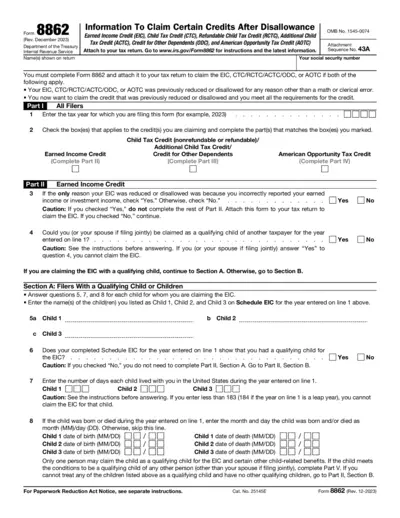

Form 8862 Instructions for Claiming Tax Credits

Form 8862 is used to reclaim certain tax credits after disallowance. It is essential for taxpayers who have had their Earned Income Credit or other credits reduced. This form must be completed accurately to ensure eligibility for these credits.

Property Taxes

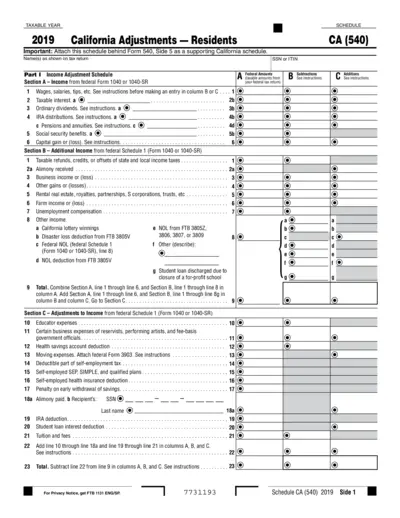

California Adjustments 2019 File for Tax Residents

This file contains the necessary California tax adjustments for residents filing in 2019. It offers detailed instructions on income adjustments, credits, and deductions. Taxpayers can use this document to accurately report their California income tax liability.

Property Taxes

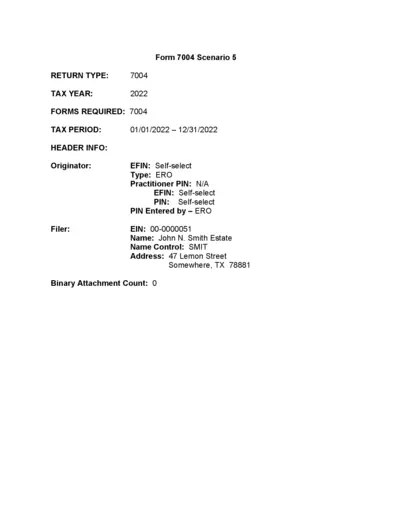

Form 7004 Automatic Extension Request 2022

Form 7004 allows taxpayers to request an automatic extension of time to file certain business income tax returns. This form is essential for businesses needing additional time for paperwork. Ensure to file by the granted due date to avoid penalties.

Real Estate

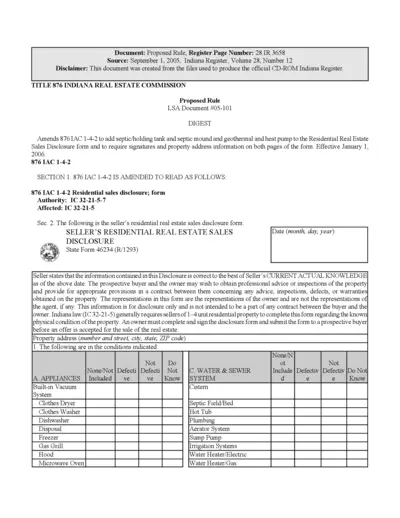

Proposed Rule for Indiana Real Estate Commission

This document outlines the proposed rule amendments by the Indiana Real Estate Commission. It details updates to the Residential Real Estate Sales Disclosure form. Effective January 1, 2006, the amendments include property details regarding septic systems and geothermal units.