Property Law Documents

Real Estate

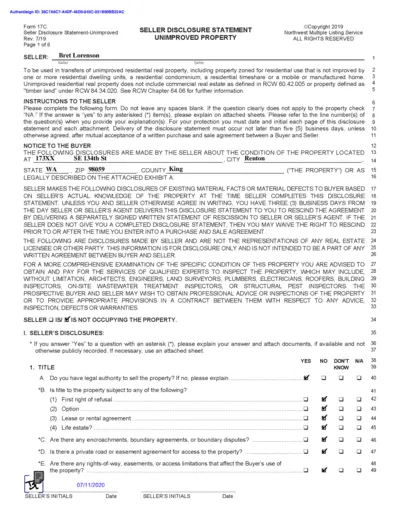

Seller Disclosure Statement Unimproved Property

This Seller Disclosure Statement is essential for transactions involving unimproved residential real property. It details the condition of the property and the seller's disclosures. Buyers are encouraged to read this document carefully before proceeding with the purchase.

Property Taxes

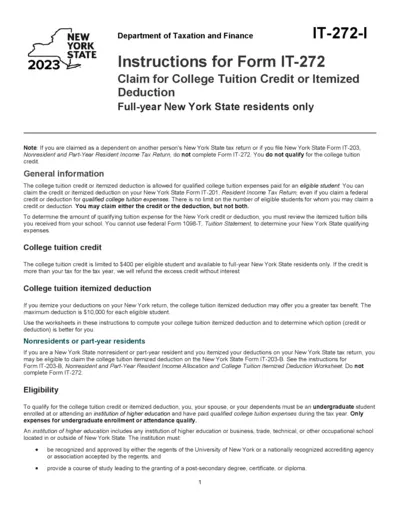

Instructions for New York College Tuition Credit

This document provides detailed instructions for New York State residents on claiming the College Tuition Credit or Itemized Deduction. It outlines eligibility criteria, required forms, and guidance for calculating the credit or deduction. Ensure you follow these guidelines precisely to maximize your tax benefits.

Property Taxes

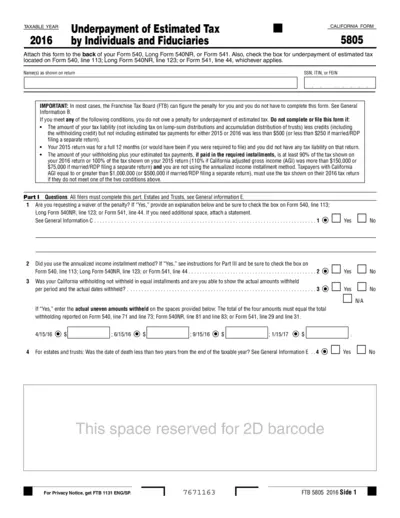

California Form FTB 5805 for Tax Year 2016

The California Form FTB 5805 is for reporting underpayment of estimated tax by individuals and fiduciaries. It is essential for those who may be subject to penalties for underpayment of tax. This form helps individuals determine if they owe a penalty based on their estimated tax payments.

Real Estate

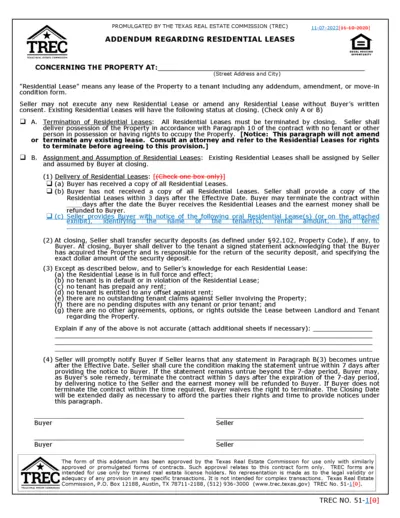

Texas Real Estate Commission Residential Lease Addendum

This document includes essential information about Residential Leases governed by the Texas Real Estate Commission. It provides instructions for buyers and sellers regarding the termination and assignment of existing leases. Ideal for anyone involved in real estate transactions in Texas.

Property Taxes

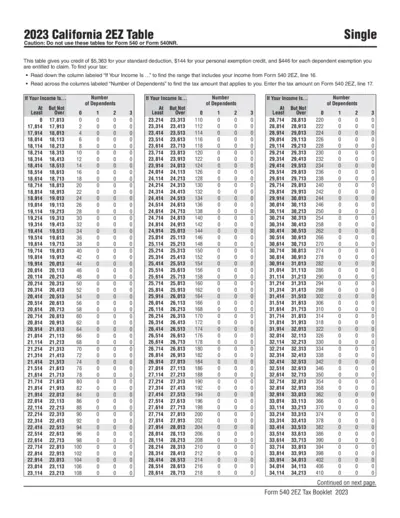

2023 California 2EZ Tax Form Instructions and Guidelines

This file provides comprehensive instructions for filling out the 2023 California 2EZ tax form. It outlines the required information and details regarding personal credits and dependent exemptions. Users can easily navigate the tax table to determine their applicable tax amount based on their income and number of dependents.

Property Taxes

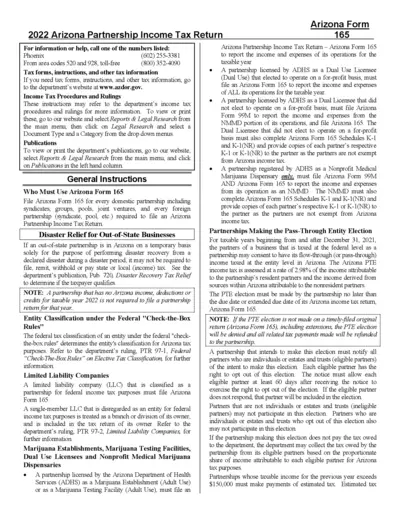

2022 Arizona Partnership Income Tax Return Form 165

The 2022 Arizona Partnership Income Tax Return Form 165 is essential for domestic partnerships to report their income. Properly filling this form ensures compliance with Arizona tax laws. Follow the guidelines closely to complete your submission.

Property Taxes

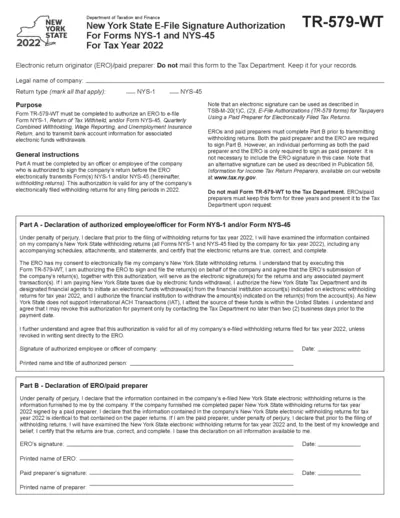

New York State E-File Signature Authorization 2022

This file provides essential information for completing the New York State E-File Signature Authorization for tax year 2022. It outlines the requirements for electronic return originators and paid preparers to e-file NYS-1 and NYS-45 forms. Familiarize yourself with the general instructions and the declaration process to ensure compliance.

Property Taxes

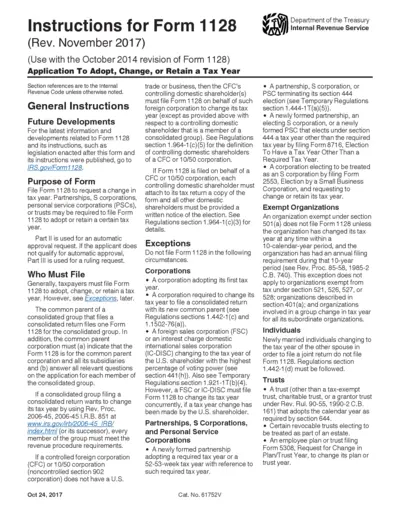

Form 1128 Instructions for Tax Year Changes

This PDF provides detailed instructions for completing Form 1128, which is used to adopt, change, or retain a tax year. It outlines the eligibility criteria, necessary forms, and submission details. Understanding these instructions is essential for ensuring compliance with IRS requirements.

Property Taxes

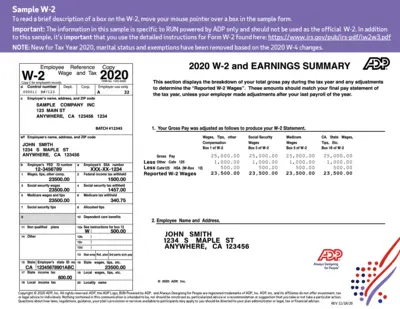

Sample W-2 Form Instructions and Guidelines

This document provides details and instructions for filling out the W-2 form, including its purpose and how to use it. Users can learn about the contents, fields, and necessary steps to complete the form accurately. It serves as a comprehensive guide for both employees and employers.

Real Estate

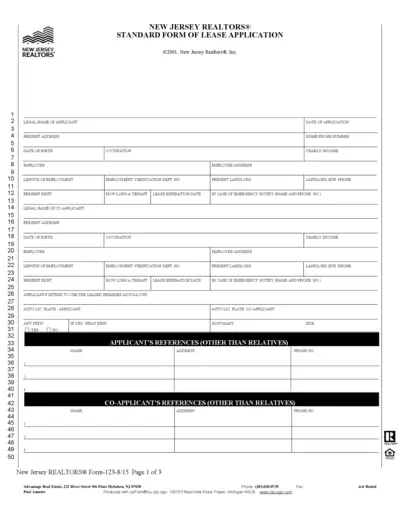

New Jersey Realtors Standard Lease Application Form

This file contains the Standard Form of Lease Application for New Jersey Realtors. It provides essential information for applicants to fill out. Users can use this form to apply for rental properties in New Jersey.

Property Taxes

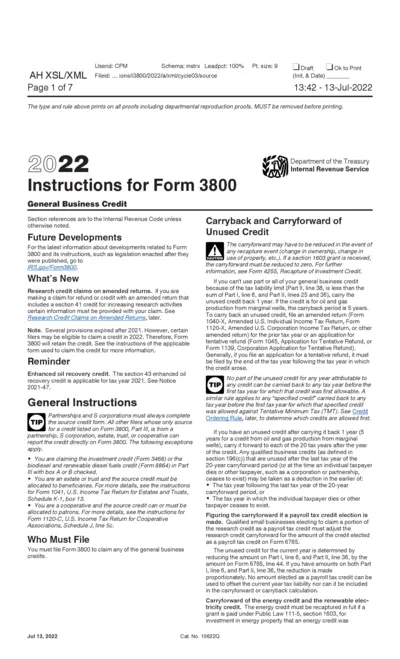

Instructions for Form 3800: General Business Credit

This file contains essential instructions for Form 3800, which details the general business credit. It offers guidelines and relevant updates for tax filers. Understanding these instructions is crucial for accurate tax reporting and credit claims.

Property Taxes

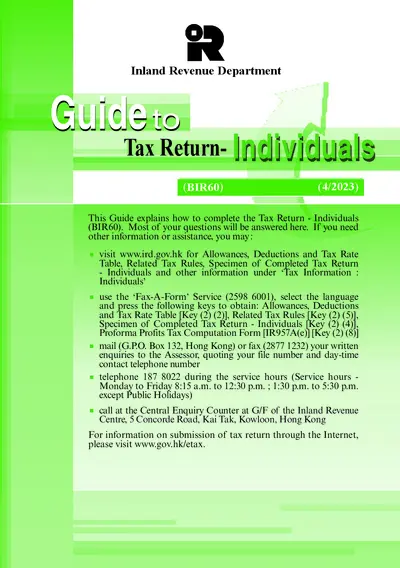

Inland Revenue Tax Return for Individuals Guide

This guide provides essential instructions for completing the Tax Return - Individuals (BIR60). It answers common questions regarding personal data and submission processes. Use this comprehensive resource for successful tax filing.