Property Law Documents

Property Taxes

California 2010 Form 109: Exempt Organization Business Income Tax

This document provides the details and instructions for California Form 109, used by tax-exempt organizations to report unrelated business income. It includes guidelines on filing, exclusions, reporting income, and recent updates for the taxable year 2010.

Property Taxes

NATIONAL TAXPAYER ADVOCATE PUBLIC FORUM

This file contains the transcript of the National Taxpayer Advocate Public Forum held on August 16, 2016, at the Cuyahoga County Public Library in Parma, Ohio. It includes appearances by several notable individuals, including Congressman Jim Renacci and National Taxpayer Advocate Nina Olson. The forum discusses the future operations of the IRS and the needs of American taxpayers.

Property Taxes

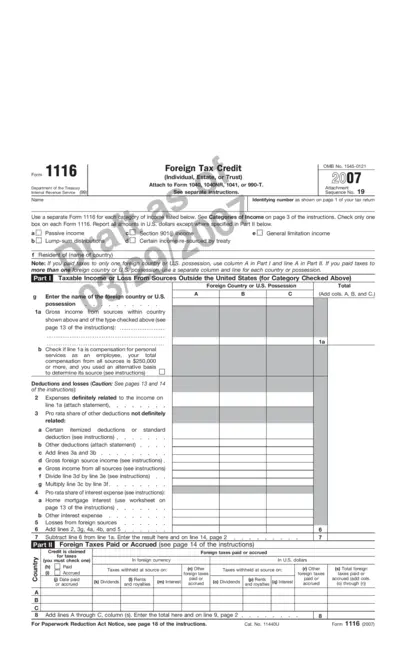

Form 1116 - Foreign Tax Credit Instructions

Form 1116 is used to claim the Foreign Tax Credit by individuals, estates, or trusts. Attach it to Form 1040, 1040NR, 1041, or 990-T. Follow the instructions provided to complete this form correctly.

Property Taxes

Hawaii Tax Clearance Form A-6 Instructions 2019

This file provides detailed instructions for filling out the Hawaii Tax Clearance Form A-6. It is used to obtain tax clearance for state and federal purposes. The instructions include line-by-line guidance for completing the form accurately.

Property Taxes

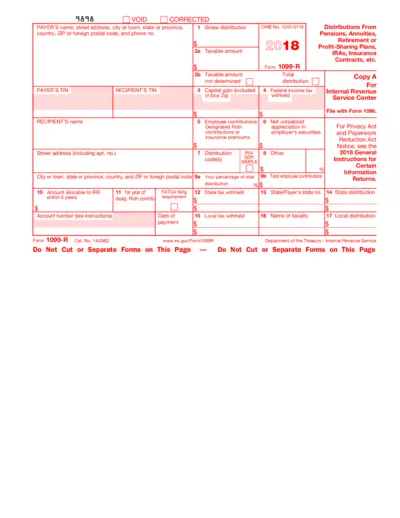

Form 1099-R: Distributions From Pensions, Annuities, etc.

Form 1099-R is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. This form details the gross distribution, taxable amount, and any federal income tax withheld. It is essential for taxpayers to report this information on their federal tax return.

Property Taxes

Pennsylvania Property Tax/Rent Rebate Program Guide

This document provides information about the Pennsylvania Property Tax/Rent Rebate Program, including eligibility criteria, income limits, and application process. It is designed to help older Pennsylvanians, widows/widowers, and people with disabilities. The document also outlines the necessary documents for filing and important dates.

Property Taxes

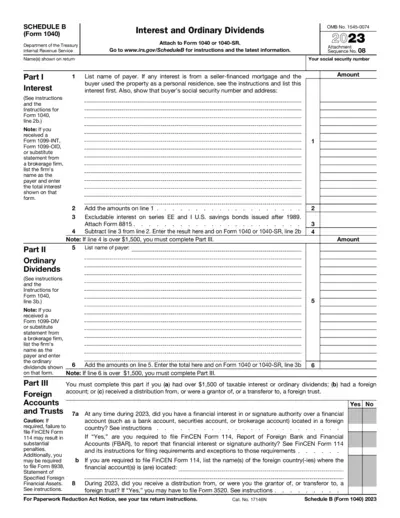

Schedule B (Form 1040) Instructions & Information

Schedule B (Form 1040) is used to report interest and ordinary dividends. Attach it to Form 1040 or 1040-SR. Ensure you complete Part III if necessary.

Property Taxes

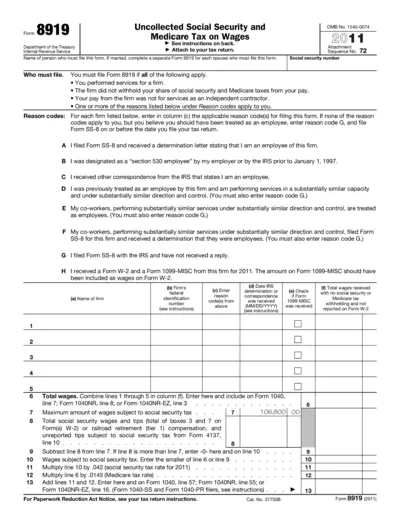

Form 8919: Uncollected Social Security and Medicare Tax on Wages

Form 8919 is used to figure and report your share of uncollected Social Security and Medicare taxes due on your compensation if you were treated as an independent contractor by your employer. Attach it to your tax return. Specific filing instructions and reason codes dictate its completion.

Property Taxes

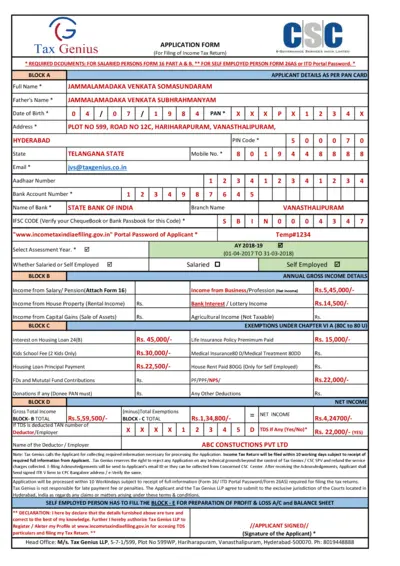

Tax Genius Income Tax Return Application Form

This file is an application form for filing income tax returns through Tax Genius. It includes sections for applicant details, income details, exemptions, and more. Complete all required fields and follow the instructions for submission.

Property Taxes

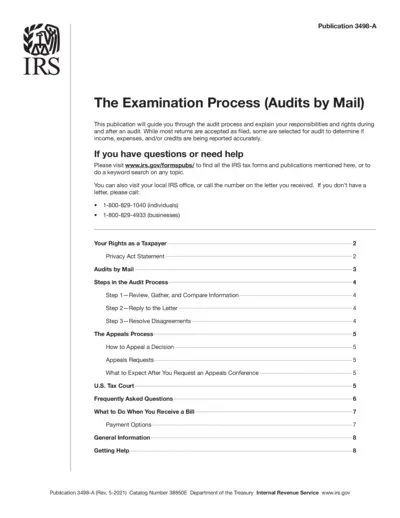

IRS Publication 3498-A: The Examination Process Guide

This guide provides detailed information on the IRS audit process, taxpayer rights, and steps to resolve disagreements. It helps understand the appeals process, payment options, and how to get help with tax-related issues. Essential for taxpayers undergoing an audit.

Property Taxes

New York City Tax Commission STAR Exemption Appeal Form

This form is used to appeal a denial of a Basic STAR or Enhanced STAR exemption by the New York City Department of Finance. Applicants must submit this form to the Tax Commission by the specified deadline and include required documentation. The form must be signed and notarized.

Property Taxes

Dependents, Standard Deduction, and Filing Information for 2023

This file provides important information on dependents, standard deductions, and filing requirements for the 2023 tax returns. It includes guidelines on who must file, who should file, and key updates for the tax year 2023. The document is essential for taxpayers to understand their obligations and benefits.