Property Law Documents

Real Estate

KW Global Property Specialist Instructions and Details

This file provides essential information about the Keller Williams Realty KW Global Property Specialist program. It outlines key support and training resources available for participants. Ideal for individuals looking to enhance their real estate marketing and networking abilities.

Property Taxes

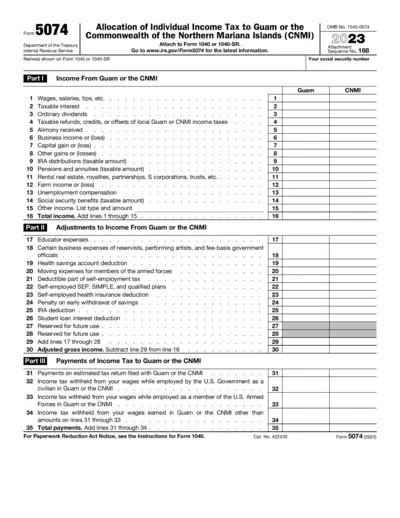

Form 5074 Instructions for Guam and CNMI Tax Reporting

Form 5074 is used by U.S. citizens and resident aliens for Guam or CNMI tax reporting. This form assists in determining individual income tax obligations. Complete this form alongside your 1040 or 1040-SR for accurate income allocation.

Property Taxes

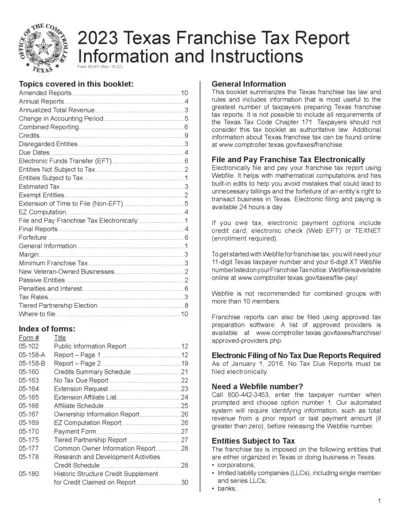

2023 Texas Franchise Tax Report: Information and Instructions

This file provides detailed information and instructions for businesses to file the Texas Franchise Tax Report for the year 2023. It includes guidelines on electronic filing, entities subject to tax, and specific tax rates. This document is essential for understanding compliance requirements under Texas Tax Code Chapter 171.

Property Taxes

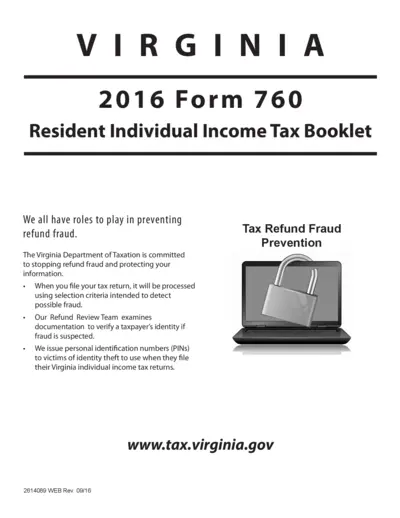

Virginia Form 760 - Resident Individual Income Tax Booklet 2016

The Virginia Form 760 booklet provides detailed instructions and information on filing resident individual income tax returns. It includes steps to prevent refund fraud, contact details for reporting identity theft, and the required documentation for filing. This booklet is vital for Virginia residents to file their state taxes accurately and securely.

Real Estate

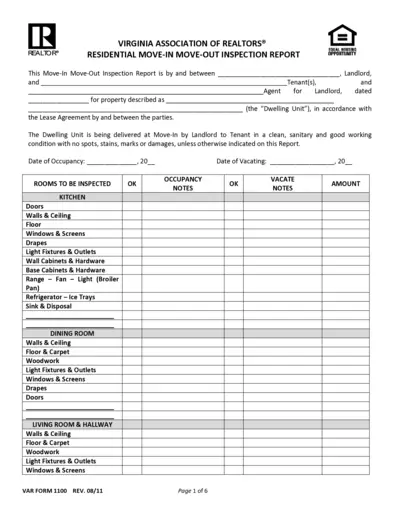

Residential Move-In Move-Out Inspection Report

This Residential Move-In Move-Out Inspection Report provides a detailed checklist for landlords and tenants to assess the condition of a rental property. It includes sections for various rooms and their respective conditions, ensuring clear communication between all parties involved. Proper completion of this form helps to prevent disputes upon moving in and out.

Property Taxes

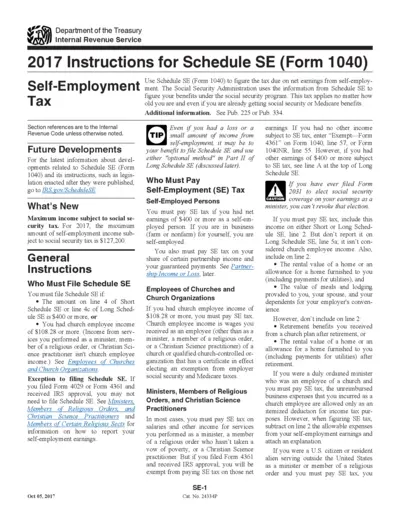

2017 Instructions for Schedule SE Form 1040

This document provides essential instructions for filing Schedule SE (Form 1040) to calculate self-employment tax. It outlines requirements, exceptions, and key figures for the 2017 tax year. Understanding this document is crucial for accurately reporting self-employment income.

Real Estate

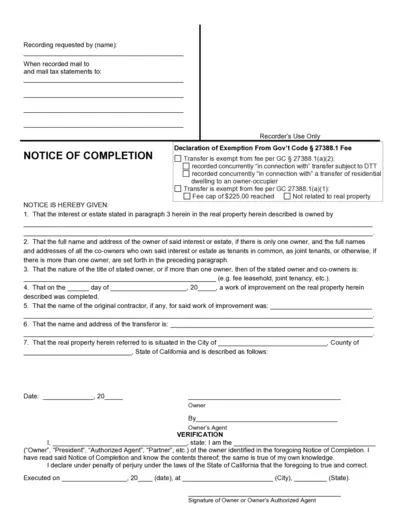

File Transfer Notification and Completion Guidance

This file provides essential information regarding the completion of a property transfer process. It includes instructions for filling out the form correctly and the necessary details for submission. Ideal for property owners, contractors, and legal representatives.

Property Taxes

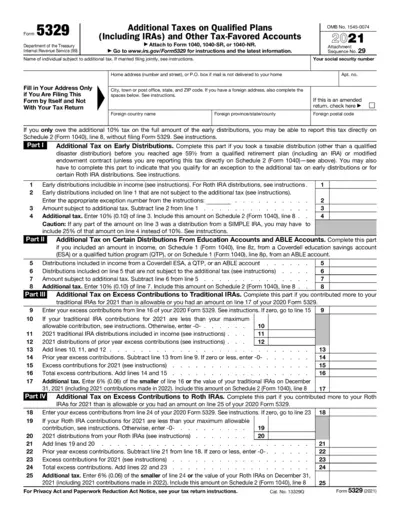

Form 5329 Additional Taxes on Qualified Plans

Form 5329 allows taxpayers to report additional taxes on qualified plans, including IRAs. This form is essential for individuals with early distributions from retirement accounts. Follow the instructions carefully to avoid penalties.

Property Taxes

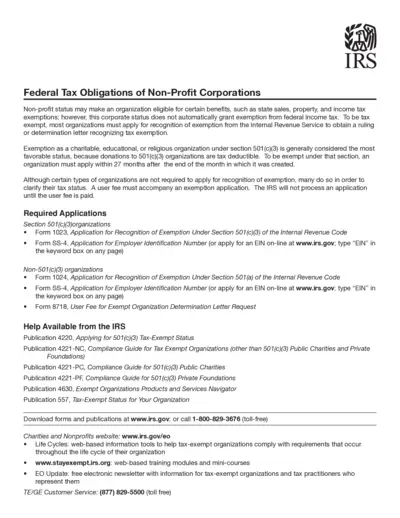

Federal Tax Obligations for Non-Profit Corporations

This document provides detailed information on the federal tax obligations and exemption processes for non-profit organizations. It outlines the necessary forms and user fees associated with obtaining tax-exempt status from the IRS. Users will find guidelines for applying for and maintaining compliance with non-profit status.

Property Taxes

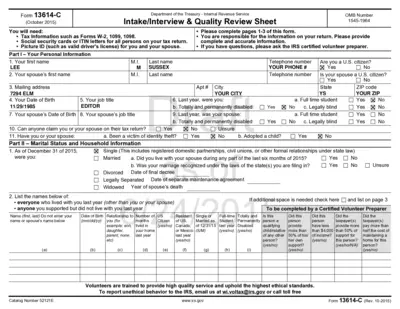

Form 13614-C: IRS Tax Intake & Interview Sheet

The Form 13614-C is an Intake/Interview & Quality Review Sheet provided by the IRS. It is used for collecting necessary tax information from individuals and couples. Completing this form helps ensure accurate tax filing and compliance with IRS regulations.

Real Estate

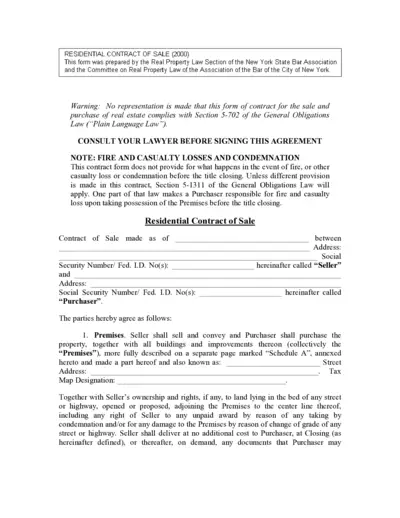

Residential Contract of Sale for Properties

This Residential Contract of Sale is essential for any property transaction in New York. It outlines the responsibilities and obligations of both the seller and purchaser. Be sure to consult a lawyer before you finalize any agreements.

Property Taxes

IRS Form 1099-NEC Instructions and Details

The IRS Form 1099-NEC is essential for reporting nonemployee compensation. This file contains crucial information for accurate tax filing. Ensure compliance by understanding the form's purpose and instructions.