Property Law Documents

Property Taxes

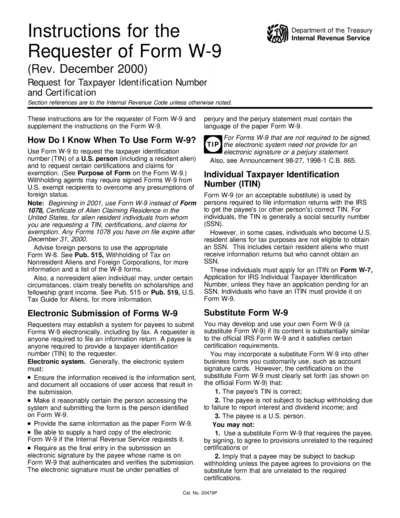

Instructions for Completing Form W-9

This file provides detailed instructions for the requester of Form W-9, including how to fill it out properly. It highlights the necessary requirements and the purpose of the form for U.S. taxpayers. Understanding these instructions is crucial for accurate tax reporting.

Property Taxes

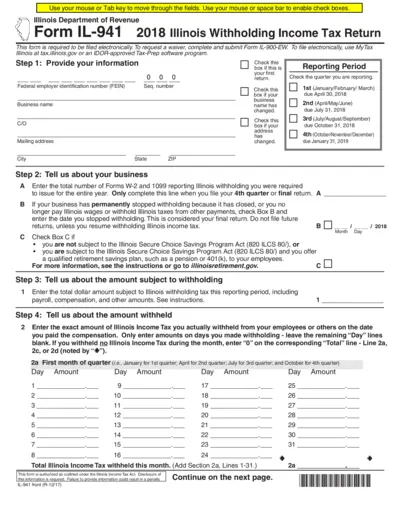

2018 Illinois Withholding Income Tax Return Form

The 2018 Illinois Withholding Income Tax Return Form IL-941 is required for employers to report withholding tax. This electronic form helps businesses comply with Illinois tax laws. Use MyTax Illinois or IDOR-approved software to file.

Property Taxes

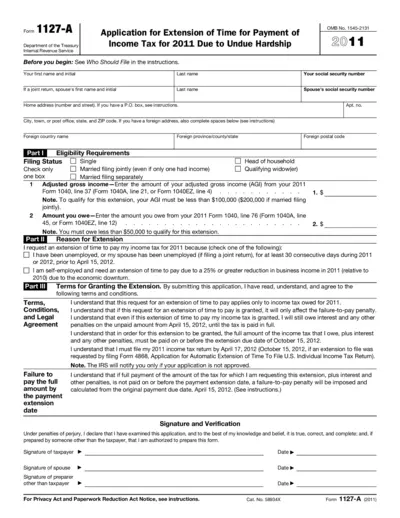

IRS Form 1127-A Application for Extension 2011

IRS Form 1127-A allows taxpayers to request an extension for income tax payments for 2011 due to undue hardship. This form is essential for those facing financial difficulties, ensuring they comply with IRS regulations. Understanding the requirements and filling out this form correctly can help alleviate tax-related stress.

Property Taxes

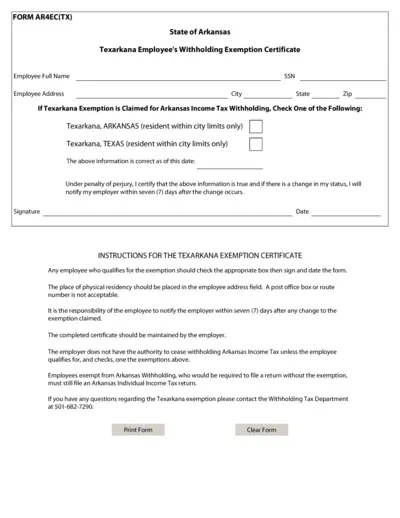

Texarkana Employee Withholding Exemption Certificate

This file is the Texarkana Employee's Withholding Exemption Certificate, required for employees in Texarkana, Arkansas, to claim their withholding exemption. It contains essential fields including personal information, residency claim, and instructions for proper completion. Completing this form allows eligible employees to reduce their Arkansas income tax withholding.

Real Estate

Cash For Keys Information for California Consumers

This document provides essential information regarding the 'Cash for Keys' program in California. It aims to help consumers and DRE licensees understand their rights and responsibilities. The file outlines the process and legal aspects surrounding foreclosures and tenant protections.

Property Taxes

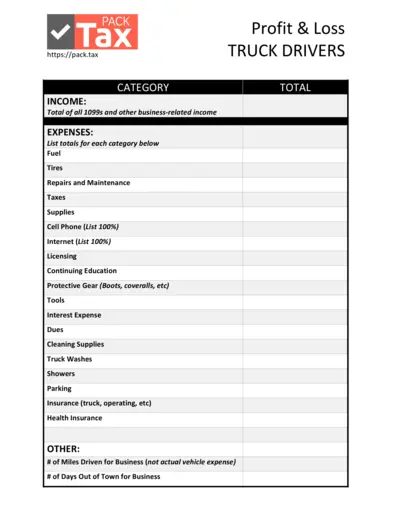

Tax Form for Truck Drivers: Income and Expenses

This file is essential for truck drivers to accurately track their income and expenses for tax purposes. It provides detailed categories for reporting all relevant financial data. Using this document can simplify your tax filing process significantly.

Property Taxes

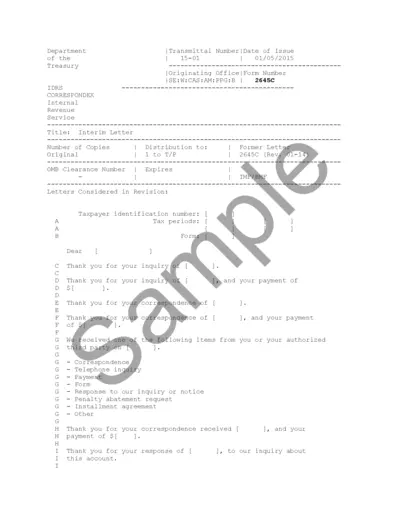

Interim Letter Transmittal IRS Form 2645C

This file contains key information regarding Interim Letters issued by the IRS. It includes transmittal details, payment acknowledgements, and necessary actions required by taxpayers. Users can understand their correspondence with the IRS clearly through this document.

Property Taxes

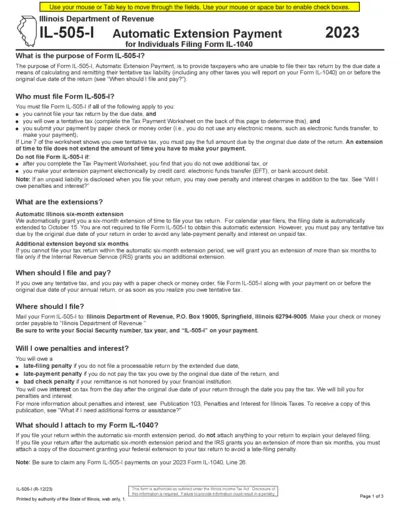

IL-505-I Automatic Extension Payment Filing Instructions

This document outlines the instructions for filing Form IL-505-I, the Automatic Extension Payment for individuals. It provides information on who must file, how to calculate tentatives taxes and where to submit the payment. Understanding this form ensures you meet your Illinois tax obligations timely.

Property Taxes

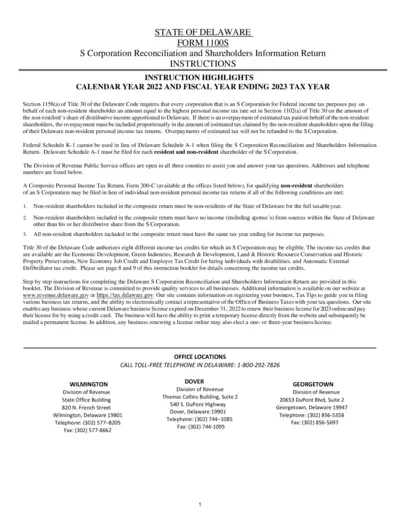

Delaware Form 1100S S Corporation Tax Reconciliation 2022

Delaware Form 1100S provides essential instructions for S Corporations on completing their tax reconciliation and shareholder information. This guide is crucial for both resident and non-resident shareholders regarding their income tax obligations. Ensure compliance with Delaware tax laws by following these guidelines.

Property Taxes

How to find your Form 1095-A online

This file provides guidance on how to access Form 1095-A online. It outlines the steps necessary to download and save the form for tax filing. Ideal for individuals seeking health coverage tax information.

Property Taxes

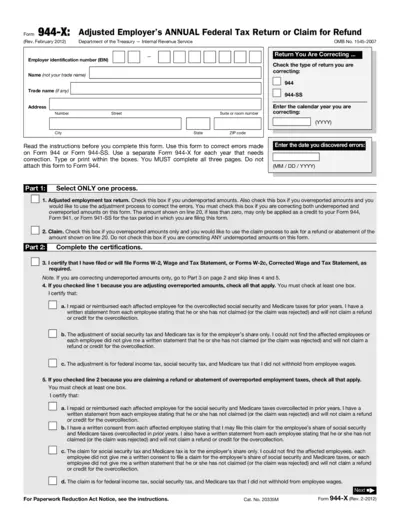

Form 944-X Adjusted Employer's Federal Tax Return

This form is used to correct errors on Form 944 or Form 944-SS. Employers can file this form to adjust reported amounts or claim refunds. Follow the provided instructions to ensure accurate corrections.

Real Estate

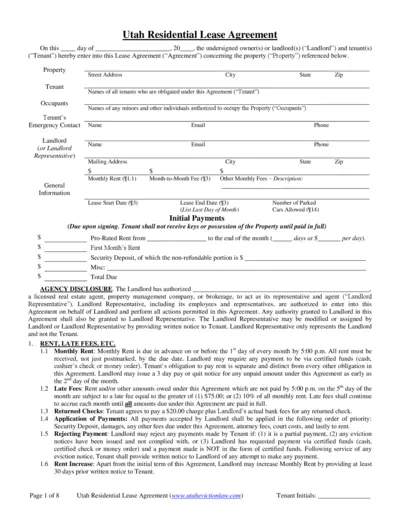

Utah Residential Lease Agreement for Renting Properties

This document serves as a legally binding lease agreement between the landlord and tenant in Utah. It outlines the terms, monthly rent, security deposit, and other essential aspects of the rental property. Utilize this agreement to ensure clarity and protection for both parties involved.