Property Law Documents

Property Taxes

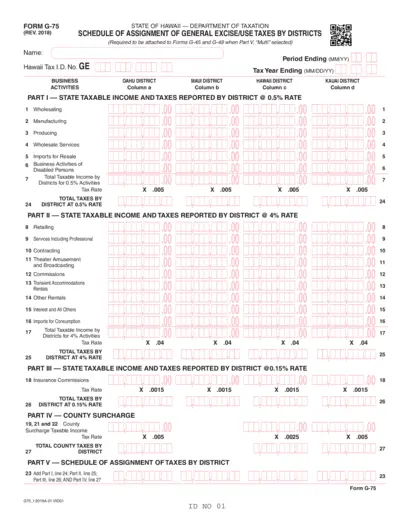

Form G-75 Hawaii Department of Taxation Filing

Form G-75 is needed for taxpayers in Hawaii with income across multiple taxation districts. It helps assign general excise and use taxes accordingly. This form must accompany certain tax returns to ensure accurate tax reporting.

Property Taxes

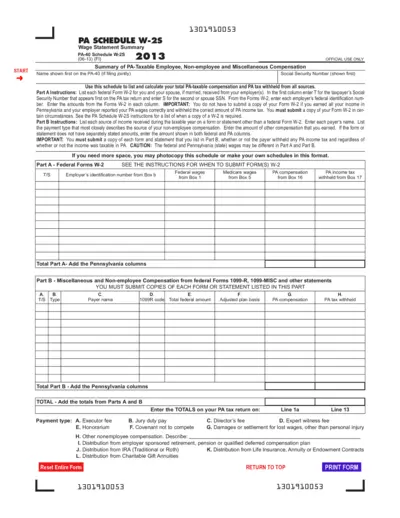

PA W-2S Schedule: Wage Statement Summary

The PA W-2S form assists users in listing and calculating their total Pennsylvania taxable compensation. It provides essential instructions for reporting income from various sources. Perfect for employees and self-employed individuals in Pennsylvania.

Real Estate

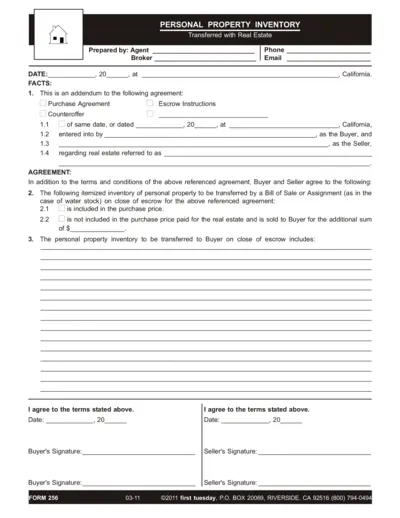

Personal Property Inventory for Real Estate Transfer

This document outlines the personal property items to be transferred with a real estate transaction. It details buyer and seller agreements concerning these items. Use this form to ensure clarity in property inventory during escrow.

Property Taxes

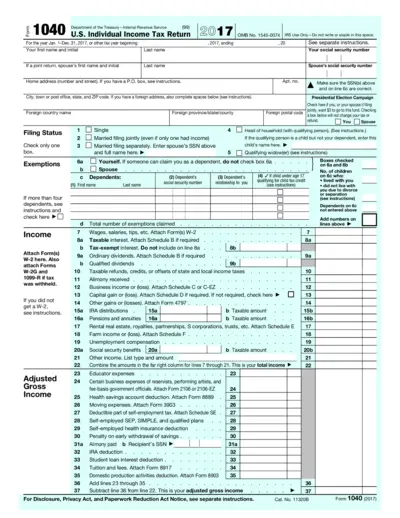

U.S. Individual Income Tax Return Form 1040 (2017)

This document provides the guidelines for completing Form 1040 for the year 2017. It includes information on income reporting, deductions, and credits. Perfect for individuals needing to file their personal income tax returns accurately.

Real Estate

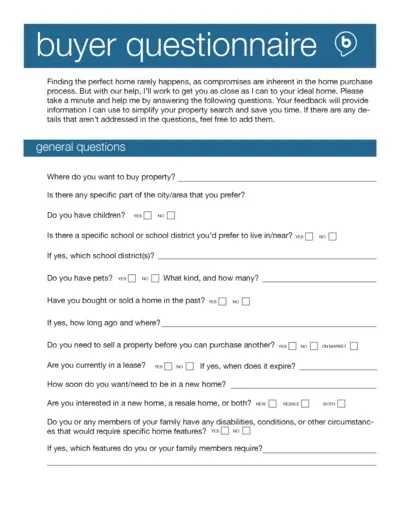

Buyer Questionnaire for Finding Your Perfect Home

This buyer questionnaire helps streamline the home purchasing process. By providing insights into your preferences and needs, we can assist you in your property search. Complete the form to help us find your ideal home.

Property Taxes

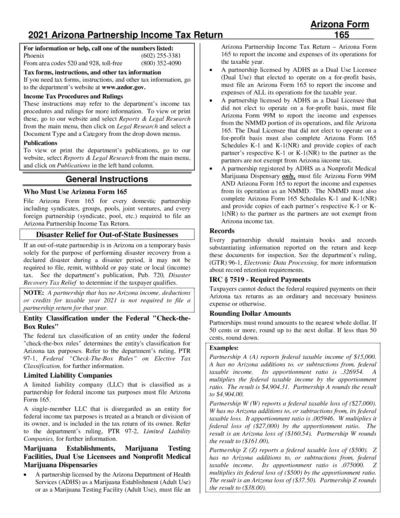

2021 Arizona Partnership Income Tax Return Form 165

This document provides detailed information about the 2021 Arizona Partnership Income Tax Return (Form 165). It includes instructions for filling out the form and essential guidelines for partnerships operating in Arizona. Make sure to follow the guidelines provided to ensure timely and accurate tax submissions.

Property Taxes

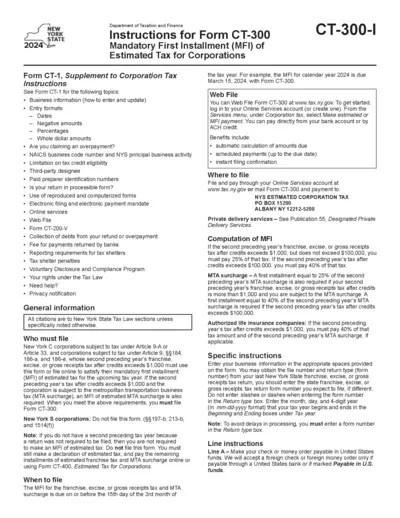

CT-300-I Instructions for Form CT-300 2024

This file provides detailed instructions for the CT-300 form, which is necessary for Corporate Estimated Tax payments in New York. It covers essential filing information, eligibility requirements, and computation methods for the Mandatory First Installment (MFI) of estimated taxes. Corporations must follow these guidelines to ensure compliance with New York State tax laws.

Property Taxes

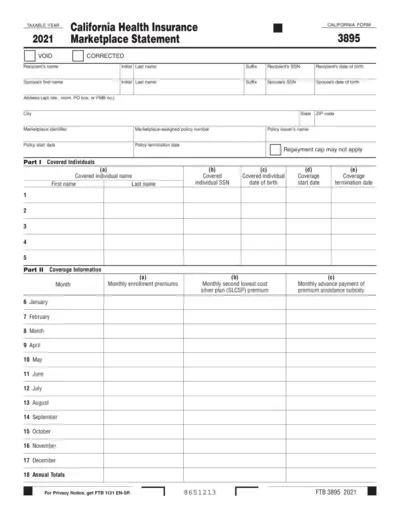

California Taxable Year 2021 Health Insurance Form

The California Health Insurance Marketplace Statement is essential for individuals who had health coverage in 2021. It provides critical information for tax reporting purposes and ensures compliance with state regulations. Users must accurately fill out this form to report their health insurance status.

Property Taxes

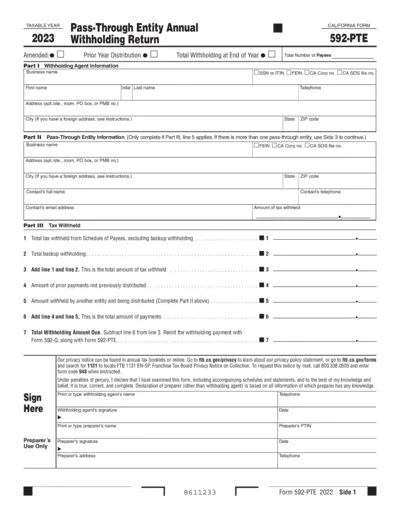

California 2023 Pass-Through Entity Annual Withholding

The California Form 592-PTE is crucial for pass-through entities to report annual withholding. This form captures information on payees and tax withheld. Ensure accuracy to avoid penalties and facilitate smooth processing.

Real Estate

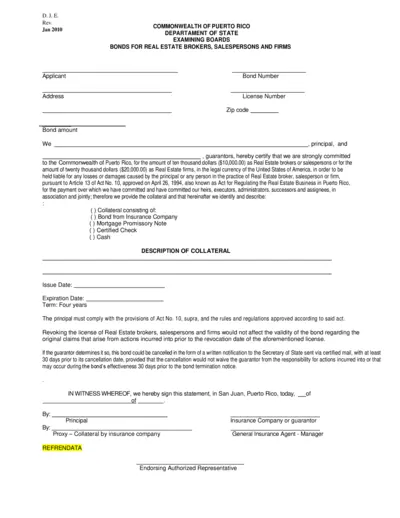

Bonds for Real Estate Brokers Salespersons Firms

This file outlines the required bonds for real estate brokers, salespersons, and firms in Puerto Rico. It includes essential details on collateral and bond amounts. Users must ensure compliance with Act No. 10 to maintain valid operational status.

Property Taxes

IRS Publication 463 Travel Expenses Instructions 2023

This document provides essential information regarding IRS Publication 463, which outlines travel expenses and deductions. It serves as a guide for individuals and businesses to understand deductible travel, meal, and transportation costs relevant for tax filing. Proper use of this form helps taxpayers navigate the complexities of travel expense reporting effectively.

Property Taxes

Instructions for Form 5329 Additional Taxes

This document provides detailed instructions for Form 5329, which reports additional taxes related to qualified retirement plans. It outlines who must file, how to complete the form, and important information regarding penalties. This is essential for taxpayers managing IRAs and retirement distributions.