Property Law Documents

Property Taxes

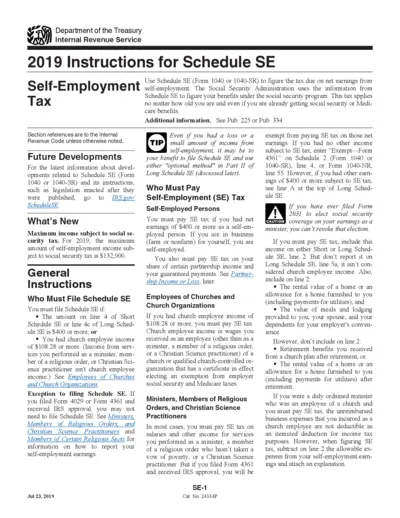

2019 IRS Instructions for Schedule SE Self-Employment Tax

This file provides essential instructions for self-employed individuals on how to calculate their self-employment tax. It outlines requirements, exceptions, and filing guidelines for Schedule SE. Understanding these instructions is crucial for compliance and accurate tax reporting.

Property Taxes

Social Security Tax Guide for Self-Employed Individuals

This file provides essential information about social security obligations for self-employed individuals. It outlines tax reporting requirements, necessary forms, and deductions available for self-employed earnings. Understanding this guide is crucial for accurate tax filing and ensuring you meet your social security responsibilities.

Property Taxes

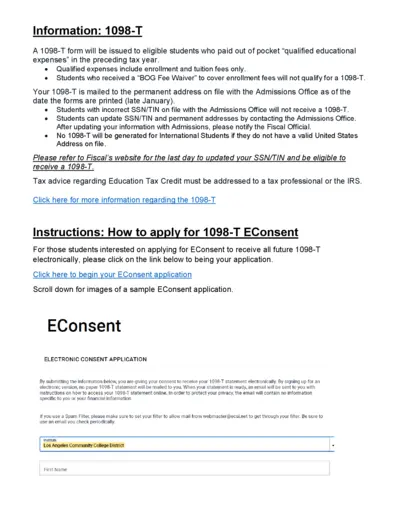

1098-T Form Instructions and Information

The 1098-T form is essential for eligible students to report qualified educational expenses for tax purposes. It details important guidelines and how to securely access your tax information. Use this guide to understand your eligibility and retrieve your 1098-T electronically.

Real Estate

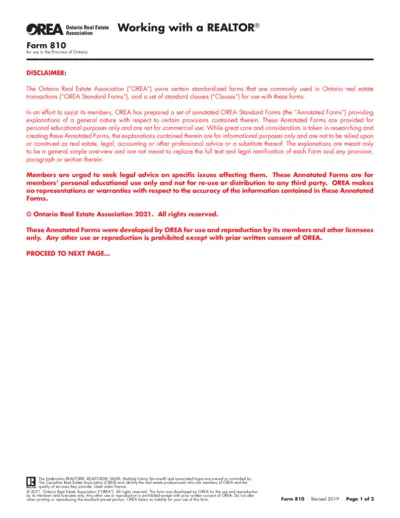

Working with a REALTOR® Form 810 for Ontario

This document outlines the relationship between consumers and REALTORS® in Ontario. It explains client and customer relationships, obligations of REALTORS®, and legal requirements. Users can learn about filling out the form for personal educational purposes.

Real Estate

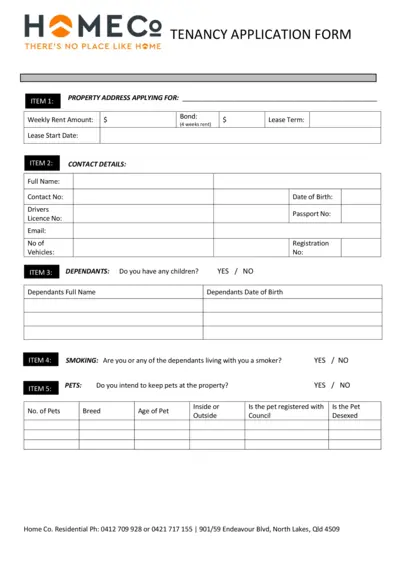

Tenancy Application Form for Renting Properties

This tenancy application form is designed for individuals seeking to rent a property. It outlines the necessary details and instructions required for successful submission. Ensure to fill out all specified sections for a smooth application process.

Property Taxes

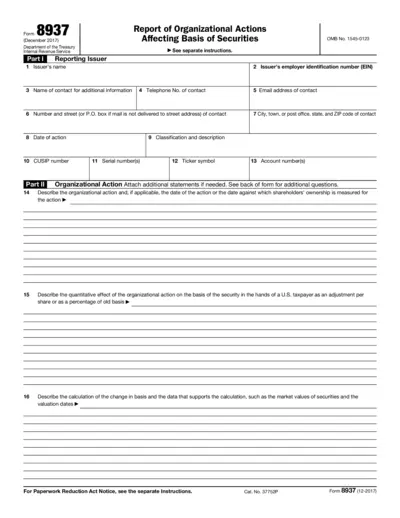

Form 8937 Reporting Issuer Organizational Actions

Form 8937 is used by issuers to report organizational actions affecting the basis of securities. It provides crucial details necessary for tax compliance and informs shareholders of changes in security basis. This form ensures accurate reporting for U.S. taxpayers.

Property Taxes

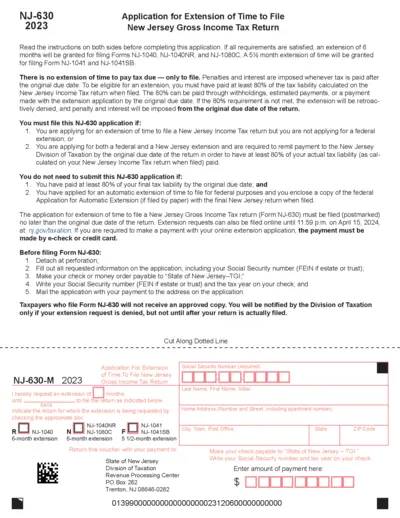

NJ-630 Form Application for Extension of Time

The NJ-630 form is used to apply for an extension of time to file the New Jersey Gross Income Tax Return. Eligible taxpayers can receive a six-month extension. Understanding the requirements can ease the filing process.

Property Taxes

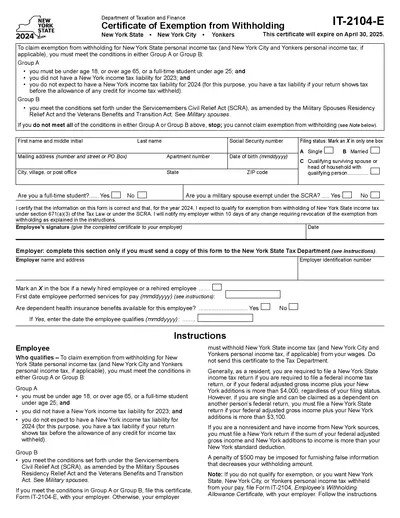

Certificate of Exemption from Withholding NY 2024

The Certificate of Exemption from Withholding is a form for New York State employees claiming exemption from income tax withholding. Designed for individuals meeting specific criteria such as age or military status, this form facilitates accurate tax withholding. Use this certificate to manage your withholding responsibilities and ensure compliance with New York State tax laws.

Property Taxes

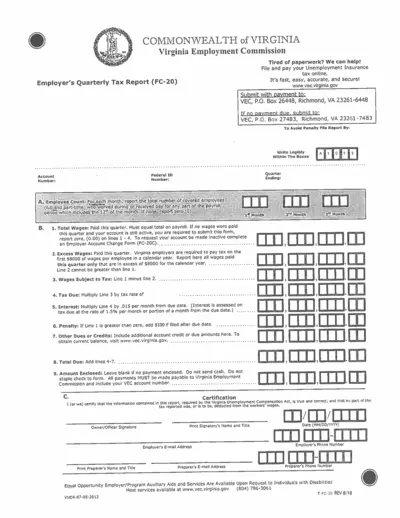

Virginia Employment Commission Quarterly Tax Report

The Virginia Employment Commission's Employer's Quarterly Tax Report (FC-20) is essential for reporting unemployment insurance taxes. This form helps employers accurately file and pay their taxes online. Ensure compliance and avoid penalties by submitting the report on time.

Property Taxes

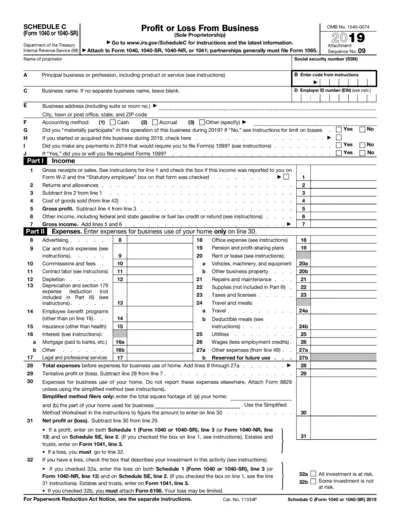

Schedule C Form 1040 or 1040-SR Profit and Loss

Schedule C (Form 1040 or 1040-SR) is used to report income or loss from a business operated as a sole proprietorship. It provides the IRS with information about your business's financial performance. Accurate completion of this form is vital for your tax return.

Property Taxes

South Carolina ST-3 Sales and Use Tax Return

The South Carolina ST-3 Sales and Use Tax Return is essential for businesses to report their sales tax. It must be filed even if no tax is due during the period. Filing guidance and details are provided to ensure compliance with state regulations.

Property Taxes

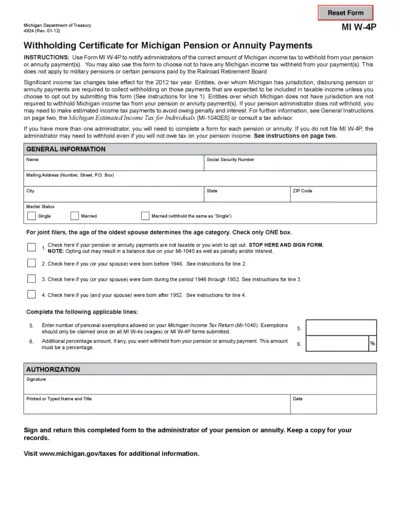

MI W-4P Withholding Certificate for Pension Payments

This form allows Michigan residents to manage their income tax withholding from pension or annuity payments. Users can opt out of withholding or specify exemptions. Essential for ensuring correct tax handling on annuity income.