Property Law Documents

Real Estate

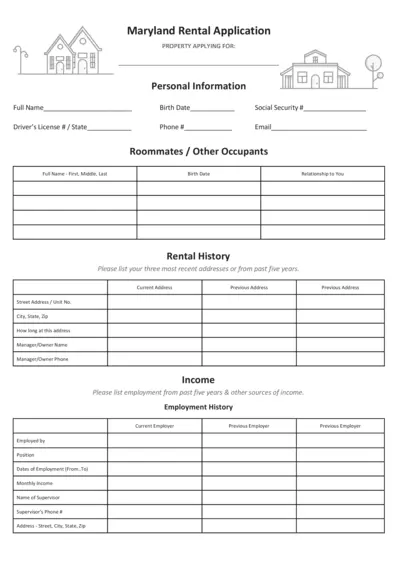

Maryland Rental Application Form Details

This Maryland Rental Application form provides detailed instructions for potential tenants applying for a property. It includes sections for personal information, rental history, and income verification. This file is essential for those looking to secure a rental agreement.

Property Taxes

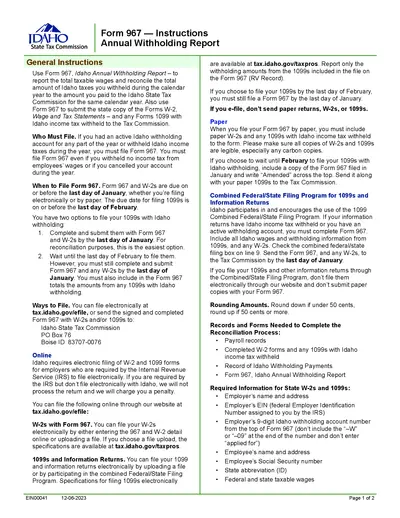

Idaho Annual Withholding Report Form 967 Instructions

This document includes detailed instructions for completing the Idaho Annual Withholding Report (Form 967). It is essential for employers to report taxable wages and taxes withheld. Learn how to submit your forms accurately to comply with Idaho tax regulations.

Property Taxes

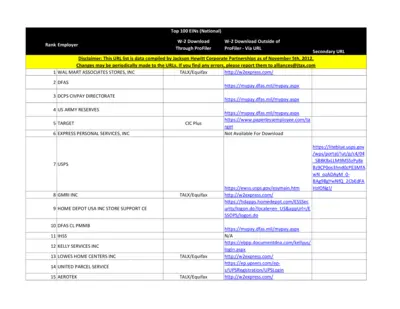

Top 100 EINs and Download Instructions

This file contains a comprehensive list of the top 100 Employers Identification Numbers (EINs) along with W-2 download instructions. Users can refer to this document for accessing W-2 forms for these employers. It serves as a valuable resource for employees seeking easy access to their tax documents.

Zoning Regulations

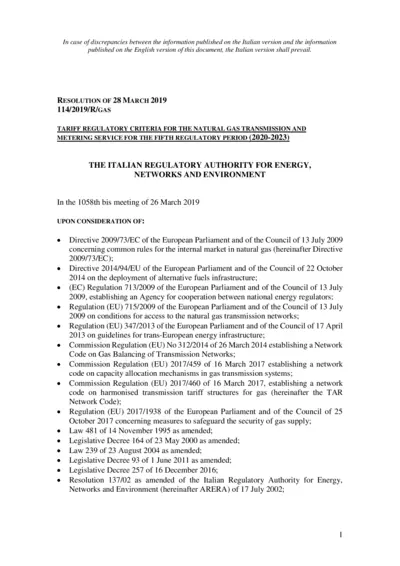

Tariff Regulatory Criteria for Natural Gas 2019

This file outlines the tariff regulatory criteria for the natural gas transmission and metering service for the fifth regulatory period from 2020 to 2023. It includes resolutions and directives relevant to gas supply regulations in Italy. Useful for stakeholders in the energy sector.

Land Use

Idaho Department of Lands Easement Templates

This document contains essential easement templates for various land use scenarios in Idaho. It is a critical resource for navigating right-of-way projects. Users can find templates for road use permits, public road easements, and more.

Property Taxes

IRS General Instructions for Information Returns 2024

This file contains essential instructions for filing IRS Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G. It provides guidance on requirements, timelines, and filing methods. Users should refer to this document to understand how to properly file their information returns.

Property Taxes

Thomson Reuters 1065 E-File Guide for Tax Year 2022

This guide provides essential instructions for e-filing Form 1065, the U.S. Return of Partnership Income. It's designed to help taxpayers and tax professionals navigate the e-filing process efficiently. For optimal results, follow the outlined steps and utilize the tools provided.

Property Taxes

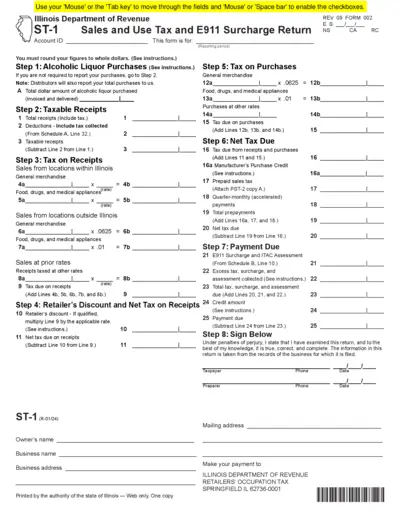

Illinois Sales and Use Tax Return Instructions

This document provides users with detailed instructions on how to fill out the Illinois ST-1 Sales and Use Tax Return. It includes guidance on various steps and calculations required for compliance. Perfect for business owners in Illinois who need to file their taxes accurately.

Property Taxes

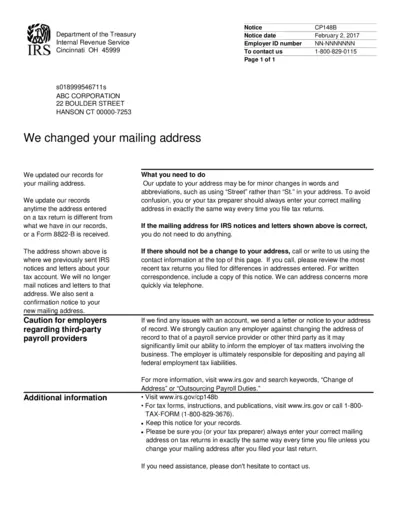

IRS CP148B Notice Address Change Guide

The IRS CP148B notice informs taxpayers about changes made to their mailing address in IRS records. It provides essential instructions and cautions for employers regarding address updates. Understanding this notice is crucial for maintaining accurate tax records and avoiding communication issues with the IRS.

Property Taxes

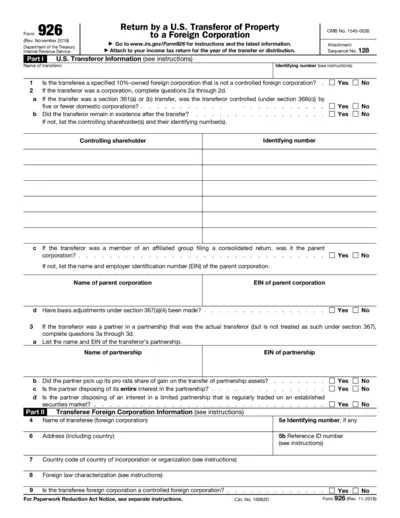

Form 926: Return by a U.S. Transferor of Property

Form 926 is required for U.S. taxpayers who transfer property to foreign corporations. This form collects information about the transferor and transferee entities. Accurate completion ensures compliance with IRS regulations.

Property Taxes

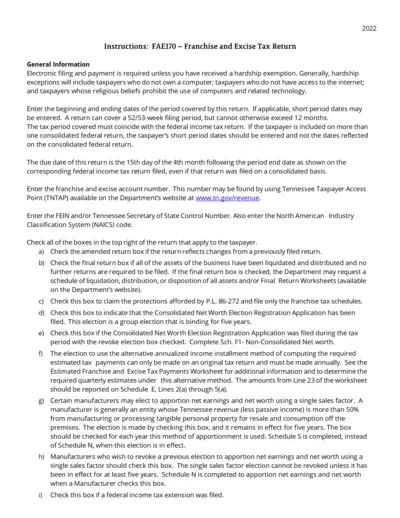

Franchise and Excise Tax Return Instructions

This document contains detailed instructions on how to complete the Franchise and Excise Tax Return. It is essential for businesses operating in Tennessee to ensure compliance. The instructions include filing requirements, tax computations, and important timelines.

Property Taxes

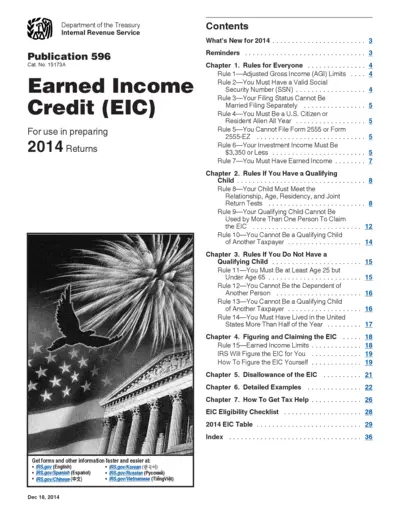

Publication 596 Earned Income Credit (EIC) 2014

This publication provides information about the Earned Income Credit (EIC) for 2014. It outlines eligibility rules, how to claim the credit, and important tables. Aimed at helping individuals maximize their tax credits.