Property Law Documents

Real Estate

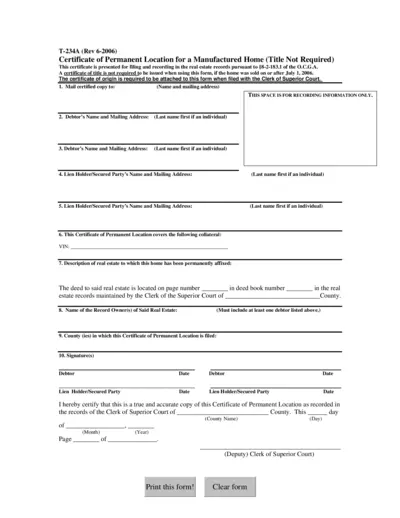

Certificate of Permanent Location for Manufactured Homes

This document serves as a Certificate of Permanent Location for manufactured homes without a title. It is essential for establishing the home as real property. Follow the provided instructions to fill out this form correctly.

Real Estate

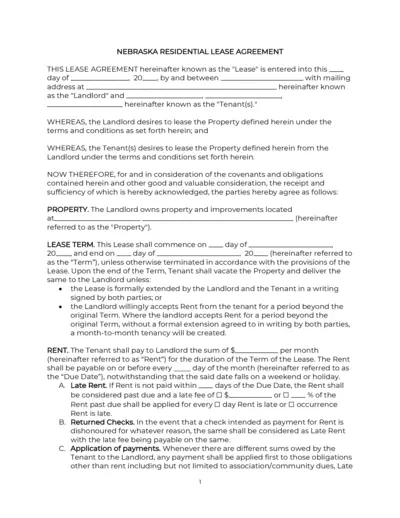

Nebraska Residential Lease Agreement Overview

This file contains the essential terms and conditions for a Nebraska residential lease agreement. It is crucial for landlords and tenants to understand their rights and obligations. Use this document to ensure a clear and legally binding rental relationship.

Property Taxes

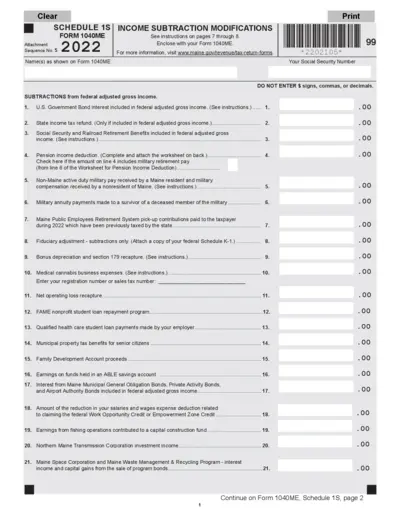

2022 Maine Form 1040ME Schedule 1S Income Subtractions

The Form 1040ME Schedule 1S allows Maine taxpayers to report income subtractions from their federal adjusted gross income. It includes specific instructions for various income types and the necessary calculations. This document is essential for ensuring accurate Maine state income tax reporting.

Property Taxes

Engagement Letter for Tax Form Preparation

This document outlines the engagement terms for tax form preparation. It specifies responsibilities of both the CPA firm and the client. Essential for ensuring compliance and understanding the structure of the engagement.

Property Taxes

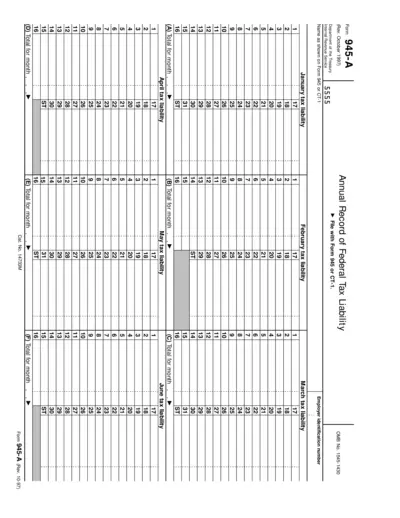

Form 945-A Annual Record of Federal Tax Liability

Form 945-A is used to report annual federal tax liabilities related to nonpayroll income. It is essential for businesses that withhold taxes on various income types, including pensions and gambling winnings. Correct completion of Form 945-A ensures accurate tax reporting to the IRS.

Property Taxes

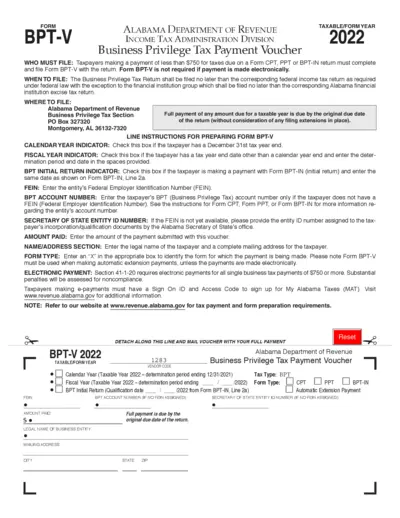

Alabama Department of Revenue BPT-V Form Instructions

The Business Privilege Tax Payment Voucher (BPT-V) is essential for taxpayers making payments under $750. It outlines the process for filing and requirements for tax compliance. Utilize this guide to ensure accurate and timely submissions.

Property Taxes

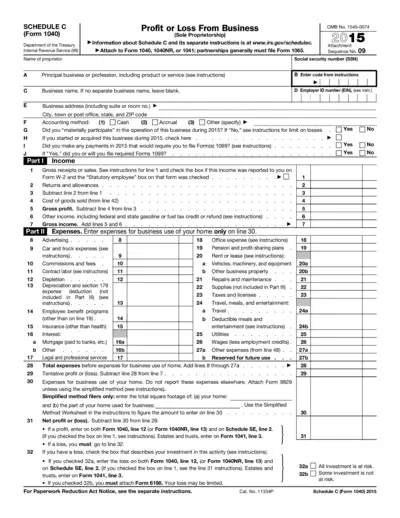

Schedule C Form 1040 Instructions for Business Filers

This document provides detailed instructions for completing Schedule C, the form used for reporting profit or loss from a business operated as a sole proprietorship. It includes essential guidelines on reporting income, expenses, and calculating net profit or loss for tax purposes. Ideal for individuals claiming business income on their personal tax returns.

Property Taxes

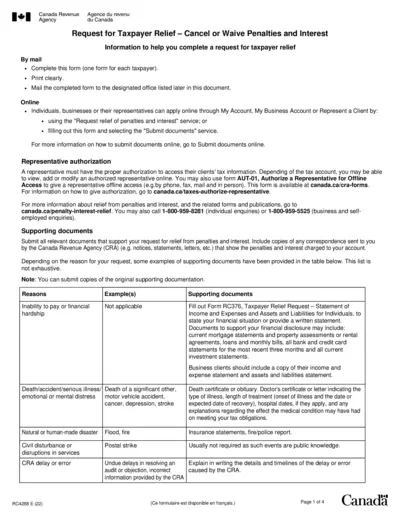

Request for Taxpayer Relief - Canada Revenue Agency

This form allows taxpayers in Canada to request the cancellation or waiver of penalties and interest from the Canada Revenue Agency. It provides essential information for completing the request effectively. Ideal for individuals or businesses facing financial difficulties or administrative errors from the CRA.

Real Estate

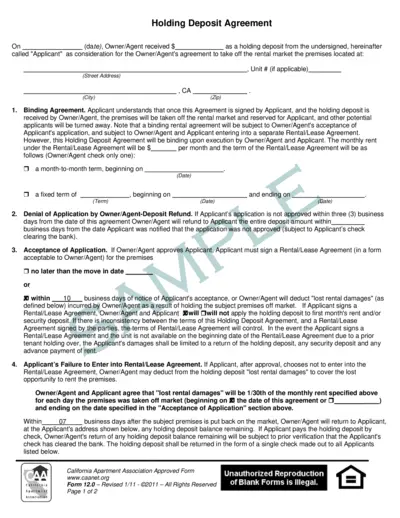

Holding Deposit Agreement for Rental Welcome Guide

This file contains a Holding Deposit Agreement crucial for applicants looking to secure a rental property. It outlines binding terms, approval processes, and refund policies. Ensure to understand the implications before signing.

Property Taxes

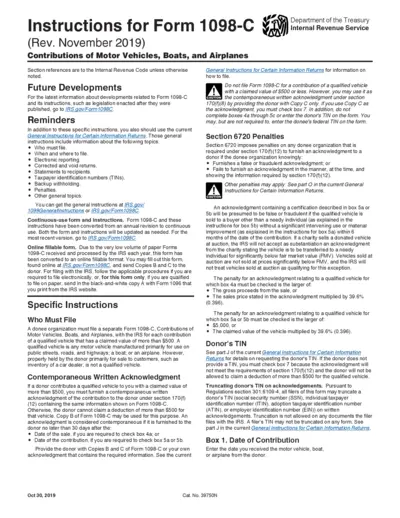

Instructions for Form 1098-C Contributions of Vehicles

This file provides detailed instructions for IRS Form 1098-C for contributions of motor vehicles, boats, and airplanes. It guides organizations on how to accurately report donations valued over $500. Stay informed on compliance to maximize your charitable contributions.

Zoning Regulations

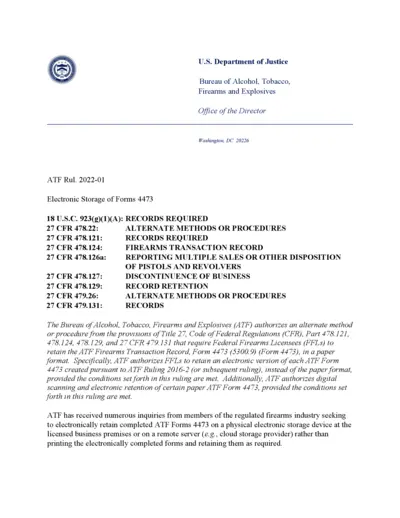

Electronic Storage of ATF Form 4473 Guidelines

This document outlines the guidelines for electronically storing ATF Form 4473. It provides essential information for Federal Firearms Licensees (FFLs) on maintaining record compliance. Understand the requirements and procedures for secure electronic retention.

Property Taxes

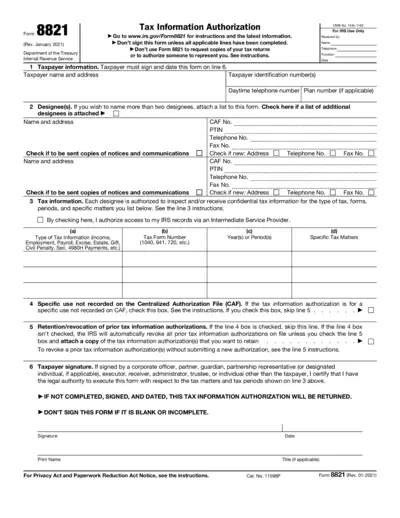

Tax Information Authorization Form 8821

Form 8821 allows taxpayers to authorize individuals to inspect their tax information. It's important for appointing processors to handle tax matters. Ensure you complete this form accurately for IRS processing.