Property Law Documents

Real Estate

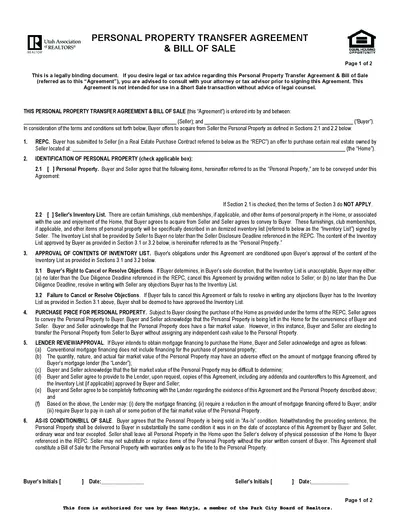

Personal Property Transfer Agreement and Bill of Sale

This document outlines the agreement for the transfer of personal property between a seller and a buyer. It is legally binding and requires careful review before signing. Consult with a legal or tax advisor if necessary.

Property Taxes

Maryland 2022 Form 511 Instructions for Pass-Through Tax

This file provides essential instructions for completing the Maryland Form 511 for Electing Pass-Through Entities in 2022. It details necessary steps for filing and important tax credits available. Perfect for business entities to ensure compliance and accurate tax returns.

Property Taxes

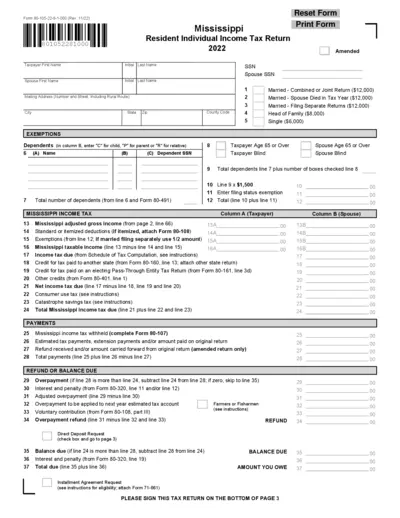

Mississippi Resident Individual Income Tax Return 2022

The Mississippi Resident Individual Income Tax Return is essential for filing taxes for the year 2022. This form is required for residents to report their income and calculate their tax obligations. Completing this form accurately ensures compliance with state tax laws and facilitates timely processing.

Property Taxes

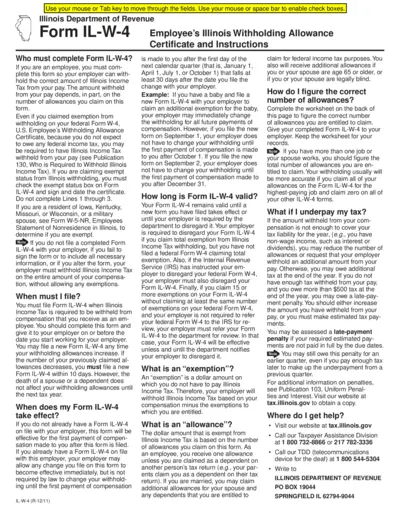

Employee's Illinois Withholding Allowance Form IL-W-4

The Illinois Form IL-W-4 is essential for employees to determine the correct amount of state income tax to withhold from their pay. It allows you to claim allowances that may reduce your withholdings based on personal circumstances. Complete this form to ensure accurate tax withholding and avoid surprises during tax filing.

Property Taxes

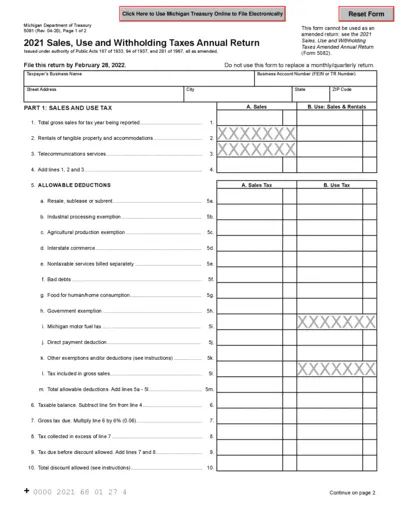

Michigan Treasury Sales Use and Withholding Tax Return

This file contains the Michigan Department of Treasury's 2021 Sales, Use and Withholding Taxes Annual Return (Form 5081). Complete and submit by the due date to ensure compliance with state tax regulations. Utilize the detailed instructions provided for accurate filing.

Property Taxes

Form 940 2024 Employer's Annual Federal Unemployment Tax Return

This is the IRS Form 940 for 2024, used by employers to report and pay Federal Unemployment Tax (FUTA). This form is essential for all employers who need to fulfill their federal tax obligations. Make sure to follow the instructions carefully to ensure accurate submission.

Real Estate

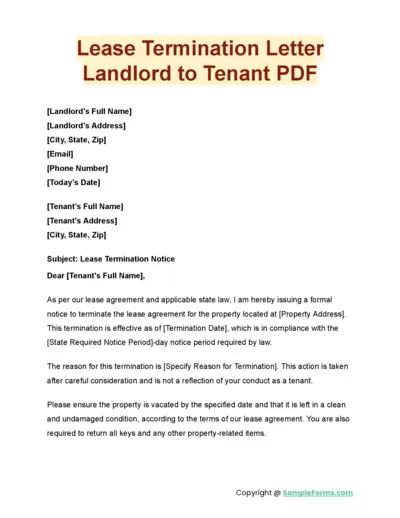

Lease Termination Letter Template for Tenants

This lease termination letter template provides a clear framework for landlords to formally notify tenants of lease termination. It includes essential details such as property address, termination date, and reason for termination. Use this template to ensure compliance with state laws and maintain a professional relationship with tenants.

Property Taxes

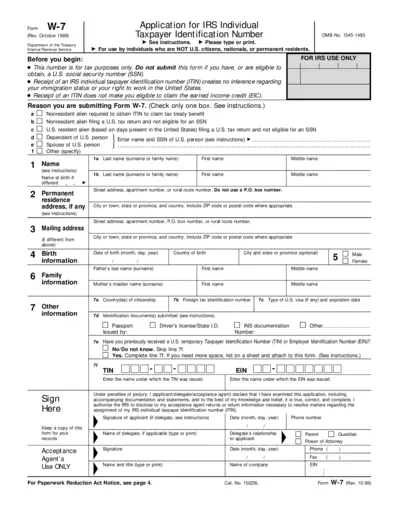

Form W-7 Application for IRS Individual Taxpayer ID

Form W-7 is essential for non-U.S. residents seeking an Individual Taxpayer Identification Number (ITIN) for tax compliance. It outlines the application process and eligibility requirements. This file serves as a guide for completing and submitting your W-7 application accurately.

Property Taxes

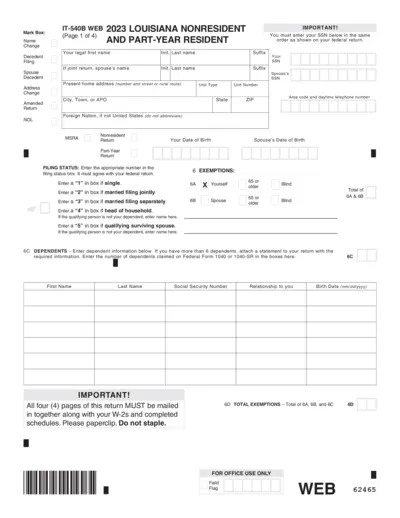

2023 Louisiana Nonresident and Part-Year Resident Form

This file contains the 2023 Louisiana Nonresident and Part-Year Resident tax form instructions and essential information. Fill out your tax return accurately with the necessary details provided. Ensure compliance with Louisiana tax regulations by using this form.

Property Taxes

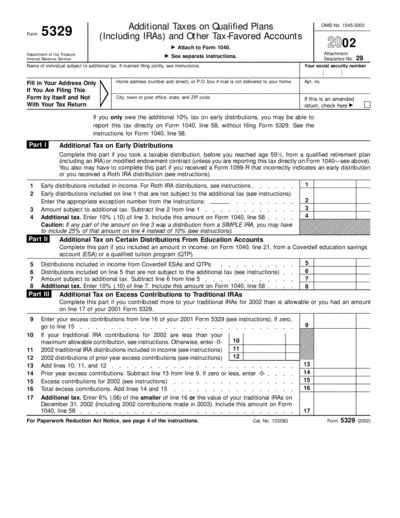

Form 5329 Additional Taxes Qualified Plans IRS 2002

Form 5329 is essential for reporting additional taxes on qualified plans, including IRAs. This form is necessary for those who took early distributions or exceeding contributions to tax-favored accounts. Use this form to ensure compliance with IRS regulations.

Real Estate

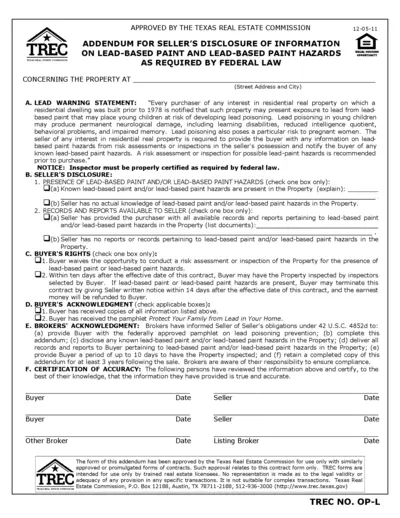

Lead-Based Paint Disclosure Addendum for Property

This document provides essential information regarding lead-based paint and hazards in residential properties built before 1978. It is crucial for buyers and sellers to understand their rights and responsibilities related to lead exposure. The addendum includes disclosures, buyer's rights, and necessary certifications.

Property Taxes

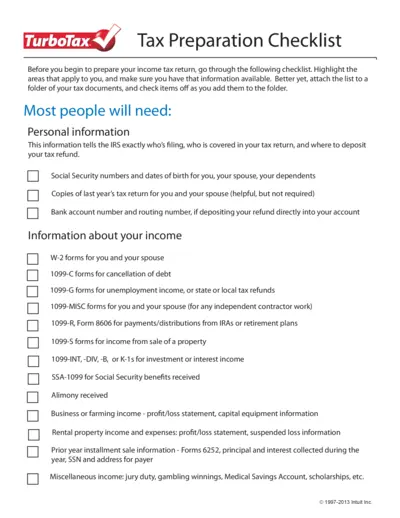

Tax Preparation Checklist for TurboTax Users

This TurboTax Tax Preparation Checklist helps users gather necessary information for filing their income tax return. Completing this checklist ensures you have all required documents to maximize your tax refund. Follow these guidelines to streamline your tax preparation process.