Property Law Documents

Property Taxes

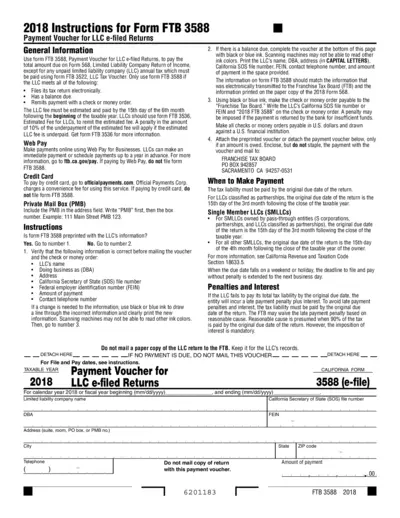

Form FTB 3588 Instructions Payment Voucher LLC

Form FTB 3588 is the payment voucher for LLC e-filed returns. It outlines the necessary steps for LLCs to pay their tax liabilities. Follow these instructions carefully to ensure compliance and avoid penalties.

Property Taxes

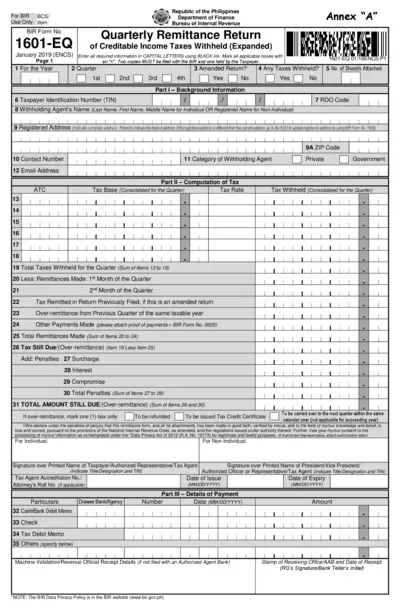

BIR Form 1601-EQ Quarterly Income Tax Remittance

This file contains the BIR Form 1601-EQ, which is used for the quarterly remittance of creditable income taxes withheld. It provides all the necessary instructions and requirements for submitting the form. Ensure your information is accurate to avoid penalties.

Real Estate

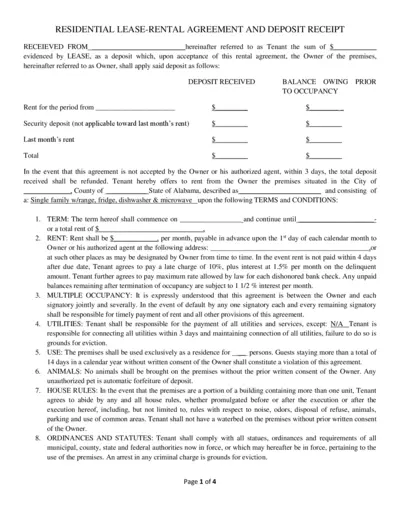

Residential Lease Rental Agreement Alabama

This Residential Lease-Rental Agreement outlines the terms for renting a residential property in Alabama. It includes details about rental amounts, security deposits, responsibilities of tenants, and eviction policies. Landlords and tenants can refer to this document to understand their obligations and ensure compliance.

Real Estate

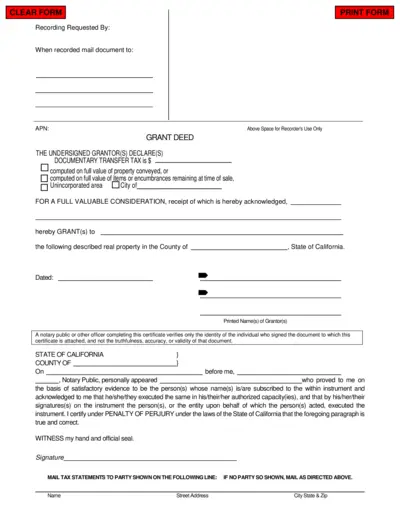

Grant Deed Form Instructions for California

This Grant Deed is essential for transferring ownership of real estate in California. It provides necessary information for both grantors and grantees. Ensure you understand each section for accurate completion.

Property Taxes

Understanding Tax-Exempt Status for Nonprofits

This document provides crucial insights into the tax-exempt status for nonprofit organizations. It outlines the application process, requirements, and necessary forms. Gain clarity on navigating federal tax exemptions and related procedures.

Real Estate

Colorado Deed of Trust Submission Form Instructions

This file is a legal document known as a Deed of Trust used in Colorado real estate transactions. It outlines the rights and responsibilities of borrowers and lenders. Understanding how to fill this form correctly is essential for anyone involved in property financing.

Real Estate

Base New Home Specifications Cardinal Crest Overview

This file provides detailed specifications for base new homes by Cardinal Crest, including budget breakdowns and upgrade options. It serves as a guide for homeowners to understand the costs associated with their new home. You will also find essential contact information and instructions to customize your selection.

Zoning Regulations

Passenger Rights Protection Regulations GACA

This file outlines the Passenger Rights Protection Regulations enforced by the General Authority of Civil Aviation. It provides crucial information for passengers regarding their rights and the obligations of air carriers. This document is essential for understanding air travel regulations in the applicable regions.

Real Estate

Fannie Mae Appraiser Independence Requirements

This file contains the Appraiser Independence Requirements (AIR) set by Fannie Mae. It outlines the standards to ensure appraiser independence, objectivity, and impartiality. Essential for compliance and understanding the appraisal process for residential properties.

Property Taxes

IRS Form 8949 Instructions for Tax Filing 2024

This document provides instructions for Form 8949, which is used to report sales and other dispositions of capital assets. Users can learn how to fill out the form correctly and understand its purpose within the tax filing process. Designed for both individuals and businesses, this form helps in accurately reporting financial transactions to the IRS.

Real Estate

Bahia Property Management Rental Process Guide

This file provides important details and instructions related to the rental application process with Bahia Property Management. It covers application requirements, processing time, fees, and resident selection criteria. Ideal for individuals looking to rent through Bahia Property Management.

Property Taxes

IRS Tax Exempt Organization Search Dataset Guide

This file serves as a comprehensive guide to the IRS Tax Exempt Organization Search Dataset. It offers detailed information on the dataset, including available forms, filing requirements, and how to search for tax-exempt organizations. Suitable for businesses and individuals needing insights on tax-exempt entities.