Property Law Documents

Property Taxes

IRS EIN Request Guidelines and Responsible Party Rules

This document outlines the IRS guidelines for EIN requests, particularly focusing on the responsible party requirements. It provides essential information on tax identification numbers, eligibility, and the process for obtaining an EIN. Users will find detailed steps on how to fill out the Form SS-4 and critical updates regarding deadlines.

Property Taxes

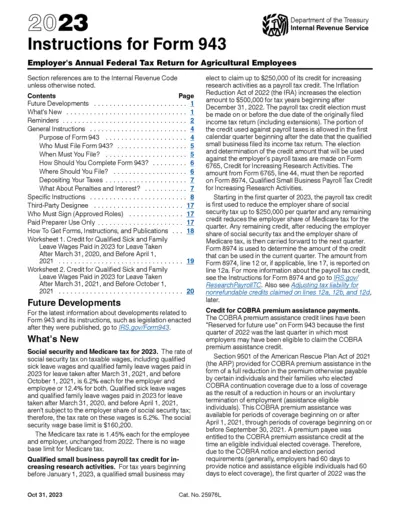

Instructions for Form 943 for Employers Tax Return

This document offers detailed instructions for employers filing Form 943, the Employer's Annual Federal Tax Return for Agricultural Employees. It outlines filing requirements, tax credits available, and essential deadlines. Access guidelines for filling out this form to ensure accurate submissions.

Property Taxes

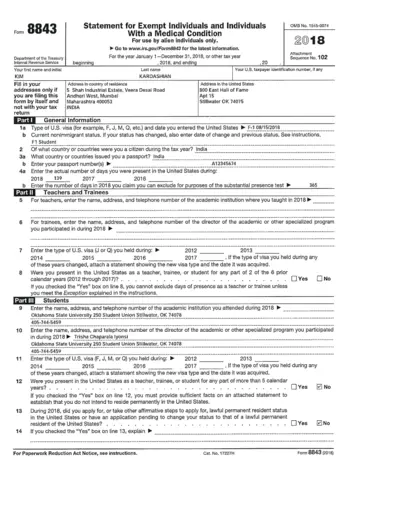

IRS Form 8843 Instructions for Tax Year 2018

This document provides essential information and instructions for completing IRS Form 8843 for the tax year 2018. It is specifically designed for individuals who are exempt from the substantial presence test. Follow these guidelines to ensure accurate and timely submission.

Property Taxes

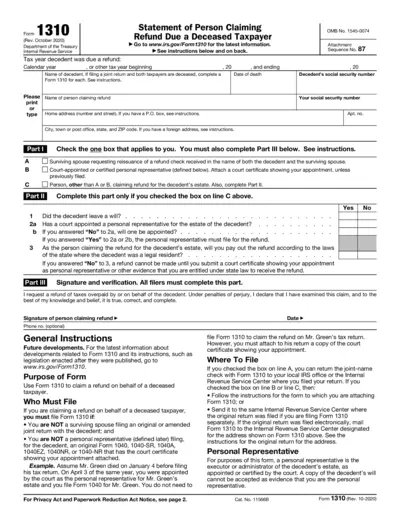

Form 1310 Instructions for Claiming Deceased Taxpayer Refunds

Form 1310 is used to claim a tax refund for a deceased taxpayer. This guide provides essential instructions and details for users filing this form. Ensure you meet the eligibility requirements before completing the form.

Real Estate

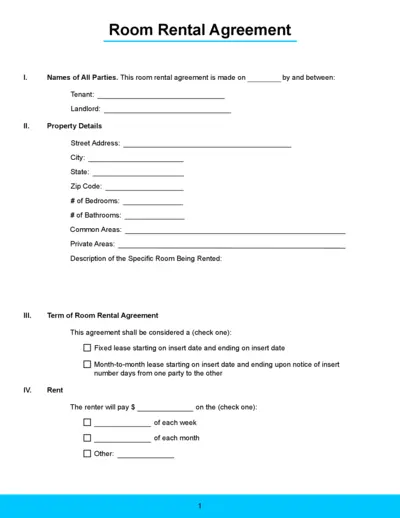

Room Rental Agreement Template for Tenants and Landlords

This room rental agreement file is essential for both tenants and landlords. It provides a clear outline of the terms and conditions of renting a room. Perfect for ensuring legal compliance and protecting both parties involved.

Real Estate

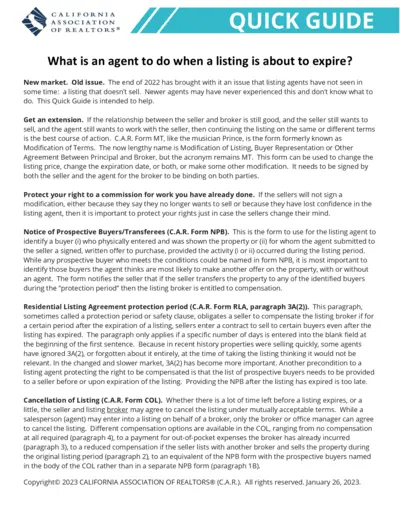

California REALTORS Quick Guide for Listing Agents

This guide provides essential instructions for listing agents on how to manage property listings effectively. It covers strategies to handle expiring listings and protect commission rights. Learn how to modify terms and utilize necessary forms to ensure a successful sale.

Real Estate

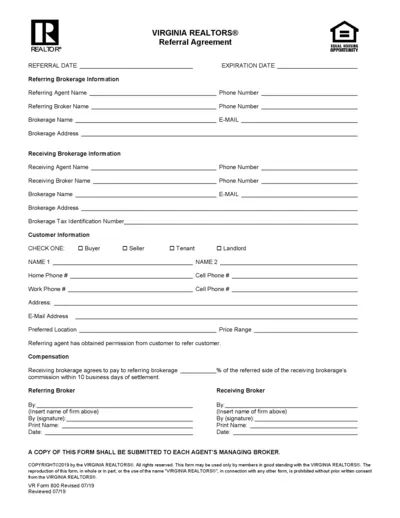

Virginia REALTORS® Referral Agreement Form

This is the official referral agreement form used by Virginia REALTORS®. It details responsibilities and compensation for referring agents. All parties involved in real estate transactions will benefit from this clear and organized agreement.

Property Taxes

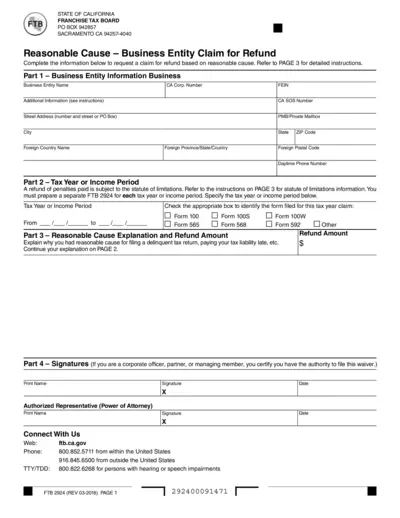

California Franchise Tax Board Refund Claim

This file offers a claim form for refund based on reasonable cause for business entities. It provides guidelines on filing and necessary details. Ensure to carefully follow the instructions for a successful submission.

Real Estate

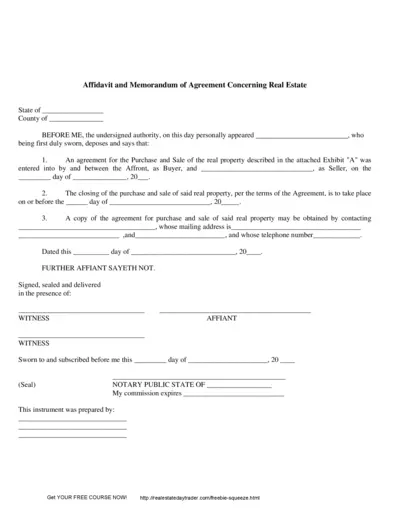

Affidavit and Memorandum of Agreement Concerning Real Estate

This document serves as an official record for an agreement regarding the purchase and sale of real estate. It outlines the key details and instructions necessary for both parties involved in the transaction. Ideal for buyers and sellers looking to formalize their property agreements.

Real Estate

Real Estate Guide for Buyers and Sellers

This guide provides essential information for buying and selling real estate in Queensland. It covers investment properties, legal responsibilities, and consumer protections. Make informed decisions with the help of this comprehensive resource.

Property Taxes

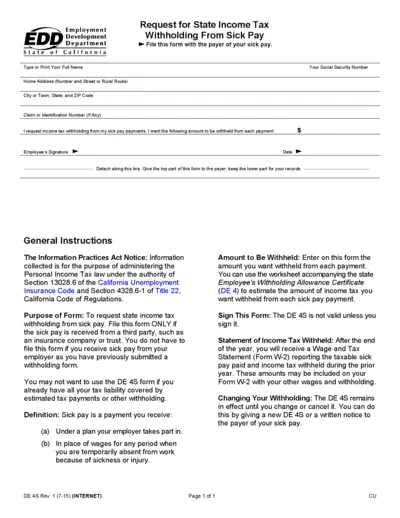

Request for State Income Tax Withholding from Sick Pay

This form allows individuals to request state income tax withholding from their sick pay. It is used in cases when sick pay is received from a third party, such as an insurance company. By submitting this request, you ensure the appropriate amount of tax is withheld from your payments.

Property Taxes

Instructions for Form IT-2105.9 Underpayment Tax

This file contains detailed instructions for individuals and fiduciaries on how to handle underpayment of estimated tax for New York State. It outlines important changes in tax rates and methods for calculating penalties. Users will find guidance on who must pay penalties and how to avoid them.