Property Law Documents

Property Taxes

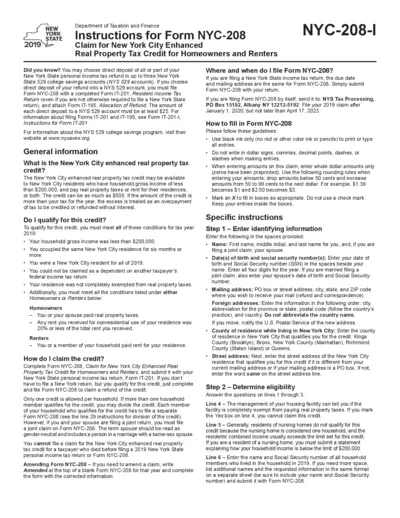

New York City Enhanced Real Property Tax Credit Guidance

This file contains the instructions for Form NYC-208, which helps New York City residents claim their Enhanced Real Property Tax Credit. It outlines eligibility criteria, how to fill out the form, filing instructions, and important deadlines.

Property Taxes

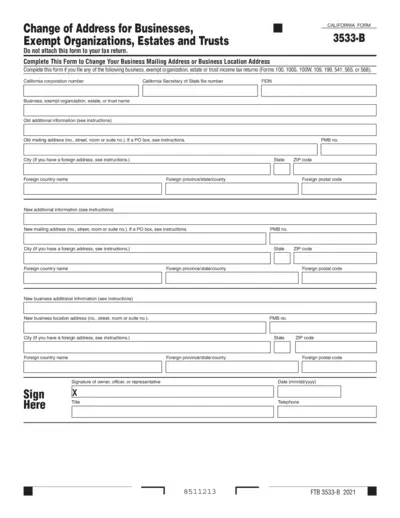

Change of Address for California Businesses

This form is essential for businesses, exempt organizations, estates, and trusts in California to update their mailing or location addresses. It's crucial to keep your records accurate to ensure you receive important correspondence. Fill out the form accurately to comply with California tax regulations.

Zoning Regulations

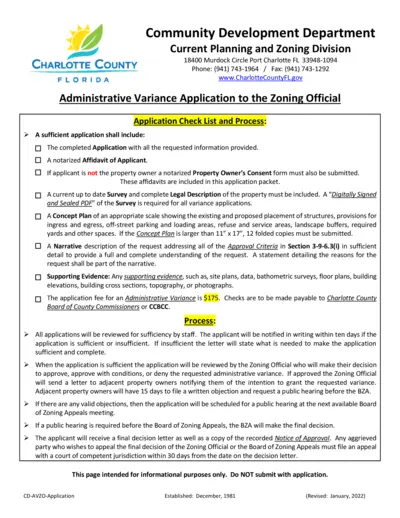

Charlotte County FL Administrative Variance Application

This file contains the Administrative Variance Application for Charlotte County, Florida. It provides detailed instructions for applicants, including necessary forms and criteria for approval. Ideal for property owners and agents seeking zoning variances.

Property Taxes

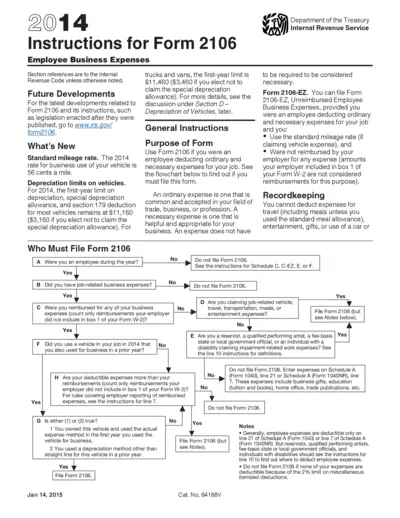

Instructions for Form 2106 Employee Business Expenses

This file contains detailed instructions for Form 2106, related to employee business expenses. It provides insights into allowable deductions, record-keeping requirements, and eligibility criteria for filing. Understanding this form is essential for employees looking to claim business-related expenses on their taxes.

Property Taxes

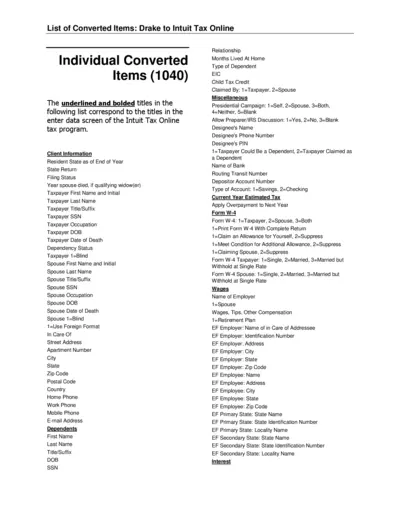

Essential Guide for Converting Drake to Intuit Tax Online

This file provides essential information for converting tax data from Drake software to Intuit Tax Online. It outlines necessary fields and items along with instructions for filling out tax forms. Ideal for tax professionals and individuals managing personal accounts.

Real Estate

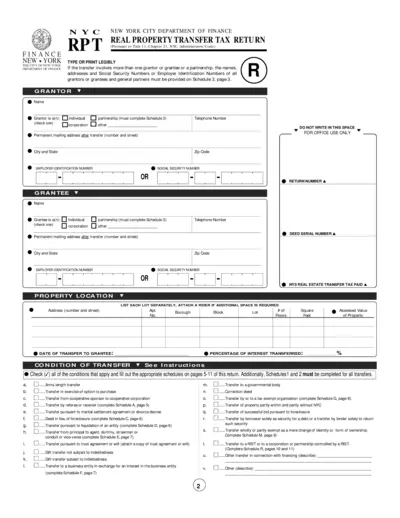

NYC Real Property Transfer Tax Return Form

This file contains the NYC Real Property Transfer Tax Return form, which is essential for reporting property transfers in New York City. It includes guidance on filling out the form and specific details about various property types and transfer conditions. This comprehensive resource is vital for individuals and organizations involved in property transactions.

Property Taxes

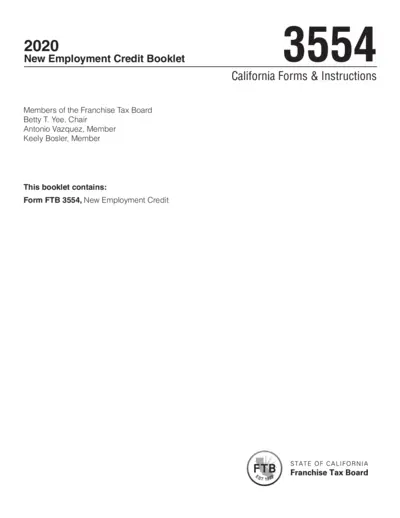

California New Employment Credit Booklet 2020

The 2020 New Employment Credit Booklet provides essential guidelines and information for California taxpayers to claim the New Employment Credit. This booklet includes updates, instructions on qualified employees, and details on how to successfully complete Form FTB 3554. Whether you are a taxpayer seeking to understand your eligibility or a tax professional needing to assist clients, this booklet serves as a comprehensive resource.

Property Taxes

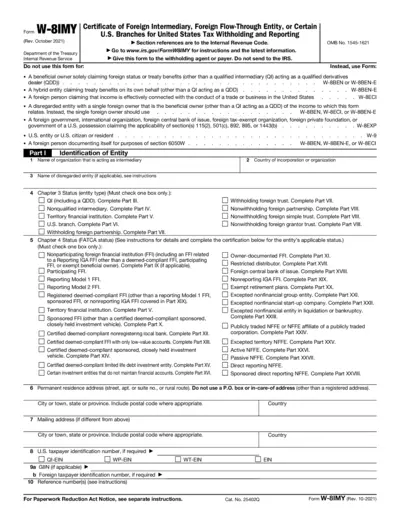

W-8IMY: Certificate of Foreign Intermediary Instructions

The W-8IMY form is used to certify the status of foreign intermediaries for U.S. tax withholding and reporting. It's crucial for entities acting on behalf of foreign owners to ensure proper tax treatment. This form must be submitted to the withholding agent, not to the IRS.

Property Taxes

Essential Information on 1095 Forms for Tax Filers

This document provides vital information about 1095 forms required for tax filing under the Affordable Care Act. It explains who needs the form and essential timelines. Make sure to review this document for necessary details related to your health insurance coverage.

Property Taxes

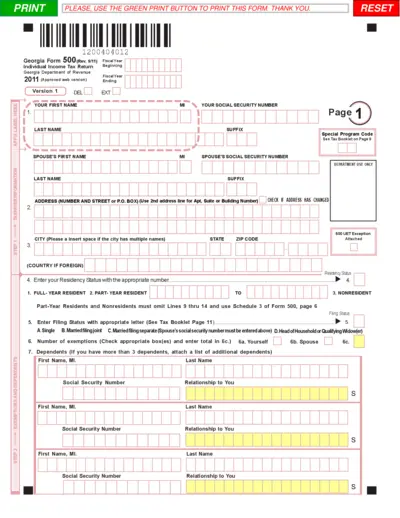

Georgia Individual Income Tax Return Form 500

The Georgia Form 500 is the state's official Individual Income Tax Return form for the fiscal year 2011. This form is essential for individual taxpayers to report their income and calculate their tax liability. It ensures compliance with Georgia tax regulations while maximizing eligible deductions.

Property Taxes

Filing Taxes for International Students - MSUB

This document provides essential tax filing instructions for international students at MSUB. It includes necessary forms, resources, and contact information for professional help. Follow the guidelines to ensure compliance with IRS requirements.

Property Taxes

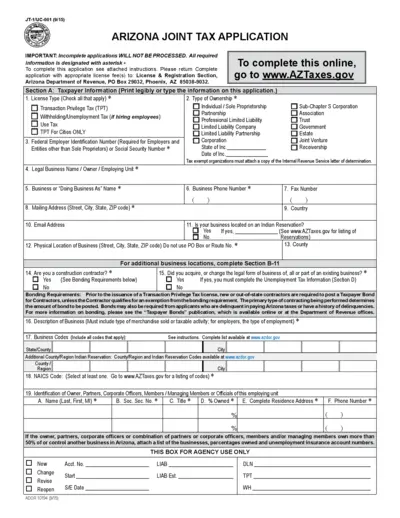

Arizona Joint Tax Application Instructions

This file contains the Arizona Joint Tax Application instructions. It provides essential information for taxpayers to complete and submit their applications. Users can find necessary details on ownership types, federal identification numbers, and tax classification.