Property Law Documents

Property Taxes

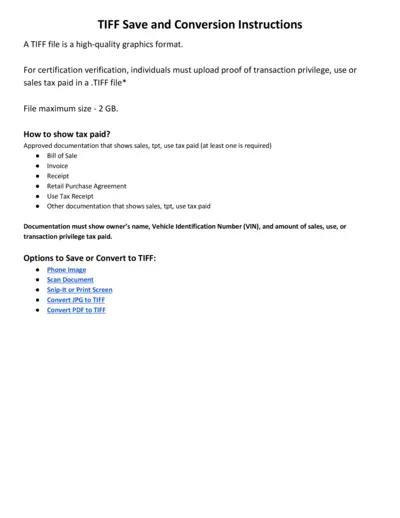

TIFF Save and Conversion Instructions

This file provides instructions for saving and converting documents to TIFF format, which is essential for certification verification. It includes details about the required documentation and how to submit proof of tax paid. Perfect for individuals and businesses needing to comply with tax regulations.

Property Taxes

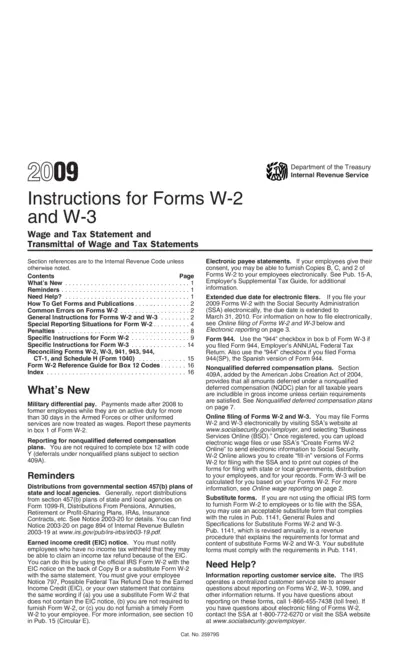

IRS Instructions for Forms W-2 and W-3 Filing

This document provides essential instructions for filing Forms W-2 and W-3, including definitions, deadlines, and filing methods. It's crucial for employers reporting employee wages and taxes. Follow the guidelines carefully to ensure compliance and avoid penalties.

Property Taxes

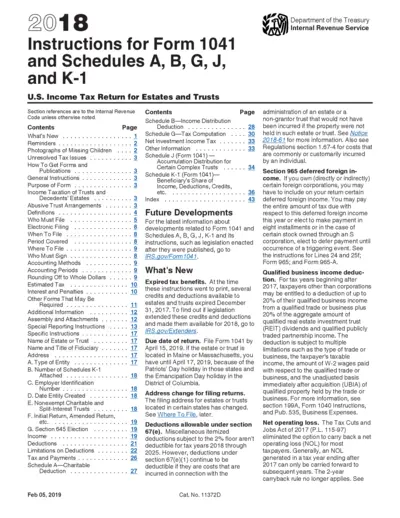

Instructions for Form 1041 and Related Schedules

This file provides essential instructions for filing Form 1041, U.S. Income Tax Return for Estates and Trusts. It covers important information regarding income, deductions, and necessary schedules. Users will benefit from a comprehensive guide to ensure accurate and timely submissions.

Property Taxes

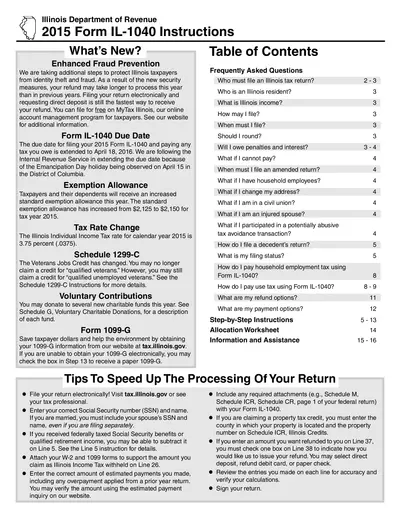

Illinois Department of Revenue 2015 Form IL-1040 Instructions

This file contains comprehensive instructions for the 2015 Form IL-1040, including important updates and procedures for taxpayers. It outlines filing requirements, exemption allowances, and tax rates for Illinois residents. Use this guide to ensure accurate completion and submission of your tax form.

Property Taxes

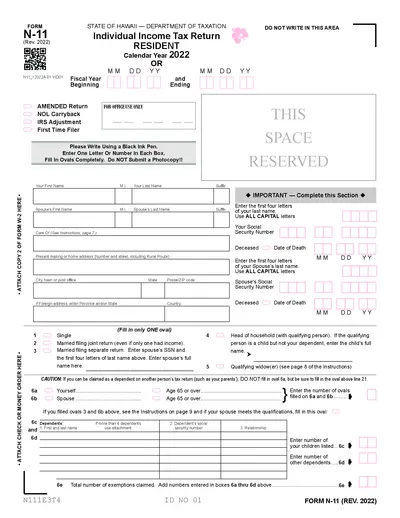

Hawaii Individual Income Tax Return N-11 Form 2022

The N-11 form is used for filing individual income taxes in Hawaii. It is essential for residents to accurately report their income for tax purposes. Ensure to complete the form fully to avoid penalties.

Property Taxes

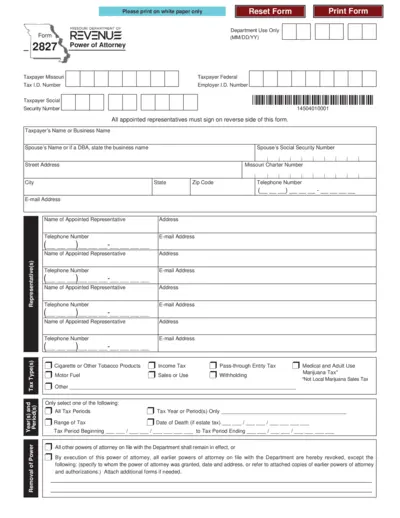

Missouri Power of Attorney Form 2827 Instructions

This file contains the Missouri Form 2827 for Power of Attorney. It is essential for taxpayers in Missouri to designate representatives for tax matters. Follow the detailed instructions provided to fill out and submit the form correctly.

Property Taxes

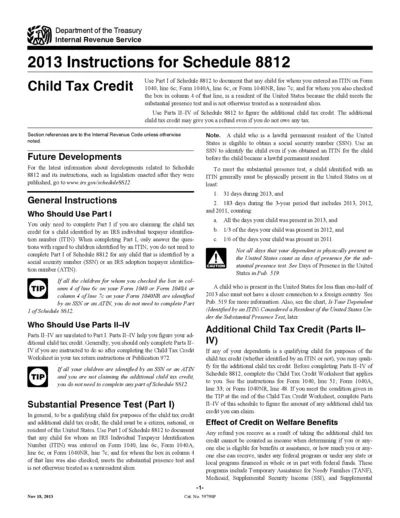

2013 Instructions for Schedule 8812 Child Tax Credit

This document provides instructions for Schedule 8812 regarding the Child Tax Credit. It outlines eligibility requirements and how to claim the credit. It is essential for taxpayers with children identified by an ITIN.

Property Taxes

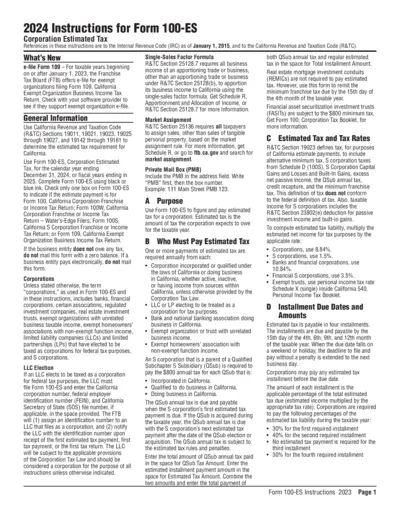

2024 Corporation Estimated Tax Instructions

This document provides essential instructions for corporations to calculate and submit estimated tax in California for 2024. It details requirements, payment methods, and important regulatory information. Businesses should use this guide to ensure compliance with state tax laws.

Real Estate

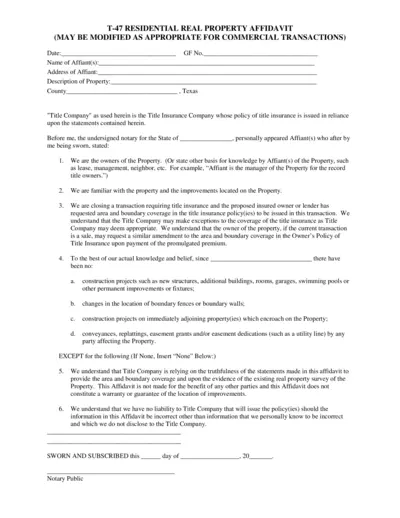

Residential Real Property Affidavit Instructions

This file contains an affidavit for residential real property transactions in Texas. It is essential for owners and lenders during title insurance processes. Proper completion ensures legal compliance and accurate property representation.

Real Estate

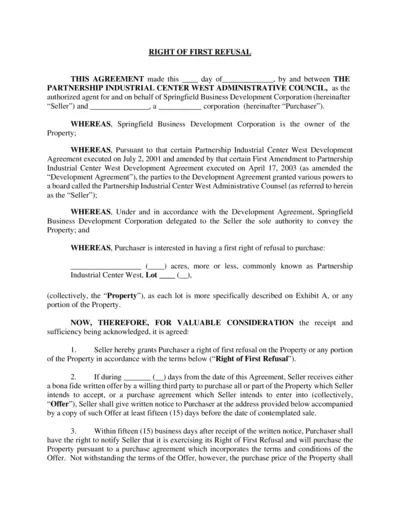

Right of First Refusal Agreement - Essential Details

This file outlines the Right of First Refusal Agreement between a seller and purchaser related to real property. It includes terms, conditions, and procedural instructions for exercising rights. Ideal for parties involved in property transactions.

Property Taxes

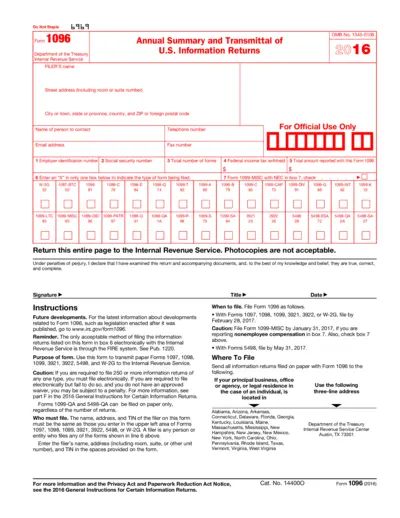

Form 1096 Annual Summary and Transmittal of Returns

Form 1096 is used to transmit various types of information returns to the IRS. It summarizes the total number of forms being submitted. Ensure that all relevant fields are accurately completed to avoid penalties.

Property Taxes

IRS W-2 and W-3 Forms Filing Instructions 2023

This document provides essential instructions for filing IRS Forms W-2 and W-3. It includes details on e-filing, deadlines, and requirements for employers. Navigate the filing process efficiently with this comprehensive guide.