Property Law Documents

Real Estate

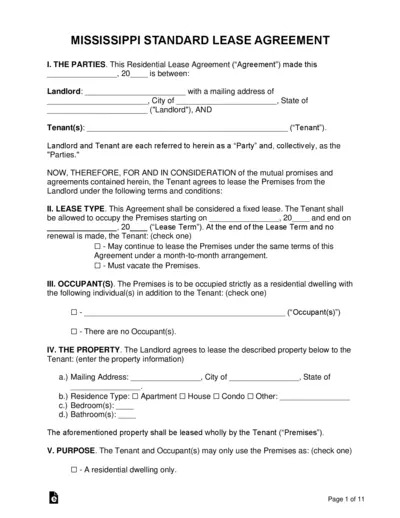

Mississippi Standard Lease Agreement Residential Form

This file is a comprehensive residential lease agreement for Mississippi. It outlines the terms between the landlord and tenant. Essential for both parties to understand their rights and obligations.

Property Taxes

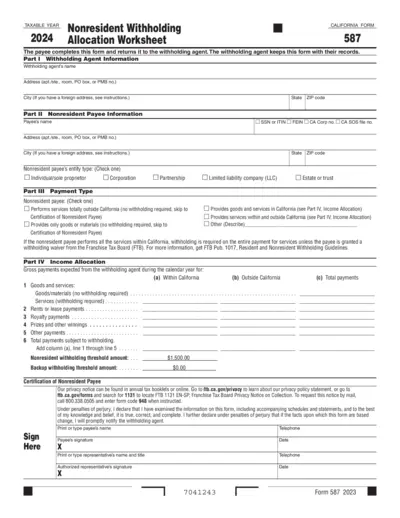

2024 California Nonresident Withholding Worksheet

This is the California Form 587 for nonresident withholding. It is used by withholding agents to gather necessary information from nonresident payees. Proper completion ensures compliance with California tax regulations.

Property Taxes

Instructions for Form 941 Employer's Quarterly Tax Return

This document provides detailed instructions for completing Form 941, the Employer's Quarterly Federal Tax Return. It covers filing requirements, tax rates, and provides insights into changes for 2024. Employers and tax professionals must refer to these instructions to ensure accurate reporting.

Real Estate

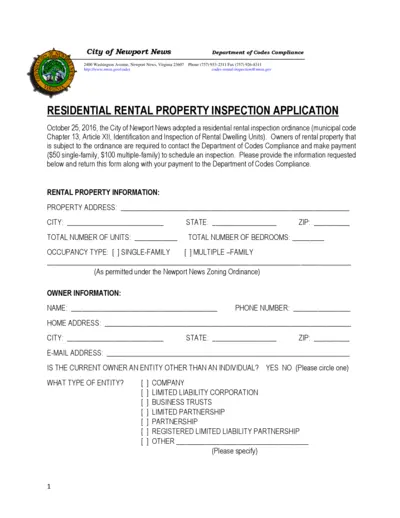

Virginia Residential Rental Property Inspection Application

This application is required for scheduling inspections of residential rental properties in Newport News. Owners must fill out and submit the form along with payment to comply with local regulations. The document includes all necessary fields to obtain relevant property and owner information.

Zoning Regulations

USAREC Regulation 601-37 Army Medical Recruiting Program

This document outlines the USAREC Regulation 601-37, detailing policies and procedures for Army Medical Recruiting. It includes eligibility criteria and updates regarding various forms and requirements. Aimed at military personnel, it serves as a guideline for processing applications efficiently.

Real Estate

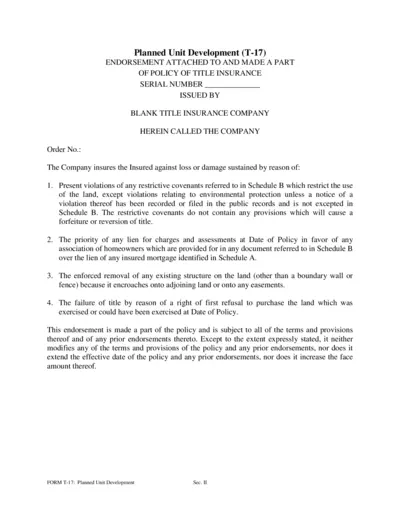

Planned Unit Development T-17 Title Insurance Policy

This document is a Planned Unit Development Title Insurance Policy. It details the protections offered by the insurance provider and outlines the terms of coverage. This file is essential for homeowners and real estate professionals to understand their rights and liabilities regarding property title.

Property Taxes

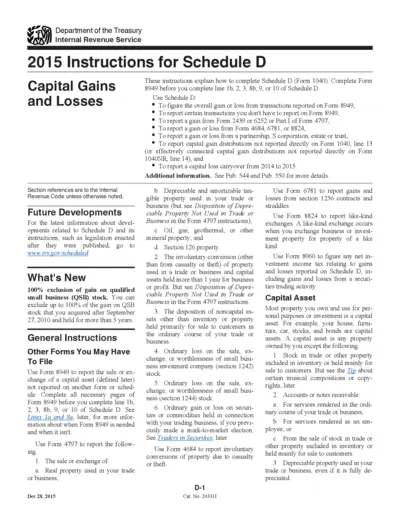

2015 Instructions for Schedule D Capital Gains and Losses

This file contains the essential instructions for completing Schedule D, which deals with capital gains and losses. It provides detailed guidelines on how to report capital assets and the necessary forms to fill. Users will find information about exclusions, inclusions, and additional forms required for accurate reporting.

Property Taxes

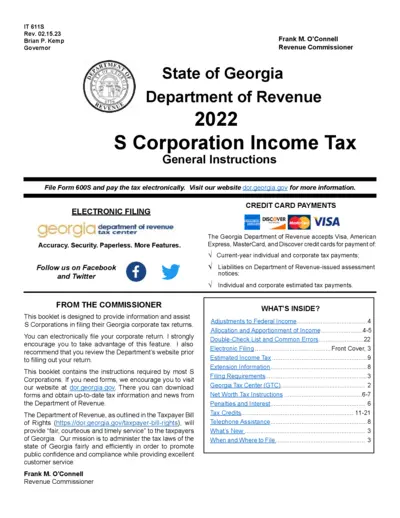

Georgia S Corporation Income Tax Instructions Guide

This guide provides essential information for filing Georgia S Corporation Income Tax. It includes instructions for electronic filing, payment methods, and important deadlines. Ideal for both individual taxpayers and tax professionals.

Property Taxes

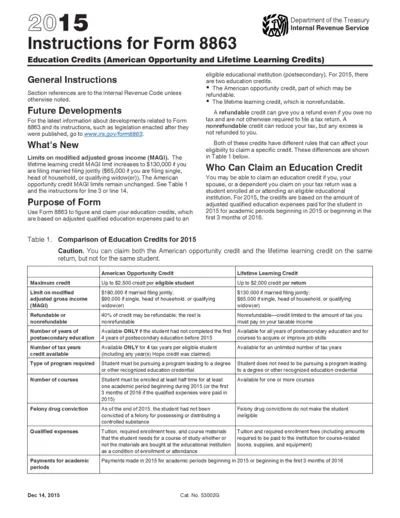

Instructions for Form 8863 Education Credits 2015

This file contains instructions for filling out Form 8863, which allows you to claim education credits related to qualified education expenses for eligible students. It outlines eligibility requirements and the calculation of both the American Opportunity and Lifetime Learning credits. Utilize this guide to maximize your educational tax benefits effectively.

Real Estate

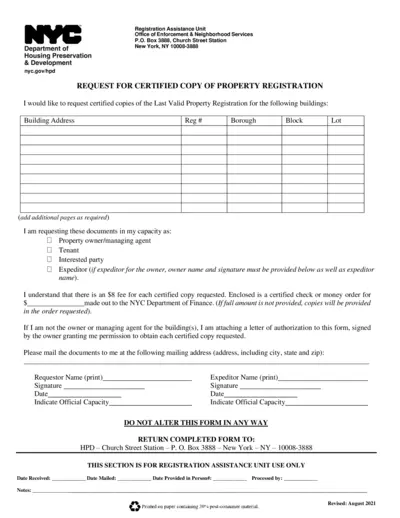

Request Certified Copy of NYC Property Registration

This form allows individuals to request certified copies of property registrations in New York City. It is essential for owners, tenants, and interested parties to obtain valid property documents. Ensure all information is accurately filled out to facilitate the request process.

Zoning Regulations

California Reformulated Gasoline Regulations 2014

This document outlines the unofficial electronic version of the California reformulated gasoline regulations. It is intended for users needing information on gasoline standards set forth by the California Air Resources Board. The file reflects amendments effective February 16, 2014.

Property Taxes

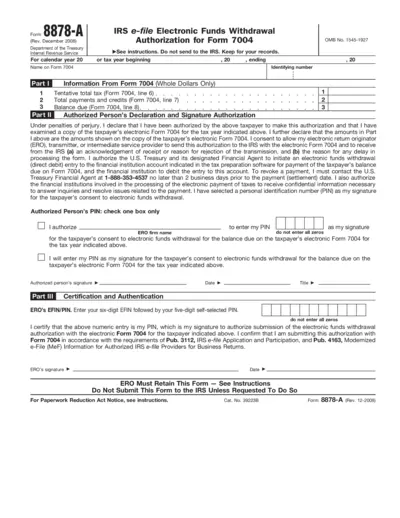

Form 8878-A IRS Electronic Funds Withdrawal Authorization

Form 8878-A is used by authorized persons to approve an electronic funds withdrawal for tax payments. It's essential for ensuring timely and accurate tax filings. Use this form in coordination with Form 7004 for business income tax extensions.