Property Law Documents

Property Taxes

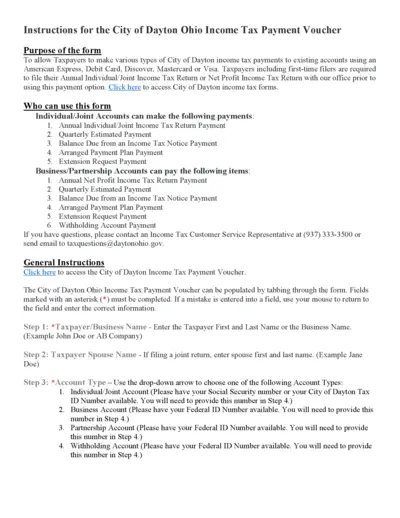

Dayton Ohio Income Tax Payment Voucher Instructions

This document provides essential instructions for the City of Dayton Ohio Income Tax Payment Voucher. It is intended for taxpayers to facilitate their various income tax payments. Included are details on who is eligible to use this form and how to complete it accurately.

Property Taxes

Colorado Sales Tax Return Instructions

This document provides comprehensive instructions for filing the Colorado Sales Tax Return. It includes details on electronic filing options, important dates, and common filing errors. A must-read for retailers in Colorado to ensure compliance with state tax regulations.

Property Taxes

Form 5471 Global Intangible Low-Taxed Income

This file contains Form 5471 which provides necessary information for reporting global intangible low-taxed income. It is crucial for U.S. taxpayers with foreign corporations. Follow the guidelines to ensure accurate reporting.

Real Estate

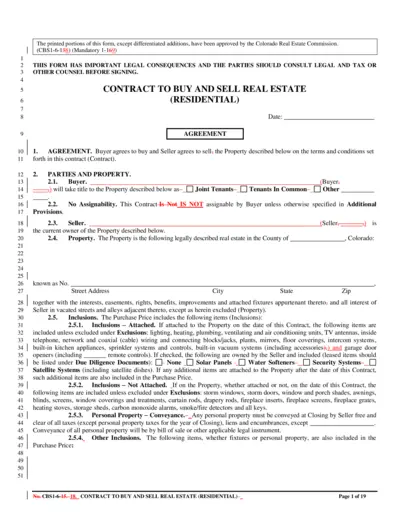

Contract to Buy and Sell Real Estate (Residential)

This form outlines the agreement between buyers and sellers in residential real estate transactions. It details the contractual obligations, inclusions, and deadlines. Users should consult legal counsel before signing.

Real Estate

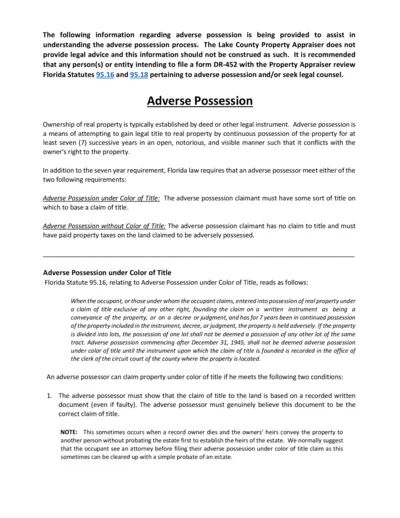

Understanding Adverse Possession in Florida

This document provides comprehensive information on the adverse possession process in Florida. It explains the legal requirements and procedures that must be followed. Ideal for individuals or entities looking to understand their rights regarding property ownership.

Real Estate

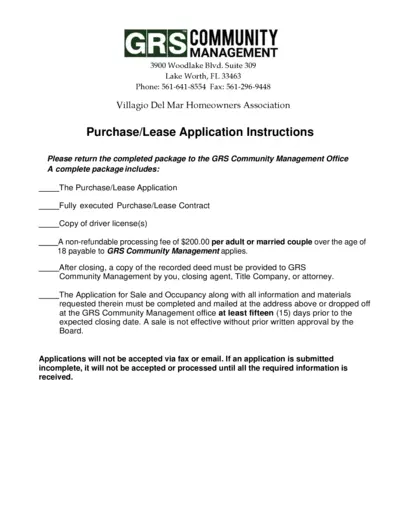

Villagio Del Mar Homeowners Association Lease Application Instructions

This document provides essential instructions for the Purchase/Lease Application of the Villagio Del Mar Homeowners Association. It contains details on the required documents and procedures for submission. Ensure to follow the guidelines closely for successful processing.

Real Estate

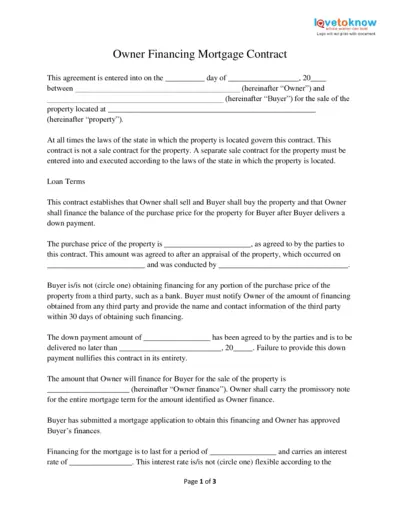

Owner Financing Mortgage Contract Guidelines

This file outlines the terms and conditions relating to an owner financing mortgage contract. It is designed to assist buyers and sellers in understanding their responsibilities and rights under this agreement. Ideal for those entering into a property sale with owner financing options.

Property Taxes

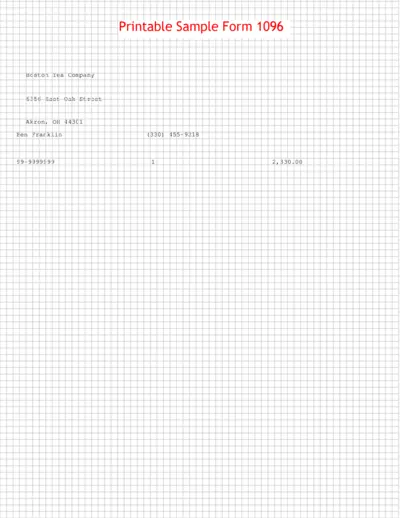

Boston Tea Company Printable Sample Form 1096

This file is a printable sample Form 1096 from Boston Tea Company, providing essential information for tax filing. It includes detailed instructions on filling out the form and necessary contact information. Users can easily access and utilize this sample for their submissions.

Property Taxes

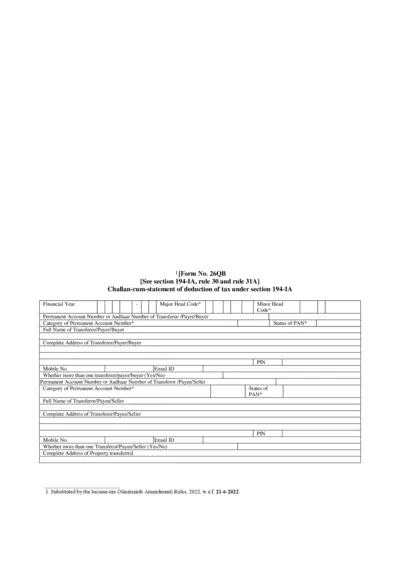

Form 26QB - Challan for Tax Deduction Under 194-IA

Form 26QB is a Challan-cum-statement for tax deduction under section 194-IA. It is crucial for individuals involved in real estate transactions for tax compliance. The form captures essential details regarding property transfer and tax deductions.

Real Estate

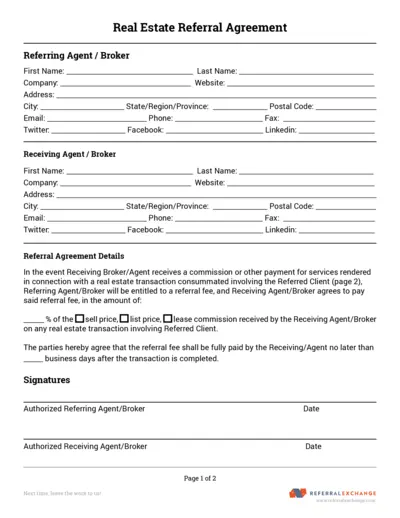

Real Estate Referral Agreement Form

The Real Estate Referral Agreement outlines the terms between agents and brokers for referrals. It includes sections for client information and details about the referral fee. This form is essential for real estate transactions involving referred clients.

Property Taxes

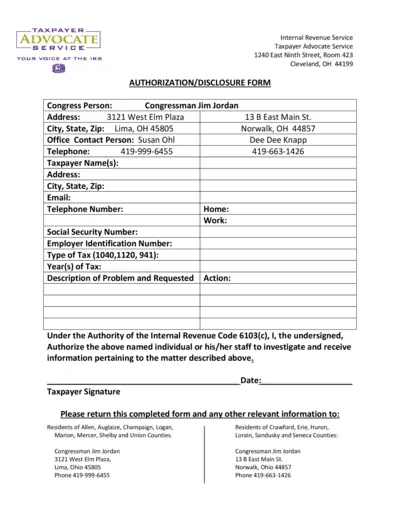

IRS Taxpayer Advocate Service Authorization Form

This file contains the IRS Taxpayer Advocate Service Authorization/Disclosure form. It allows taxpayers to authorize an advocate to act on their behalf. Complete this form to facilitate communication with the IRS.

Real Estate

Agreement of Purchase and Sale for Condominium

This file is an Agreement of Purchase and Sale tailored for condominium resales in Ontario. It outlines the essential terms and conditions for buyers and sellers involved in the transaction. Understanding this document is crucial for ensuring a smooth real estate process.