Property Law Documents

Property Taxes

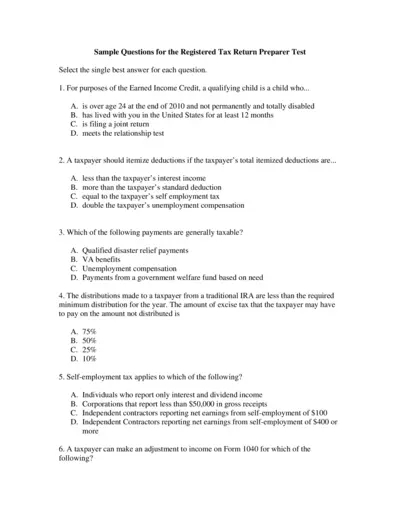

Tax Return Preparer Test Question Sample Guide

This file contains sample questions for the Registered Tax Return Preparer Test. It provides insights into the types of questions that may appear in the actual test, helping candidates prepare effectively. Utilize this resource to enhance your understanding of key tax concepts.

Real Estate

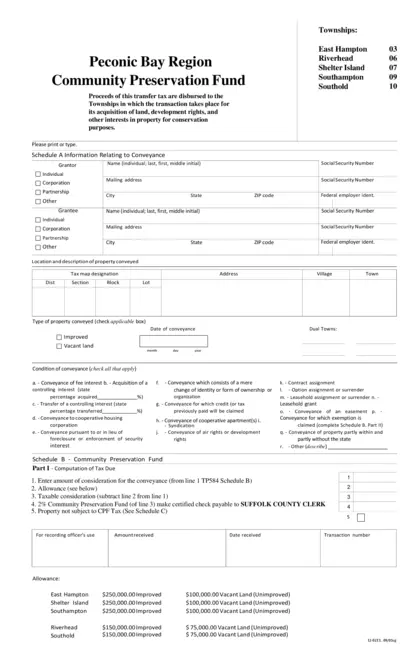

Peconic Bay Community Preservation Fund Form

This document is essential for individuals involved in property transactions within the Peconic Bay Region. It details the Community Preservation Fund and related taxes. Users must complete it for land conservation or property acquisition activities.

Real Estate

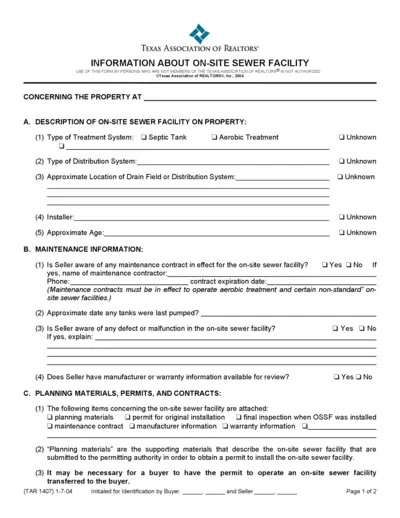

Texas Association of Realtors On-Site Sewer Facility

This file contains essential information regarding on-site sewer facilities, including maintenance data and usage estimates. It serves as a guideline for property sellers and buyers to understand the wastewater management systems. Utilize this form to ensure compliance with local regulations and for seamless property transactions.

Property Taxes

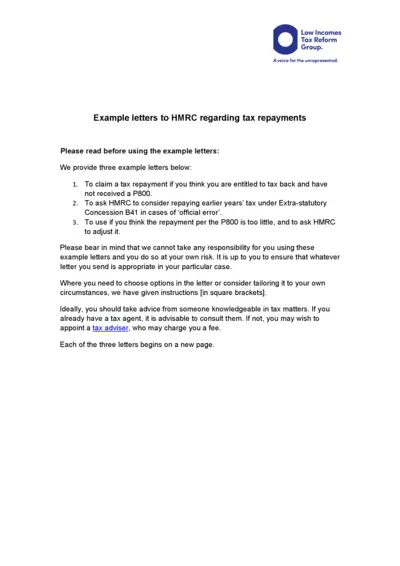

Tax Repayment Letters for Low Income Individuals

This file contains example letters to HMRC for tax repayments. It is designed for individuals who believe they are entitled to a tax refund. Follow the detailed instructions for proper usage.

Property Taxes

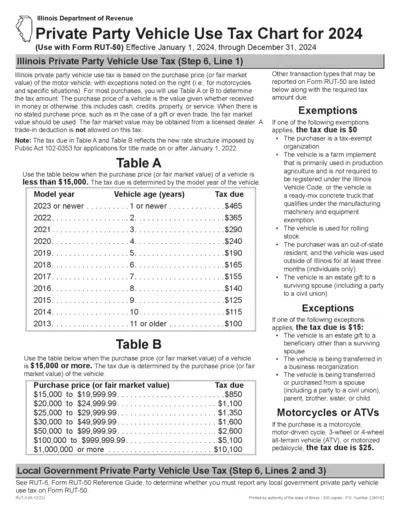

Illinois Vehicle Use Tax Chart for 2024

This document details the Illinois Private Party Vehicle Use Tax for 2024, outlining tax rates based on vehicle purchase prices. It provides guidance on filling out Form RUT-50. Essential for both consumers and businesses needing to understand vehicle use tax obligations.

Real Estate

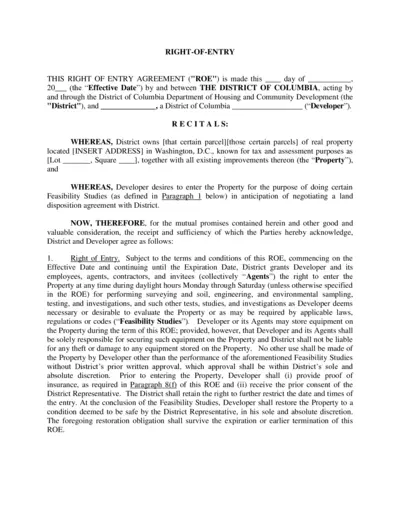

Right of Entry Agreement for Property Access

This Right of Entry Agreement outlines the terms for a developer to access a specified property in Washington, D.C. It covers feasibility studies and related activities permitted by the District of Columbia. Essential for developers and real estate professionals, this document is critical for site assessments.

Property Taxes

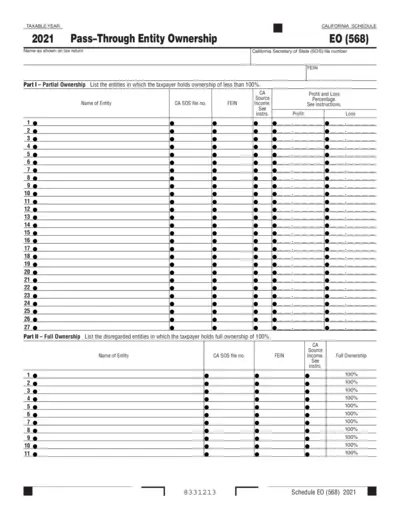

2021 California Schedule EO for Pass-Through Entities

The California Schedule EO (568) is designed for reporting ownership in pass-through entities. It provides tax-related information required for state tax compliance. This form is essential for California taxpayers with ownership interests in various entities.

Property Taxes

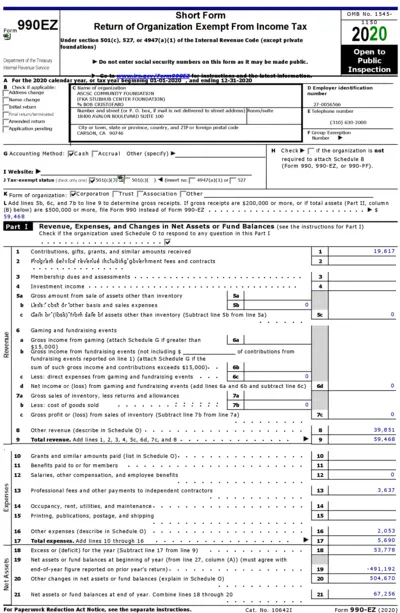

Return of Organization Exempt From Income Tax

This file contains the Return of Organization Exempt From Income Tax, Form 990-EZ filed under section 501(c). It provides details about the organization’s financial activities including revenue, expenses, and assets. It's essential for tax-exempt organizations to accurately report their financial information.

Property Taxes

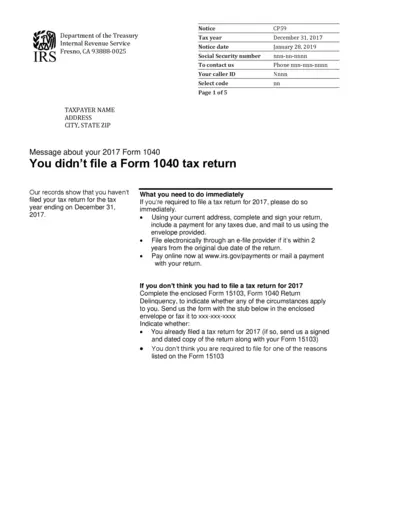

IRS CP59 Notice for 2017 Tax Year Instructions

This document is a notice from the IRS regarding your 2017 tax filing status. It provides instructions on how to file your tax return if you haven't done so. Follow the guidelines to ensure compliance and avoid penalties.

Real Estate

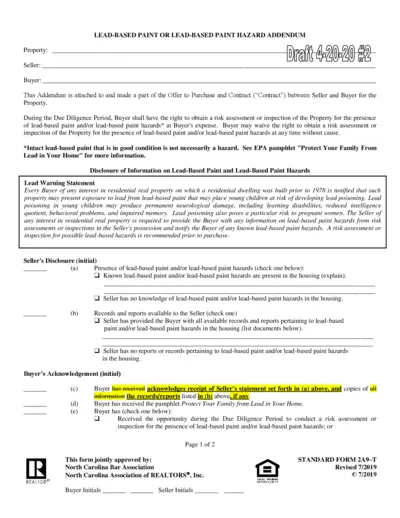

Lead-Based Paint Hazard Addendum Form Details

This document outlines the Lead-Based Paint Hazard Addendum, essential for buyers of residential properties built before 1978. It informs about potential lead hazards and the rights of the buyer during the due diligence period. Compliance ensures the safety of buyers, especially families with young children.

Real Estate

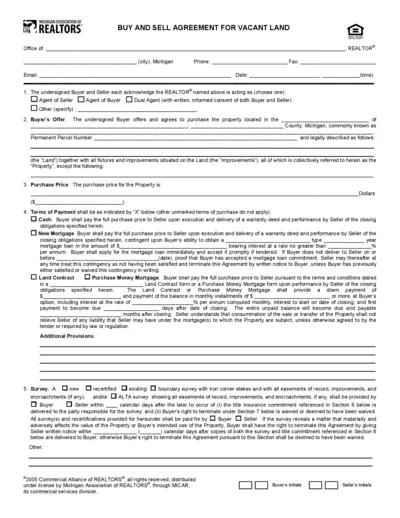

Michigan Realtors Buy and Sell Agreement Form

This Buy and Sell Agreement form is specifically designed for vacant land transactions. It outlines the terms of purchase, payment details, and responsibilities of both buyers and sellers. Perfect for real estate agents and individuals engaged in property buying and selling.

Property Taxes

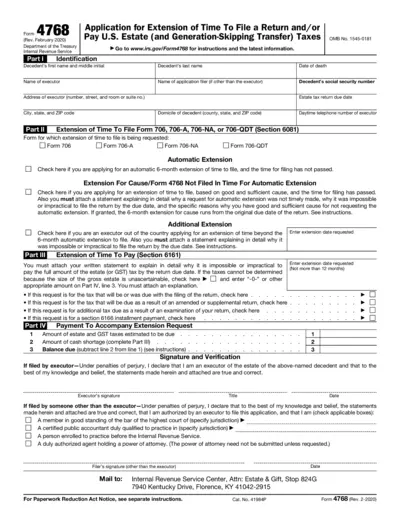

Application for Extension of Time to File Return - Form 4768

Form 4768 is a request form for taxpayers seeking an extension of time to file U.S. Estate and Generation-Skipping Transfer Taxes. This form can be crucial for executors managing decedent estates, ensuring compliance and avoiding penalties. Follow the specific instructions to complete and submit this form correctly.