Property Law Documents

Real Estate

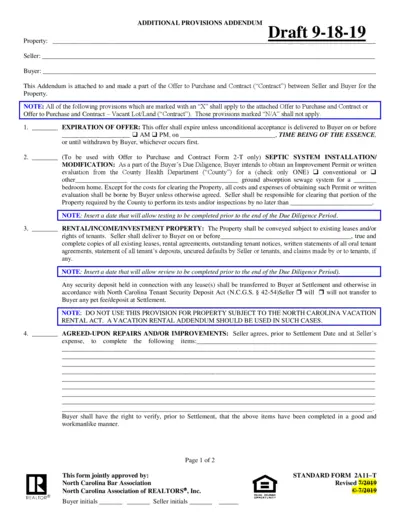

Additional Provisions Addendum for Property Purchase

This Additional Provisions Addendum outlines essential terms related to the purchase of a property. It details the responsibilities of buyers and sellers, while ensuring compliance with North Carolina real estate regulations. This file serves as a crucial document for securing a smooth transaction.

Property Taxes

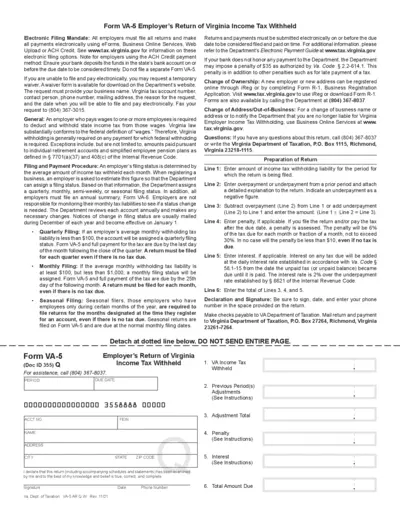

Form VA-5 Employer's Return of Virginia Income Tax Withheld

This form, VA-5, is required for employers in Virginia to report income tax withheld from employees. It mandates electronic filing and payment to ensure timeliness and compliance. Employers must follow specific instructions for accurate completion and submission.

Real Estate

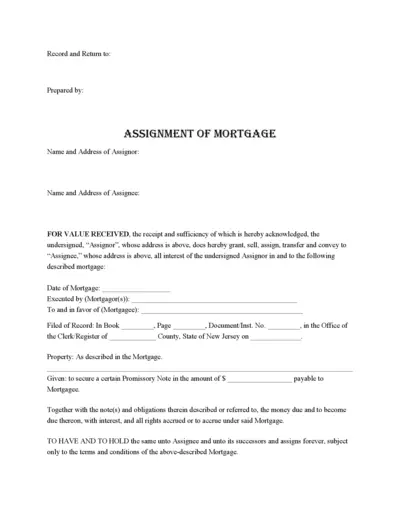

Assignment of Mortgage Form Guidelines

This document is essential for transferring mortgage rights from one party to another. It outlines the responsibilities and requirements for both the assignor and assignee. Properly completing this form ensures that all parties are protected legally.

Real Estate

Oklahoma Real Estate Contract Information Booklet

The Oklahoma Real Estate Contract Information Booklet is a comprehensive guide for real estate licensees detailing the residential sales contracts and related addenda. It offers essential instructions for both buyers and sellers, ensuring clarity in the offer and acceptance process. This booklet is a valuable tool for understanding the legal implications in real estate transactions.

Property Taxes

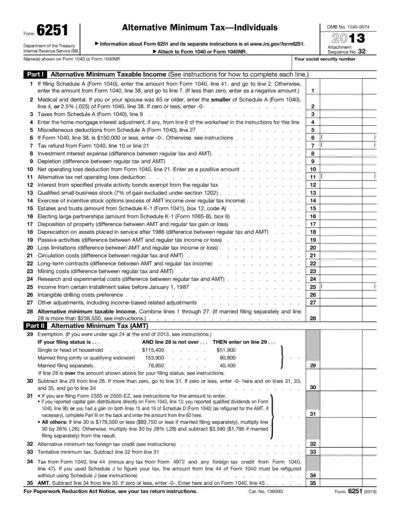

Form 6251 Alternative Minimum Tax for Individuals

Form 6251 is essential for individuals calculating their alternative minimum tax obligations. It outlines the adjustments and preferences that impact tax liabilities. This form is a must-have for accurate tax reporting.

Real Estate

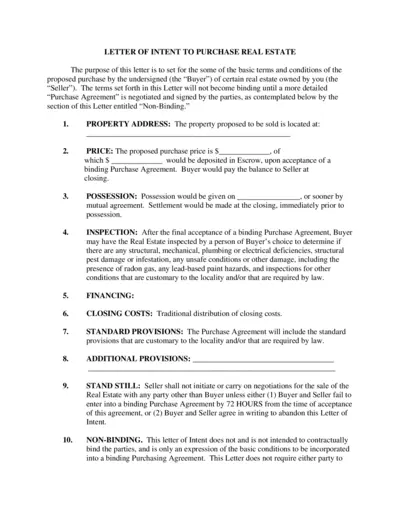

Letter of Intent to Purchase Real Estate

This letter outlines the basic terms and conditions for purchasing real estate. It serves as a preliminary agreement between the buyer and seller before a formal Purchase Agreement is established. Ideal for both parties to understand their intentions regarding the purchase.

Property Taxes

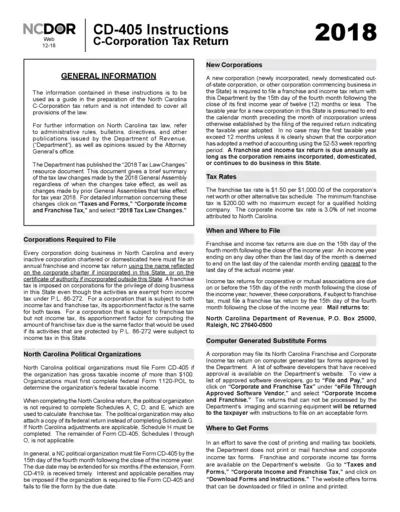

CD-405 Instructions for C-Corporation Tax Return 2018

This file contains essential instructions for completing the North Carolina C-Corporation tax return for 2018. It guides users through filing requirements, deadlines, and relevant tax law changes. Ideal for corporations operating in North Carolina and ensuring compliance with state tax regulations.

Real Estate

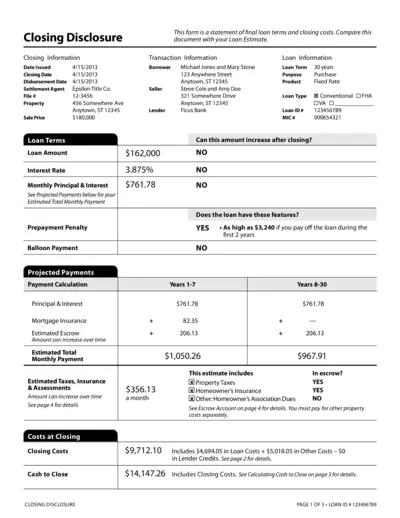

Closing Disclosure Summary for Home Purchase Loan

The Closing Disclosure provides a detailed statement of final loan terms and closing costs. It helps borrowers compare their final loan terms with the initial Loan Estimate. Understanding this document is crucial for ensuring a smooth transaction.

Property Taxes

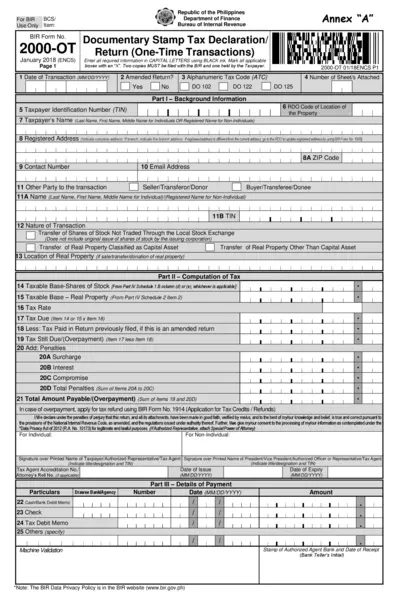

BIR Documentary Stamp Tax Declaration Form 2000-OT

This file contains the BIR Form No. 2000-OT for Documentary Stamp Tax Declaration related to One-Time Transactions in the Philippines. It provides essential information and instructions for taxpayers and representatives to properly fill out the form. This document is crucial for compliance with tax regulations.

Real Estate

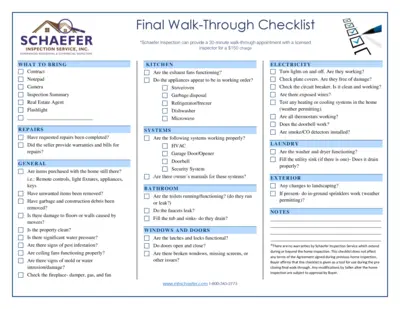

Final Walk-Through Checklist for Home Inspection

This file provides a comprehensive checklist for the final walk-through during a home inspection. It's essential for both buyers and sellers to ensure that all aspects of the property have been addressed. Follow the detailed instructions to effectively utilize this checklist.

Property Taxes

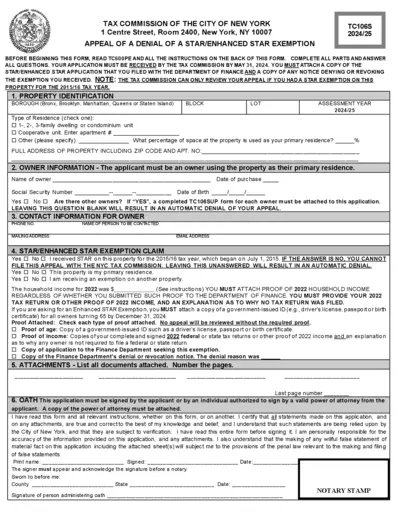

NYC Tax Commission STAR Exemption Appeal Form

This document is an appeal form for denial of a STAR or Enhanced STAR exemption in New York City. It provides necessary instructions and requirements for applicants to follow. Ensure to attach all required documents before submission.

Property Taxes

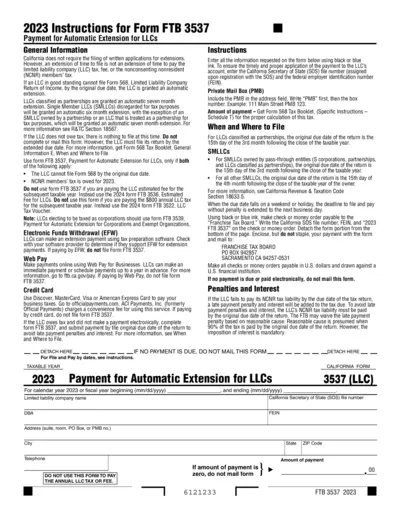

FTB 3537 Automatic Extension Payment Instructions

The FTB 3537 form provides instructions for LLCs in California for automatic extension payments. This guide outlines filing procedures and deadlines. Ensure compliance with tax regulations to avoid penalties.