Property Law Documents

Property Taxes

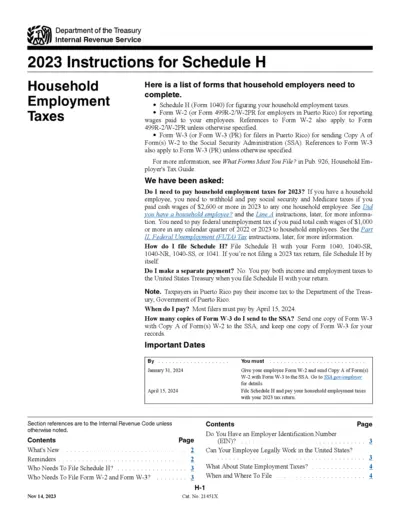

2023 Instructions for Schedule H Household Employment Taxes

This file contains comprehensive instructions for household employers regarding the completion of Schedule H for employment taxes. It covers requirements for filing, important dates, and specific forms needed. Understanding this document is essential for complying with federal regulations and fulfilling tax obligations.

Real Estate

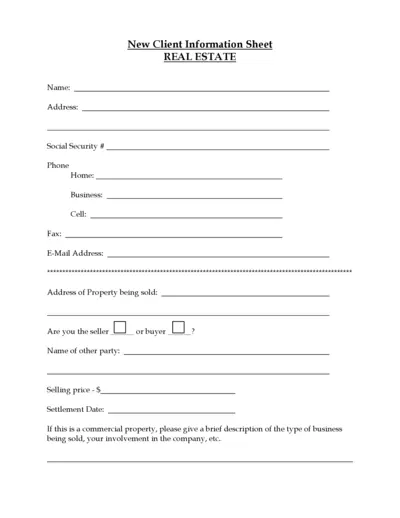

New Client Information Sheet for Real Estate 2023

This file serves as a New Client Information Sheet for real estate transactions. It collects essential details from clients, including their property information and personal contact details. Utilize this form to streamline the communication process between buyers and sellers.

Property Taxes

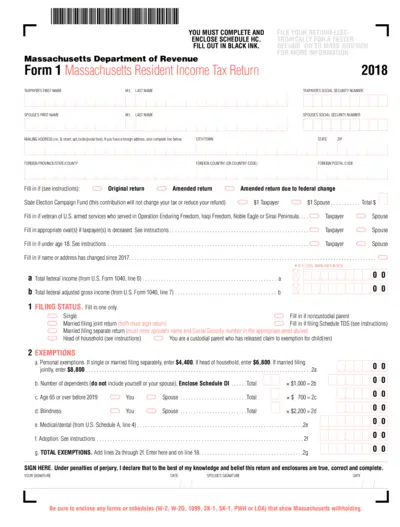

Massachusetts Resident Income Tax Return Form 1

This document is the Massachusetts Resident Income Tax Return Form 1. It is crucial for residents to file their annual tax return accurately. Follow the provided instructions to ensure proper completion and submission.

Property Taxes

Instructions for Form 2290 Heavy Highway Vehicle Tax

This file contains detailed instructions for completing Form 2290, which is used for reporting and paying heavy highway vehicle use tax. It outlines who must file, how to calculate the tax, and the process for filing electronically or via mail. Perfect for individuals and businesses managing heavy vehicles.

Property Taxes

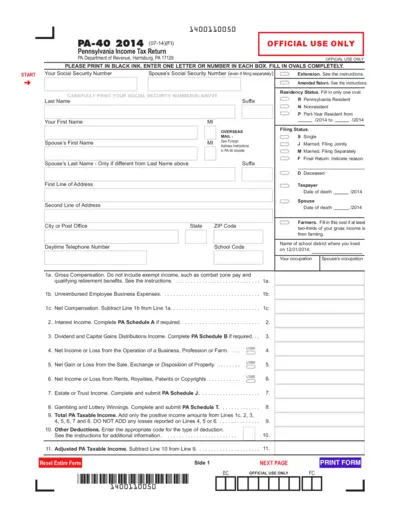

PA 40 Income Tax Return Form Instructions

The PA-40 2014 is the official Pennsylvania income tax return form. This document provides essential details on how to complete your tax return. Complete the form accurately to ensure that your tax obligations are met.

Real Estate

Life Estate Change in Ownership Instructions

This document provides detailed information on how to properly fill out a preliminary change of ownership report. It explains the significance of reserving a life estate and outlines legal implications. This resource is essential for anyone dealing with property transfers in California.

Real Estate

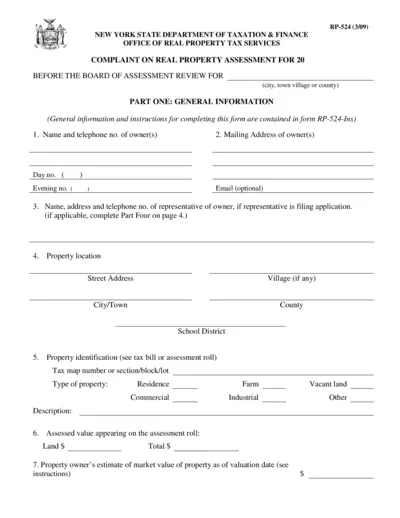

Complaint on Real Property Assessment Form

The RP-524 form is used by property owners in New York State seeking to contest their property assessment. This document provides the necessary instructions and fields for filing a complaint. It helps ensure that homeowners understand their rights and the process for appealing tax assessments.

Property Taxes

CP500 Tax Installment Form Instructions and Guide

This document provides essential information regarding the CP500 tax installment scheme in Malaysia. It includes instructions on filing, deadlines, and important notes for taxpayers. It's crucial for taxpayers with non-employment income to understand their obligations.

Property Taxes

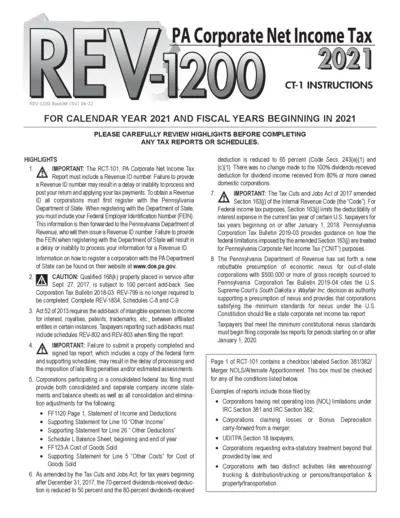

PA Corporate Net Income Tax Report Instructions

This file contains essential instructions for completing the PA Corporate Net Income Tax report for 2021. It includes important regulations, filing requirements, and contact details for assistance. Ensure you read through the highlights to avoid processing delays.

Property Taxes

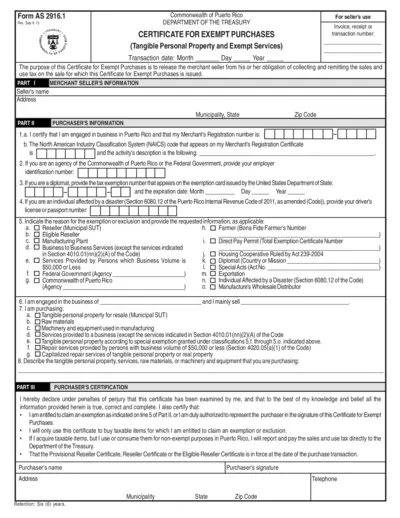

Puerto Rico Exempt Purchase Certificate

This file provides a Certificate for Exempt Purchases in Puerto Rico, allowing qualifying purchasers to exempt sales tax. Suitable for registered merchants and agencies, it details necessary information for tax exemption. Complete the form accurately to ensure compliance with Puerto Rican tax regulations.

Real Estate

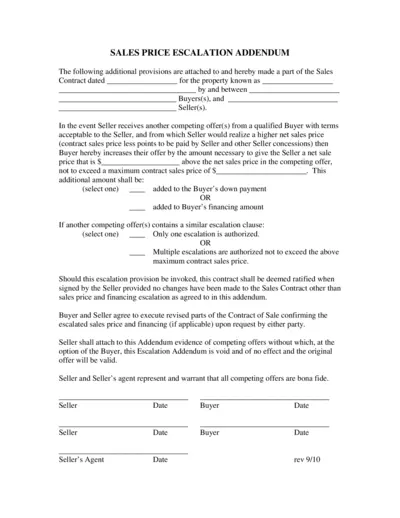

Sales Price Escalation Addendum for Real Estate

This Sales Price Escalation Addendum provides detailed provisions for buyers and sellers in real estate transactions. It allows buyers to increase their offers based on competing bids. Ideal for real estate professionals and buyers looking to enhance their offers.

Property Taxes

Form 941 Employer Quarterly Federal Tax Return Instructions

This document provides instructions for filing Form 941, which reports income taxes, social security tax, and Medicare tax withheld from employee wages. It includes important updates on tax rates and filing requirements. Employers can find detailed guidance on how to complete the form correctly.