Property Law Documents

Real Estate

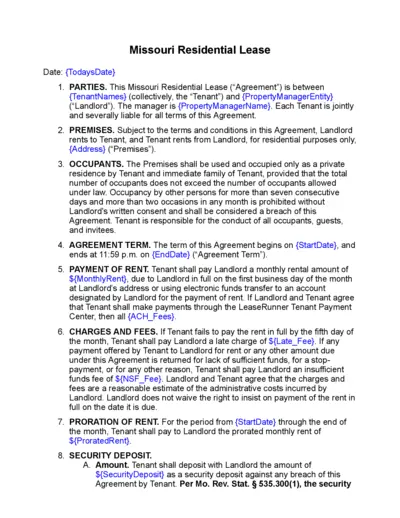

Missouri Residential Lease Agreement Document

The Missouri Residential Lease provides a comprehensive agreement between tenants and landlords. It outlines essential terms such as payment schedules, security deposits, and occupancy rules. This document is crucial for ensuring clear communication and legal protection for both parties involved.

Property Taxes

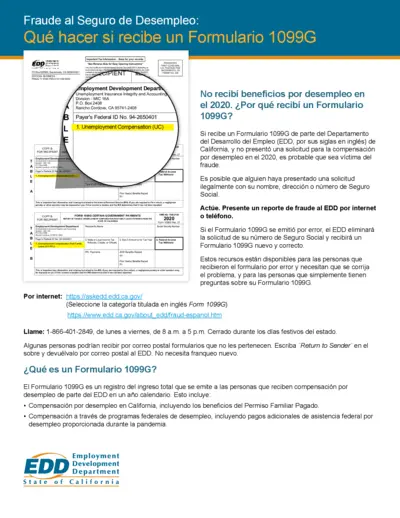

Fraude de Seguro de Desempleo y Formulario 1099G

This file provides crucial instructions on handling Form 1099G related to unemployment compensation fraud. It outlines what to do if you receive this form incorrectly. Essential for residents of California who need to report unemployment benefits for tax purposes.

Property Taxes

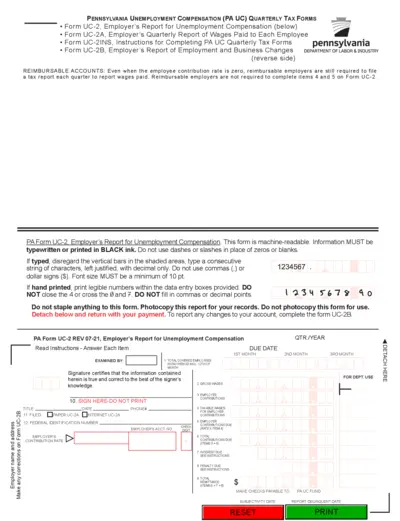

Pennsylvania Unemployment Compensation Quarterly Tax Forms

This file contains essential Pennsylvania unemployment compensation tax forms needed for employer reporting. It includes the employer's report for unemployment compensation, quarterly wage reports, and completion instructions. The forms need to be submitted quarterly to comply with employment regulations.

Property Taxes

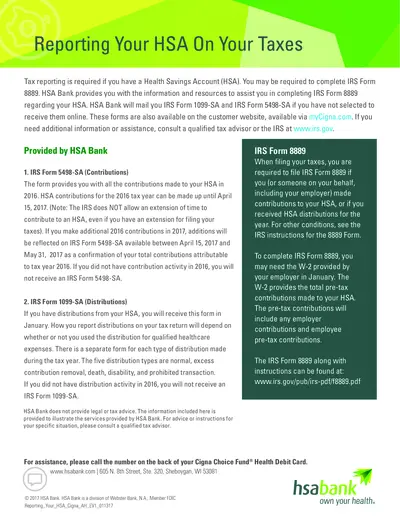

Reporting Your HSA On Your Taxes: IRS Forms 8889

This file provides essential information on reporting your Health Savings Account (HSA) on your taxes. It includes details about the relevant IRS forms, requirements, and deadlines. Users can find guidance on how to fill out IRS Form 8889 and related forms.

Property Taxes

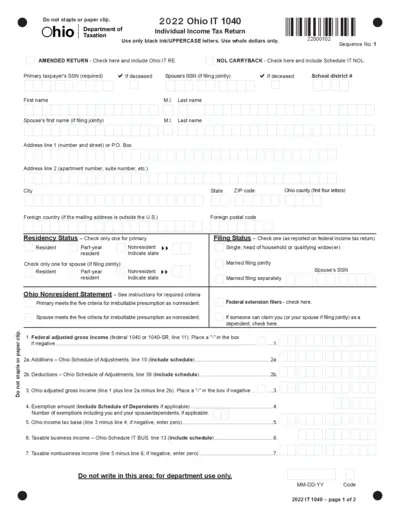

2022 Ohio IT 1040 Individual Income Tax Return

The 2022 Ohio IT 1040 is essential for residents filing their individual income taxes. It provides guidance on forms and instructions for various tax situations. Complete this form accurately to ensure compliance and avoid penalties.

Property Taxes

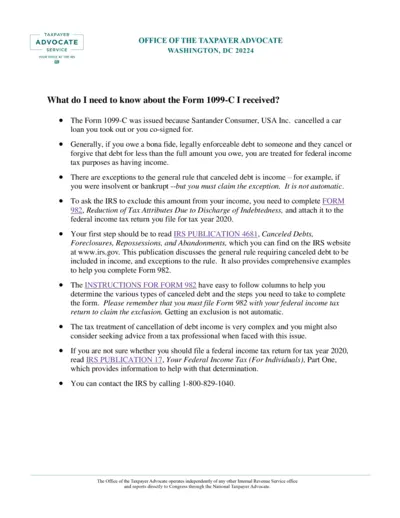

Understanding Form 1099-C for Tax Reporting

This document provides comprehensive guidance on Form 1099-C, including instructions for filling it out. It covers the tax implications of canceled debts and necessary actions to take. Users will find essential information on seeking exemptions and filing procedures.

Property Taxes

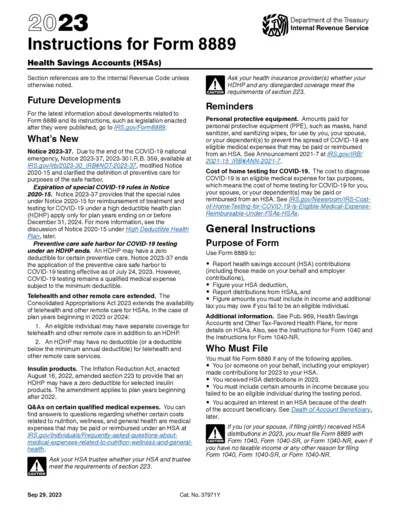

Instructions for Form 8889 Health Savings Accounts

This document provides vital instructions on filling out Form 8889, which is used for Health Savings Accounts (HSAs). It explains eligibility, contributions, and distribution reporting. This is essential for taxpayers managing their HSAs.

Property Taxes

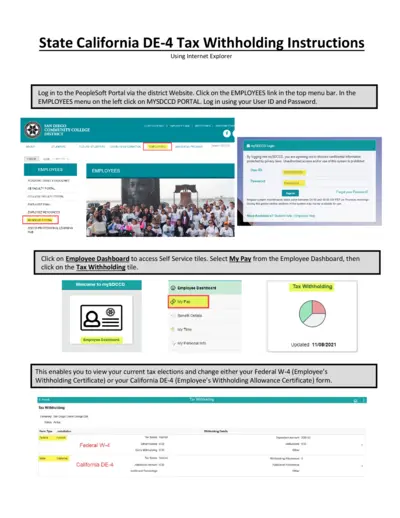

California DE-4 Tax Withholding Instructions

This file provides essential instructions for completing the California DE-4 tax withholding form. It outlines how to access and fill out the form to ensure accurate tax withholding. It also explains the importance of updating your tax information as needed.

Property Taxes

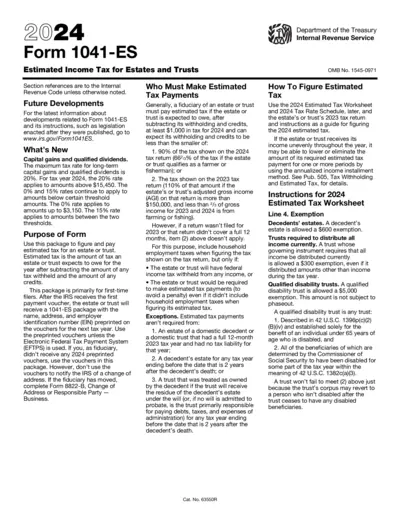

2024 Form 1041-ES Estimated Income Tax Instructions

This document provides essential instructions for filing Form 1041-ES, the Estimated Income Tax for Estates and Trusts for the year 2024. It details estimated tax payment requirements, filing deadlines, and important exemptions. Perfect for fiduciaries managing estates or trusts.

Real Estate

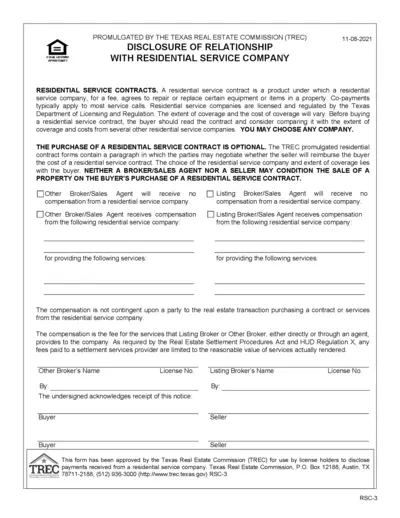

Texas Residential Service Contract Disclosure Form

This file provides a detailed explanation of the Texas Residential Service Contract. It outlines essential information regarding repairs and replacements for residential properties. Readers will find instructions and guidelines to help them navigate and utilize the service contract effectively.

Property Taxes

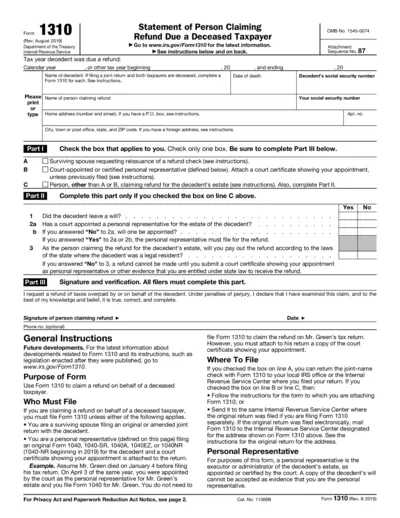

IRS Form 1310 Claim Refund Deceased Taxpayer

IRS Form 1310 allows individuals to claim a tax refund on behalf of a deceased taxpayer. It is essential for personal representatives and surviving spouses to ensure proper execution. This form is vital for managing estate taxes and refunds efficiently.

Property Taxes

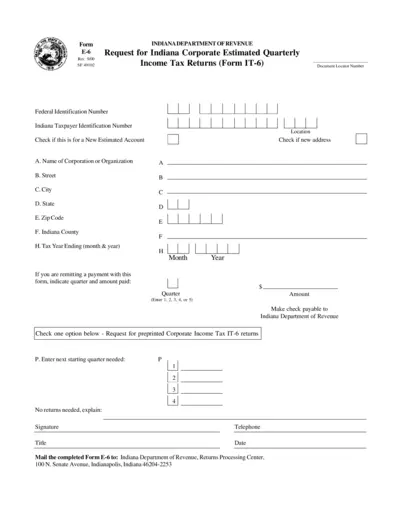

Request for Indiana Corporate Estimated Tax Returns

This file provides essential information and forms for corporations in Indiana to request estimated quarterly income tax returns. It includes instructions on how to fill out Form E-6 and details on due dates and penalties. It is a crucial document for businesses to ensure compliance with Indiana's tax regulations.