Property Law Documents

Real Estate

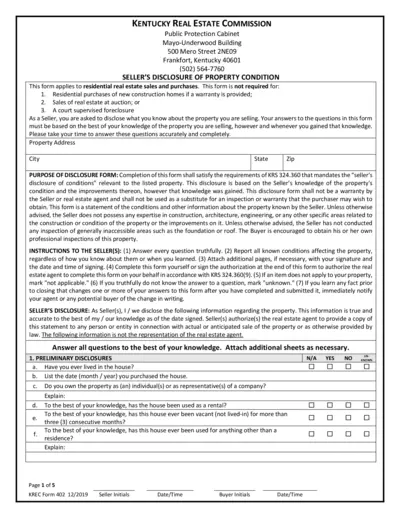

Kentucky Seller's Disclosure of Property Condition Form

This file is the Seller's Disclosure of Property Condition form for Kentucky real estate transactions. It provides important details about property conditions and seller disclosures. Accurate completion of this form helps facilitate the sale process and protects both buyers and sellers.

Real Estate

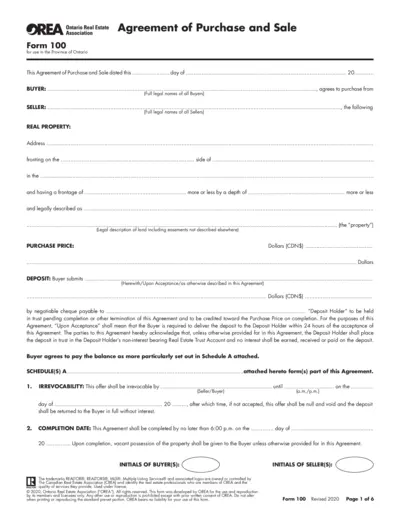

Ontario Real Estate Agreement of Purchase and Sale Form

This file provides the official Agreement of Purchase and Sale for real estate transactions in Ontario. It includes necessary details for buyers and sellers to ensure a legal and binding sale process. Essential for anyone involved in property transactions in Ontario, this form streamlines legal agreements.

Property Taxes

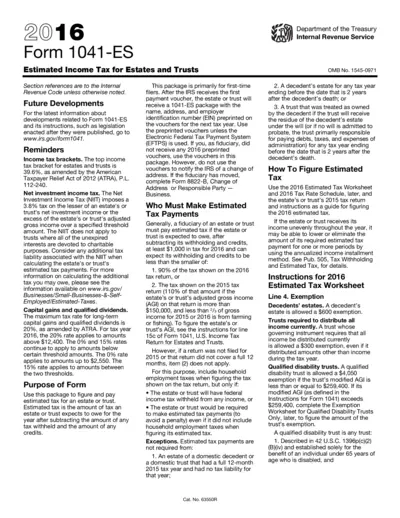

Form 1041-ES Estimated Income Tax for Estates

This file provides essential instructions and details on filing estimated tax payments for estates and trusts. It outlines the requirements and guidelines necessary for compliance. Users can benefit from understanding the payment schedules and exemptions applicable to their estates or trusts.

Property Taxes

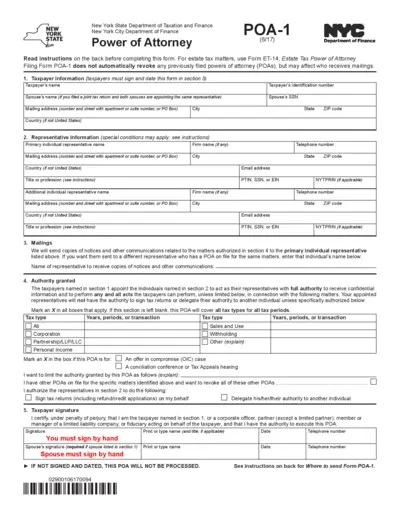

New York State Power of Attorney Form Instructions

This file provides detailed instructions on how to complete the New York State Power of Attorney Form POA-1. It includes information about the necessary taxpayer information, representative information, and filing instructions. Ensure compliance with tax obligations and authority granted.

Real Estate

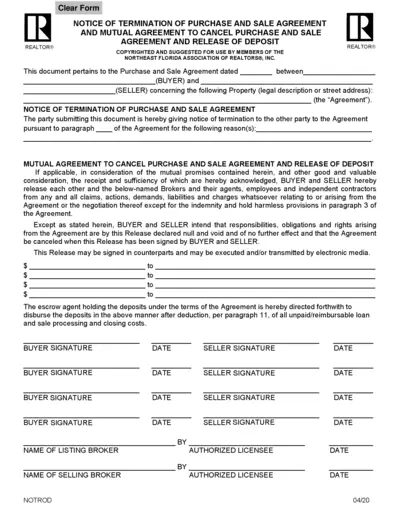

Notice of Termination of Purchase Agreement

This form serves as a formal notice for the termination of a purchase and sale agreement. It outlines the mutual agreement between the parties involved to release the deposit. Users can use this document to ensure that all parties acknowledge the cancellation properly.

Property Taxes

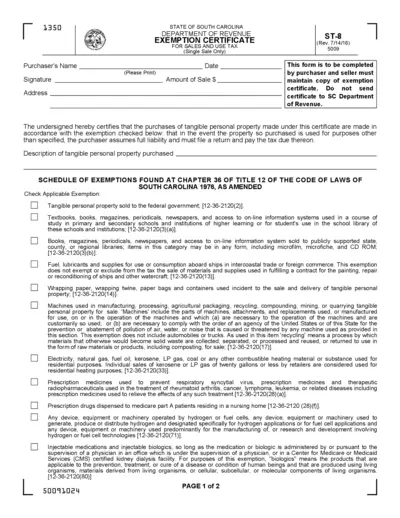

South Carolina Sales and Use Tax Exemption Certificate

The South Carolina Sales and Use Tax Exemption Certificate is essential for individuals and organizations to claim tax exemptions on purchases. This document outlines the necessary steps and exemptions applicable under South Carolina state law. Completing this certificate accurately ensures compliance and facilitates tax savings.

Real Estate

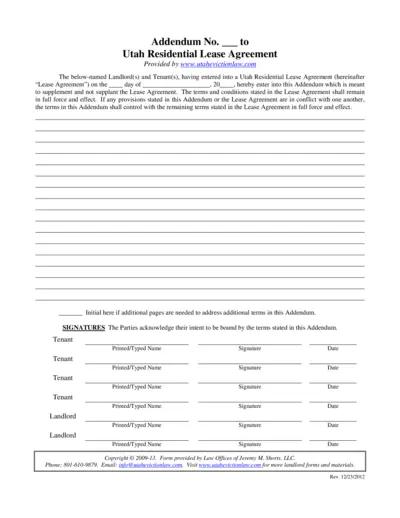

Utah Residential Lease Agreement Addendum

This addendum supplements the Utah Residential Lease Agreement between landlords and tenants. It outlines any additional terms or conditions agreed upon after the lease signing. Use this form to ensure compliance with lease modifications.

Property Taxes

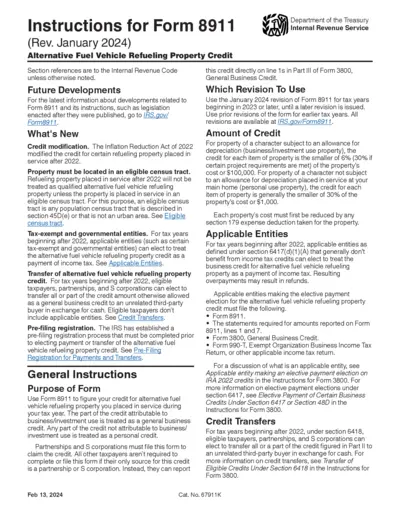

Form 8911 Instructions for Alternative Fuel Credits

This document provides important instructions for filing Form 8911 for Alternative Fuel Vehicle Refueling Property Credits. It outlines eligibility requirements, credit calculations, and procedures for submitting the form. Stay informed about necessary steps to claim your credits effectively.

Property Taxes

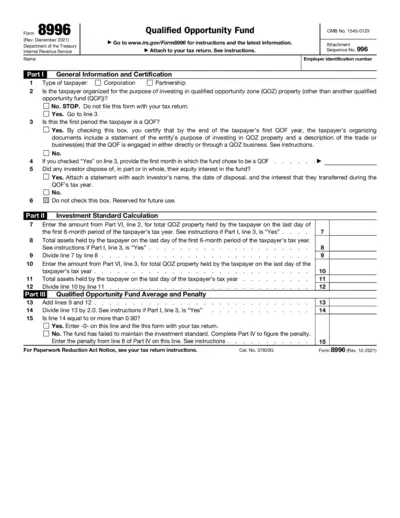

Form 8996 Instructions for Qualified Opportunity Fund

Form 8996 is used to certify a Qualified Opportunity Fund (QOF). Properly filled out, this form helps in tax benefits related to investments in Opportunity Zones. Ensure to follow the guidelines provided to maintain compliance.

Property Taxes

Quarterly Fuel Tax Return IFTA

The Quarterly Fuel Tax Return under the International Fuel Tax Agreement (IFTA) allows users to report fuel tax information. It includes details on various fuel types like diesel, gasoline, and more. This file is essential for compliance and tax reporting for licensed distributors.

Property Taxes

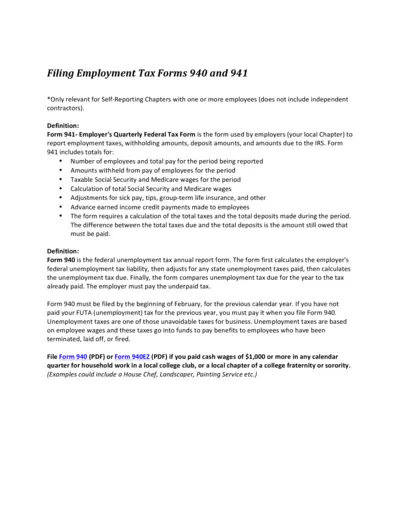

Filing Employment Tax Forms 940 and 941 Instructions

This file provides essential information on how to file Employment Tax Forms 940 and 941. It includes definitions, filing requirements, and crucial deadlines. Ideal for local chapters managing employee taxes.

Property Taxes

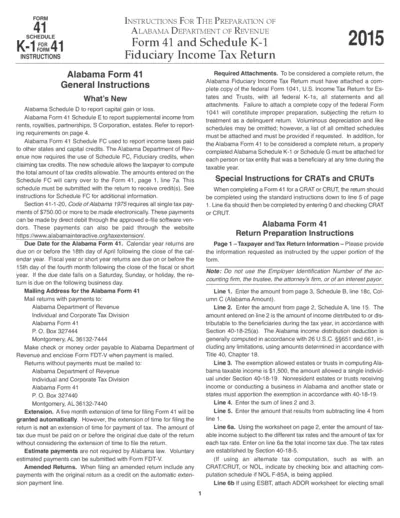

Alabama Form 41 Instructions and Schedule K-1 Details

This file provides comprehensive instructions for completing the Alabama Form 41 and its associated Schedules. It covers submission guidelines, important dates, and the necessary attachments required for a successful filing. Designed for fiduciaries and tax professionals, this guide aims to simplify the preparation process.