Property Law Documents

Real Estate

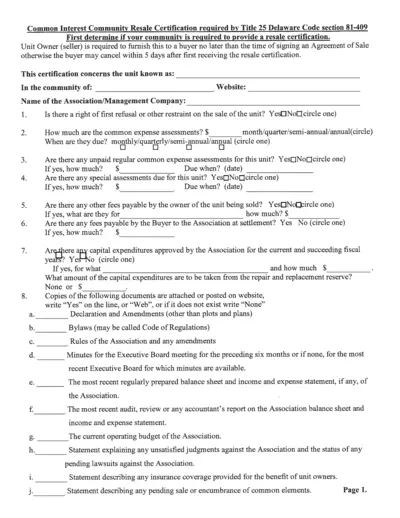

Common Interest Community Resale Certification Guide

This file provides essential information regarding the resale certification for common interest communities. It outlines the responsibilities of unit owners and offers clear guidelines for completing the certification process. Whether you are a buyer or seller, this document can help ensure a smooth transaction.

Property Taxes

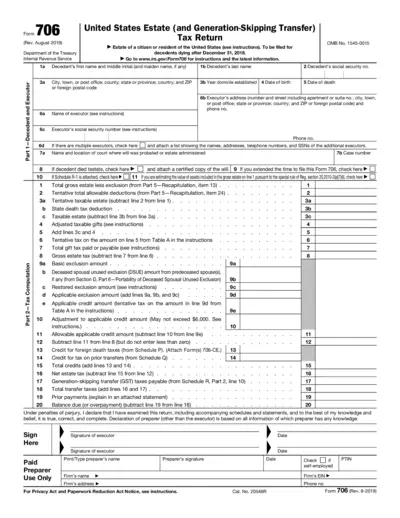

United States Estate Tax Return Form 706 Instructions

This PDF file contains the US Estate Tax Return Form 706 and its instructions. It is crucial for executors of estates to report regarding the decedent's estate. This document is essential for ensuring compliance with federal estate tax laws.

Real Estate

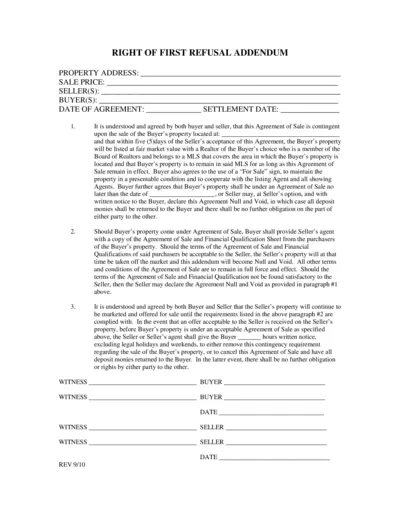

Right of First Refusal Agreement Instructions

This document outlines the Right of First Refusal Agreement between buyers and sellers. It details the contingency of sale based on another property's status. This file is essential for parties involved in property transactions requiring this agreement.

Property Taxes

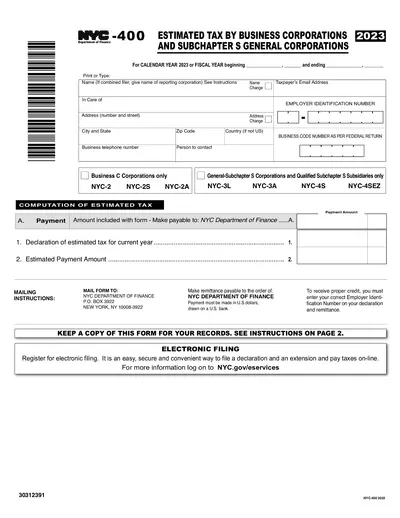

NYC-400 Estimated Tax Form for Corporations 2023

The NYC-400 form is a declaration for estimated tax by business corporations and Subchapter S corporations. This form is essential for corporations in NYC, ensuring compliance with tax liabilities. Users can submit the form electronically for convenience.

Property Taxes

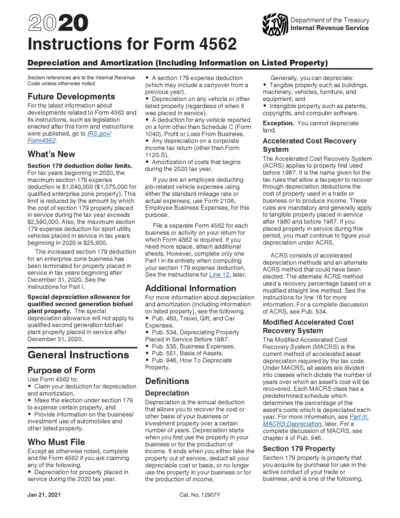

Instructions for Form 4562 - Depreciation and Amortization

This file provides detailed instructions for completing IRS Form 4562, which is used for claiming depreciation and amortization for business assets. It includes guidelines on Section 179 expense deductions and special depreciation allowances. Essential for anyone involved in asset management for tax purposes.

Property Taxes

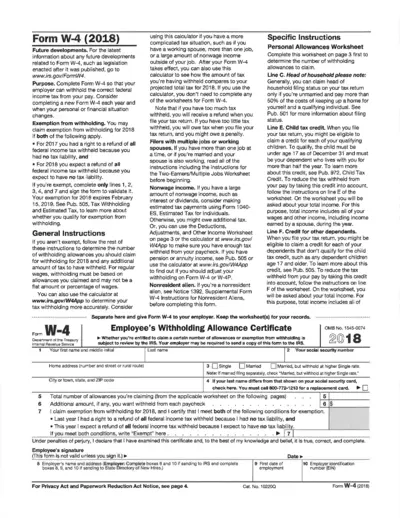

Form W-4 2018 Guidelines for Tax Withholding

Form W-4 is essential for determining federal income tax withholding. This document guides employees on their withholding allowances. Ensure correct tax withholding by completing this form accurately.

Real Estate

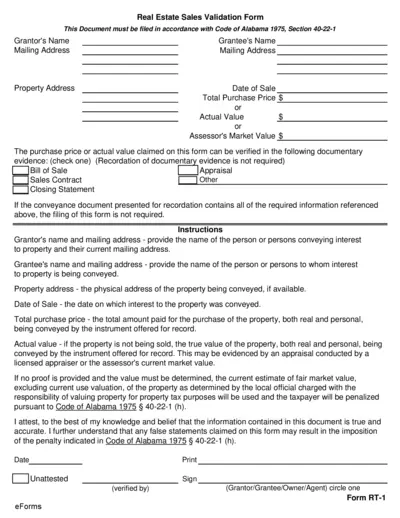

Real Estate Sales Validation Form for Alabama

This form is essential for documenting real estate transactions in Alabama. It ensures compliance with state tax laws. Use this form to accurately report property sales information.

Real Estate

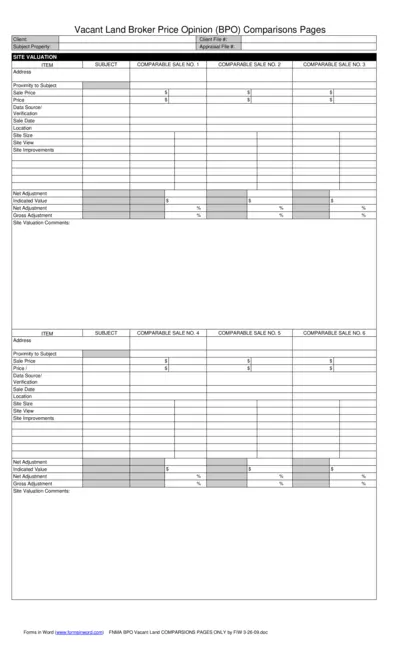

Vacant Land Broker Price Opinion Comparisons

This document provides detailed comparisons for vacant land broker price opinions. It includes essential information on comparable sales, adjustments, and valuation. Useful for real estate professionals and appraisers.

Real Estate

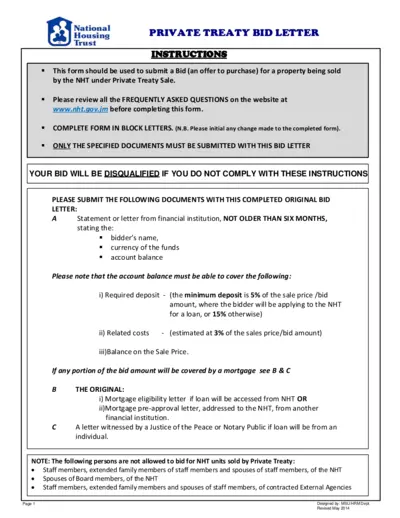

National Housing Trust Private Treaty Bid Letter

This document outlines the instructions for submitting a bid to purchase a property through the NHT's Private Treaty Sale. It provides essential details required for potential bidders to complete the bid process efficiently. Ensure all specified documents are attached to avoid disqualification.

Property Taxes

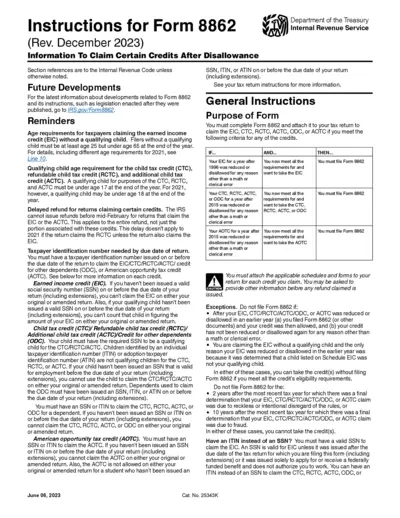

Form 8862 Instructions for Claiming Tax Credits

This document provides essential instructions for filling out Form 8862 to claim certain tax credits after disallowance. It covers requirements for the Earned Income Credit, Child Tax Credit, and American Opportunity Tax Credit among others. Perfect for taxpayers needing detailed guidelines on these credits.

Property Taxes

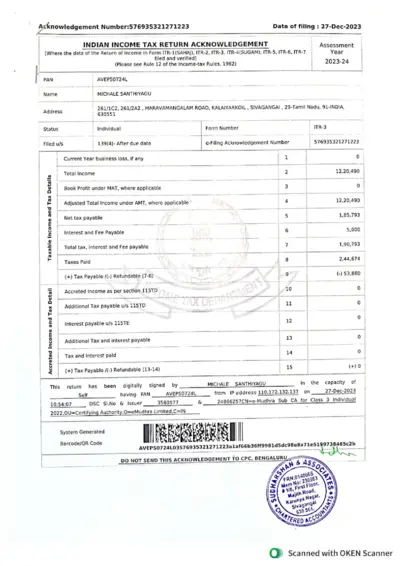

Indian Income Tax Return Acknowledgement 2023

This document serves as an acknowledgement for the Indian Income Tax return filing for the Assessment Year 2023-24. It provides key details such as the taxpayer's PAN, income details, and tax payable. Users can utilize this document for record-keeping and future reference.

Property Taxes

Instructions for Form 8960 - Net Investment Income Tax

This document provides detailed instructions for completing Form 8960. It outlines the process for calculating Net Investment Income Tax for individuals, estates, and trusts. Users can find necessary definitions, filing requirements, and key updates within the document.