Property Law Documents

Property Taxes

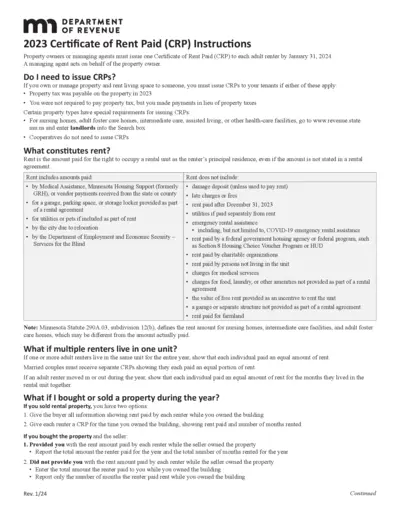

2023 Certificate of Rent Paid Instructions

The 2023 Certificate of Rent Paid (CRP) Instructions provide essential information for property owners and managers on issuing CRPs to tenants by January 31, 2024. It details the conditions under which CRPs are required and guidelines for filling them out accurately. This document is crucial for ensuring compliance with Minnesota state requirements regarding rental properties.

Real Estate

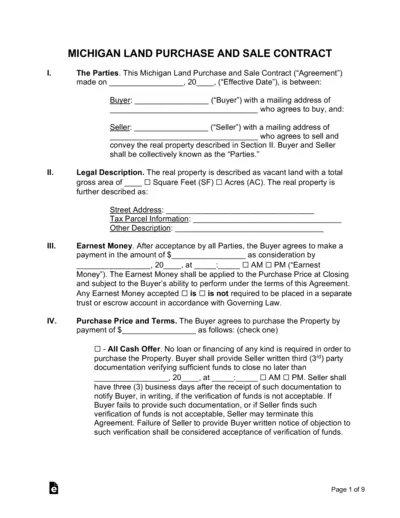

Michigan Land Purchase and Sale Contract Overview

This file contains the Michigan Land Purchase and Sale Contract which outlines the agreement between buyers and sellers for real estate transactions. It details the necessary legal descriptions and terms involved in the purchasing process. Ideal for individuals looking to understand their obligations in real estate deals.

Real Estate

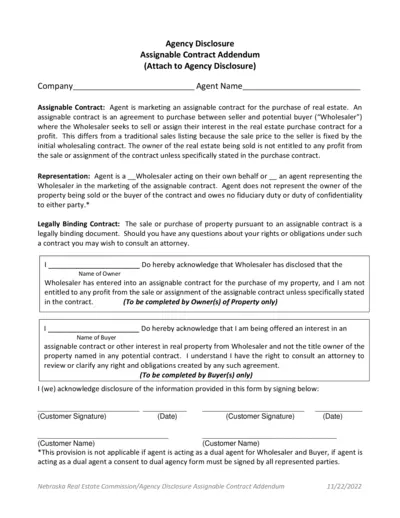

Agency Disclosure Assignable Contract Addendum

This file serves as an Agency Disclosure for an assignable contract related to real estate transactions. It outlines the roles of the agent and wholesaler, ensuring transparency for all parties involved. Users can utilize this form to acknowledge their understanding of the terms set forth.

Property Taxes

IRS Form 2555-EZ Foreign Earned Income Exclusion

Form 2555-EZ allows U.S. citizens to exclude foreign earned income. This form helps in avoiding double taxation for individuals working abroad. Proper completion is essential for accurate tax reporting.

Property Taxes

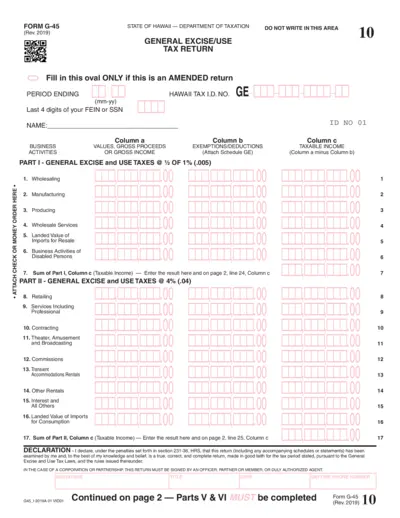

Hawaii Department of Taxation Form G-45 Instructions

This file contains important instructions and details for filling out Form G-45, which is the General Excise/Use Tax return for businesses in Hawaii. It provides guidelines for reporting gross income and calculating taxes owed. Users are encouraged to review this document carefully to ensure compliance with state tax requirements.

Property Taxes

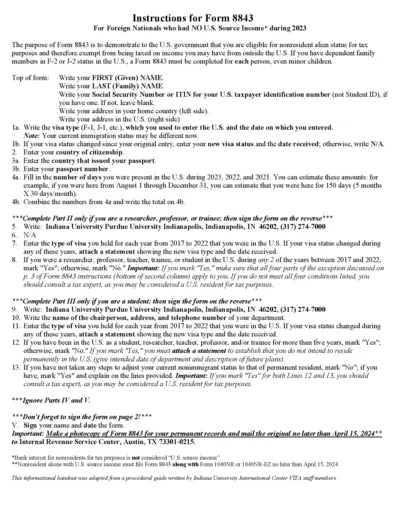

Instructions for Form 8843 for Foreign Nationals

This file provides instructions for completing Form 8843 for foreign nationals. It outlines what information is needed and how to fill it out. Understanding this form is crucial for nonresident aliens to ensure proper tax status.

Property Taxes

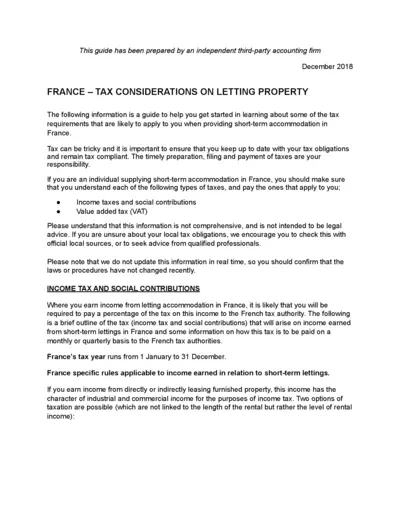

France Tax Considerations on Letting Property

This guide provides essential tax information for individuals letting property in France. It outlines the tax obligations and forms required. Learn how to remain tax compliant when offering short-term accommodations.

Property Taxes

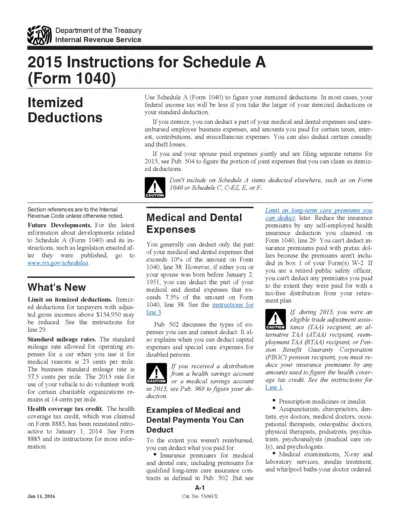

2015 IRS Instructions for Schedule A Itemized Deductions

This document provides detailed instructions for filing Schedule A (Form 1040), which allows taxpayers to itemize deductions. It includes updates on tax credits, mileage rates, and what medical expenses can be deducted. Perfect for individuals looking to maximize their tax returns through itemized deductions.

Property Taxes

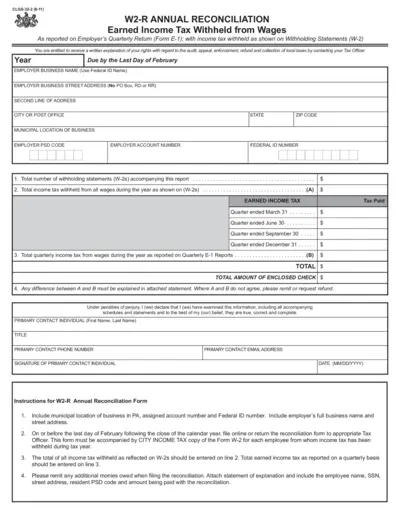

W2-R Annual Reconciliation Instructions and Details

The W2-R Annual Reconciliation is a crucial form for employers to report withheld earnings. This file provides important guidelines for completing and submitting the necessary documentation. Ensure compliance with tax regulations by understanding your responsibilities outlined in this file.

Property Taxes

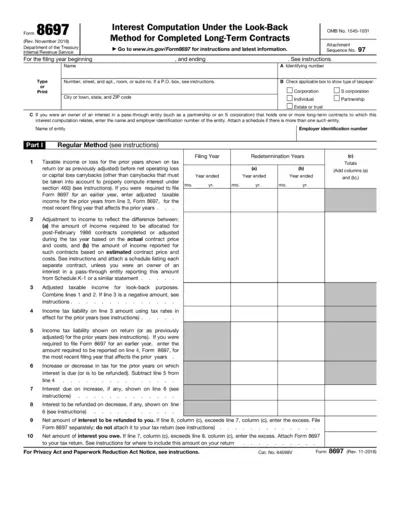

Interest Computation Look-Back Method for Contracts

Form 8697 is used for computing interest under the look-back method for completed long-term contracts. It is crucial for taxpayers involved in long-term contracts to accurately report their tax liability. This form ensures proper allocation of income and consideration of adjustments for the prior years.

Property Taxes

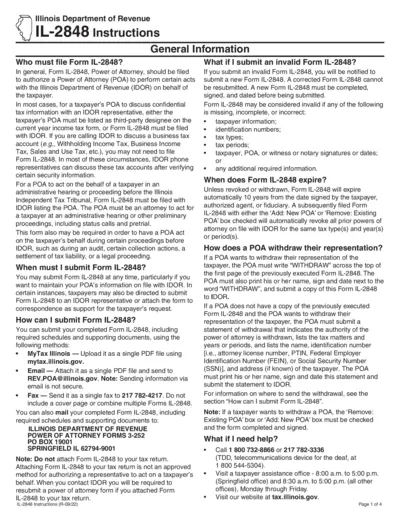

IL-2848 Power of Attorney Instructions for Illinois

Form IL-2848 provides guidance for taxpayers in Illinois to authorize a Power of Attorney. This form is essential for allowing your representative to act on your behalf for various tax matters. Proper submission ensures compliance and expedites communication with the Illinois Department of Revenue.

Property Taxes

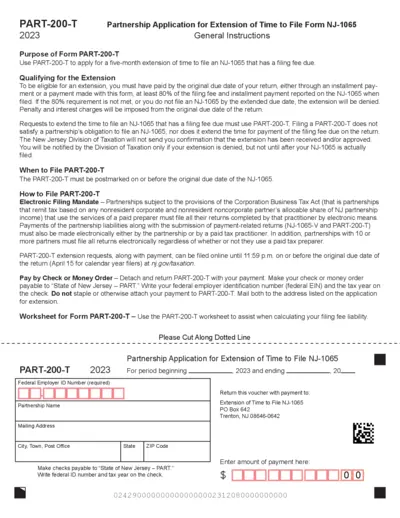

NJ Partnership Extension Application PART-200-T

The PART-200-T form is used for applying for a five-month extension to file the NJ-1065. This extension allows partnerships to submit their returns later while managing filing fees. Failure to meet specific requirements could lead to penalties.