Property Law Documents

Property Taxes

Form 1040-ES Estimated Tax for Individuals 2012

This form is utilized by individuals to calculate and pay their estimated taxes for the year 2012. It contains details on who must file estimated taxes and the deadlines for payment. Ensure you have the necessary information ready for accurate calculations.

Property Taxes

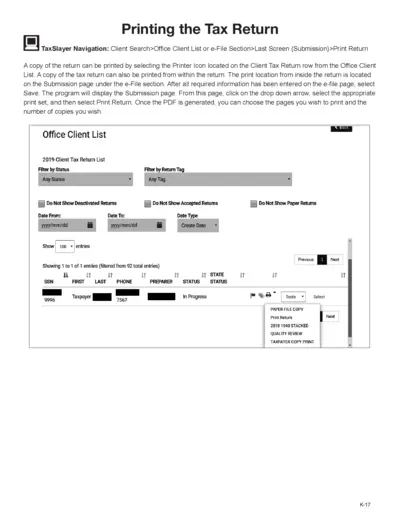

Tax Return Printing Instructions and Guidance

This file provides detailed instructions on how to print various copies of tax returns using TaxSlayer. It includes steps for distributing copies to taxpayers and filing requirements. Perfect for tax preparers and individuals looking to understand the tax return printing process.

Property Taxes

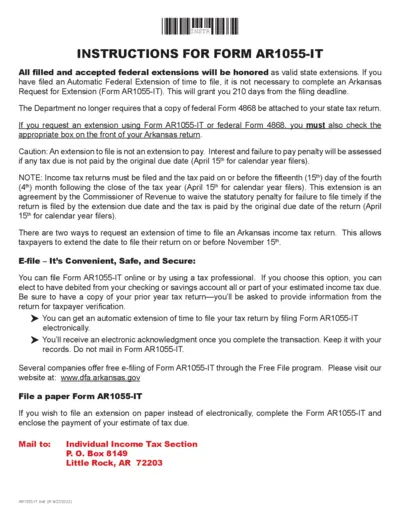

Instructions for Form AR1055-IT Extension Filing

This document provides detailed instructions for filing Form AR1055-IT for Arkansas income tax extensions. It covers who needs the form, how to fill it out, and important submission details. Be sure to check the extension guidelines to avoid penalties.

Real Estate

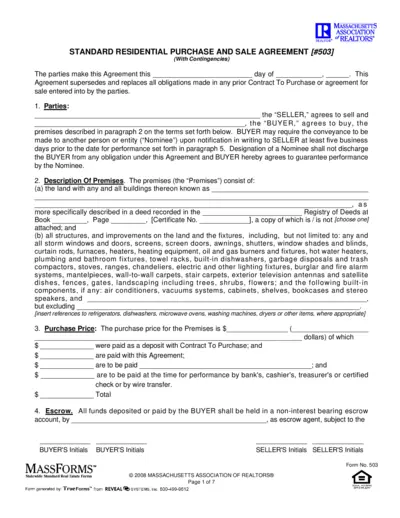

Massachusetts Standard Residential Purchase Agreement

This file serves as the Massachusetts Standard Residential Purchase and Sale Agreement. It outlines the key terms, conditions, and obligations involved in the real estate transaction between a seller and buyer. This document ensures both parties are protected and clear on their responsibilities for a successful property transfer.

Property Taxes

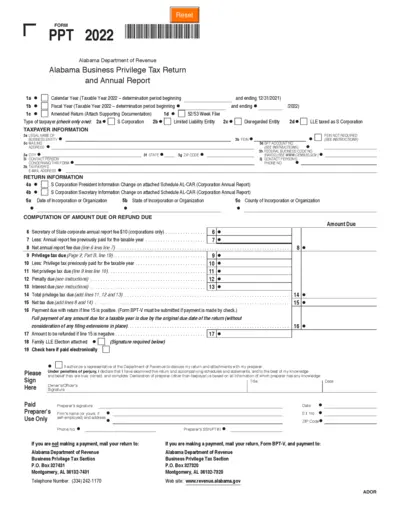

Alabama Business Privilege Tax Return 2022

This document is the Alabama Business Privilege Tax Return for the year 2022. It includes detailed instructions for filing and information about the necessary forms. Use this guide to ensure compliance and understand your tax responsibilities.

Real Estate

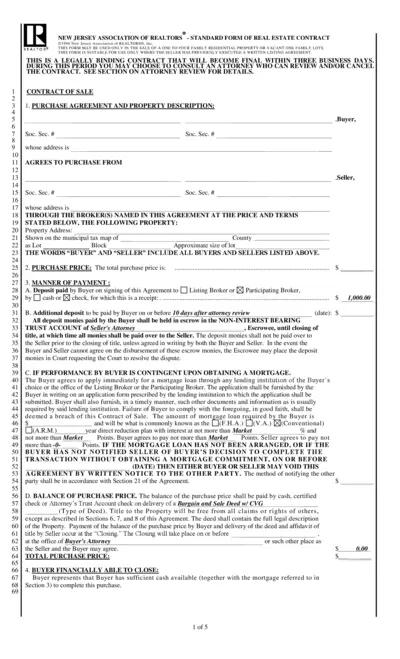

New Jersey Real Estate Contract Form

This document is the standard real estate contract used in New Jersey for the sale of one to four family residential properties. It outlines the terms and conditions of the sale, including purchase price, payment methods, and various legal obligations. Home buyers and sellers should carefully review this contract prior to signing.

Property Taxes

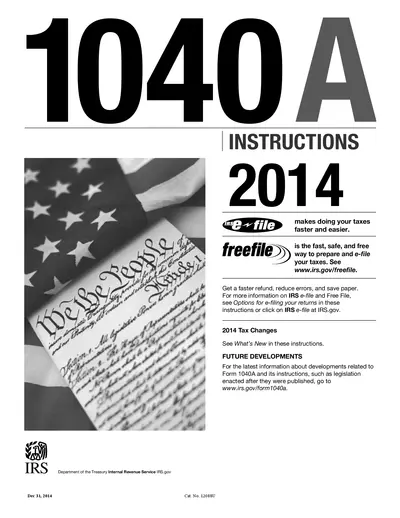

1040A Tax Instructions for 2014 Filing

This file contains detailed instructions for completing Form 1040A, including filing requirements, income reporting, and tax credits. It's designed to help taxpayers efficiently prepare and e-file their taxes for the year 2014. Follow the guidelines to ensure a smooth tax filing experience.

Property Taxes

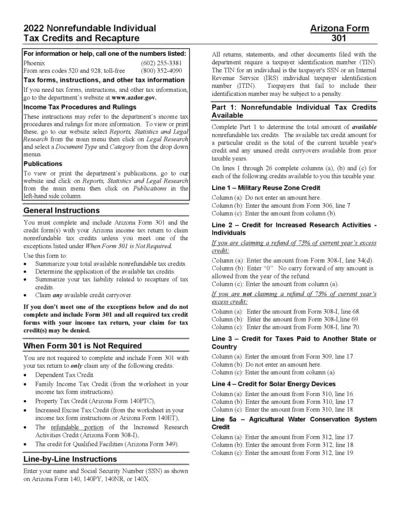

Arizona 2022 Nonrefundable Individual Tax Credits

This file contains detailed information about the Arizona form 301, which is used to claim nonrefundable individual tax credits. It includes instructions on filing and eligibility criteria for various tax credits. Users can also find line-by-line guidance on how to fill out the form correctly.

Property Taxes

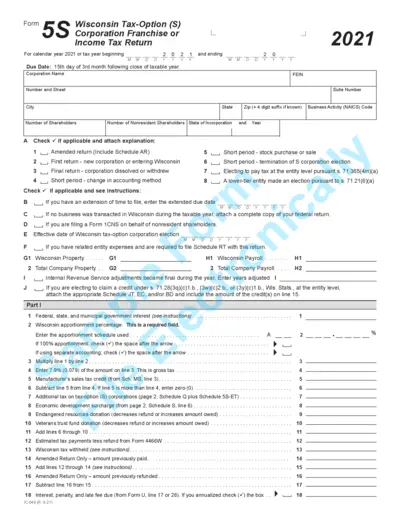

Wisconsin 2021 Tax-Option Corporation Franchise Return

The Wisconsin Tax-Option Corporation Franchise or Income Tax Return form for the year 2021 is essential for corporations in Wisconsin. This form is used to report income, deductions, and credits for tax purposes. Proper completion is necessary to fulfill state tax obligations.

Property Taxes

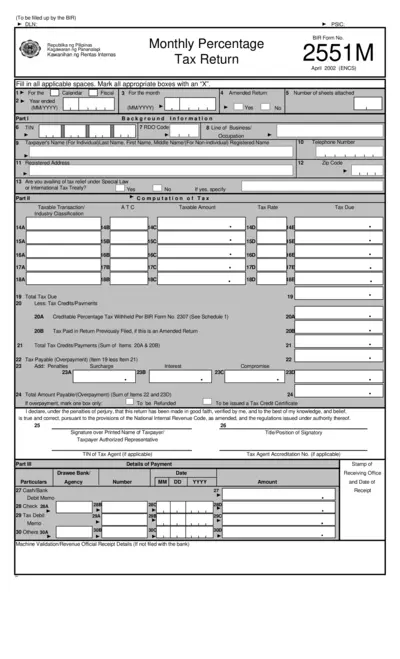

BIR Form 2551M Monthly Percentage Tax Return

This PDF form is crucial for taxpayers filing their monthly percentage tax return in the Philippines. It contains detailed sections for taxpayer information, computation of tax, and payment instructions. Utilize this form to ensure compliance with local tax regulations.

Real Estate

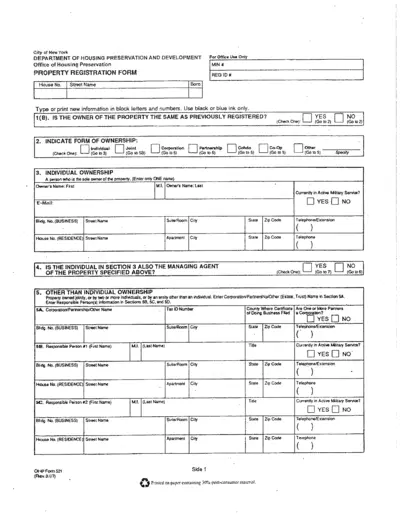

New York Property Registration Form Instructions

This document provides essential information for registering properties in New York City. It details ownership forms, requirements, and submission guidelines. Users must complete this form accurately to ensure proper property management and compliance.

Real Estate

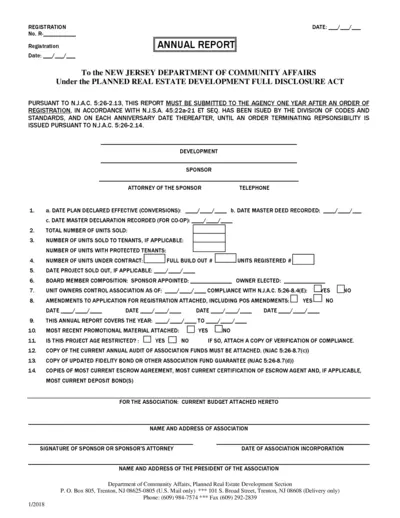

Annual Report Submission for Planned Real Estate

This file provides essential information and instructions for submitting the annual report required by the New Jersey Department of Community Affairs. It outlines the responsibilities of developers and includes sections related to unit sales, elections, and compliance. This guide is crucial for any developer involved in real estate in New Jersey.