Property Law Documents

Property Taxes

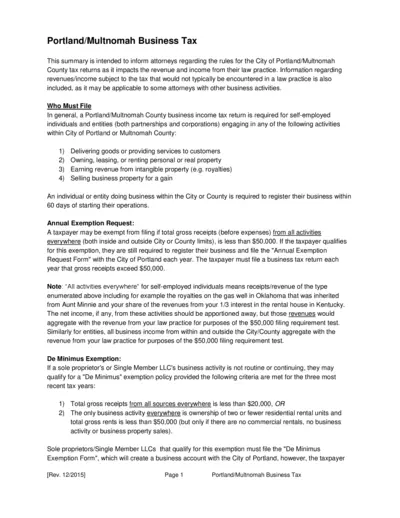

Portland Multnomah Business Tax Overview and Guidelines

This document outlines the Portland/Multnomah Business Tax regulations impacting legal practices. It details the filing requirements and exemptions for attorneys and self-employed individuals. The file serves as a comprehensive guide to help attorneys understand their tax obligations.

Property Taxes

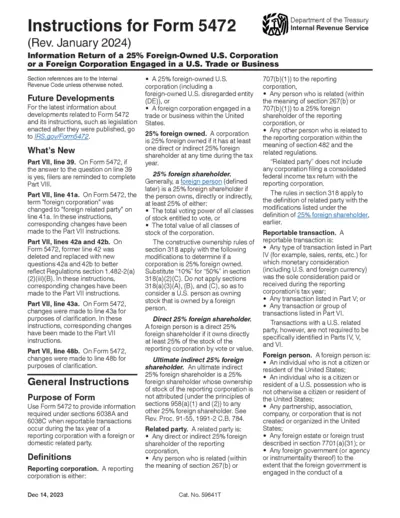

Instructions for Form 5472 Information Return

This file contains the detailed instructions for Form 5472, which is used by foreign-owned U.S. corporations or foreign corporations engaged in U.S. trade. It provides essential information required under sections 6038A and 6038C during a reporting corporation's tax year.

Real Estate

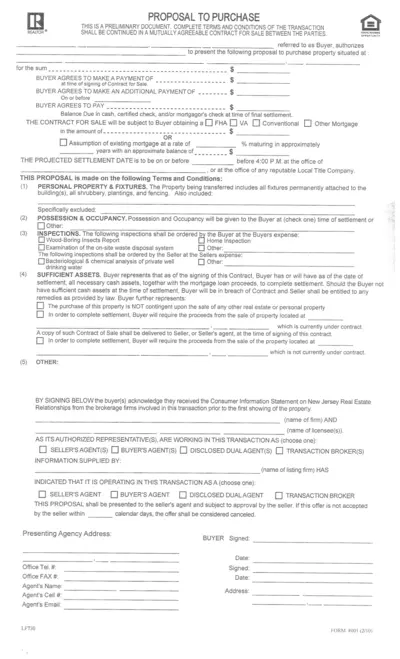

Proposal to Purchase Real Estate in New Jersey

This file is a Proposal to Purchase Real Estate in New Jersey, outlining the terms and conditions for buyers. It serves as a preliminary document for the real estate transaction and details the obligations of both buyer and seller. Use this document to understand the proposal process and prepare for the contract signing.

Property Taxes

NCDOR Photos and Photographers Guidelines

This file provides essential information regarding the NCDOR guidelines for photos and photographers. It offers insights into tax obligations and registration processes. Ideal for businesses and individuals involved in photography in North Carolina.

Property Taxes

IRS Instructions for Form 990 Exempt Tax Return

This document provides essential guidelines for completing IRS Form 990, which is required for tax-exempt organizations. It includes detailed instructions and information on filing deadlines. Use it to ensure compliance with IRS regulations.

Zoning Regulations

Village of Three Oaks Zoning Ordinance June 2017

This document outlines the zoning ordinance for the Village of Three Oaks, Michigan. It provides essential regulations and guidelines for land use within the village. Ideal for residents, developers, and municipal planners.

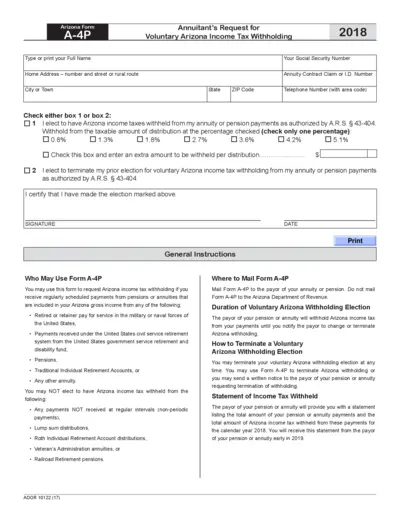

Property Taxes

Arizona Form A-4P Voluntary Income Tax Withholding

The Arizona Form A-4P allows annuitants to request voluntary income tax withholding from their pension or annuity payments. This form is essential for ensuring monthly tax compliance. Completing this form accurately ensures proper withholding from your taxable distributions.

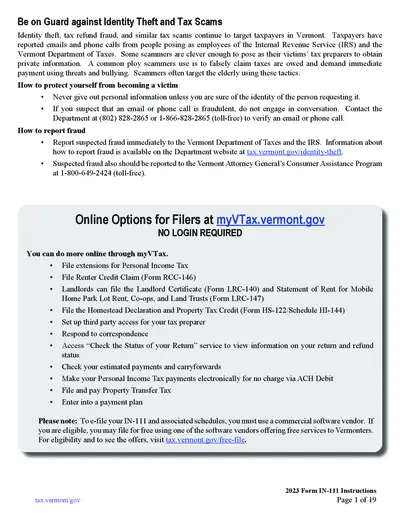

Property Taxes

Tax Filing Instructions and Identity Theft Protection

This document provides essential instructions for filing Vermont taxes and important details on protecting against identity theft and tax scams.

Property Taxes

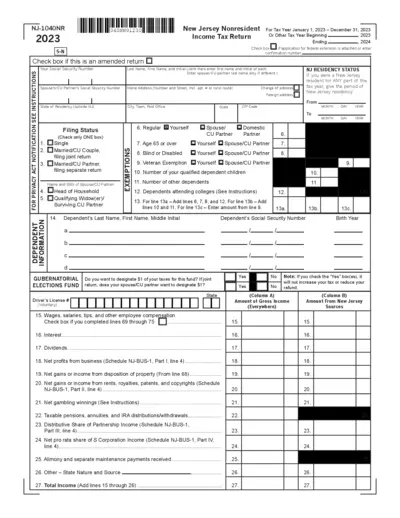

New Jersey Nonresident Income Tax Return 2023

This file is the New Jersey Nonresident Income Tax Return for the tax year 2023. It allows nonresidents to report their taxable income and calculate the taxes owed. Complete this form to ensure compliance with New Jersey tax laws.

Property Taxes

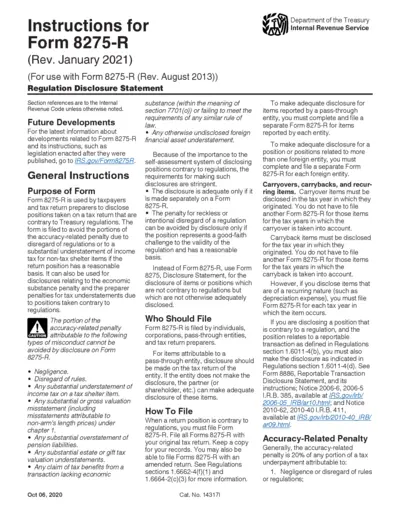

Form 8275-R Instructions for Regulation Disclosure

This document provides comprehensive instructions for filling out Form 8275-R. It includes information on filing requirements, penalties, and disclosure obligations. Taxpayers and preparers should consult these instructions to ensure compliance with the IRS.

Property Taxes

Foreign Derived Intangible Income FDII Overview

This file outlines the regulations and implications of Foreign-Derived Intangible Income (FDII) and GILTI. It serves as a guide for U.S. corporations on how to apply these deductions. Learn how to leverage these provisions for tax benefits.

Property Taxes

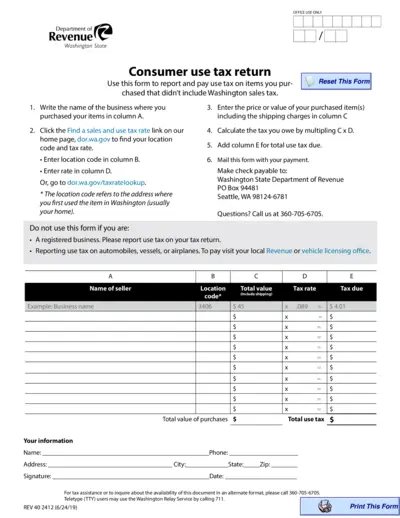

Consumer Use Tax Return Washington State Form

This form allows taxpayers to report and pay use tax on items purchased without Washington sales tax. It includes instructions for completing the form accurately. Businesses and individuals can use it to track and calculate their use tax obligations.