Property Law Documents

Real Estate

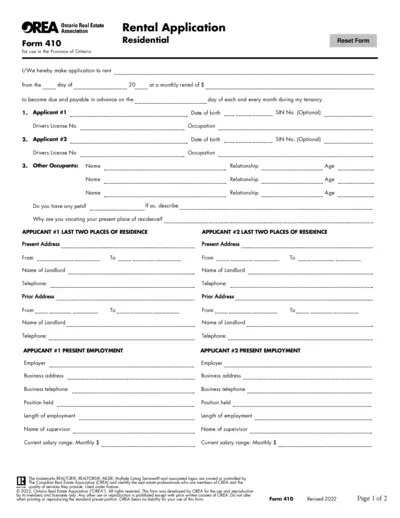

Ontario Real Estate Rental Application Form 410

The Ontario Real Estate Rental Application Form 410 is essential for tenants applying to rent a property in Ontario. This form gathers necessary information regarding applicants and their financial status. Completing this form accurately can facilitate the rental process with landlords.

Property Taxes

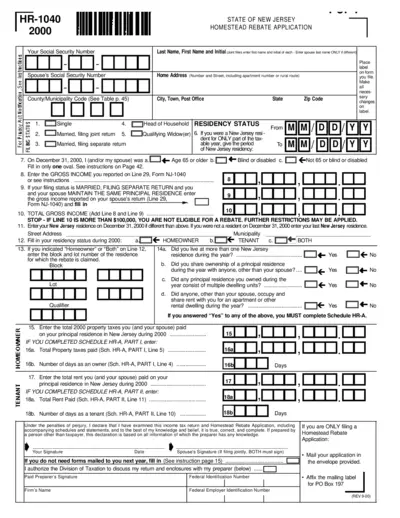

New Jersey Homestead Rebate Application Guide

This document provides the necessary instructions and information to correctly file the New Jersey Homestead Rebate Application. It includes detailed sections on eligibility, filing status, and necessary information for applicants. Users can refer to this document to ensure they meet all requirements and submit accurately.

Property Taxes

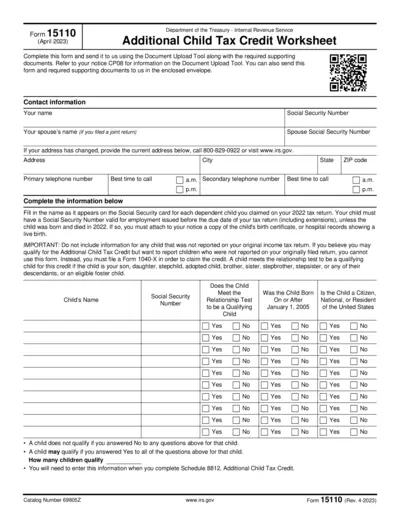

Additional Child Tax Credit Worksheet Form 15110

The Additional Child Tax Credit Worksheet helps individuals claim the Additional Child Tax Credit. This form is essential for taxpayers to report dependent children correctly. Fill this form accurately to ensure your claim is processed efficiently.

Property Taxes

Travel Logbook Guide for Tax Deductions

This file provides essential guidelines for taxpayers who receive travel allowances and need to claim tax deductions for business travel. It outlines the requirements, calculations, and maintenance of a travel logbook. The information ensures compliance with the South African Revenue Service regulations.

Real Estate

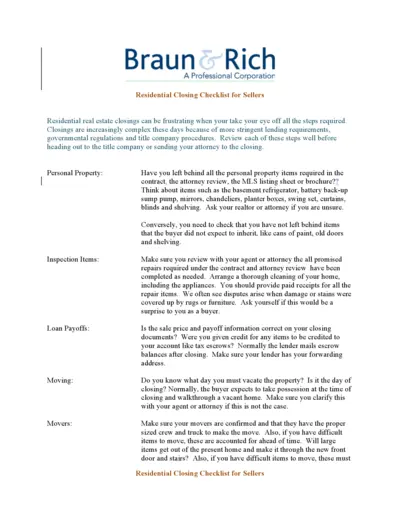

Residential Closing Checklist for Sellers

This checklist helps sellers navigate the complex steps involved in residential real estate closings. It includes important reminders and tasks to ensure a smooth closing process. Use this guide to avoid common pitfalls and ensure all necessary items are addressed.

Property Taxes

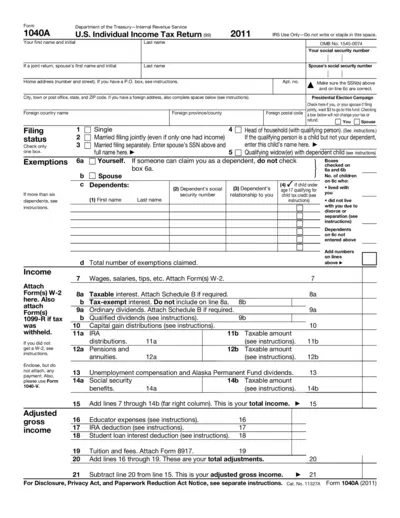

Form 1040A U.S. Individual Income Tax Return

Form 1040A is used for filing U.S. individual income tax returns. It is suitable for individuals with straightforward tax situations. Complete this form accurately to ensure proper tax processing.

Property Taxes

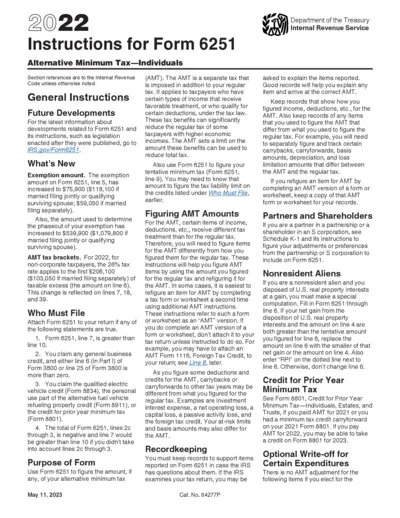

Instructions for Form 6251: Alternative Minimum Tax

This file provides essential instructions for filling out Form 6251 for the Alternative Minimum Tax. It outlines important guidelines, exemptions, and who must file. Understanding this form is crucial for correct tax reporting.

Property Taxes

IRS 2020 Recovery Rebate Credit FAQs

This fact sheet provides essential FAQs regarding the 2020 Recovery Rebate Credit. It helps taxpayers understand their eligibility and claiming process for the credit. Updated information ensures taxpayers have access to the latest guidance.

Property Taxes

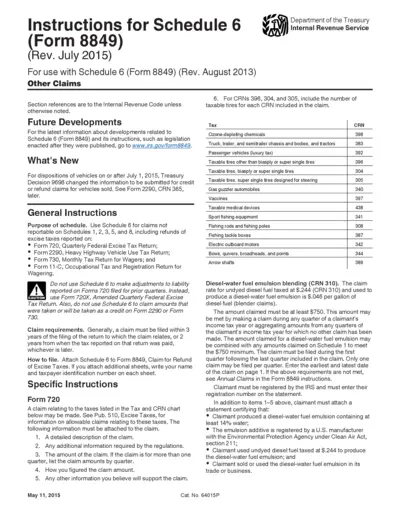

Instructions for Schedule 6 Form 8849 Tax Refund Claims

This file provides detailed instructions for completing Schedule 6 of Form 8849, used to claim refunds on excise taxes. Users can learn about eligibility, requirements, and the filing process effectively. It serves as a comprehensive guide for individuals and businesses seeking tax refunds.

Property Taxes

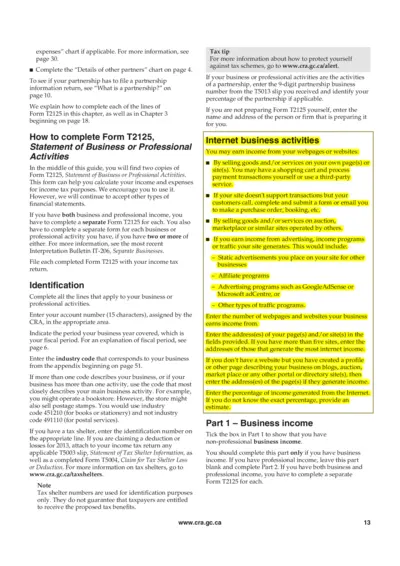

Understanding Form T2125 for Self-Employed Individuals

This guide provides essential information on Form T2125, which self-employed individuals use to report their business income and expenses. It helps in calculating taxes accurately and understanding fiscal responsibilities. Learn how to fill out this form effectively for smoother tax processing.

Real Estate

Texas Real Estate Commission Subdivision Information

This document provides detailed subdivision information required by the Texas Real Estate Commission. It includes property assessments, association details, and compliance with regulations. Use this form for property transactions requiring a resale certificate.

Property Taxes

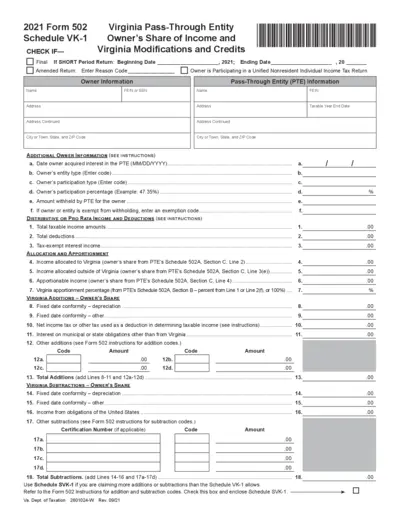

2021 Virginia Schedule VK-1 Owner's Share Income

This file provides details about the Owner's Share of Income for Virginia's Pass-Through Entities. It includes instructions for completing the form and information about Virginia tax credits. Ideal for business owners and tax professionals dealing with Virginia taxation.