Legal Documents

Business Formation

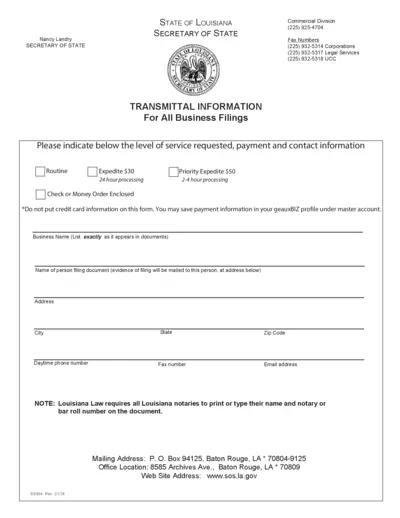

Louisiana Application to Register Trade Name Form

This document provides a comprehensive guide for filing an application to register a trade name, trademark, or service mark in Louisiana. It outlines the necessary information and fees required for submission. Ensure you follow the instructions carefully to avoid delays in processing.

Property Taxes

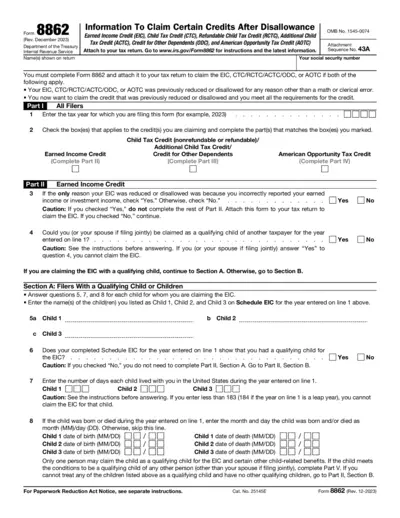

Form 8862 Instructions for Claiming Tax Credits

Form 8862 is used to reclaim certain tax credits after disallowance. It is essential for taxpayers who have had their Earned Income Credit or other credits reduced. This form must be completed accurately to ensure eligibility for these credits.

Property Taxes

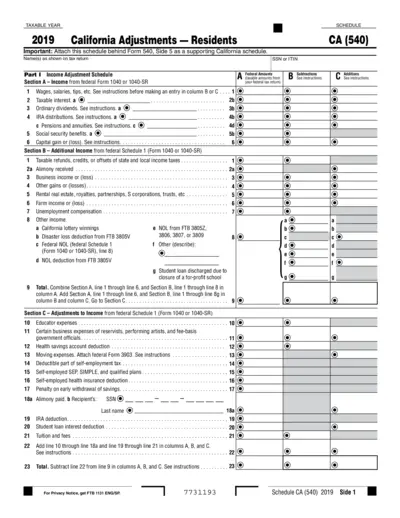

California Adjustments 2019 File for Tax Residents

This file contains the necessary California tax adjustments for residents filing in 2019. It offers detailed instructions on income adjustments, credits, and deductions. Taxpayers can use this document to accurately report their California income tax liability.

Business Formation

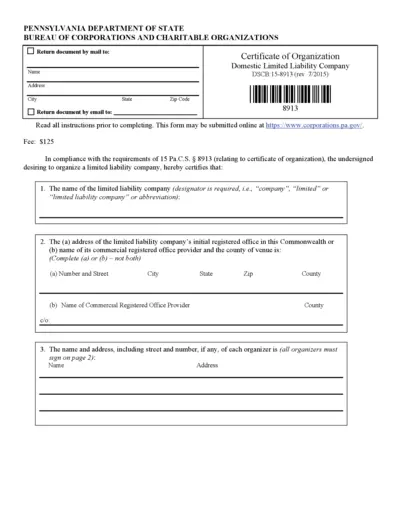

Certificate of Organization for Pennsylvania LLC

This document serves as the official Certificate of Organization for Domestic Limited Liability Companies in Pennsylvania. It outlines the necessary steps to complete the filing and provides important details for organizers. Understanding this form is crucial for compliance with Pennsylvania state regulations.

Property Taxes

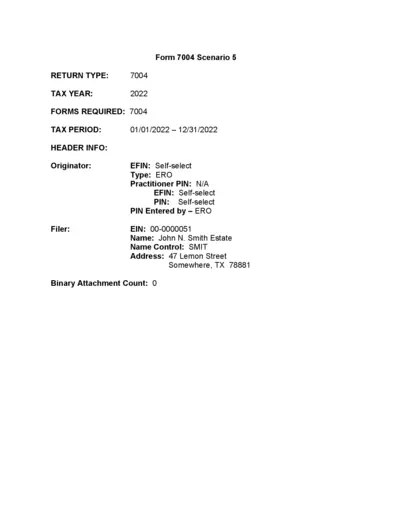

Form 7004 Automatic Extension Request 2022

Form 7004 allows taxpayers to request an automatic extension of time to file certain business income tax returns. This form is essential for businesses needing additional time for paperwork. Ensure to file by the granted due date to avoid penalties.

Real Estate

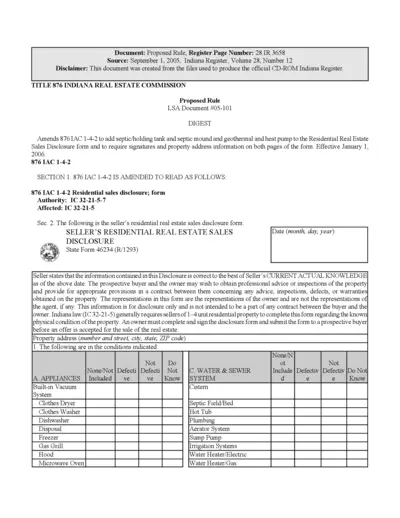

Proposed Rule for Indiana Real Estate Commission

This document outlines the proposed rule amendments by the Indiana Real Estate Commission. It details updates to the Residential Real Estate Sales Disclosure form. Effective January 1, 2006, the amendments include property details regarding septic systems and geothermal units.

Business Formation

Panera LLC Purchase Order Terms and Conditions

This document outlines the terms and conditions for Panera's purchase orders. It details the responsibilities and rights of both sellers and Panera regarding goods and services. Users should review these terms to ensure compliance during transactions.

Contracts

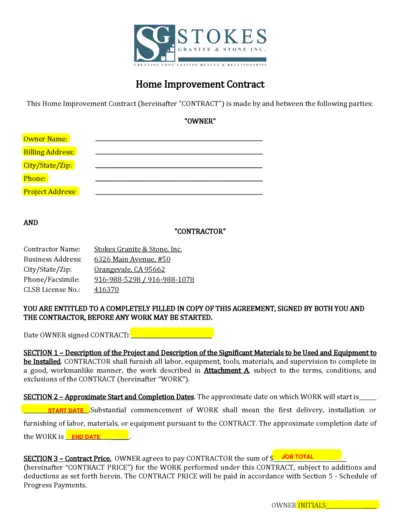

Home Improvement Contract and Guidelines

This home improvement contract outlines the agreement between the owner and contractor. It details project descriptions, payment schedules, and legal requirements. It's essential for ensuring a smooth and legally compliant home improvement process.

Real Estate

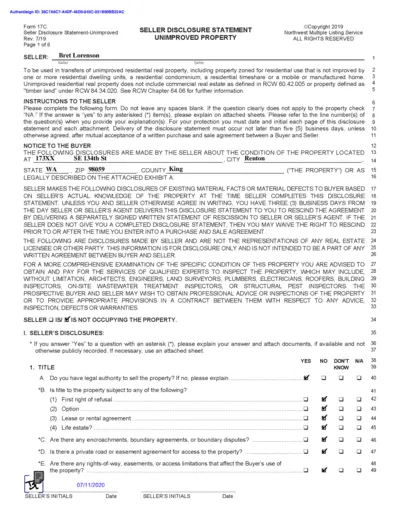

Seller Disclosure Statement Unimproved Property

This Seller Disclosure Statement is essential for transactions involving unimproved residential real property. It details the condition of the property and the seller's disclosures. Buyers are encouraged to read this document carefully before proceeding with the purchase.

Property Taxes

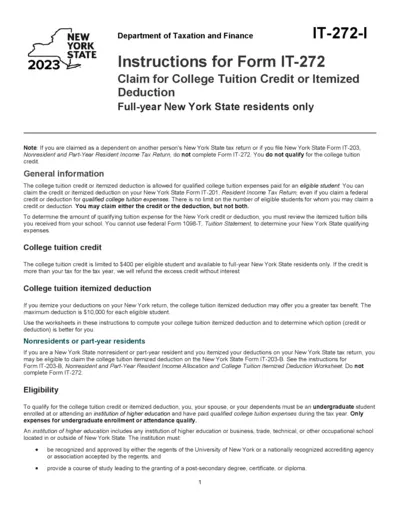

Instructions for New York College Tuition Credit

This document provides detailed instructions for New York State residents on claiming the College Tuition Credit or Itemized Deduction. It outlines eligibility criteria, required forms, and guidance for calculating the credit or deduction. Ensure you follow these guidelines precisely to maximize your tax benefits.

Property Taxes

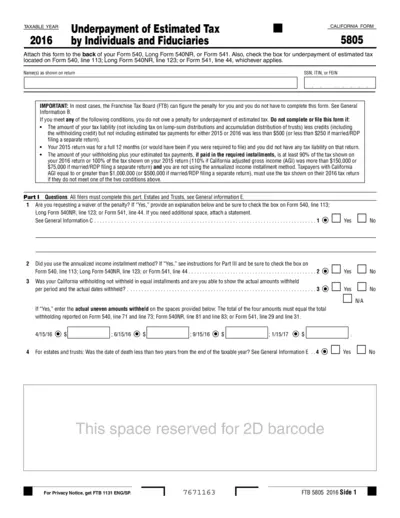

California Form FTB 5805 for Tax Year 2016

The California Form FTB 5805 is for reporting underpayment of estimated tax by individuals and fiduciaries. It is essential for those who may be subject to penalties for underpayment of tax. This form helps individuals determine if they owe a penalty based on their estimated tax payments.

Real Estate

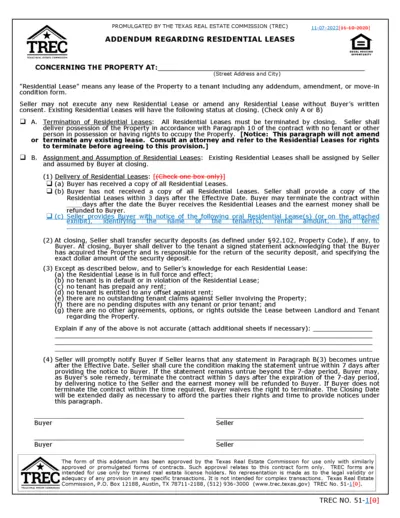

Texas Real Estate Commission Residential Lease Addendum

This document includes essential information about Residential Leases governed by the Texas Real Estate Commission. It provides instructions for buyers and sellers regarding the termination and assignment of existing leases. Ideal for anyone involved in real estate transactions in Texas.