Legal Documents

Property Taxes

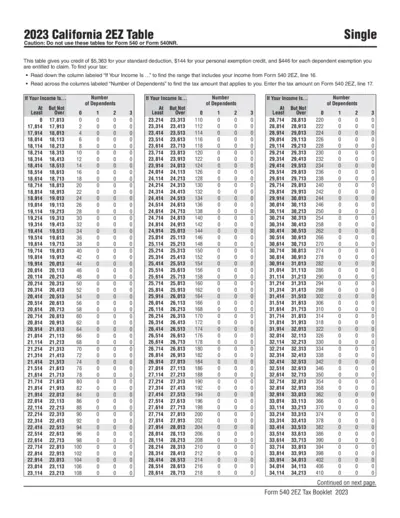

2023 California 2EZ Tax Form Instructions and Guidelines

This file provides comprehensive instructions for filling out the 2023 California 2EZ tax form. It outlines the required information and details regarding personal credits and dependent exemptions. Users can easily navigate the tax table to determine their applicable tax amount based on their income and number of dependents.

Property Taxes

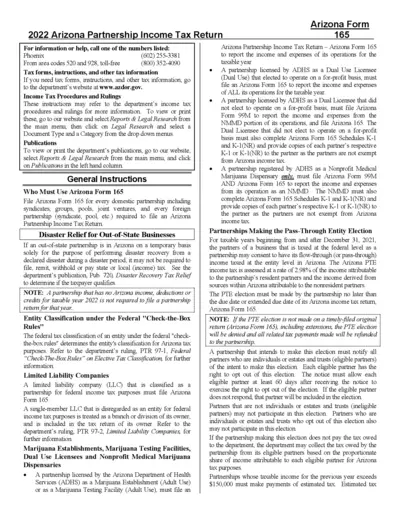

2022 Arizona Partnership Income Tax Return Form 165

The 2022 Arizona Partnership Income Tax Return Form 165 is essential for domestic partnerships to report their income. Properly filling this form ensures compliance with Arizona tax laws. Follow the guidelines closely to complete your submission.

Property Taxes

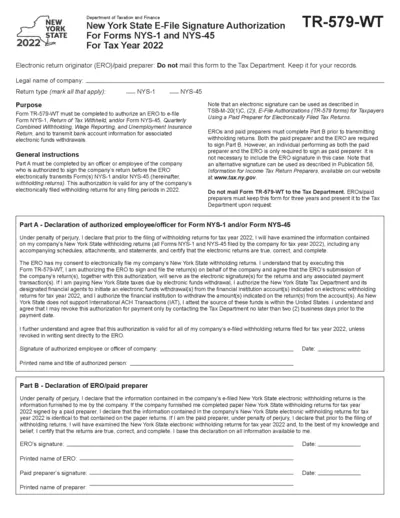

New York State E-File Signature Authorization 2022

This file provides essential information for completing the New York State E-File Signature Authorization for tax year 2022. It outlines the requirements for electronic return originators and paid preparers to e-file NYS-1 and NYS-45 forms. Familiarize yourself with the general instructions and the declaration process to ensure compliance.

Property Taxes

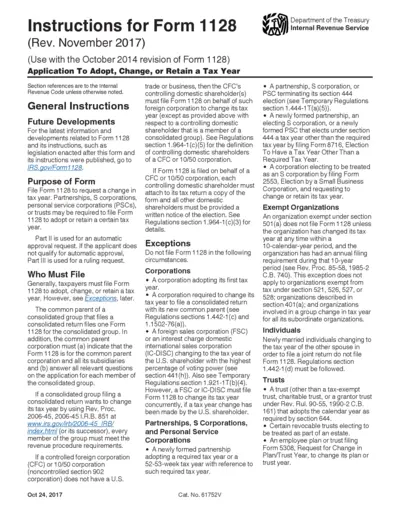

Form 1128 Instructions for Tax Year Changes

This PDF provides detailed instructions for completing Form 1128, which is used to adopt, change, or retain a tax year. It outlines the eligibility criteria, necessary forms, and submission details. Understanding these instructions is essential for ensuring compliance with IRS requirements.

Property Taxes

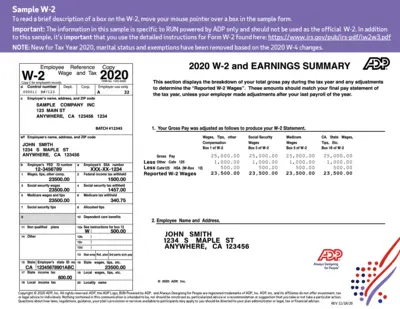

Sample W-2 Form Instructions and Guidelines

This document provides details and instructions for filling out the W-2 form, including its purpose and how to use it. Users can learn about the contents, fields, and necessary steps to complete the form accurately. It serves as a comprehensive guide for both employees and employers.

Real Estate

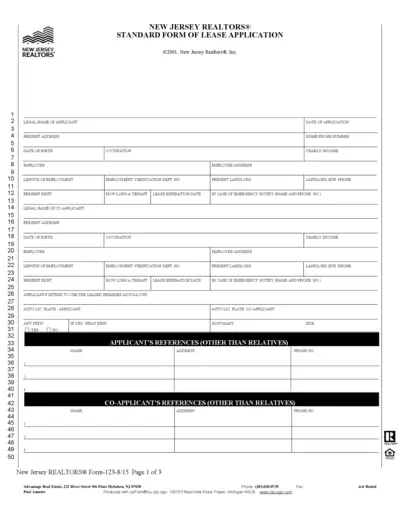

New Jersey Realtors Standard Lease Application Form

This file contains the Standard Form of Lease Application for New Jersey Realtors. It provides essential information for applicants to fill out. Users can use this form to apply for rental properties in New Jersey.

Property Taxes

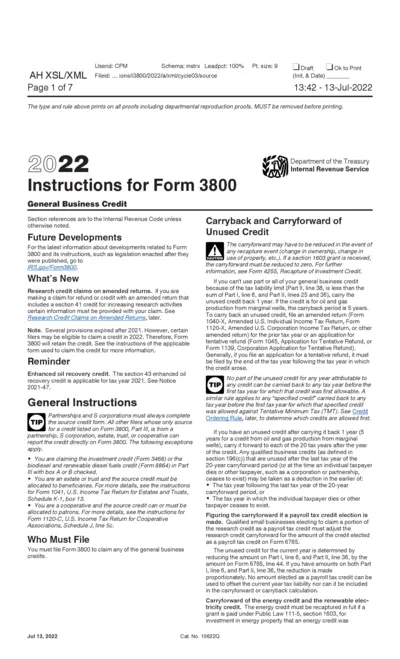

Instructions for Form 3800: General Business Credit

This file contains essential instructions for Form 3800, which details the general business credit. It offers guidelines and relevant updates for tax filers. Understanding these instructions is crucial for accurate tax reporting and credit claims.

Property Taxes

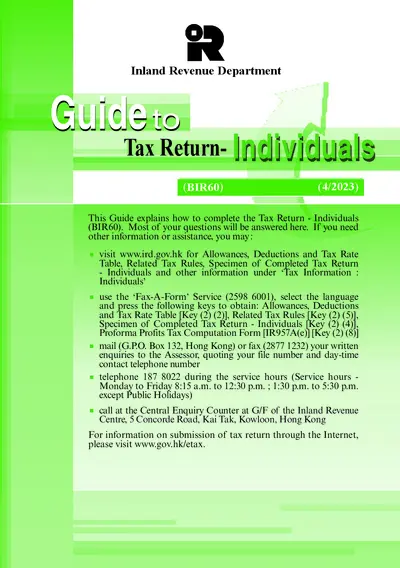

Inland Revenue Tax Return for Individuals Guide

This guide provides essential instructions for completing the Tax Return - Individuals (BIR60). It answers common questions regarding personal data and submission processes. Use this comprehensive resource for successful tax filing.

Business Formation

Victoria's Secret Photo Shoot Compliance Procedures

This document outlines Victoria's Secret & Co.'s compliance procedures for photo shoots. It includes detailed guidelines to ensure a respectful environment for all participants. Essential for employees and third parties involved in photo shoots.

Contracts

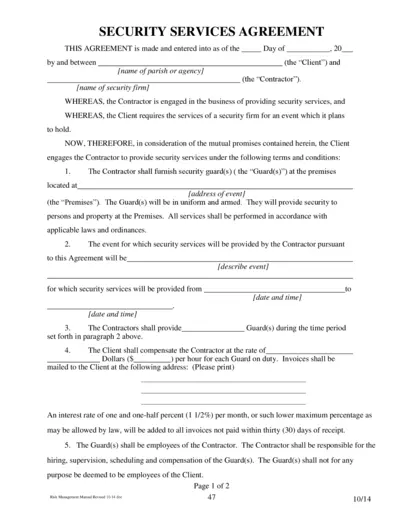

Security Services Agreement for Events

This Security Services Agreement outlines the terms under which security services will be provided by a contractor for an event. It includes essential details such as the rate of compensation, liabilities, and insurance requirements. This file is crucial for clients seeking to ensure safety and security during events.

Property Taxes

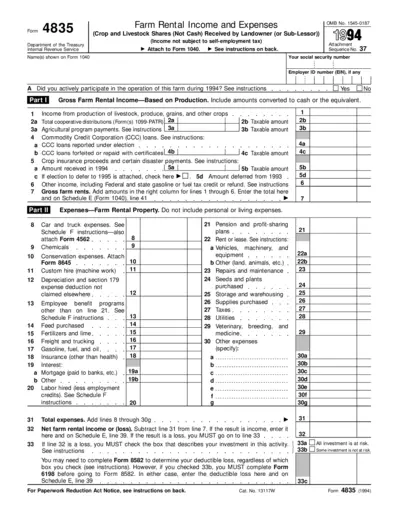

Farm Rental Income and Expenses Form 4835 1994

Form 4835 is used to report farm rental income based on production of crops and livestock. It is essential for landowners who did not materially participate in the operation of the farm. Ensure accuracy to comply with IRS regulations and optimize your tax reporting.

Real Estate

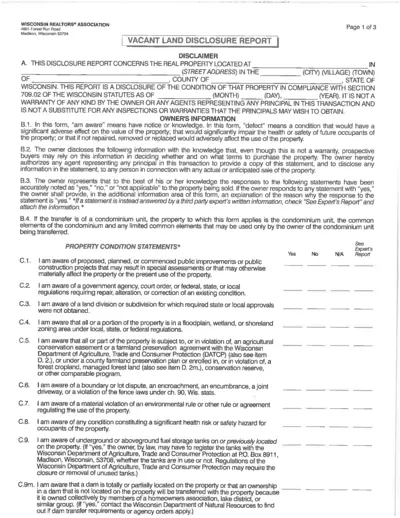

Wisconsin Vacant Land Disclosure Report

The Wisconsin Vacant Land Disclosure Report provides essential information regarding the condition of a property being sold in Wisconsin. It is a legal disclosure to protect buyers by informing them of potential defects and issues. This report complies with Wisconsin statutes and serves as a crucial document in real estate transactions.