Legal Documents

Real Estate

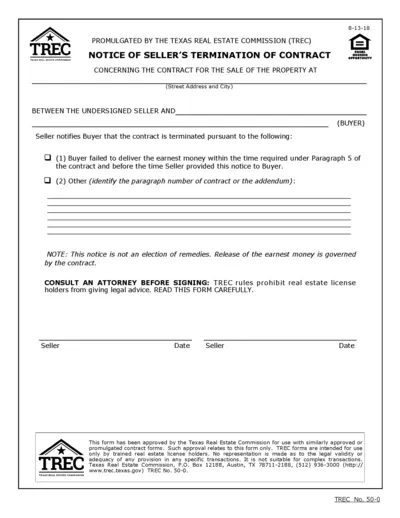

Texas Seller's Termination of Contract Notice

This form serves as a formal notice of termination of a real estate contract by the seller. It details the reasons for termination and instructs the buyer on the next steps. Use this document to comply with Texas Real Estate Commission regulations.

Property Taxes

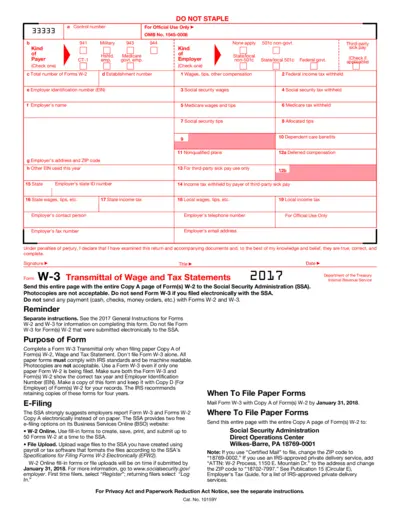

Form W-3 Transmittal of Wage and Tax Statements 2017

Form W-3 is a transmittal document for reporting wage and tax statements. It's essential for employers to file with the IRS when submitting Forms W-2. This file includes instructions and information on employer tax submission.

Business Formation

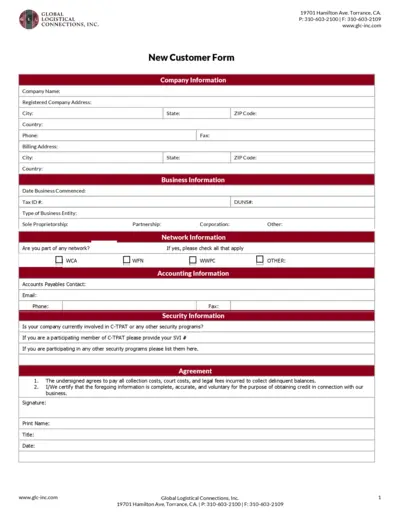

New Customer Form - Global Logistical Connections

This New Customer Form is essential for businesses seeking credit with Global Logistical Connections, Inc. It captures necessary details such as company information, billing address, and security program involvement. Properly filling out this form ensures a streamlined onboarding process and credit approval.

Property Taxes

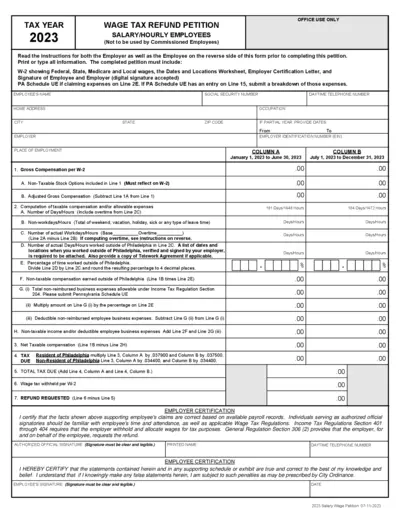

2023 Wage Tax Refund Petition Form for Employees

This file contains the Wage Tax Refund Petition for salary and hourly employees. It includes essential filing instructions and necessary documents for tax-related claims. Use this form to claim a refund for withheld wage tax.

Labor Law

Overview of Fair Labor Standards Act for Workers

This file provides essential information about the Fair Labor Standards Act (FLSA) as it applies to restaurant workers. It includes key points on minimum wage, overtime, and employee rights. This document serves as a comprehensive guide for both employees and employers in the restaurant industry.

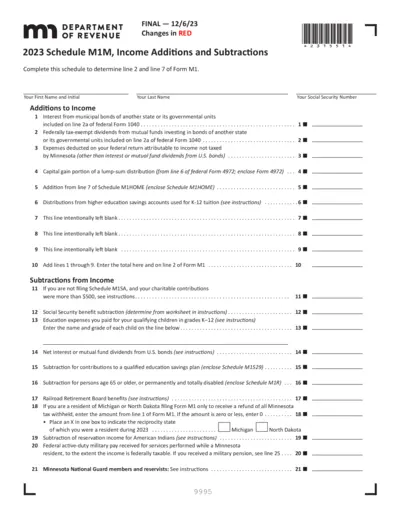

Property Taxes

2023 Schedule M1M Income Additions and Subtractions

This file contains detailed instructions for the 2023 Schedule M1M, which is used to report income additions and subtractions. It provides guidance on how to complete the form to determine your taxable income effectively. Essential for individuals looking to comply with Minnesota tax regulations.

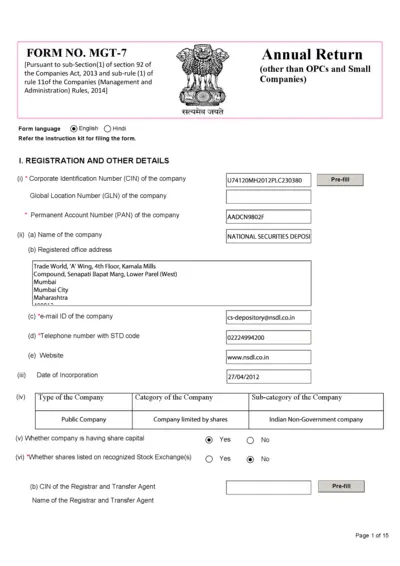

Business Formation

Companies Act MGT-7 Annual Return Filing Form

The MGT-7 form is required for filing annual returns for companies as mandated by the Companies Act, 2013. This form helps provide necessary details related to the company and its activities. Ensure accurate information to comply with legal requirements.

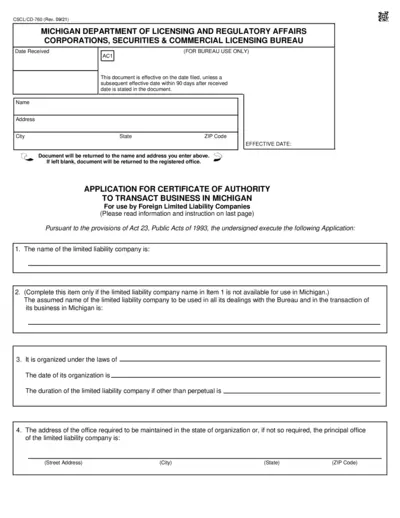

Business Formation

Application for Certificate of Authority Michigan

This file contains the application for foreign limited liability companies to transact business in Michigan. It outlines the necessary steps and requirements for obtaining certification. This document is essential for legal compliance when doing business in the state.

Business Formation

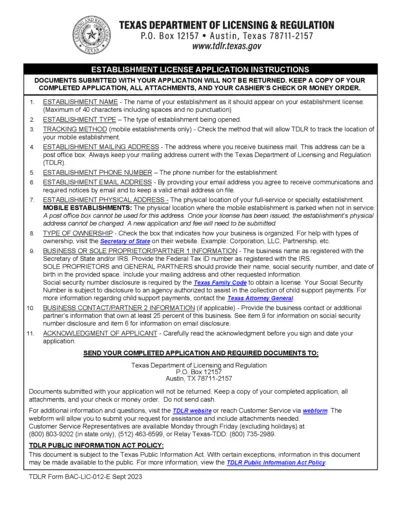

Texas Establishment License Application Instructions

This document provides detailed instructions for completing the establishment license application in Texas. It is essential for individuals and businesses wishing to operate licensed establishments including full-service and mobile services. Ensure compliance with all requirements to obtain your license smoothly.

Real Estate

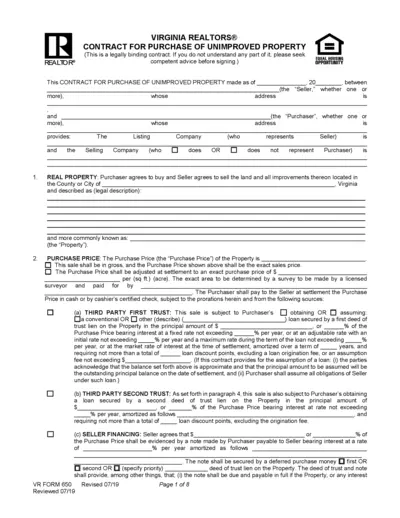

Virginia REALTORS Contract for Purchase of Property

This legally binding contract outlines the terms for purchasing unimproved property in Virginia. It is designed for buyers and sellers involved in real estate transactions. Ensure you understand each section carefully before signing.

Real Estate

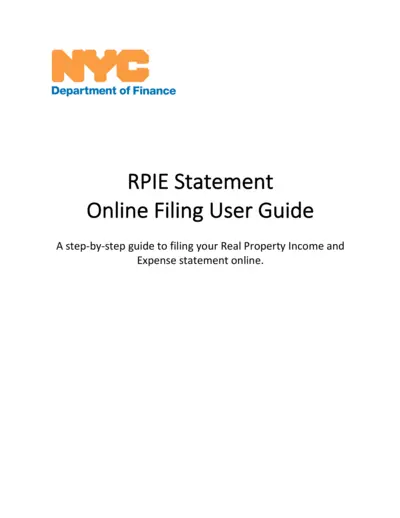

NYC RPIE Statement Online Filing User Guide

This user guide provides step-by-step instructions for filing the NYC Real Property Income and Expense (RPIE) statement online. It's essential for property owners to understand how to accurately submit their income and expense information. This guide simplifies the process to ensure compliance with the NYC Department of Finance.

Property Taxes

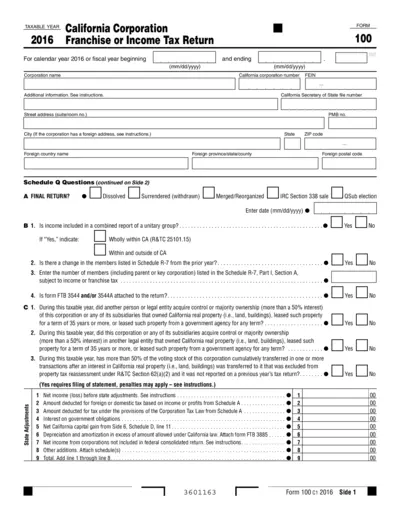

California Corporation Franchise Tax Return 2016

This document is the California Corporation Franchise or Income Tax Return for the year 2016. It provides essential instructions and necessary fields for corporations in California to fulfill their tax obligations. Proper completion of this form is crucial for accurate reporting and compliance with California tax laws.