Payroll Tax Documents

Payroll Tax

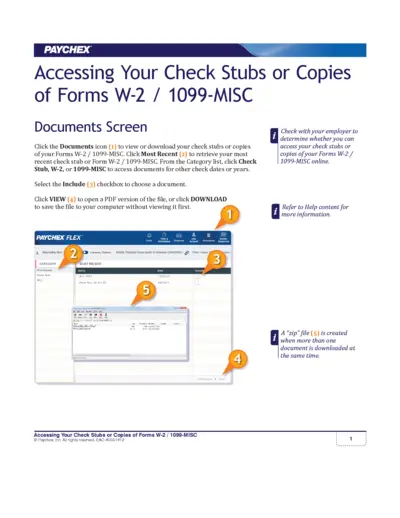

Access Your Paychex Check Stubs and W-2 Forms

This file provides step-by-step instructions for accessing your Paychex check stubs and W-2 forms. Users can learn how to view, download, and manage their payroll documents efficiently. Ensure you have your credentials ready to follow the instructions detailed within.

Payroll Tax

Paylocity: Important Year-End Reminders for Employers

This document provides crucial year-end reminders and tips for payroll reporting. It includes essential instructions for using Paylocity. Ensure your payroll processes are accurate and compliant with regulations.

Payroll Tax

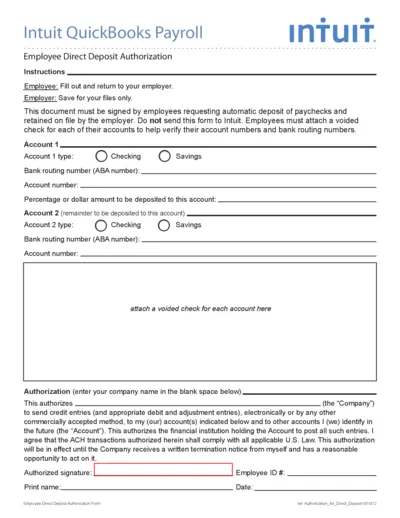

Employee Direct Deposit Authorization Form Instructions

This document provides instructions for employees to set up direct deposit for their paychecks. It includes detailed steps for completing the authorization form. Employers must maintain this form for their records.

Payroll Tax

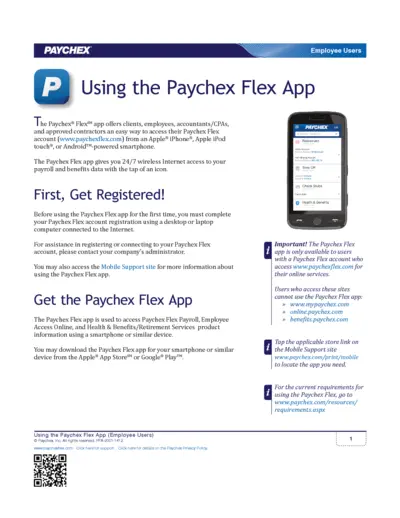

Paychex Flex App User Instructions for Employees

This file provides essential instructions for employees using the Paychex Flex app. It covers registration, app features, and security measures. Follow these guidelines to make the most of your Paychex experience.

Payroll Tax

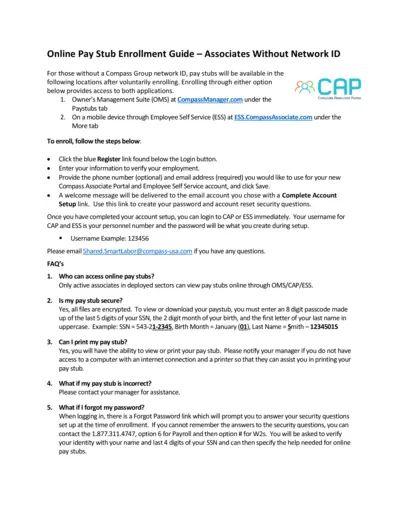

Online Pay Stub Enrollment Guide for Associates

This guide provides instructions for associates without a Compass Group network ID to access their pay stubs online. It covers enrollment steps and FAQs for a seamless experience. Follow these guidelines to ensure you can view and manage your pay stubs effectively.

Payroll Tax

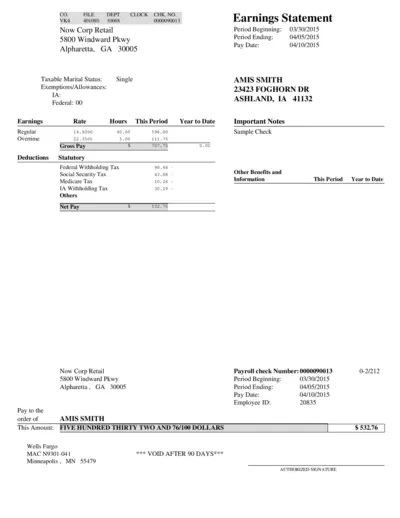

Earnings Statement and Pay Information for Employees

This document is an Earnings Statement that details the pay information for employees. It provides a summary of earnings, deductions, and net pay. Use it to understand your compensation and tax withholdings for the reporting period.

Payroll Tax

Time Sheet Import and RUN Powered by ADP Instructions

This file provides comprehensive guidance on importing time sheets using ADP's payroll application. Users will find detailed instructions on setting up their time sheet import file. It's essential for businesses looking to streamline their payroll processes with ADP.

Payroll Tax

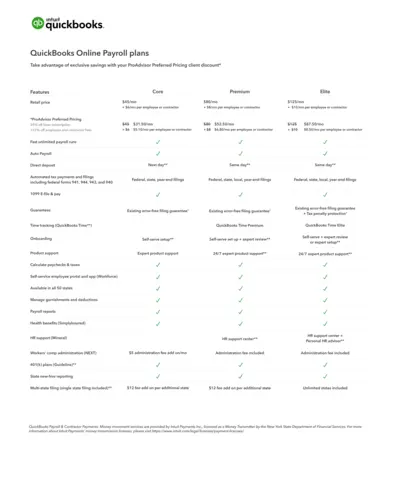

QuickBooks Online Payroll Plans Overview

Explore the features and pricing of QuickBooks Online Payroll plans. Understand how each plan can benefit your business payroll management needs.

Payroll Tax

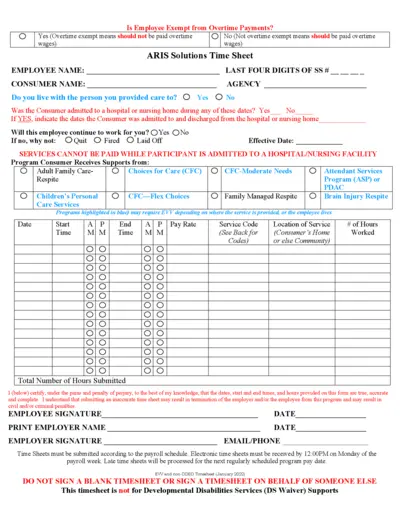

Employee Overtime Payment Exemption Form Guide

This file contains essential information about employee exemptions from overtime payments, including important instructions for filling out the associated time sheets. It's crucial for both employers and employees to understand their rights and responsibilities regarding overtime compensation. This guide also provides a step-by-step approach to ensure accurate submission of time sheets.

Payroll Tax

IRIS Payroll Professional Car and Fuel Benefit Guide

This document provides comprehensive instructions on managing car and fuel benefits in payroll. It includes how to add, edit, and allocate cars to employees. Understanding this guide is essential for employers managing benefits for their staff.

Payroll Tax

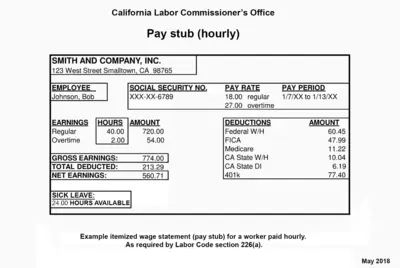

California Labor Commission Pay Stub Example

This file provides a sample pay stub for hourly employees. It outlines important earnings and deductions. Use it to understand your wage statements better.

Payroll Tax

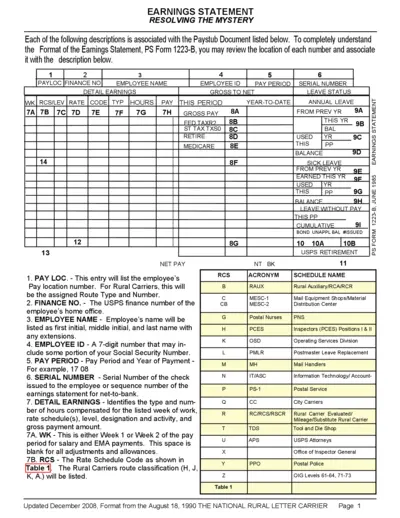

Earnings Statement Instructions and Format Guide

This document provides detailed instructions on how to fill out and interpret the earnings statement. Users can easily navigate the various fields and understand what information is required. This guide serves as a comprehensive resource for new and existing employees needing assistance with their paystub.