Payroll Tax Documents

Payroll Tax

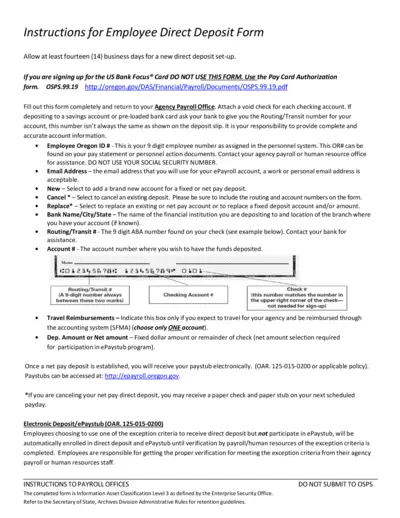

Employee Direct Deposit Form Instructions Oregon

The Employee Direct Deposit Form provides essential details for setting up direct deposits for employees in Oregon. It includes instructions for filling out the form and information required for successful processing. Follow the guidelines to ensure a smooth direct deposit experience.

Payroll Tax

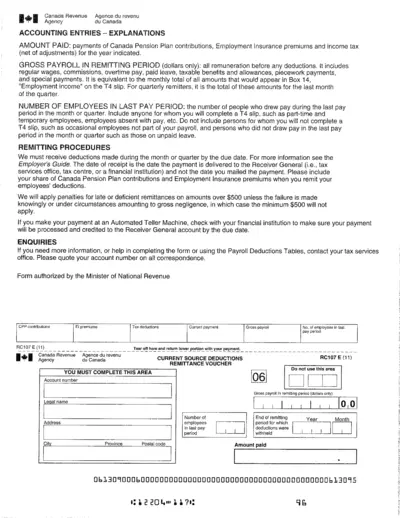

Canada Revenue Agency Accounting Entries Explanations

This file provides detailed explanations regarding accounting entries relevant to Canada Revenue Agency. It includes instructions for payroll remittances and how to report deductions. A must-have resource for employers handling payroll in Canada.

Payroll Tax

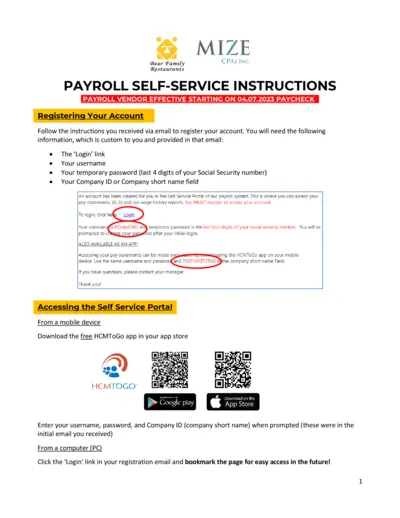

Payroll Self-Service Instructions for Employees

This document provides instructions for employees to register and access their payroll self-service account. It guides users on how to manage pay statements, tax withholdings, and direct deposit information. Essential for new and existing employees to navigate payroll processes smoothly.

Payroll Tax

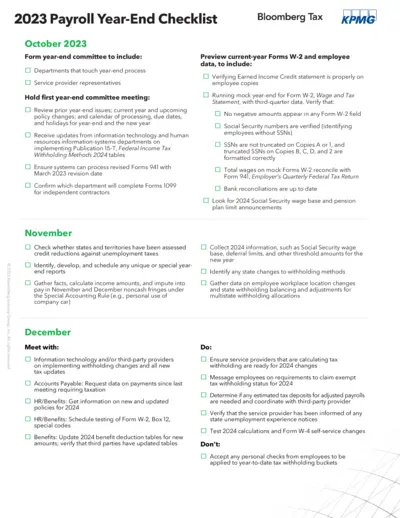

2023 Payroll Year-End Checklist Overview

This file provides a comprehensive checklist for year-end payroll processing, including important dates, tasks, and compliance measures. It aids employers in preparing required forms and making necessary updates for the year-end payroll close. Use this checklist to streamline your payroll processes and ensure compliance with tax regulations.

Payroll Tax

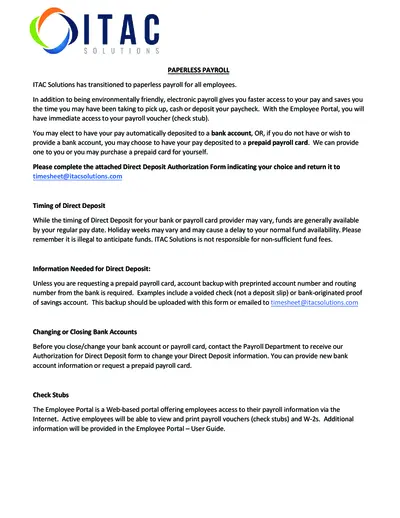

Paperless Payroll Solutions from ITAC

ITAC Solutions has transitioned to paperless payroll for all employees. This document provides essential information regarding direct deposits and payroll options. Ensure a seamless experience with the Employee Portal for payroll access.

Payroll Tax

Federal and State W-4 Filing Instructions

This document outlines the necessary steps to complete and submit Federal and State W-4 forms. It provides important deadlines and guidelines for employers regarding withholding exemptions. Understanding these forms is essential for compliance and accurate tax filing.

Payroll Tax

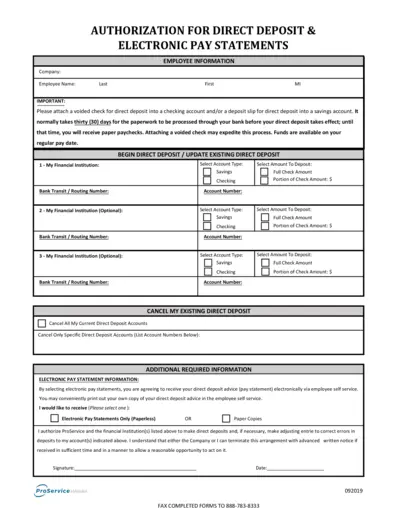

Authorization for Direct Deposit Form Instructions

This document provides instructions for filling out the authorization for direct deposit and electronic pay statements. Users can learn how to securely submit their information for direct deposits into their checking or savings accounts. Follow the steps carefully to ensure correct processing of your direct deposit enrollment.

Payroll Tax

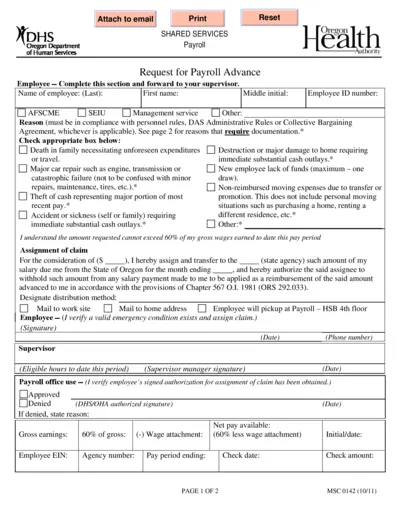

Request for Payroll Advance Form Oregon DHS

This form is used by employees to request a payroll advance due to emergency situations. It ensures that employees can access funds quickly when necessary. Please fill out the necessary fields and provide documentation as required.

Payroll Tax

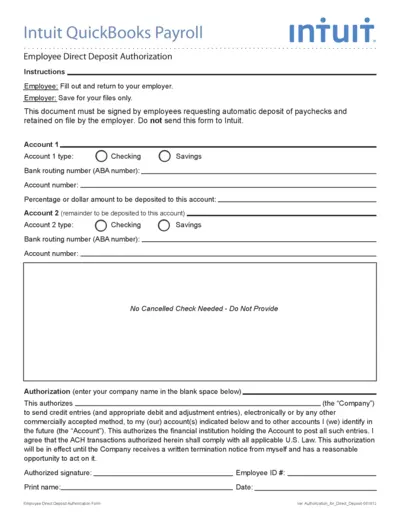

Intuit QuickBooks Payroll Direct Deposit Authorization

This file is the Employee Direct Deposit Authorization form provided by Intuit QuickBooks Payroll. It allows employees to authorize direct deposit of their paychecks into their bank accounts. This form must be filled out and returned to the employer for processing.