Federal and State W-4 Filing Instructions

This document outlines the necessary steps to complete and submit Federal and State W-4 forms. It provides important deadlines and guidelines for employers regarding withholding exemptions. Understanding these forms is essential for compliance and accurate tax filing.

Edit, Download, and Sign the Federal and State W-4 Filing Instructions

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill out the W-4 form, first gather necessary personal information including your Social Security number. Next, follow the instructions for indicating your filing status and any allowances you wish to claim. Lastly, review your completed form for accuracy before submitting it.

How to fill out the Federal and State W-4 Filing Instructions?

1

Gather all necessary personal information.

2

Indicate your filing status on the form.

3

Claim any allowances as necessary.

4

Review the completed form for accuracy.

5

Submit the W-4 form to your employer.

Who needs the Federal and State W-4 Filing Instructions?

1

Employees claiming exempt status requiring a new W-4.

2

Employers needing updated employee tax information.

3

Individuals wanting to adjust their withholding allowances.

4

New hires needing to establish their tax withholding.

5

Employees anticipating significant life changes affecting taxes.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Federal and State W-4 Filing Instructions along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Federal and State W-4 Filing Instructions online.

You can easily edit this PDF using PrintFriendly's intuitive editing tools. Make any necessary changes directly within the document before finalizing it. Enjoy a seamless editing experience that allows for quick adjustments to your file.

Add your legally-binding signature.

Signing this PDF on PrintFriendly is hassle-free. Utilize our electronic signature feature to add your signature easily. Once signed, you can save or share your document as needed.

Share your form instantly.

Sharing your PDF file through PrintFriendly is straightforward. Once your document is finalized, simply select the share option. You can easily send your file via email or share it through various platforms.

How do I edit the Federal and State W-4 Filing Instructions online?

You can easily edit this PDF using PrintFriendly's intuitive editing tools. Make any necessary changes directly within the document before finalizing it. Enjoy a seamless editing experience that allows for quick adjustments to your file.

1

Open the PDF file in PrintFriendly's editor.

2

Make edits to any textual fields as required.

3

Adjust formatting if necessary for clarity.

4

Review all changes made to the document.

5

Download the edited PDF or share directly from the platform.

What are the instructions for submitting this form?

To submit your W-4 form, provide it directly to your employer as part of your hiring paperwork. You may send it via email, fax, or in person as dictated by your employer's policy. Ensure that the form is completed accurately to avoid any delays in processing your tax withholdings.

What are the important dates for this form in 2024 and 2025?

The key dates for the W-4 form include submission deadlines of February 15th for claiming exempt status each year. Additionally, ensure any revisions are completed by the first payroll period of the new calendar year. Employers must comply with IRS regulations regarding employee withholding exemptions.

What is the purpose of this form?

The W-4 form serves a crucial purpose in the realm of payroll and tax withholding. It determines how much federal income tax should be withheld from an employee's paycheck based on their individual circumstances. Accurate completion ensures compliance with tax laws and helps employees avoid owing large sums during tax filing season.

Tell me about this form and its components and fields line-by-line.

- 1. Personal Information: Includes name, address, and Social Security number.

- 2. Filing Status: Select filing status: Single, Married, or Head of Household.

- 3. Allowances: Indicate the number of allowances to claim based on personal circumstances.

- 4. Additional Withholding: Option to specify any additional amounts to be withheld.

- 5. Signature: Employee must sign and date the form to validate it.

What happens if I fail to submit this form?

Failure to submit a W-4 form can result in higher federal income tax withholding. Employers will withhold taxes as if the employee is claiming the highest status, which may lead to tax issues at year-end. It is critical to complete and submit this form to maintain appropriate withholding.

- Incorrect Tax Withholding: Higher withholding may lead to reduced take-home pay.

- Tax Liabilities: Owing taxes at the end of the year if not enough withheld.

- Delays in Processing: Delays in tax processing and potential penalties for employers.

How do I know when to use this form?

- 1. New Employment: To establish initial tax withholding amounts.

- 2. Life Changes: After marriage, children, or significant financial changes.

- 3. Exemption Claims: To renew or claim exempt status for withholding.

- 4. Annual Review: To ensure current withholding aligns with expected tax liabilities.

- 5. Tax Planning: In preparation for filing taxes and adjusting withholdings.

Frequently Asked Questions

What is the W-4 form used for?

The W-4 form is used by employees to inform their employers of their tax withholding allowances.

How often can I update my W-4?

You can update your W-4 form at any time as your financial situation changes.

Do I need to submit a new W-4 every year?

You only need to submit a new W-4 if your withholding status or allowances change.

What happens if I don’t submit a W-4?

If a W-4 is not submitted, the employer will withhold taxes as if you are claiming the highest withholding status.

Can I erase my previous W-4 submissions?

No, all previous submissions should be retained for reference and compliance purposes.

How do I ensure my W-4 is processed quickly?

Submit your W-4 as early as possible, especially before the first payroll period.

Is there a deadline for submitting my W-4?

Yes, for exemptions, it must be submitted by February 15th each year.

Can I fill out the W-4 form online?

Yes, PrintFriendly allows you to fill out and edit the W-4 form online.

Where can I find a W-4 form template?

You can find a W-4 form template on the IRS website or use PrintFriendly to access an editable PDF.

Can I submit my W-4 form electronically?

Yes, employers may allow electronic submission of the W-4 form.

Related Documents - W-4 Instructions

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

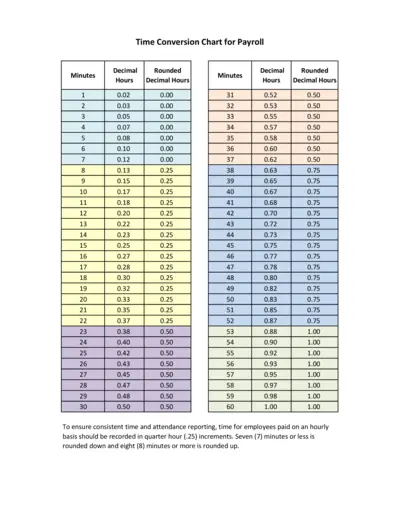

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

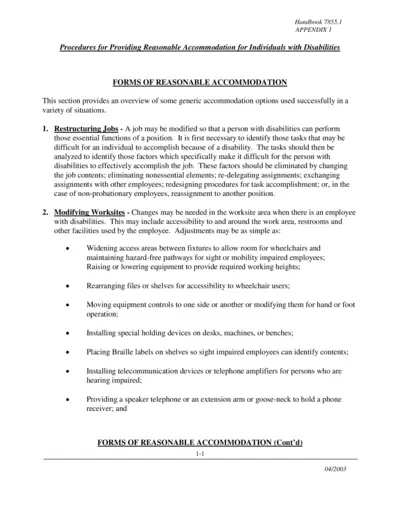

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

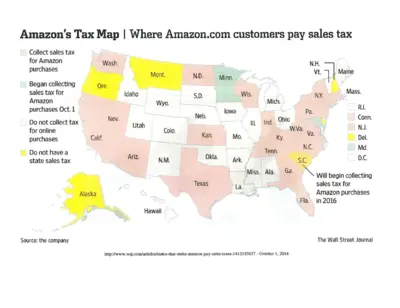

Amazon Sales Tax Map and Collection Details

This document provides a map of U.S. states where Amazon collects sales taxes and details the reasons for tax collection. It includes information on states with physical Amazon facilities, affiliate nexus laws, and states that will begin collecting taxes in the future. This is useful for understanding Amazon's tax obligations across states.

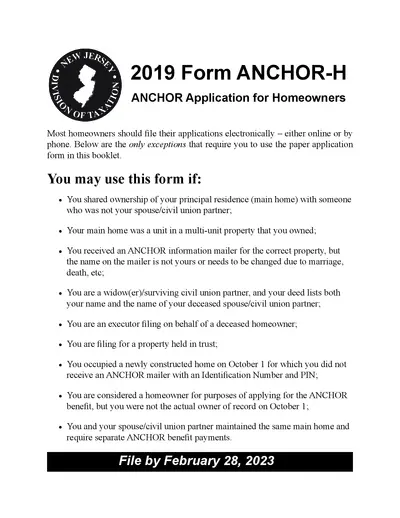

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

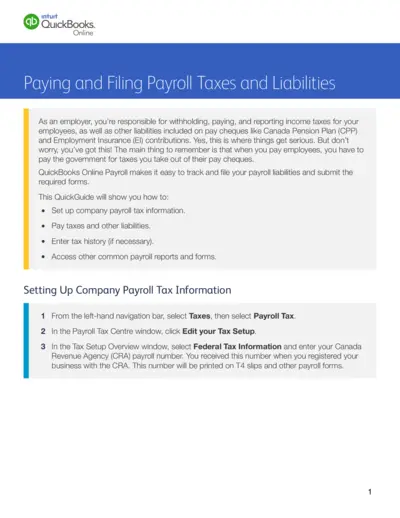

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

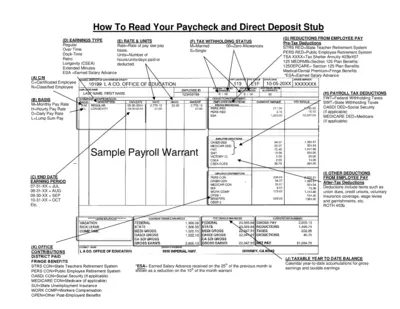

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

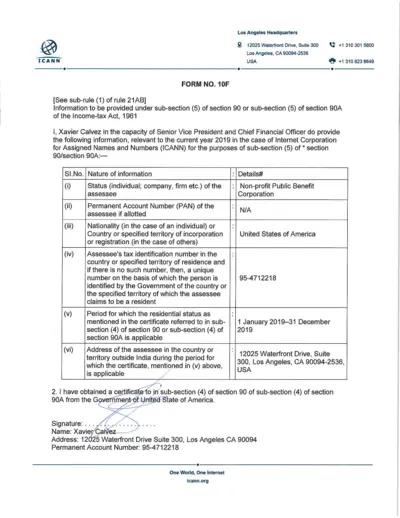

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

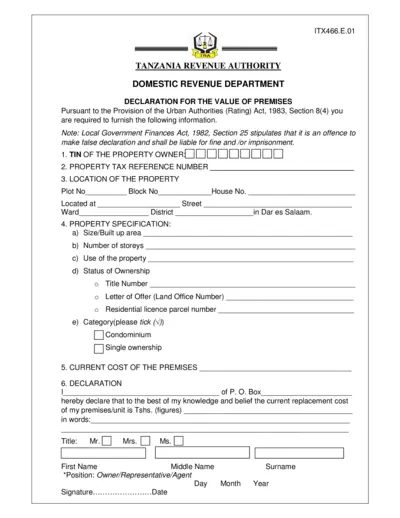

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

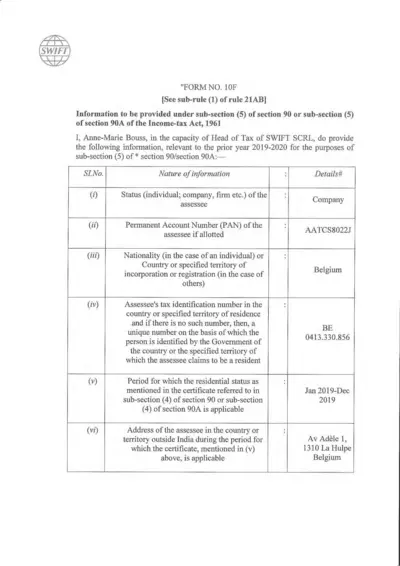

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

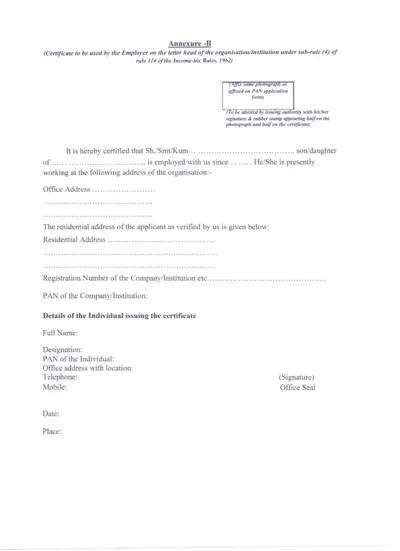

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

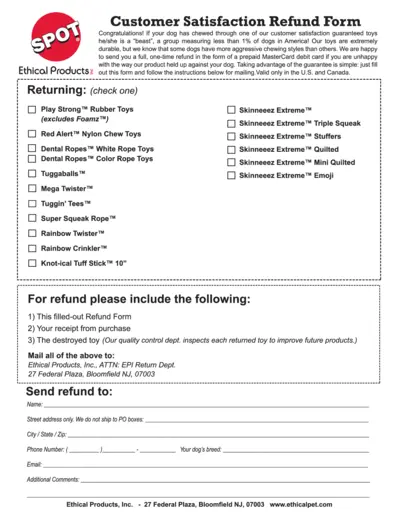

Customer Satisfaction Refund Form For Dog Toys

This file is a refund form for customer satisfaction guaranteed dog toys from Ethical Products Inc. If your dog has chewed through one of their durable toys, you can request a one-time refund using this form. Follow the instructions to obtain a refund via a prepaid MasterCard debit card.