Cross-Border Taxation Documents

Cross-Border Taxation

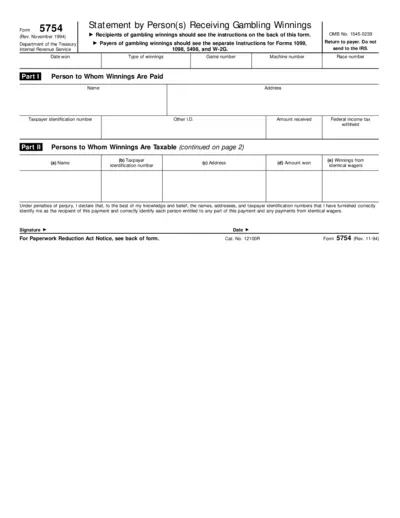

Form 5754 Instructions for Reporting Gambling Winnings

This file provides essential details and instructions for individuals receiving gambling winnings. It outlines the necessary fields to complete the form accurately. Use this form to ensure compliance with IRS regulations and correct reporting.

Cross-Border Taxation

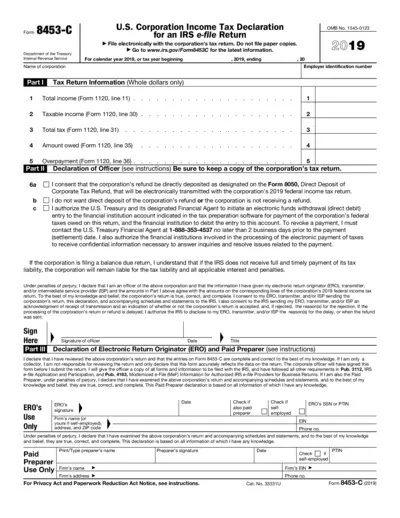

Form 8453-C - U.S. Corporation Income Tax Declaration

Form 8453-C is used for the e-filing of U.S. corporation tax returns. It serves as an electronic declaration and consent for corporate tax refunds. This form must be filed electronically along with the corporation's federal income tax return.

Cross-Border Taxation

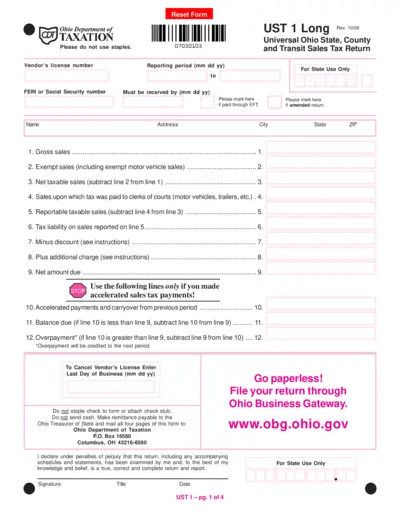

Universal Ohio State Sales Tax Return Form

This document is the Ohio State, County, and Transit Sales Tax Return form. It is used for reporting sales tax for a specified period. Fill it out to ensure compliance with Ohio tax regulations.

Cross-Border Taxation

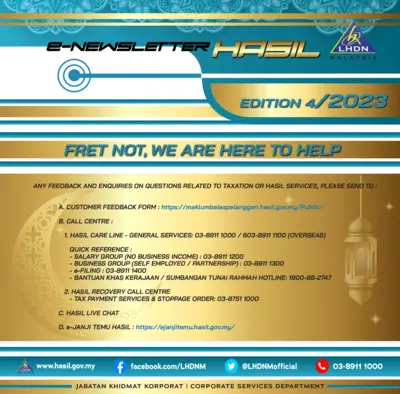

E-Newsletter Hasil LHDN Malaysia Edition 4/2023

This file contains crucial information regarding E-Newsletter Hasil LHDN Malaysia for Edition 4 of 2023. It includes updates, important dates, and services related to taxation. Utilize the resources and contact points mentioned for further assistance.

Cross-Border Taxation

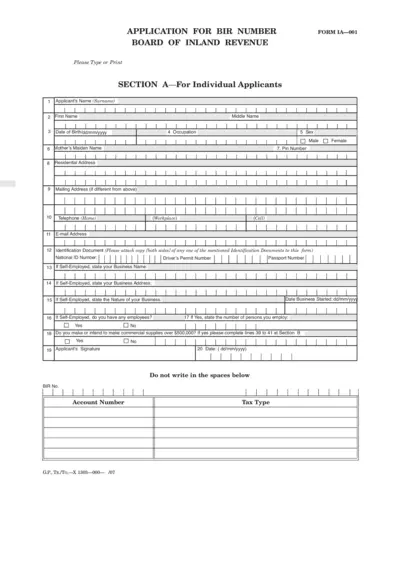

Application for BIR Number Form IA-001

The Application for BIR Number form IA-001 is essential for individuals to register with the Board of Inland Revenue. It collects personal details, employment status, and business information. Completing this form ensures compliance with tax regulations.

Cross-Border Taxation

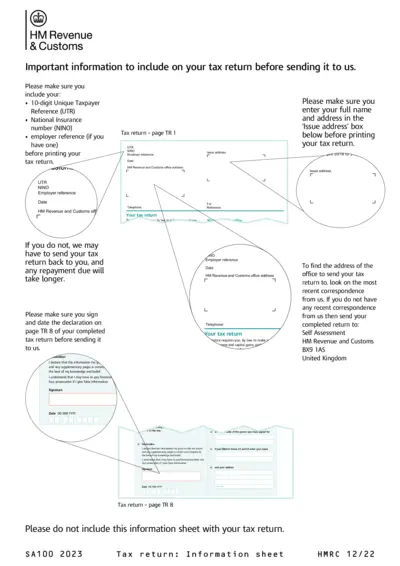

HM Revenue and Customs Tax Return Instructions 2023

This file provides essential instructions for completing your HMRC tax return for the tax year 2022-23. It includes important deadlines, personal details required, and guidelines for submitting your return on time. Whether you're a first-time filer or a seasoned taxpayer, this guide can help ensure you complete your tax return correctly.

Cross-Border Taxation

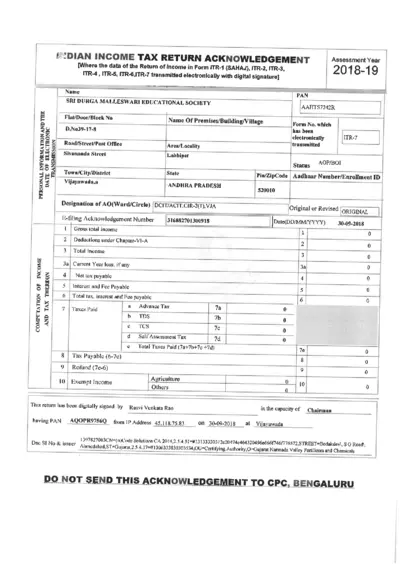

Endiann Income Tax Return Acknowledgement 2018

This document serves as an acknowledgment for the Endiann Income Tax Return for the assessment year 2018-2019. It includes important details related to the digital filing of the tax return. Users will find necessary information regarding their PAN, income, and tax calculations.

Cross-Border Taxation

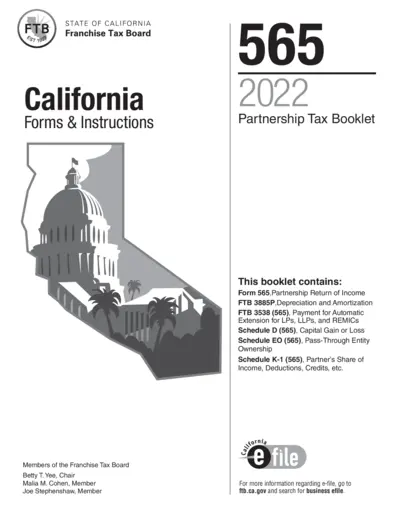

FTB Form 565 Instructions for Partnership Return

This file contains detailed instructions for completing the California FTB Form 565 for partnership returns. It provides essential information regarding tax credits, filing requirements, and submission guidelines. Businesses and individuals should refer to this document for accurate tax preparation.

Cross-Border Taxation

Nebraska Estimated Income Tax Payment Instructions

This file provides essential information on estimated income tax payments for Nebraska residents and nonresidents. It includes instructions on payment deadlines and methods, as well as eligibility criteria for required payments. Utilize this guide to ensure compliance with Nebraska tax regulations.

Cross-Border Taxation

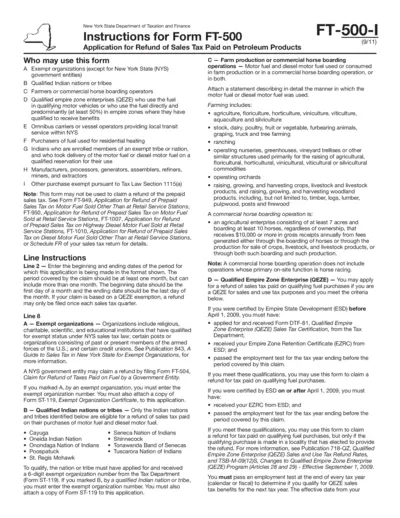

Instructions for Form FT-500 Application for Refund

This document provides detailed instructions for the Form FT-500, which is used to apply for refunds of sales tax paid on petroleum products in New York State.

Cross-Border Taxation

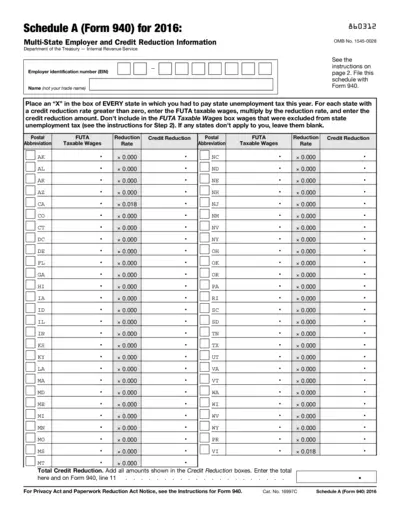

Schedule A Form 940 Multi-State Employer Instructions

This file contains Schedule A (Form 940) instructions for the year 2016, including multi-state employer information. It outlines steps for reporting state unemployment tax payments and credit reductions. This guide is essential for employers who need to navigate their unemployment tax obligations accurately.

Cross-Border Taxation

EFTPS Payment Instruction Booklet for Taxpayers

This booklet provides instructions for using the Electronic Federal Tax Payment System (EFTPS) for federal tax payments. It's designed for both business and individual taxpayers to facilitate timely payments. Follow the detailed guidelines for efficient use of the system.