Cross-Border Taxation Documents

Cross-Border Taxation

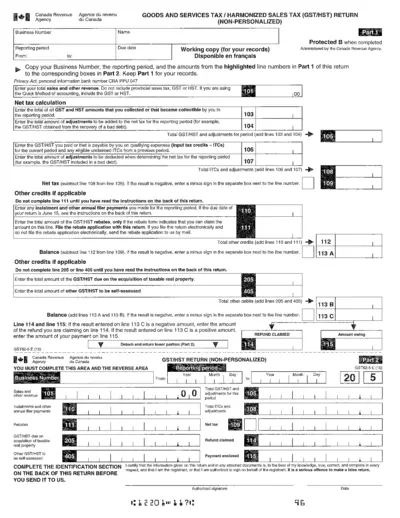

Canada GST/HST Return Filing Instructions

This file contains important instructions for completing your GST/HST return. It details the necessary steps, required fields, and guidelines for accurate reporting. Ensure compliance with Canada Revenue Agency regulations by following this guide.

Cross-Border Taxation

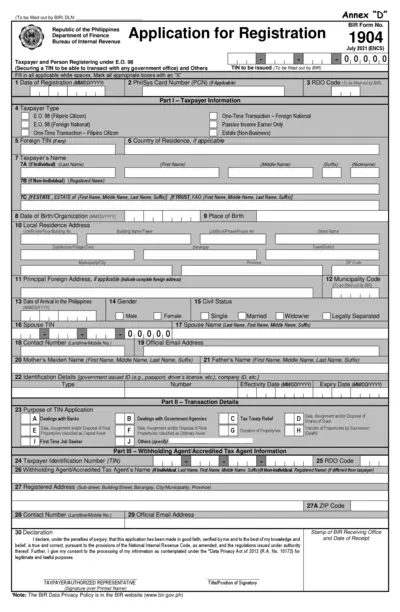

Application for Registration - BIR Form 1904

This file contains the application form for registration with the Bureau of Internal Revenue in the Philippines. It includes essential details for both individuals and non-individuals applying for a Tax Identification Number (TIN). Use this document to ensure compliance with tax regulations.

Cross-Border Taxation

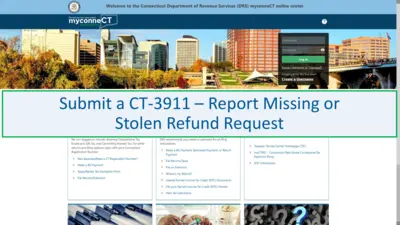

Connecticut DRS myconneCT Online Tax Filing

This file contains essential instructions for using the Connecticut Department of Revenue Services myconneCT online center. It guides users on filing and paying taxes efficiently online. Ideal for both individuals and businesses needing to manage their tax obligations.

Cross-Border Taxation

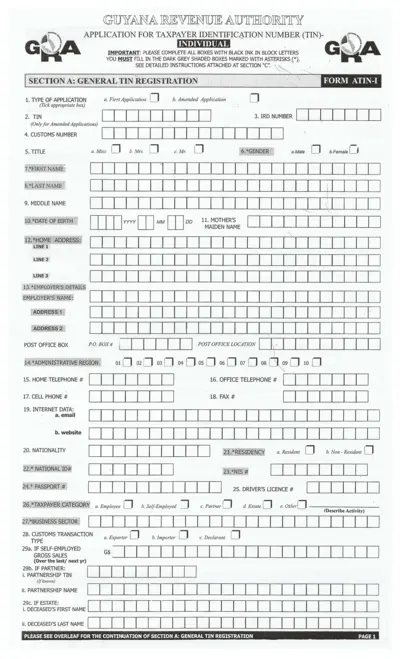

Guyana Taxpayer Identification Number Application

This file contains the application form for obtaining a Taxpayer Identification Number (TIN) in Guyana. It includes detailed instructions for individual applicants. Proper completion of the form is essential for successful registration.

Cross-Border Taxation

Atlantic City Luxury Tax Guidance and Instructions

This file provides comprehensive guidance on Atlantic City Luxury Tax and New Jersey Sales Tax. It outlines taxable status, exemptions, and guest check details to ensure compliance. Ideal for individuals and businesses involved in transactions in Atlantic City.

Cross-Border Taxation

Refundable Tax Credits Overview and Instructions

This file provides essential information regarding refundable tax credits, including eligibility requirements and necessary forms. Users will learn how these credits can impact their tax return. This is a must-read for taxpayers looking to maximize their benefits.

Cross-Border Taxation

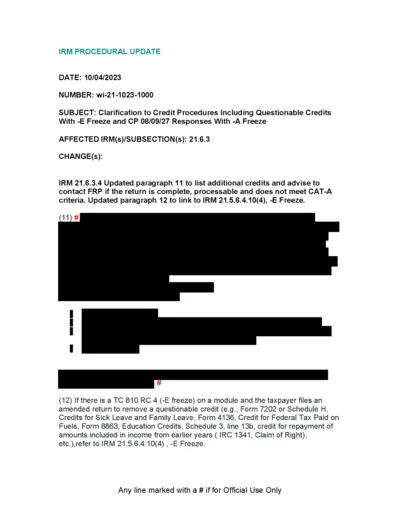

IRM Procedural Update on Credit Procedures

This file offers a comprehensive update on credit procedures with specific clarifications. It includes essential changes to the IRM sections. Users can benefit from detailed instructions regarding questionable credits and amended returns.

Cross-Border Taxation

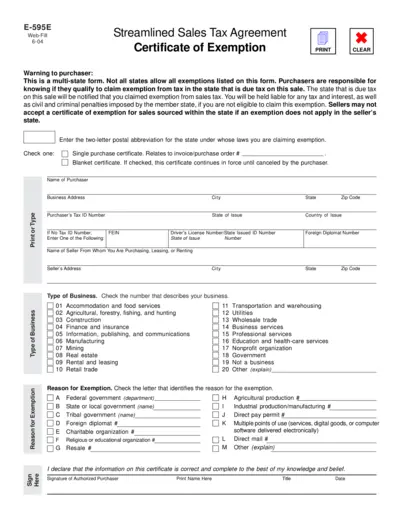

Sales Tax Exemption Certificate Guidelines

This document provides comprehensive instructions for completing the Streamlined Sales Tax Agreement Certificate of Exemption. It details the required fields and responsibilities of purchasers and sellers. Essential for anyone claiming a sales tax exemption, ensuring compliance with state laws.

Cross-Border Taxation

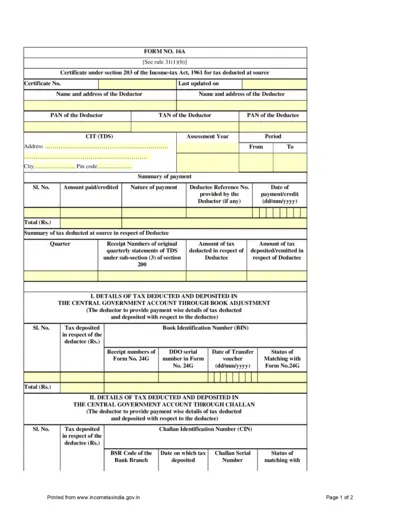

Form 16A: TDS Certificate Under Income Tax Act

Form 16A is an essential document for taxpayers who have had tax deducted at source. It certifies the amount of tax and provides necessary details of the deductor and deductee. This form is crucial for filing income tax returns accurately.

Cross-Border Taxation

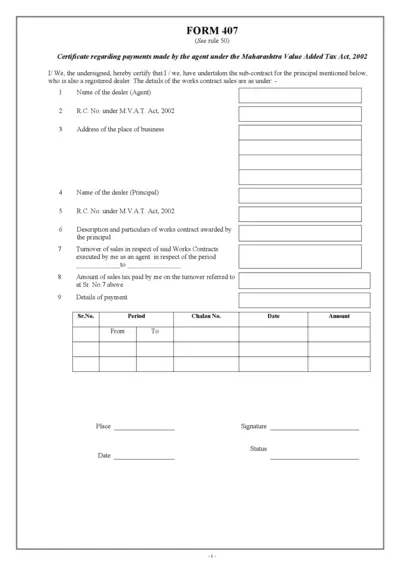

Maharashtra Value Added Tax Certificate Form 407

FORM 407 is used for certifying payments made by agents under the Maharashtra Value Added Tax Act, 2002. This form contains essential details regarding works contracts and associated sales tax payments. It is crucial for compliance and verification of transactions in the state of Maharashtra.

Cross-Border Taxation

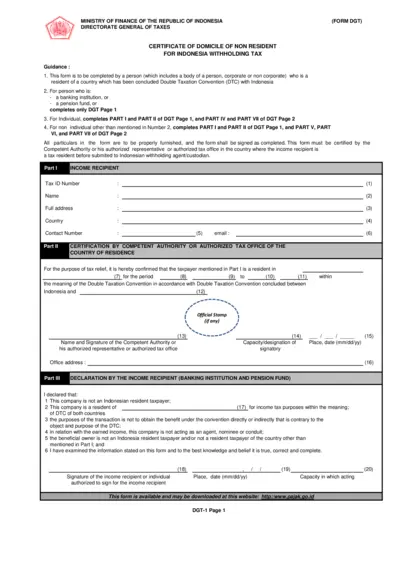

Certificate of Domicile for Non-Resident Tax Relief

This file provides a comprehensive guide for non-residents seeking withholding tax relief in Indonesia. It includes detailed instructions and sections to be filled out by individuals and entities. Use this form to ensure compliance with the Double Taxation Convention and facilitate tax relief efficiently.

Cross-Border Taxation

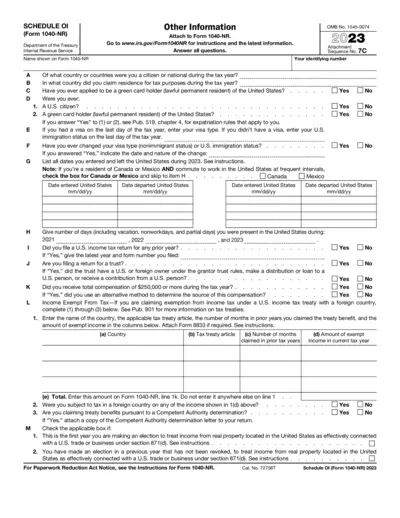

Schedule OI Form 1040-NR Instructions and Details

This file contains the Schedule OI for Form 1040-NR, detailing important information on residency, citizenship, and income tax treaty benefits. It serves as a guide for users needing help with their tax filing in the U.S. and outlines the necessary steps to complete the form accurately.