International Tax Documents

Cross-Border Taxation

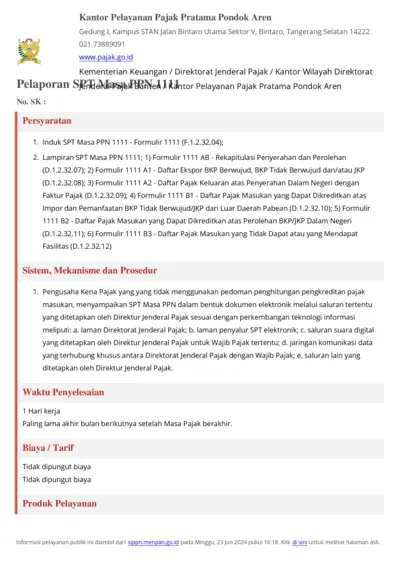

Kantor Pelayanan Pajak Pratama Pondok Aren Instructions

This file provides essential details and instructions for filing SPT Masa PPN at Kantor Pelayanan Pajak Pratama Pondok Aren. It includes necessary forms, requirements, and submission methods. Perfect for individuals and businesses needing to comply with tax regulations in Indonesia.

Cross-Border Taxation

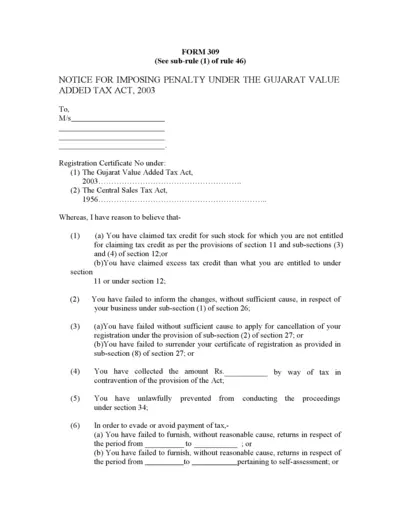

Penalty Notice Under Gujarat VAT Act 2003

This file contains a formal penalty notice under the Gujarat Value Added Tax Act, 2003. It outlines various reasons for imposing a penalty related to tax credits and compliance. Users must understand their obligations and rights regarding this notice.

Cross-Border Taxation

Taxation of Short-Term Rental Units in TN 2023

This file provides comprehensive guidelines on the taxation of short-term rental units in Tennessee. It covers various tax types including Sales and Use Tax, Local Occupancy Taxes, and Business Tax. A must-read for property owners and managers involved in short-term rentals.

Cross-Border Taxation

IRS e-Services e-file Application Process

This file provides essential details for corporations required to electronically file with the IRS. It includes instructions on the e-Services application process and related resources. Perfect for tax professionals and corporate taxpayers.

Cross-Border Taxation

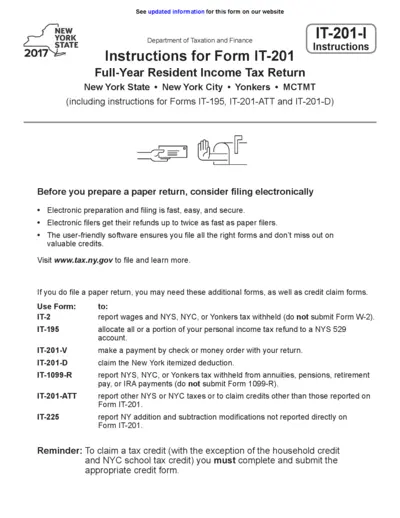

NY State IT-201-I Full-Year Resident Income Tax

This document provides detailed instructions for the New York State IT-201 Full-Year Resident Income Tax Form. It is essential for taxpayers to understand their filing requirements and available credits. Follow the guidelines provided to ensure accurate and timely submission.

Cross-Border Taxation

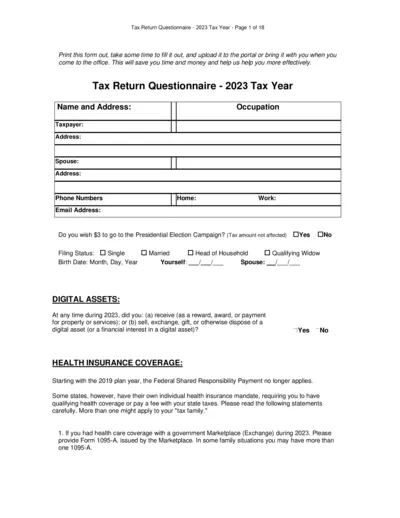

Tax Return Questionnaire 2023 - Complete Guide

This file contains the Tax Return Questionnaire for the 2023 tax year. It includes important instructions and fields necessary for accurate tax filing. Use this questionnaire to ensure you have all your information ready for your tax return.

Cross-Border Taxation

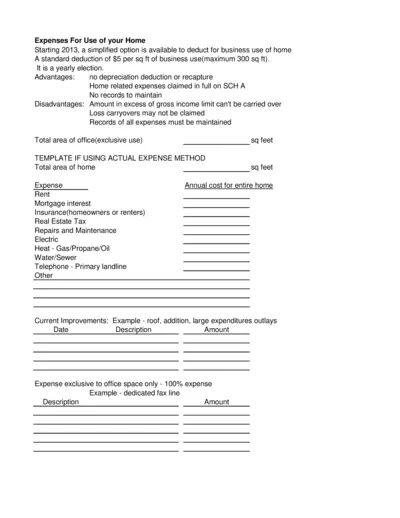

Home Business Expenses Deduction Guide 2013

This file provides information about deductions for business use of home starting in 2013. It outlines simplified and actual expense methods. Users will find a breakdown of required records and instructions for filling out the form.

Cross-Border Taxation

Malaysia LHDN EA & EC Guide Notes 2021

This file provides comprehensive guide notes for completing Forms C.P.8A (EA) and C.P.8C (EC) in Malaysia. It includes details regarding income types, allowances, and relevant tax information. Essential for both employers and employees to ensure correct tax submissions.

Cross-Border Taxation

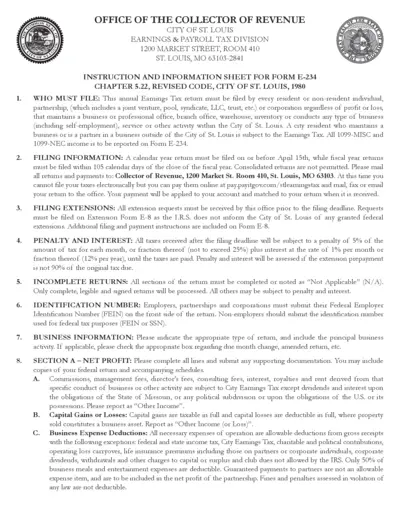

St. Louis Earnings Tax Return Instructions

This document provides essential guidance on filing the St. Louis Earnings Tax Return Form E-234. It includes instructions for various business types and details on penalties for late submissions. Ensure compliance with local tax regulations by following the guidelines outlined in this form.

Cross-Border Taxation

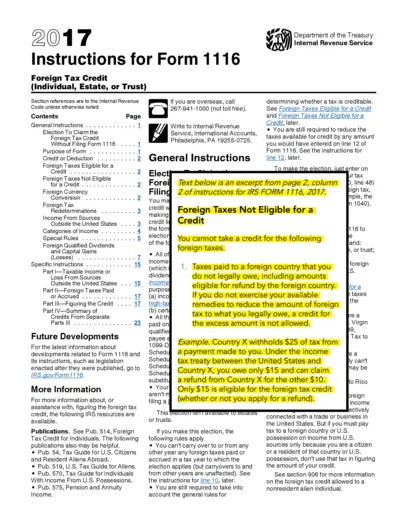

Instructions for Form 1116 Foreign Tax Credit

This file provides detailed instructions for filling out Form 1116, which is used to claim a foreign tax credit. It explains eligibility, deductions, and how to correctly report foreign taxes paid. Users will find guidance on specific line items and necessary qualifications to ensure compliance.

Cross-Border Taxation

Homestead Credit Refund and Renter's Property Tax Refund Instructions

This document provides guidance for homeowners and renters in Minnesota regarding the Homestead Credit Refund and Renter's Property Tax Refund. It includes eligibility criteria, filing instructions, and important dates for refunds. Use this resource for accurate filing and timely refunds.

Cross-Border Taxation

Personal Property Tax Exemption Information 2024

This file provides essential details about the Personal Property Tax Exemption for the 2024 tax year in Michigan. It outlines crucial forms and deadlines for businesses to ensure they receive the appropriate tax exemptions. Users should carefully review the instructions to maximize their benefits.