International Tax Documents

Cross-Border Taxation

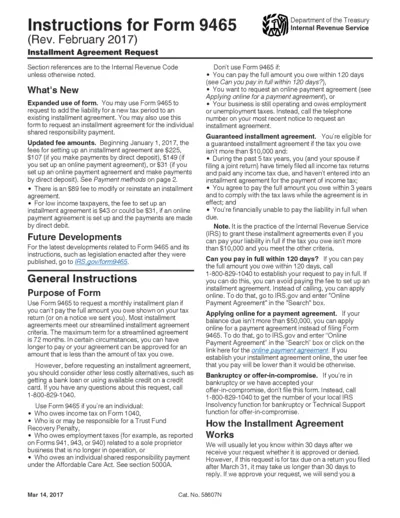

Instructions for Form 9465 Installment Agreement Request

Instructions for Form 9465 provide guidance on how to request a monthly installment plan for taxes owed. It includes information on installment agreement fees, payment methods, and eligibility criteria. Follow these instructions to successfully complete and submit Form 9465.

Cross-Border Taxation

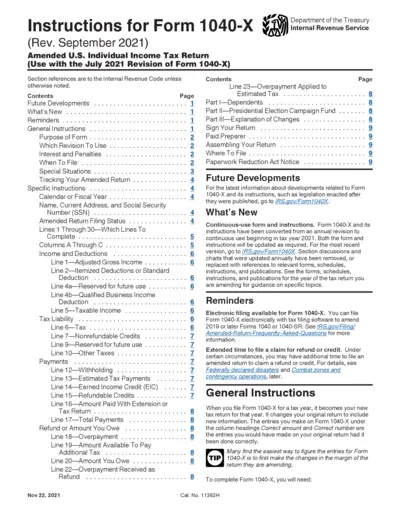

Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return

This file provides detailed instructions for filling out Form 1040-X, which is used to amend U.S. individual income tax returns. It includes information on when to file, special situations, and interest and penalties. The instructions also cover specific lines and fields in the form, as well as how to assemble your return and where to file it.

Cross-Border Taxation

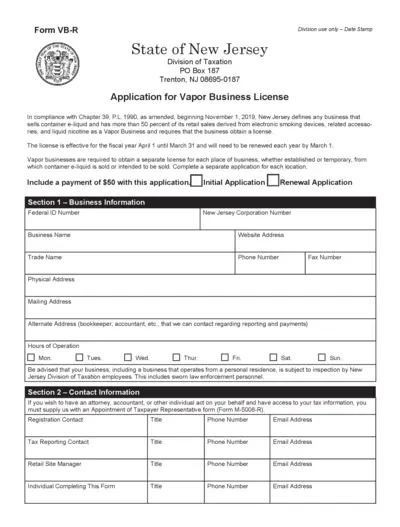

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

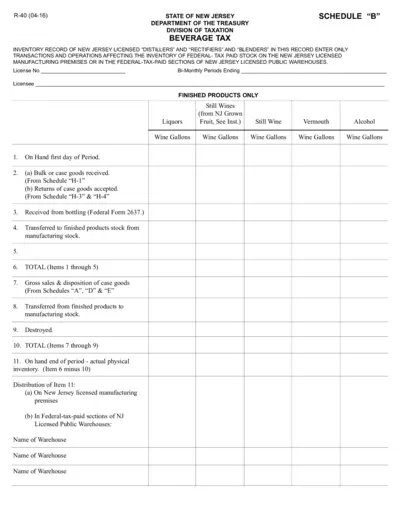

New Jersey Beverage Tax Inventory Record Form

This file is the R-40 (04-16) form used by the New Jersey Department of the Treasury, Division of Taxation. It is used by licensed distillers, rectifiers, and blenders to record transactions and operations affecting the inventory of federal-tax paid stock. This includes inventory on licensed manufacturing premises or in federal-tax paid sections of licensed public warehouses.

Cross-Border Taxation

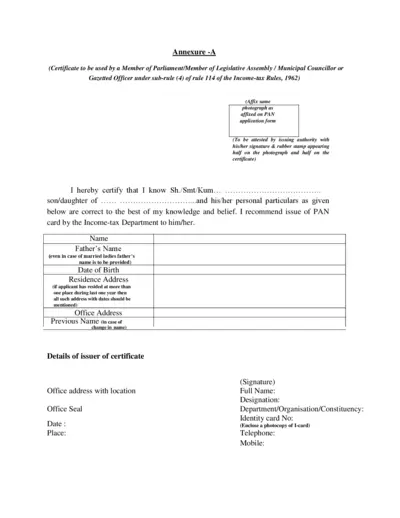

Certificate for PAN Card Application by Gazetted Officer or MP MLA

This file is Annexure-A, a certificate used by a Member of Parliament, Member of Legislative Assembly, Municipal Councillor or Gazetted Officer to attest an individual's PAN card application. It includes details such as the applicant's name, father's name, date of birth, residence and office address, and details of the issuing authority. This certificate is necessary under rule 114 of the Income-tax Rules, 1962.

Cross-Border Taxation

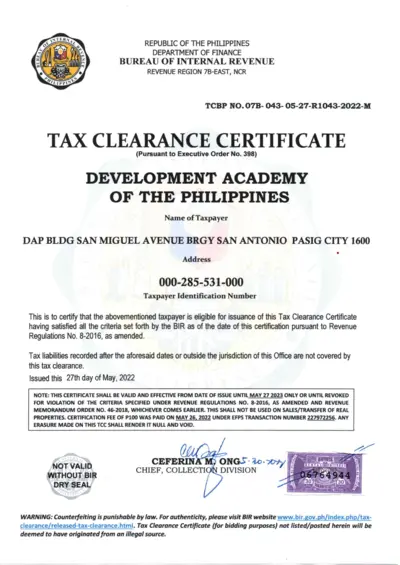

Philippine Tax Clearance Certificate - Essential Information

This document is a Tax Clearance Certificate issued by the Bureau of Internal Revenue in the Philippines. It verifies that the taxpayer has met all taxation criteria as of the certification date. Valid from May 27, 2022, to May 27, 2023.

Cross-Border Taxation

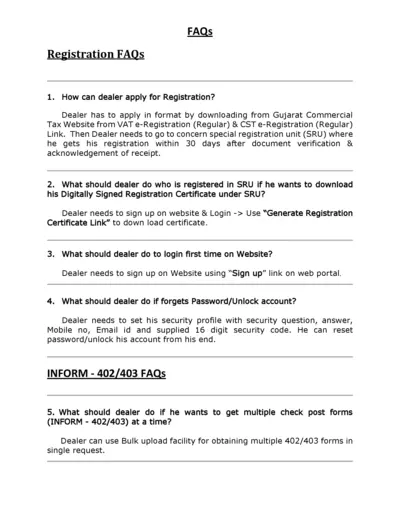

Gujarat Commercial Tax Dealer Registration and E-Services FAQs

This file contains FAQs regarding dealer registration, downloading certificates, submitting grievances, and making e-payments. It covers various e-services provided by the Gujarat Commercial Tax Department.

Taxation of Digital Services

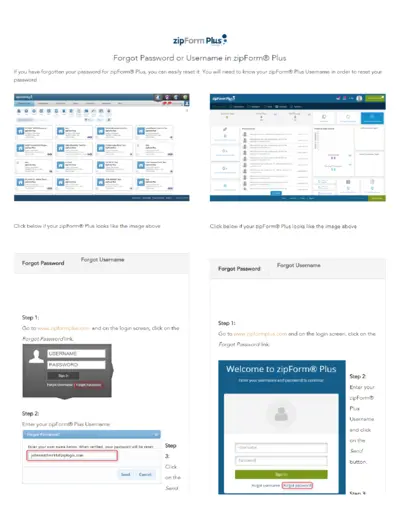

zipForm Plus® Password or Username Recovery Guide

This guide helps users recover their zipForm Plus® password or username. It provides step-by-step instructions on resetting your password. Ensure you know your username for a successful reset.

Cross-Border Taxation

VAT Cancellation Application Form Guide

This file provides a comprehensive guide to cancelling your VAT registration. It includes essential instructions for filling out the application. Follow the outlined steps to ensure a smooth registration cancellation process.

Cross-Border Taxation

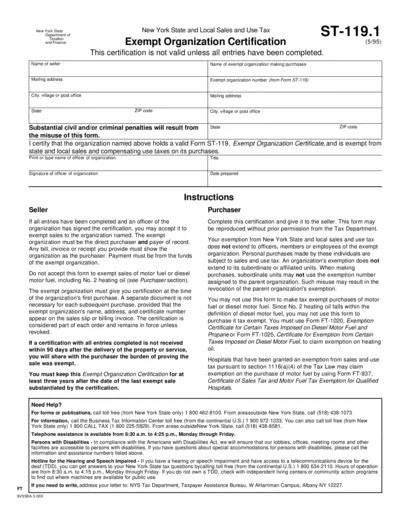

New York State Exempt Organization Certification

This document is the New York State Exempt Organization Certification form. It certifies that an organization is exempt from state and local sales and compensating use taxes. This certification must be filled out completely to be valid.

Cross-Border Taxation

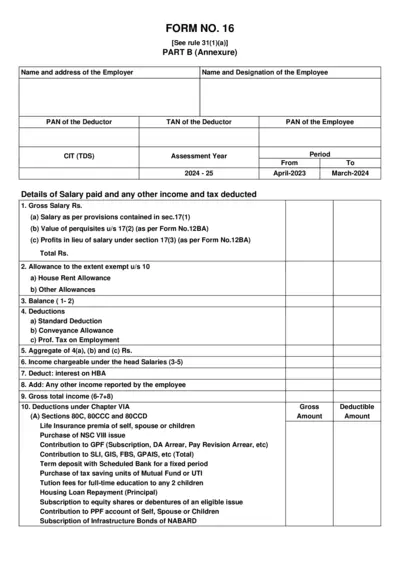

FORM NO. 16 Details and Instructions

This PDF contains essential information and instructions for completing FORM NO. 16. It provides details on salary, deductions, and tax calculations for the assessment year 2024-25. Users can utilize this guide to ensure accurate completion of the form.

Cross-Border Taxation

Tax Penalties Analysis and Instructions

This document provides a comprehensive analysis of tax penalties related to failure to file, failure to pay, and estimated tax penalties under the Internal Revenue Code. It reviews case decisions issued by federal courts and outlines taxpayer rights impacted by these penalties. Users will find legislative recommendations and most litigated issues concerning tax penalties.