International Tax Documents

Cross-Border Taxation

Sales and Use Tax Workshop Guide by NCDOR

This document outlines the Sales and Use Tax Workshop provided by the NC Department of Revenue. It serves as a valuable resource for understanding tax laws and application procedures. Discover various topics covered including business registration, online filing, and common tax issues.

Cross-Border Taxation

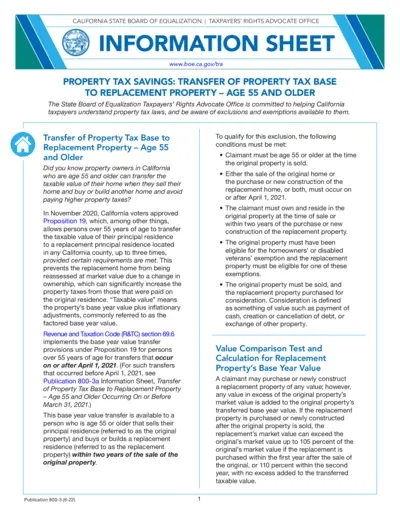

California Property Tax Savings Base Year Transfer 55+

This file provides property tax savings guidelines for California residents aged 55 and older. Learn how to transfer your property's taxable value to a new home and minimize tax increases. The document includes eligibility criteria and application instructions.

Cross-Border Taxation

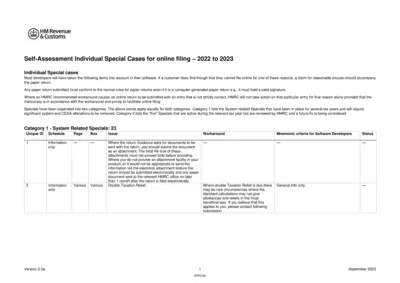

HMRC Self-Assessment Individual Filing Guide 2022-2023

This file provides essential guidelines for online filing of self-assessment forms for individuals. It details special cases and instructions for developers to ensure compliance. Users can find valuable information regarding filing exceptions and necessary attachments.

Cross-Border Taxation

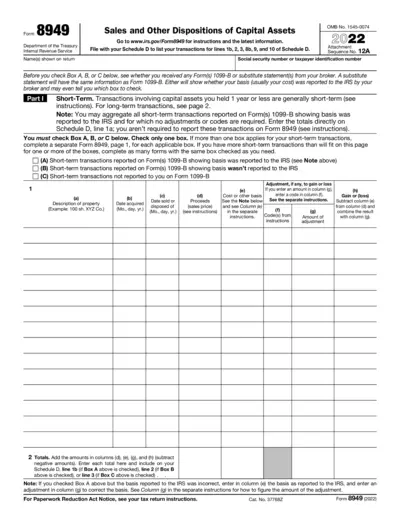

Form 8949 Instructions for Capital Asset Transactions

Form 8949 is used to report sales and other dispositions of capital assets. It is essential for accurately reporting gains and losses during tax filing. This form assists both individuals and businesses in detailing their capital asset transactions for IRS compliance.

Cross-Border Taxation

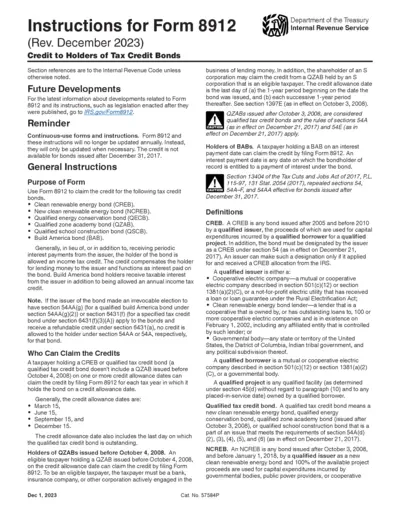

Instructions for Form 8912 - Tax Credit Bonds

This document provides essential instructions for using Form 8912 to claim tax credits for various tax credit bonds. It outlines eligibility, necessary steps, and specific instructions for accurate completion.

Cross-Border Taxation

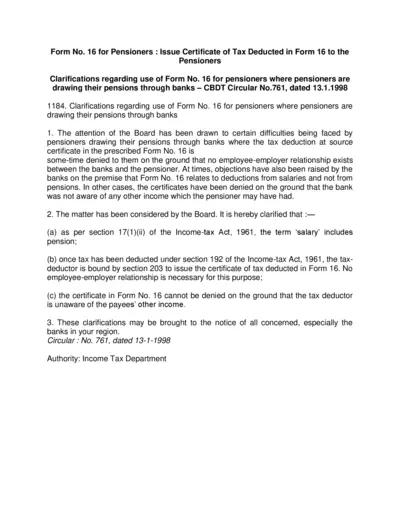

Form No. 16 for Pensioners Tax Deduction Certificate

Form No. 16 for Pensioners is essential for tax certification. This document clarifies tax deduction procedures for pensioners. Obtain crucial guidance regarding Form 16 to ensure compliance.

Cross-Border Taxation

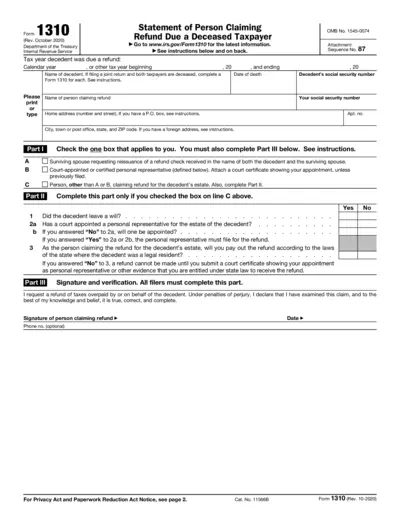

Claim Refund After Deceased Taxpayer Form Instructions

This document provides detailed instructions for claiming a tax refund due to a deceased taxpayer. It guides users through the process of completing Form 1310 effectively. Ensure compliance with IRS requirements by following this comprehensive guide.

Cross-Border Taxation

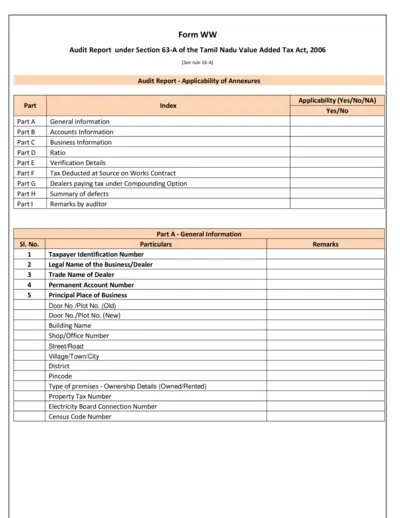

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.

Cross-Border Taxation

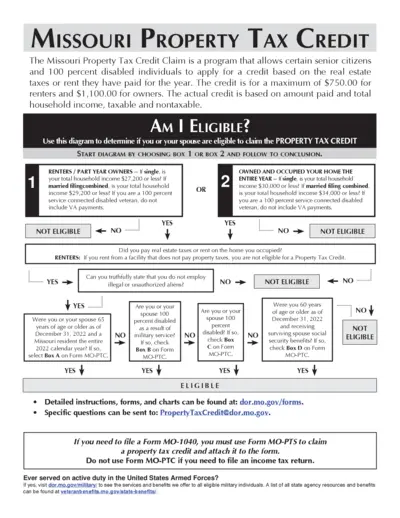

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

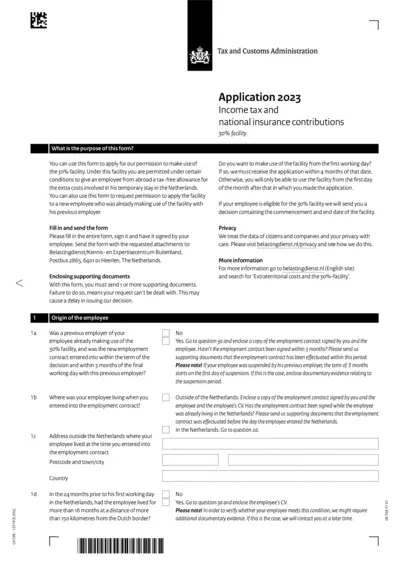

Tax and Customs Administration Application 2023

This file contains the application process for the Income Tax and National Insurance contributions concerning the 30% facility. It provides essential guidelines for employers seeking tax relief for expatriate employees in the Netherlands. Follow the detailed instructions to ensure proper completion and submission of this form.

Cross-Border Taxation

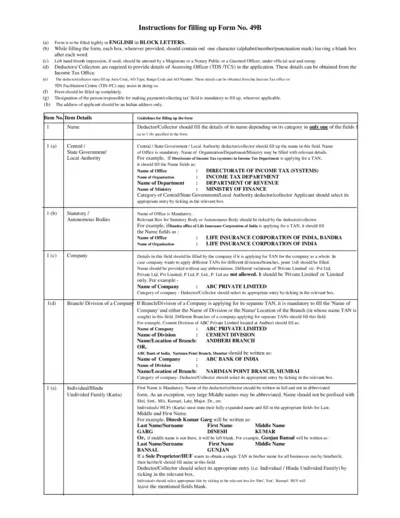

Instructions for Filling Form No. 49B - TDS/TCS Application

Form No. 49B is essential for taxpayers needing to obtain a Tax Deduction and Collection Account Number. This document provides detailed instructions for completing the form accurately to ensure compliance with tax regulations. It is critical for entities required to deduct or collect tax at source.