International Tax Documents

Cross-Border Taxation

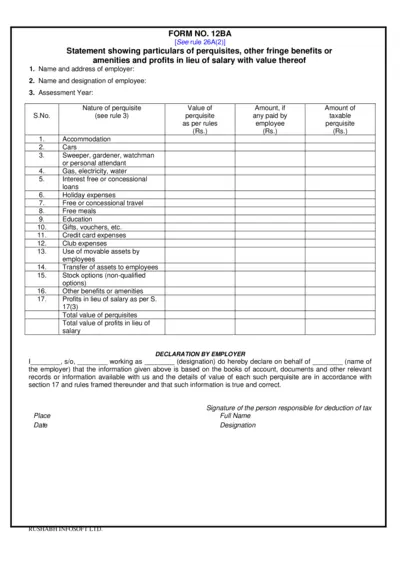

FORM NO. 12BA Statement of Perquisites and Benefits

FORM NO. 12BA provides an overview of the particulars of perquisites, fringe benefits, and amenities related to salary for taxation purposes. It assists employers in documenting employee perks and calculating their monetary value. This file is essential for tax assessment and compliance.

Cross-Border Taxation

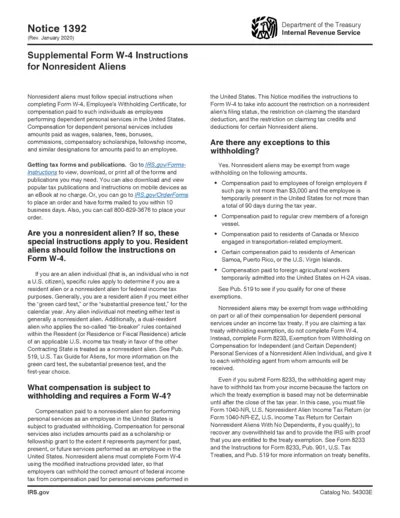

Supplemental Form W-4 Instructions for Nonresident Aliens

This file contains detailed instructions for nonresident aliens filling out Form W-4. It outlines the unique requirements and exemptions applicable to nonresident aliens. Make sure to follow the guidelines precisely to ensure correct tax withholding.

Cross-Border Taxation

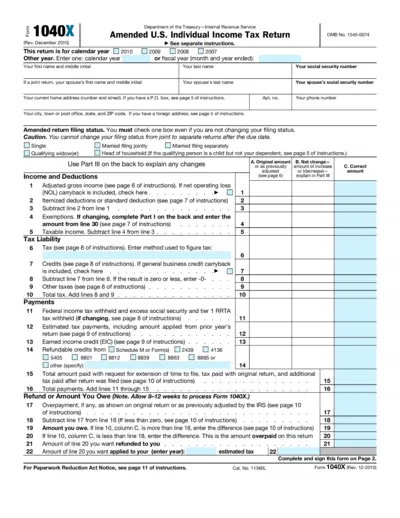

Amended U.S. Individual Income Tax Return (Form 1040X)

Form 1040X is the Amended U.S. Individual Income Tax Return for correcting your previously filed tax return. This form allows taxpayers to make changes to their filing status, income, deductions, or credits. It's essential for ensuring your tax records are accurate and up to date.

Cross-Border Taxation

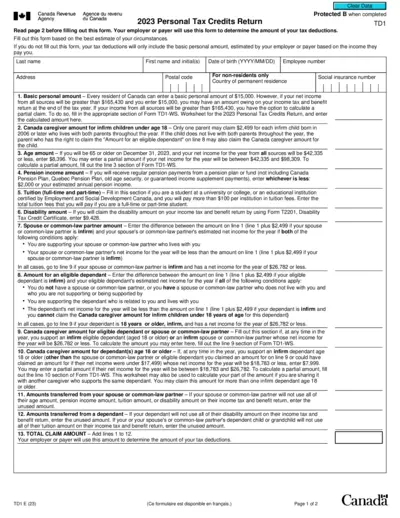

2023 Personal Tax Credits Return TD1 for Canada

The 2023 Personal Tax Credits Return (TD1) is essential for Canadians to specify tax deductions and credits accurately. This form helps determine how much tax is deducted from your pay. It contains various fields to report personal amounts and caregiving credits.

Cross-Border Taxation

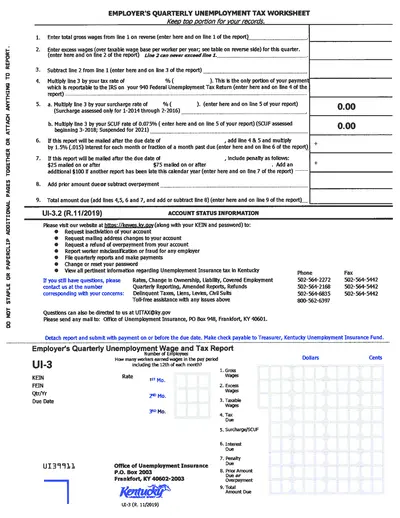

Employer's Quarterly Unemployment Tax Worksheet

This document is crucial for employers to report wages and calculate taxes related to unemployment. It includes instructions on how to calculate taxable wages, interest, penalties, and total amounts due. Regular submission helps ensure compliance with unemployment tax requirements.

Cross-Border Taxation

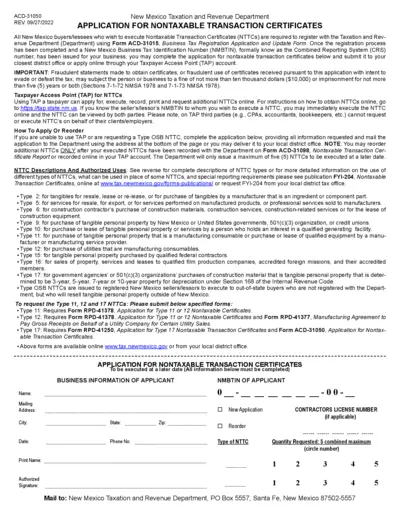

New Mexico Nontaxable Transaction Certificates Application

This application allows New Mexico buyers to obtain Nontaxable Transaction Certificates (NTTCs). Users can register with the Tax Department and submit applications. Follow the guidelines to complete the process correctly.

Cross-Border Taxation

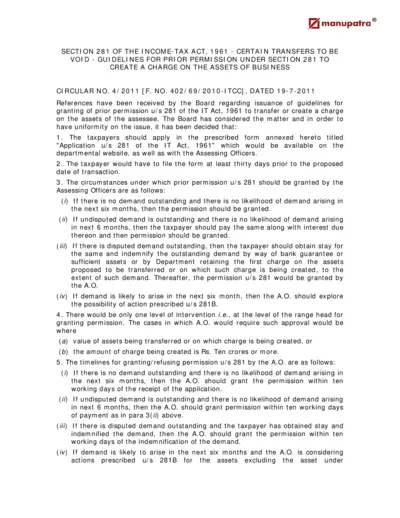

Section 281 IT Act 1961 - Guidelines for Transfers

This file contains guidelines on obtaining prior permission under Section 281 of the Income-Tax Act, 1961 for creating charges on assets. It details the application process, necessary conditions, and time frames for approval. Aimed at ensuring compliance with legal requirements surrounding asset transfers.

Cross-Border Taxation

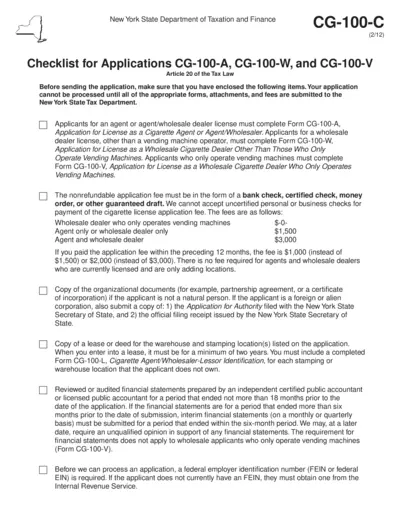

New York Cigarette License Application Checklist

This file contains essential information and instructions for submitting the CG-100-C application for cigarette licensing in New York State. It outlines the necessary forms, fees, and documents required to complete your application. Understanding these details will ensure a smooth application process.

Cross-Border Taxation

Massachusetts Estimated Income Tax Payment Guidance

This document provides essential information about Massachusetts' estimated income tax payment process. It includes guidelines for various taxpayers, instructions for filling out the forms, and deadlines to keep in mind. Understanding these details can help you ensure compliance and avoid penalties.

Cross-Border Taxation

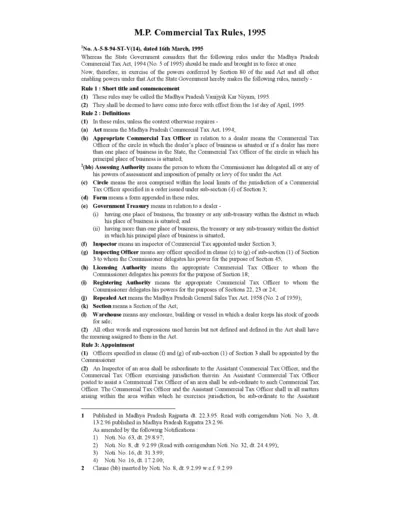

Madhya Pradesh Commercial Tax Rules and Guidelines

This document outlines the Madhya Pradesh Commercial Tax Rules, 1995. It provides detailed instructions and definitions for taxpayers. Essential for understanding compliance in commercial taxation.

Cross-Border Taxation

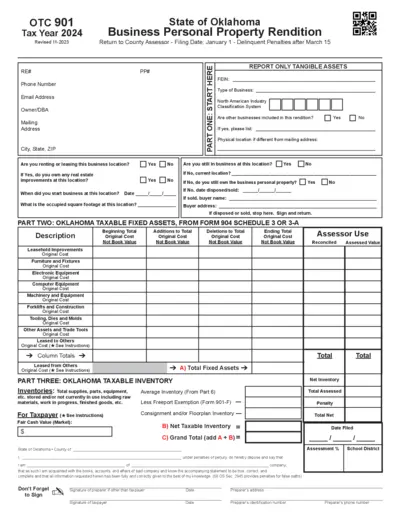

Oklahoma Business Personal Property Rendition 2024

This file serves as the Business Personal Property Rendition for the State of Oklahoma for the tax year 2024. It is crucial for businesses to accurately report their taxable personal property to avoid penalties. Use this form to provide necessary details about your business assets and filing information.

Taxation of Digital Services

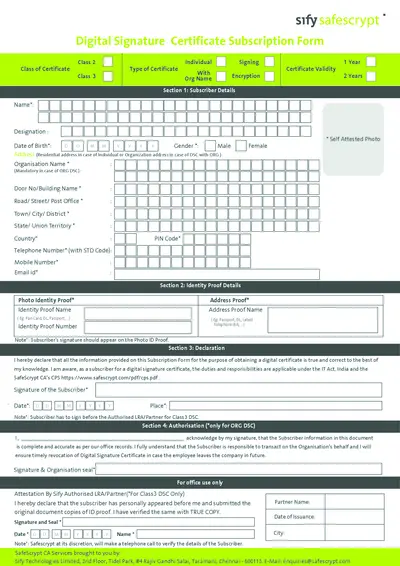

Digital Signature Certificate Subscription Form

This form is essential for obtaining a Digital Signature Certificate. It captures subscriber details required for identity verification. Complete this form accurately to ensure a smooth application process.